In his State of the Nation Address July 24, 2017, President Duterte lobbied hard before the senators for the passage of his Comprehensive Tax Reform Program (CTRP), saying “revenues are the lifeblood of the government, which enable us to provide for the people’s needs.”

Looking at Sen. Juan Edgardo “Sonny” Angara, the President said: “Ano bang gustong ninyong gawin, mag-luhod ako niyan” (What do you want me to do, kneel before you to plead?). “I call on the Senate to support my tax reform in full and to pass it without haste,” Duterte pleaded, to the applause of the audience. Then he looked around to find some people not joining the applause.

He saw Angara. “Si Angara ayaw rin mag-clap. [laughter] Bantay ka lang sa election tingnan mo. [laughter]. (Even Angara refuses to applaud. Watch out in the next election),” Duterte smirked. The young senator is due for reelection in 2019.

Death and taxes a certainty

Next to death (to drug lords and addicts), Duterte is deadly serious about taxes. His secretary of finance, Carlos “Sonny” Dominguez, is about to enforce the biggest tax settlement in history, with P25 billion against cigarette giant Mighty Corp. which has agreed to pay the liabilities.

“The fate of the tax reform is now in the hands of the Senate,” Duterte said. He congratulated the House of Representatives by passing the first of five packages of the CTRP, with an overwhelming 246 votes by congressmen representing 90% of the Filipino electorate.

Part of the credit for that huge mandate for tax reform goes to Albay Second District Rep. Joey Salceda, an economist by education, a management whiz by reputation, and an investment manager by wealth creation.

Pro-poor

Duterte said “These (tax) reforms are designed to be pro-poor, especially when the people understand how the revenues will be spent. The passage of the Tax Reform Law is needed to fund the proposed 2018 budget which I am submitting here and today. The poor and vulnerable [applause] are at the heart of my tax reform.” “Your full support will ensure that the benefits of the tax reform can be felt immediately by them,” the President told the senators.

Indeed, says Salceda himself, the House-approved tax package “is decidedly pro-poor.” In fact, it “deliver a total monetary impact of P354 billion annually on middle income and poorest Filipino households.”

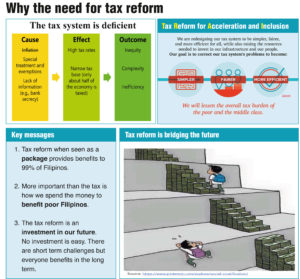

Salceda calls the tax package TRAIN – Tax Reform for Acceleration and Inclusion.

TRAIN consolidated Salceda’s original HB 4688, Quirino Rep. Dakila Carlo Cua’s HB 4774 and several others. Aimed at addressing the gross “inequality between the elite and marginalized Filipinos,” the consolidated version, House Bill 5636 adopted the title and most provisions of Salceda’s bill, including his expanded conditional cash transfers, and the proposals of the Department of Finance.

Cua and Salceda are chairman and senior vice chairman, respectively, of the House Ways and Means Committee. The measure, the most significant —and most controversial—reform under the Duterte administration, was approved by 246 congressmen, voted against by nine (with one abstention) on its second and third readings on May 31. Duterte had earlier certified the measure as urgent.

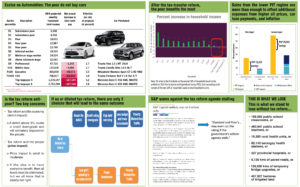

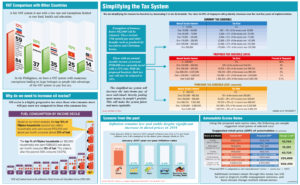

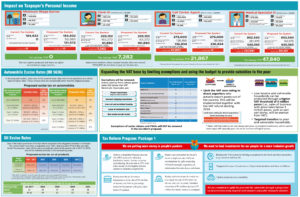

Tax increases on oil and auto

As approved, TRAIN imposes hefty increase in excise taxes on oil and vehicles, an expanded value-added tax (VAT), and tax on sweetened beverage and lotto winnings. It retains VAT exemptions for senior citizens and disabled persons, and on transactions by various cooperatives.

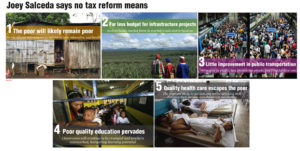

The higher tax revenues are suppose to help bankroll Duterte’s ambitious P8.4-trillion infrastructure program over the next five years and give large cash doleouts to the poor.

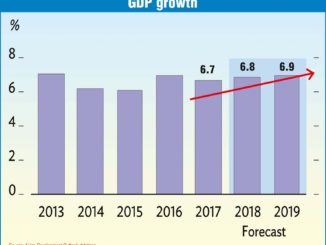

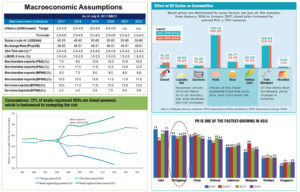

Finance Secretary Carlos Dominguez III says TRAIN will ensure a steady revenue flow for the government’s massive infrastructure buildup and guarantee a “breakout growth rate” of above 7% that will be sustained over the medium term.

The robust growth, in turn, will enable the government to pull down the poverty rate from 21.6% to 14% by 2022, making the benefits of growth inclusive for all Filipinos, promises the DOF chief.

Income tax cut for 83% of Filipinos

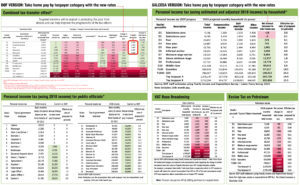

The House-approved TRAIN bill cuts personal income tax rates for 83% of Filipinos, enabling them to increase their disposable income, which, in turn, will drive the growth of the domestic market.

