• Global oil supply remains exceptionally tight. The International Energy Agency reported that there is an “OPEC Plus” production shortage of around one million barrels-per day (bpd) at the beginning of the year, and despite requests from oil consuming countries, the OPEC Plus group stood firm on its decision to implement a gradual monthly increase of a modest 400,000 barrels-per-day (bpd) from August of last year to September of this year.

• Philippine oil inventory is sufficient.

By Secretary Alfonso G. Cusi

Department of Energy

(Presented at Rotary Club of Manila 35th weekly membership meeting, March 17, 2022)

Rotary Club of Manila (RCM) President Francisco “Chito” S. Zaldarriaga, RCM President-Elect for 2022-2023 Herminio “Hermie” S. Esguerra,

My fellow Rotarians,

Ladies and gentlemen,

Good afternoon.

Before we begin, I would like to express my sincere appreciation to the Rotary. Over the past few years, I have been coordinating with the Rotary Club – Makati Central and its RCMC Foundation, Inc. for several projects in the MIMAROPA region, where I am designated as Cabinet Officer for Regional Development and Security.

Through the generosity of Rotary members, we have been able to work on meaningful projects that would help make a lasting difference in the lives of our kababayans in MIMAROPA.

• We are currently working on housing projects for the indigenous communities that were gravely affected by the devastation of Typhoon Odette last year

• To help ensure the health and food security of various identified communities in the region, we have also been giving livestock such as cattle, goats, and turkeys

• To provide broader energy access even to the remotest parts of MIMAROPA, CORDS and RCMC Foundation donated solar units to various areas

• And to assist former rebels in creating a new start in life, we distributed motorboats to those residing in an isolated island in Occidental Mindoro for their livelihood.

Going back to today’s event, thank you for inviting me to join this week’s Membership Meeting to discuss concerns over soaring oil prices, and the steps we have been taking to address the situation.

My presentation is divided into three main topics:

• First, to provide context, we will take a brief look at the current global oil situation and how and the Russia-Ukraine conflict plays into the Philippine setting.

• This will be followed by an assessment on how these international geopolitical developments affect our oil products’ supply and inventory levels, as well as the resulting price movements which we all have been feeling these past several months.

And lastly, we will go through the various measures that seek to assist the consuming public cope with rising fuel costs.

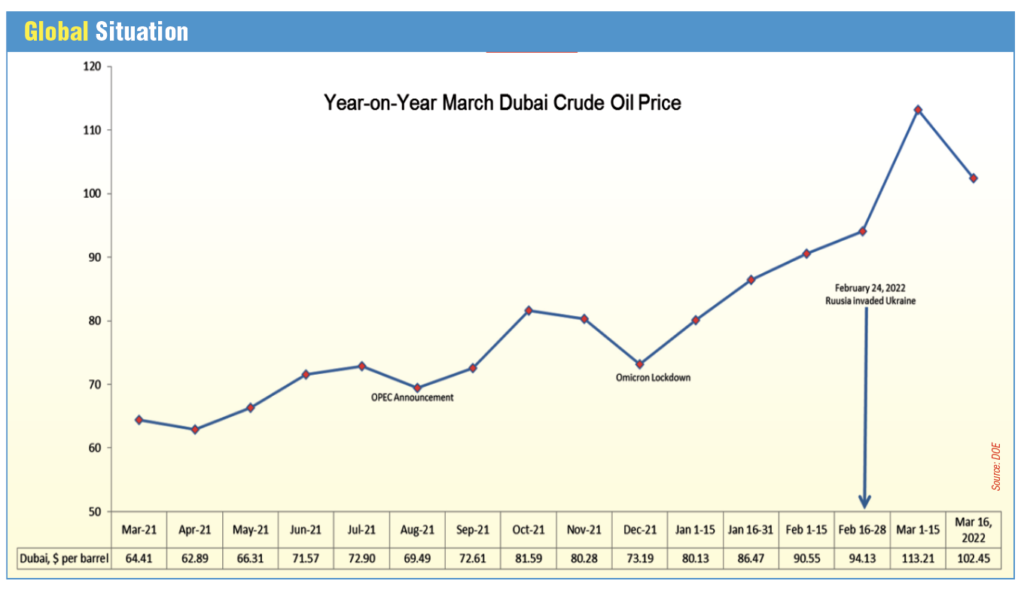

• Now, in terms of context, looking at things from a global perspective, the increase in the price of oil products has been driven by Organization of Petroleum Exporting Countries or OPEC supply disruptions which started in as early as May 2021, and has then been further exacerbated by the ongoing Russian invasion of Ukraine.

