By Carlos G. Dominguez

Secretary of Finance

(Keynote speech during Philippine Economic Briefing for Foreign Chambers, Nov. 26, 2021)

Bangko Sentral ng Pilipinas Governor Benjamin Diokno; Trade and Industry Secretary Ramon Lopez; Agriculture Secretary William Dar; Transportation Secretary Arthur Tugade; Public Works and Highways Acting Secretary Roger Mercado; fellow workers in government; distinguished panelists from the private sector; officers and members of the foreign chambers in the Philippines; friends in the media: good afternoon.

First of all, I thank the foreign chambers in the Philippines for building bridges of trade and commerce between our countries.

This is a good time to expand collaborations. Our countries are emerging from the pandemic, led by adept public policy and strong private sector initiatives.

After so many challenging months, the numbers are now all in our favor.

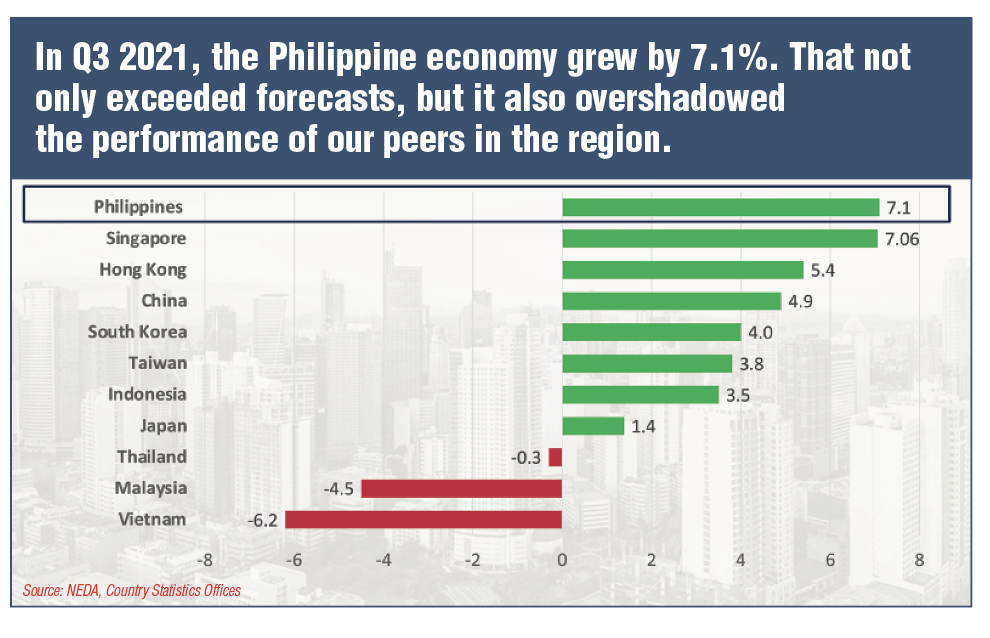

In the third quarter of this year, the Philippine economy grew by 7.1%. That not only exceeded forecasts, but it also overshadowed the performance of our peers in the region. Our year-to-date growth is presently at 4.9%. There is now a greater likelihood that our full-year growth will hit the higher end of our 4 to 5% GDP target for this year.

Investments are up. Total investments increased by 22% in the third quarter of 2021, driven by public construction.

The government’s decision to allow all construction activities to resume regardless of the area’s quarantine status must be credited for this strong performance.

Meanwhile, net foreign direct investments rebounded by 40% in the first eight months of 2021.

Remittance inflows from our overseas Filipino workers continue to increase significantly. From January to September of this year, overseas Filipinos’ cash remittances grew year on year by 6%. As a reflection of these, our gross international reserves increased to $108 billion by the end of October, equivalent to 10.8 months worth of import cover.

Our international reserves even exceeded our total external debt obligations of $101.2 billion as of the end of August of this year. During this period, our external debt to GDP ratio declined to 26.5% from 27.2% in 2020.

Strong financial position

Our strong financial position is reflected by the relatively stable exchange rate.

