Ramon S. Ang wants to entice the world’s best names in semiconductors, battery making, e-vehicles, health care and Ivy League education to SMC’s freeport to industrialize the country and generate $200 billion in annual exports.

Antonio S. Lopez

With President Marcos Jr. taking over promising to do things differently for the welfare of the Filipino, the question has arisen:

Amid the gravest food, energy, education and geopolitical crises, can the Philippines ever be prosperous on a path of more robust growth?

Yes, says Ramon S. Ang (RSA), the president and CEO of San Miguel Corp., the country’s largest diversified industrial conglomerate. With P316 billion sales in the first quarter, SMC is on track to chalk up a record P1.2 trillion revenues in 2022.

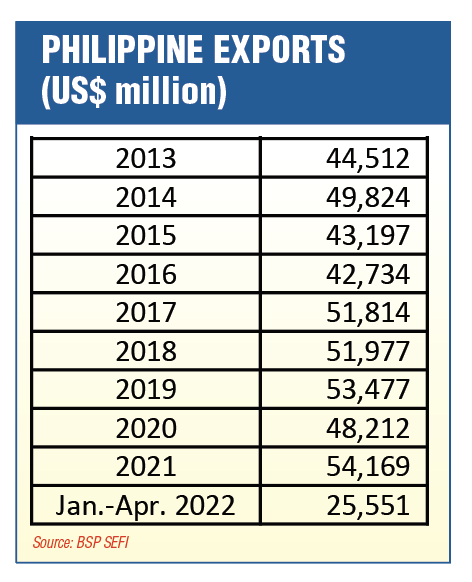

How can the Philippines grow higher and faster? Thru rapid industrialization and expanded exports earnings, says Ang. He thinks that the country can easily generate $200 billion in exports a year, up from the disappointing $60 billion to $76 billion at present.

The plan: SMC’s ecozone and freeport

In 2020, Ang managed to convince Congress (the House of Representatives) to pass House Bill 7575, the Bulacan Airport City Special Economic Zone and Freeport Act. In May 2022, the Senate amended the House version, resulting a final bill that was then sent to then President Duterte. Even without his signing it, the bill would have become law on July 4, 2022.

But then Marcos Jr. became president at noon of June 30, 2022. The next day, July 1, he vetoed the bill. The rejection ended, at least for now, Ramon Ang’s dream of having a special economic zone and freeport in Bulacan. The SMC CEO must again go thru the wringer of a congressional procedure to re-pass the bill after curing its alleged “defects”.

Congressional action could take anywhere between one week and forever. And even if a new reformed bill is passed, Marcos Jr. can take his own sweet time studying the measure. Or veto it again.

Why?

Tax incentives will drain state coffers

In Marcos’s view, HB 7575 will grant tax incentives or foregone tax revenues—money the government can ill afford to give away given the current multiple crises, especially the food shortage which the President said is very severe and could last for at least three years.

Former Finance Secretary Carlos Dominguez estimated the “leakages” up to P60 billion in 50 years or P1.2 billion per year. P1.2 billion can buy you 40 million kilos of rice at P30 per kilo. Those 40 million kilos can feed 300,000 Filipinos in one year. So why give that money away to some largest industrial or technology company that is probably richer than 90% of mankind? See the logic?

But then you get into what is called a chicken-and-egg situation. Which comes first? Before the government can give away money, it must first attract investors who naturally won’t come—unless you give them incentives, like the tax perks. Without the investors, the government cannot generate jobs.

30 million jobless

The Philippines easily has 30 million jobless today, officially and unofficially. Officially jobless are those declared by the government as unemployed. That is the 5.8% who are unemployed as of March 2022 based on the labor force participation rate of 65.4%.

The Philippines has 77 million adults, those above 15. They are part of the labor force. Of the 77 million, only 65.4% or 50.35 million are reckoned as part of the labor force. Of the 50.38 million, only 5.8% or 2.92 million are supposed to be jobless. That is a big lie. Subtract 50.38 million from 77 million, you get 26.62 million. Add the 2.92 million officially jobless, you get 29.54 million or 30 million rounded up.

Unofficially, the jobless are those that the government refuses to recognize as jobless because they are not part of the so-called labor force participation rate (LFPR). They are not part of the LFPR because they are not looking for a job. They are not looking for a job because they have gotten tired of looking for jobs that do not exist or are too demanding for their level of skills.

To solve massive unemployment, the government must generate three million jobs a year or 8,000 jobs a day.

If the President simply sits on his ass, the economy by itself can generate one million jobs a year—if there is no crisis. If the economy grows by 8% per year, it creates another one million jobs. That’s two million jobs. The third million is the President’s job to do.

How to generate jobs

Generating jobs takes two to tango—government with its enlightened policy (incentives, little or no corruption, easier ways of doing business); and the private sector, with guys like Ramon Ang visioning of a prosperous country. As the president of SMC, the Philippines’ biggest food and consumer products company, RSA must constantly think of ways of how many more consumers can afford his products.