The interplay between these two events have been shaping bullish market sentiments, with uncertainties stoking fears that continue to push oil prices upward.

• We all know that shifts in demand and supply, coupled with geopolitical tensions result in oil price fluctuations. Global market movements definitely influence domestic prices. This is true especially in the case of the Philippines, as we are a net importer of oil.

Global oil supply tight

• At present, global oil supply remains exceptionally tight. The International Energy Agency reported that there is an “OPEC Plus” production shortage of around one million barrels-per day (bpd) at the beginning of the year, and despite requests from oil consuming countries, the OPEC Plus group stood firm on its decision to implement a gradual monthly increase of a modest 400,000 barrels-per-day (bpd) from August of last year to September of this year.

We must note, however, that their actual production increase has been lower than the 400,000 bpd target. In January, production increase has been reported to be at 320,000 bpd only.

This performance of the OPEC Plus has been causing price upticks since last year and continuing into this year.

As I mentioned earlier, the current volatility of global oil prices has been heightened by the Russia-Ukraine crisis, which started on February 24 of this year.

In this regard, let’s do a bit of scenario analysis.

• Russia exports roughly five million barrels of crude per day. A huge chunk of the five million barrels go to Europe at 58%, while the remaining 42% goes to the Asia-Pacific region, with 31% going to China, 6% to South Korea, and 5% to Japan.

• Our country’s oil refinery, Petron, does not import crude from Russia or Ukraine, but sources its supply from the Middle East and the Asia- Pacific.

• Likewise, neither of our direct finished product importers source from Russia or Ukraine. However our domestic oil companies import from China, South Korea, and Japan.

Worst case scenario

Assuming the worst case scenario where there would be a total ban of Russian oil imports to China, South Korea, and Japan, and that these countries would be unable to find a suitable replacement, then, you would see the projected exposure impact on our current importation from these countries, based on 2021’s total import volume figures.

In this scenario, we estimate a:

• 10% potential exposure for our diesel imports (out of the 8.9 billion liters we imported in 2021) • 4.4% potential exposure for our gasoline imports (out of the 6.9 billion liters in 2021)

• 5% potential exposure for our jet fuel imports (out of 526 million liters in 2021)

• 2% potential exposure for our LPG imports (out of the 3.1 million liters in 2021)

“Should we be alarmed by this?”, you may ask.

No, because we are still able to get the remainder of our requirements, for example the other 90% of our diesel importation needs, from other countries such as Singapore, Malaysia, Brunei, India, Taiwan, Thailand, Qatar, and the United Arab Emirates.

Since we already touched on domestic impact projections, let us now go into greater detail about what these geopolitical developments mean for our energy industry.

• First, let us talk about supply. On March 4, I convened an emergency meeting with our oil and power stakeholders to come up with collective strategies and solutions.

During this meeting, our oil companies gave their assurances that there is no problem with our supply, and that they would be able to secure more if needed. However, they did state that they would be needing additional capital in order to replenish their respective inventories.

• Second, I have also met with our power industry players in anticipation of rising electricity costs following the increase in the price of coal in the world market. Note that coal accounts for about 58% of our power generation. The price of Newcastle Coal increased from around $170 per tonne in December 2021, to a high of $435 per tonne in early March of this year.

Coal prices

The good news is, coal prices fell to $351 as of March 16, 2022.

Nonetheless, we could also expect to feel the effect of this in our electricity prices by April or in May.

• With regard to petroleum products, we cannot talk about supply availability without discussing inventory levels. Thus, I would like to emphasize that we have a sufficient oil inventory.

Petroleum inventory

• The country’s inventory of major products to date, both in-country and in-transit is estimated to be at: 41 days equivalent for diesel oil, 52.6 days for gasoline, 89.5 days for kerosene, 55.1 days for Jet A1, 38.6 days for fuel oil, and 23.9 days for liquefied petroleum gas (LPG).

• And for our per product petroleum inventory, we actually exceed the prescribed Minimum Inventory Requirement levels provided for in Executive Order No. 134. Again, let me underscore that this means we have enough supply for our country’s current needs.

Unfortunately, we continue to face the harsh reality of coping with the continued rise in world market oil prices.

What could bring prices down

• From an international standpoint, among the measures that could help bring oil prices down include the lifting of sanctions against Iran, which could produce around 700 thousand to one million bpd, and Venezuela, which could produce around 500 thousand to one million bpd of potential additional supply that would augment current global supply levels.

Another would be having the OPEC Plus group increase their output to meet the one million bdp production shortage.