As of November 24, the peso depreciated by 5% against the US dollar since the start of the year, broadly in line with other regional currencies.

Meanwhile, the combined tax collections of the Bureau of Internal Revenue and the Bureau of Customs from January to October 2021 have been exactly as projected. Our collections are already 9% above last year’s level. The Bureau of Customs’ collections, in particular, grew by 17%, signaling a rise in imports. This reflects strong trade flows and more economic activity driven by the infrastructure modernization program.

It was to our advantage that when the pandemic struck, we had a solid fiscal position due to our tax reforms and improved tax administration.

Fiscal discipline

Through fiscal discipline, our debt-to-GDP ratio hit a historic low of 39.6%. Our revenue effort was at a two-decade high of 16.1%. Our credit ratings were at the highest they have ever been. These have not been downgraded despite the economic crisis brought about by the pandemic.

All of these meant that we had the headroom to contract new debt at lower interest rates and costs.

Recognizing our efforts at maintaining fiscal discipline and ensuring prudence in public expenditure, the multilateral financial institutions and the commercial markets remain very supportive of our financing program.

Because of the unexpected costs of the andemic and lower revenue collection due to the lockdown, our debt-to-GDP ratio climbed up to about 63.1% in the third quarter of this year.

Nevertheless, this remains eminently sustainable—especially as more than two-thirds of our borrowings are being sourced from our very liquid domestic market. The stability of the peso indicates this. We expect to begin working down our debt by next year.

Although we increased our borrowings, we have reduced the cost of public debt through judicious debt management. For instance, our average annual interest rate on domestic and external debt has declined from 6.3% in 2010 to 3.9% in September 2021. This reflects the country’s success in maintaining good macroeconomic fundamentals.

Debt well-managed

The affordability of our debt remains well-manageable with interest payments as a share of revenues declining from 24.4% in 2010 to just 15.2% in September 2021. Meanwhile, our interest payments as a share of expenditures even improved from 19.3% in 2010 to just 10.1% in September 2021.

The share of debt denominated in foreign currency declined to 29.6% as of the third quarter of 2021 from 42.4% in 2010. Thus, the risk of peso depreciation inflating the debt level has been significantly reduced.

Our programmed budget deficit will start to decline, with next year’s target reaching 7.7% of GDP. This is well-supported by the rebound of revenue collections, which puts less pressure on our borrowing requirement and debt sustainability threshold.

With brightening prospects for the economy, we expect to do even better in the fourth quarter as we continue to relax mobility restrictions.

We will continue easing restrictions as our infection rates continue their steep decline and we are able to vaccinate more people. From a peak of more than 21,000 daily cases on September 15, these fell to just about 1,100 as of November 24.

In the first few months of this year, our vaccination program was hampered by the availability of vaccine doses amid a tight global supply situation. Today, by contrast, we have secured all the vaccines we need and have been receiving steady supplies.

It was to our advantage that we have moved quickly to build up our health system and made provisions for our massive vaccine procurement.

Even before any vaccine was certified against COVID-19, we were able to bring together the World Bank, the Asian Development Bank, and the Asian Infrastructure Investment Bank under a joint financing arrangement for the purchase of vaccine doses. This was the first in the Asia-Pacific region.

Enough funding to vaccines

As a result, we had enough funding to vaccinate a hundred percent of our adult population and teenagers as soon as possible.

Both the government and the private sector were able to quickly procure a total of 197 million vaccine doses.

As of November 25, our running total of vaccine supply has already reached 139.4 million doses and we have successfully administered 79.6 million shots. A total of 35 million Filipinos are now fully vaccinated. The numbers will improve rapidly as we continue to vaccinate about one million people daily.

From November 29 to December 1, we will conduct a three-day national vaccination campaign against COVID-19 where we target to inoculate 15 million individuals nationwide.

We are taking the same proactive stance on the procurement of more vaccines for booster shots next year as well as for inoculating our children. We are determined to roll back this pandemic for good.