Having a job is the best way to feed oneself and one’s loved ones, to send one’s children to school so they become useful to society themselves, and of course, to stay away from crime and nefarious activities that yield unforgiven money to the unscrupulous.

In RSA’s vision the jobs can come from high-tech industries—like semiconductors, batteries, electric vehicles, and medical care. You can entice these industries if you have a place like a freeport, a quality educational system, and no-hassle, no-red tape management that only a privately managed economic zone and freeport can provide.

$600 billion semiconductor market

The global semiconductor market will reach $601 billion in 2022, according to the World Semiconductor Trade Statistics (WSTS).

The $601 billion is an increase of 8.8% from the estimated 2021 trade of $553 billion, which is an increase of 25.6% from the 2020 total.

The 2021 jump is the biggest since the 31.8% increase in 2010, 11 years ago.

Of the $553 billion, the Asia Pacific and Japan accounted for $386.98, or 60%. The Americas settled for 21%, indicating that semiconductor production is clearly now dominated by Asian chips makers.

$193 billion in lithium battery production

Meanwhile, according to Fortune Business Insights, the global lithium-ion battery market size is projected to grow from $36.90 billion in 2020 to $193.73 billion in 2028, an average growth rate of 23.3% per year.

According to analysts, “the incessant demand for power supply for numerous applications, augmented demand for electric vehicles, surging necessity of battery-operated equipment and machinery in automotive industries, and the usage of lithium-ion batteries in renewable energy applications are sustaining the lithium-ion battery market growth.”

Electric vehicles

A major growth industry is the manufacture of electric vehicles.

Automakers worldwide will spend more than $500 million to develop new electric cars and passenger trucks, and also on battery manufacturing, through 2030, according to the latest report by London-based sustainability consultancy firm ERM for the Environmental Defense Fund (EDF).

The report, the “Electric Vehicle Market Update,” is the fifth update to a report that tracks the current status and projected growth of the US EV industry.

Global automakers are projected to spend more than $515 billion by 2030 to develop and build electric vehicles.

In the US alone, 13 carmakers have announced plans to spend more than $75 billion to open electric vehicle manufacturing plants in six states.

By 2025, more than 100 EV models are expected to be on the market and available to US customers. That includes cars, trucks, and SUVs.

Both global and US EV sales remained strong in 2021 – up 40% and 4% year-over-year, respectively – despite supply chain disruptions and material shortages.

$1.3 trillion from three industries alone

So $600 billion from semiconductors, $200 billion from lithium batteries, and $515 billion from electric vehicles, that’s $1.3 trillion in business from these three industries. Ramon Ang’s vision of $200 billion looks very achievable indeed.

For semiconductors, the SMC president has in mind Taiwan Semiconductor Manufacturing Corp., the Hsinchu-based semiconductor giant that is biggest in its many product lines—11,617 products in 281 distinct process technologies and delivered to 510 customers worldwide.

China is interested in TSMC’s technology, one reason why Beijing wants to seize the island because it is its province. TSMC has to relocate some of its factories to Bulacan as a backup manufacturing base.

CATL EV battery maker

Another potential investor is CATL, the largest EV (electric vehicle) battery producer in the world. CATL grossed $20 billion in 2021, up 159%, and netted $2.5 billion, up185%. CATL sold $2 billion worth of EV batteries to Tesla, 10% of CATL total revenue in 2021.

The gross profit for EV battery, energy storage battery, and battery material are 22%, 28.5%, and 25.1%, respectively.

CATL has 170GWh capacity in operation and 140GWh capacity under construction as of Dec. 31, 2021. And the capacity utilization rate was 95% in 2021.

Technology export hubs

Says Ang: “Among our plans for the ecozone is to help create science and technology export hubs with the cheapest logistics cost, because these will be close to the airport and seaport. We will attract world-class semiconductor manufacturers, battery power storage system manufacturers, electric vehicle makers, and even modular nuclear power assemblies and other new and emerging tech industries. We estimate these industries alone will add some $200 billion in annual exports—a big boost to our GDP.”

These industries will create hundreds of thousands of new jobs, which will benefit primarily the next and future generations of young Filipino graduates, professionals, and skilled workers.

The transfer of knowledge and technology from foreign investors and locators, as well as access to world-class education and healthcare opportunities and services—industries the ecozone also looks to attract—would also be invaluable.

Higher tax revenues

These gains are on top of the trillions in tax revenues that will accrue to the government for the entire lifetime of the ecozone and airport, coming from the various industries and institutions that will set up facilities and operations there, to take advantage of the low cost of logistics, incentives, and our country’s primary asset: a high-quality workforce.

Ang explains: “Incentives are really a way for government to attract much-needed investments into our country, especially now that we are all pulling together to help our economy not just recover, but continuously grow in the post-pandemic era. This way, our future generations will have enough and better opportunities than we have.”