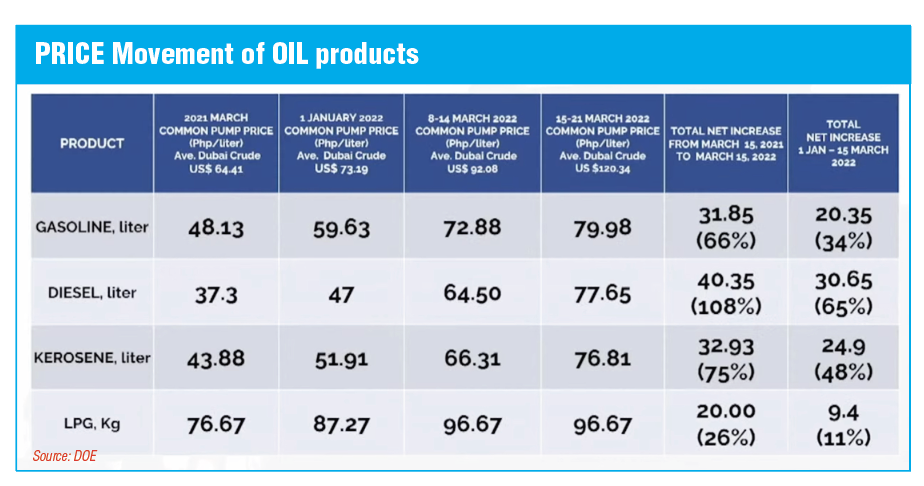

• On the screen (above), you will see the actual prices of oil products compared to their prices during the same period last year, and the total net increase from January 2022 up to March 15, where we could see the sharp rise in prices.

• This week, we experienced the eleventh increase in petroleum product prices for the year, with oil companies implementing the following increases:

From P7.10 to P7.20 for gasoline

From P12 to P13.15 for diesel, and

P10.50 for kerosene

Assuming that Dubai crude prices continue to rise from last week’s $120 per barrel up to $150 per barrel, pump prices would climb to:

Gasoline: P90.39 per liter

Diesel: P84.76 per liter

Kerosene: P84.17 per liter

LPG: P126.10 per kilogram

• The good news is, Dubai crude dropped from the previous week’s $125 to $102.45 as of March 16, 2022. Hopefully, this downward trend continues so that prices would start rolling back.

• In addition, there have been developments pointing to a potential de-escalation of tensions between Russia and Ukraine. Likewise, the ongoing COVID surge in Singapore and China which have resulted in travel bans and lockdowns will slow down economic activities, and in turn also lower oil demand.

We’ve now reached the final portion of my presentation, where I will be talking about our various response mechanisms geared towards easing the financial burden of our consumers.

Short-term measures

For our short-term measures, we currently have four:

• Promotional Activities of Oil Companies

Our oil companies have been actively offering various promos that provide incentives which include, among others, monetary discounts of P1 to 4 per liter; loyalty rewards points with cash value equivalents; as well as non-monetary sales promotions where they give out rice, vitamins, and other essential goods to their customers.

The “Pantawid Pasada Program”

A program of the Department of Transportation and the Land Transportation Franchising and Regulatory Board (LTFRB), “Pantawid Pasada” provides fuel subsidies to qualified members of our public transport sector. It has an allocated budget of P5.0 billion for 2022, P2.5 billion of which has already been downloaded to the LTFRB.

• Fuel Discounts for Farmers and Fisherfolk

The Department of Agriculture (DA) launched an unprecedented P1.1 billion-discount program, which would extend fuel subsidies to our farmers and fisherfolk.

• Industry Compliance Monitoring

In addition to our regular consultation meetings with our industry players, the DOE continues to ensure their strict compliance to all relevant national standards. We have been conducting spot inspections at various liquid fuel retail outlets to see to it that they are complying with all prescribed quality and quantity requirements, and that they are not engaging in unscrupulous profiteering or other unethical business practices.

Long-term measures

Then, for our long-term measures, we have the following:

• First, we have submitted to Congress proposals that seek to:

• Grant government intervention powers during spikes and extended periods of increases in the price of petroleum products that would also give the DOE flexibility in evaluating fuel blends;

Including in the law, a provision that would require private oil companies to maintain a set minimum inventory level to uphold our energy security goals; and lastly,

• The unbundling of petroleum products’ prices to ensure transparency.