With current trends, we expect to achieve the full reopening of the economy by the onset of the New Year. We are ready for a strong recovery.

Throughout this difficult period, the digital transition reforms undertaken across the bureaucracy enabled the government to respond effectively.

The electronic channels in place even before the pandemic enabled our main revenue-generating agencies to consistently over-perform and collect more revenues to fund our economic investments and pandemic response.

SEC transactions online

The Securities and Exchange Commission, for its part, now processes transactions online. These have paved the way for a host of market issuances, from real estate investment trusts, initial public offerings, to corporate bonds. Digital technology helps us make our capital markets more broad-based and inclusive.

Meanwhile, the Bureau of the Treasury has floated a series of government securities, including our first-ever Retail Dollar Bonds. These were sold to individual investors through mobile applications. By increasing the number of platforms for purchasing government securities through digital channels, the bonds were consistently oversubscribed.

The timely passage of the CREATE or the Corporate Recovery and Tax Incentives for Enterprises Act helps in our recovery efforts. With the immense corporate tax savings, this law offers the biggest stimulus package ever.

CREATE cuts corporate income tax

Aside from the hefty cut in corporate income taxes, CREATE puts in place a performance-based, time-bound, targeted, and transparent fiscal incentives system to effectively encourage more investments and innovation.

Within the first eight months since this law was passed, the Fiscal Incentives Review Board already approved incentives for four big-ticket projects. In the coming months, we expect to attract more investments to benefit our people with more jobs, greater competitiveness, and effective transfers of technology.

With CREATE, we see opportunities to strengthen investment and business partnerships with your countries especially in the areas of manufacturing, digital technology, renewable energy, and research and development activities.

The CREATE law complements all the other reform efforts initiated by the Duterte administration intended to provide a more business-friendly environment. These include the Anti Red-Tape Act, the Ease of Doing Business Act, the infrastructure modernization program, and the establishment of a national ID system, among other measures.

As both the private and public sectors innovate, we are taking full advantage of the demographic sweet spot the Philippines enjoys. A young and talented population profile means we will have a workforce prepared to swiftly adjust to the transformations taking place in our economy.

Modernization in the remaining period

In the remaining period of President Duterte’s term, we will rapidly modernize governance and accelerate the rollout of the infrastructure program.

The modernization of our infrastructure should open many opportunities for foreign investors looking at the region for expanding their operations.

We will likewise continue to pursue our economic liberalization bills to bring dynamism to the domestic economy. We also commit to complete the comprehensive tax reform program that will provide the country with efficient and reliable revenues. These include improvements in our property valuation system and in the taxation on passive income and financial intermediaries.

To maximize the impact of these interventions, we are urging our entrepreneurs and investors to promote a sustainable business model by shifting to the circular economy and using more renewables.

On the part of the Philippine government, we have shifted global discussions on climate change from focusing on general scientific findings to undertaking practical actions that may immediately be undertaken on the ground.

In fact, the Philippines has outperformed its peers in the Asia Pacific Region in climate protection performance according to the recent Climate Change Performance Index.

We have put together a group of Filipino experts from all corners of the Philippines to engage Filipinos in climate-vulnerable communities and prepare them to execute localized action plans.

Sustainable Finance Roadmap

Recently, we launched the Philippines’ Sustainable Finance Roadmap to encourage public and private investment in green projects.

We are pushing for a law banning single-use plastics. We are also embarking on a project with the Asian Development Bank to accelerate the country’s transition from coal to clean energy through an equitable, scalable, and market-based approach.

We are now finalizing a sustainable finance framework for the issuance of our first-ever sovereign green bonds.

I hope the foreign chambers in the Philippines will help us spread the word and encourage more investors to be involved in all of these game-changing undertakings. We look forward to your continued support and to working with you more closely in achieving a sustainable and better future for the Filipino people.

We have gone through a difficult episode and proved that our institutions are strong to keep our people safe and prosperous. We have laid down firm foundations to ensure a strong recovery towards a more inclusive economy. We have what it takes to do this. The Philippines is more than ready for the new and better normal.

Thank you.