• Second, we have also been looking into the establishment of the Philippine Strategic Petroleum Reserve or SPR through the Philippine National Oil Company (PNOC), which will help shield the country against global supply and price disruptions. Given the current oil crisis, I have directed the PNOC to expedite the SPR, including the urgent establishment of an interim SPR to help address our present situation.

And third, the DOE has been active in ensuring the full implementation of our Energy Efficiency and Conservation Act.

With its institutionalization, we are working towards transforming energy efficiency and conservation into a way of life for all Filipinos.

I would also like to discuss the public clamor for the removal of the excise tax on fuel.

I have already recommended for its suspension, only for targeted consumers, specifically those consumers who are buying fuel products like low octane gasoline, diesel, kerosene, and LPG, directly from retail stores.

However, after discussing it with our economic managers, it has been agreed that it would be best for the government to increase the provision of subsidies instead of the excise tax suspension.

As our government still needs to fund other programs, greater subsidies would prove to be a more equitable response rather than the suspension, which would only benefit the “richer people”.

I hope I was able to capture everything that the Rotary Club of Manila needs and wishes to know about the rising costs of fuel and what we have been doing about it.

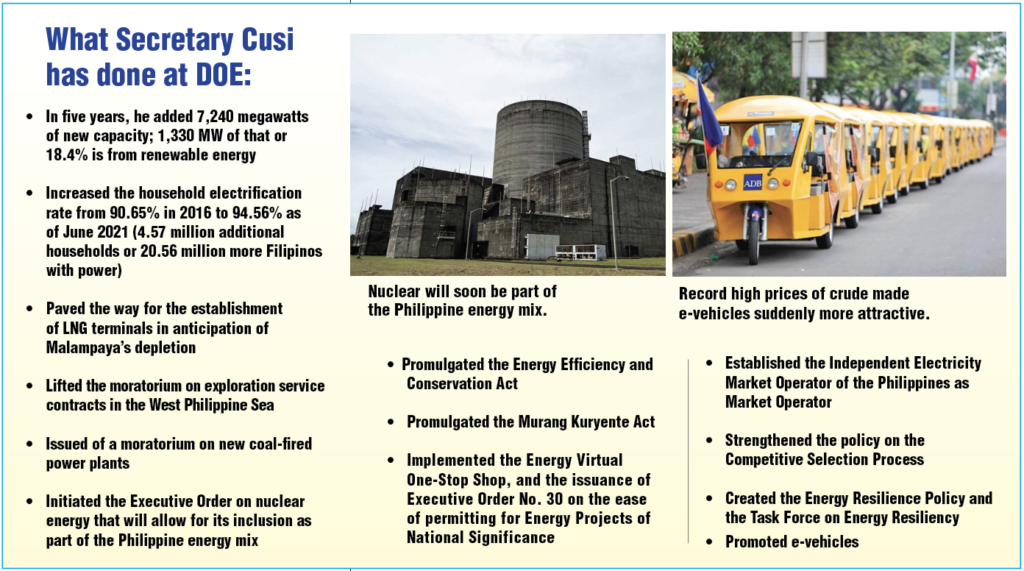

Given that I am in my final three months of office and we have commenced our preparations for a smooth and orderly transition, I would like to take this opportunity to share with you some of our significant accomplishments in the last six years.

Ensuring our country’s energy security, equity, and sustainability have been the centerpiece of my term.

Towards this end, we worked hard to achieve the following throughout the duration of my service:

Achievements

• Added 7,240 MW new capacity within my term, 1,330 MW of which are from renewable energy

• Increased the household electrification rate from 90.65% in 2016 to 94.56% as of June 2021 (4.57 million additional households)

• Paved the way for the establishment of LNG terminals in anticipation of Malampaya’s depletion

• Lifting of the moratorium on exploration service contracts in the West Philippine Sea

• Issuance of a moratorium on new coal-fired power plants

• Issuance of the Executive Order on nuclear energy that will allow for its inclusion as part of our energy mix

• Promulgation of the Energy Efficiency and Conservation Act

• Promulgation of the Murang Kuryente Act

• Implementation of the Energy Virtual One-Stop Shop, and the issuance of Executive Order No. 30 on the ease of permitting for Energy Projects of National Significance

• Establishment of the Independent Electricity Market Operator of the Philippines as Market Operator

• Strengthening of the policy on the Competitive Selection Process

• Creation of the Energy Resilience Policy and the Task Force on Energy Resiliency

• Promotion of e-vehicles

With that, I end my presentation.

It was indeed a colorful six years, but as our Rotary motto goes, “Service Above Self”. Again, thank you very much and I look forward to answering your questions shortly.

(See related articles on pages 16-21)