To make up for the alleged tax losses, TRAIN has companion measures to raise additional revenues of P133.8 billion in 2018.

Salceda believes TRAIN is “the only tool that could make the tax system more efficient, equitable and pro-poor, as the government cannot exclusively tax the rich because such a measure would immediately be struck down as class legislation.”

The Albay congressman estimates TRAIN will have a total monetary impact of P354 billion annually on the country’s poorest households.

The consolidated measure aims to lower the PIT rates for 99% of the country’s taxpayers while expanding the VAT base and adjusting rates for consumption taxes like those on petroleum products and automobiles.

Diesel excise tax

The bill would impose a P6 per liter excise tax on diesel in three stages – P3 this year, P5 by January 2018 and to P6 by July 2019. It would also increase the tax on lubricating oils and greases, waxes, regular gasoline, leaded gasoline, unleaded gasoline and aviation gas to a uniform P7 per liter, going up to P9 in 2018 and to P10 in 2019. The present tax on these products ranges from P3.50 to P5.35.

Cars will be slapped excise taxes double current rates.

Salceda says P200 will be given monthly for one year to the poorest 50% households or 10 million families. Cash cards will given jeepney drivers to help them cope with higher diesel prices because of higher diesel taxes. Low-income users of electricity (which will rise in cost with higher taxes) will get subsidies. Budgetary subsidies, Salceda explains, are better than using a tax system that supposedly protects the poor and low income earners.

P170B annual subsidies to the poor

Salceda estimates some P170 billion annually will be taken from the rich to the middle class and transferred to low income households thru subsidies. The tax measure, he points out, is expected to “ultimately reduce poverty to single digit, grow the economy and transform the Philippines into an Asian economic powerhouse by 2028, with $1.2 trillion GDP.”

“TRAIN is the only tool that could make the tax system more efficient, equitable and pro-poor, as the government cannot exclusively tax the rich because such a measure would immediately be struck down as class legislation,” Salceda enthuses.

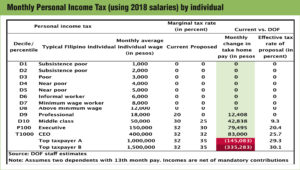

New personal income tax rates

TRAIN overhauls the country’s personal income tax (PIT) system. Effective 2018 to 2020, taxpayers earning up to P250,000 a year will be tax exempt. This will help people like call center agents making P273,000 a year. They pay at present P21,867 tax on their income. That will be zero soon.

Those earning up to P400,000 will pay a 20% tax on the excess over P250,000. People earning up to P800,000 will be taxed P30,000 plus 25% of income above P400,000.

Those earning up to P2 million will pay P130,000 plus 30% in excess of P800,000. Those earning up to P5 million will pay P490,000 plus 32% in excess of P2 million, while those earning over P5 million will be taxed P1.45 million plus 35% in excess of P5 million.

P250,000 income zero tax

Effective 2021 onwards, taxpayers earning up to P250,000 a year will remain tax exempt, while those earning more will pay a little more but with a reduced percentage.

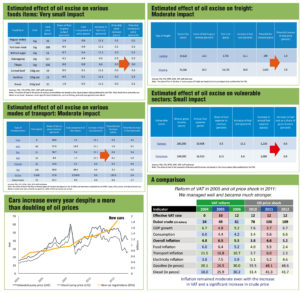

Some economists are not so sanguine whether TRAIN can deliver.

Writing in her Inquirer column June 10, Solita Monsod, also an economist, says:

“The total impact of TRAIN is negative for the majority of our people. It will reduce the household income of the bottom 60% of our households. Ironically, it increases the income of the top 40% of our households, except for the top one – tenth of 1% (those whose incomes are over P1.38 million a month) — their incomes are reduced by something like P8,000 a month (sob!). The richest ones, those earning more than P2.75 million a month, get their incomes reduced by P21,000 a month.”

P133.8 billion net gain to gov’t

Monsod figures: “TRAIN itself (tax reform), or Package 1 of it, includes reforms on the personal income tax (-P144.5 billion), value-added tax (+P81 billion), petroleum excise (+P73.7 billion), automobile excises (+P14.1 billion), sugar-sweetened beverage excise (+P47 billion), tax administration measures (+P43.8 billion), and complementary measures (+P18.9 billion). The figures in parentheses are the estimated impact of the measures for 2018. On this basis, the package would result in a net gain of P133.8 billion for the government, equivalent to about 0.8% of the country’s gross domestic product.”

She says House Bill No. 5636 will transfer to bottom 60% an amount more than enough to compensate for the losses imposed on them by TRAIN. It has earmarked 40% of the petroleum excises, or roughly P30 billion for this transfer.

“Not content with compensating the bottom 60%, our Congress also decides to distribute largesse to the seventh and eighth deciles which includes the minimum-wage-and-above workers,” notes Monsod.

What TRAIN does

What does this transfer scheme do? It will give P3,600 a year to the bottom 50% and P1,500 a year to the next 30%.

Why not P3,600 a year to the bottom 60% who have been harmed, and P1,500 a year to the next 20%? I have no idea. But the “informal worker” who is in the sixth decile has just been left out to dry.

Monsod doesn’t think transfers are a great solution. Why? First, it will be a bureaucratic and a logistical nightmare since the tax-transfer scheme involves 80% of Filipino families, or roughly 16 million families. And second, the transfers are good only for one year.

Economic goals on track

Meanwhile, Dominguez notes that GDP grew 6.68% in the first nine months of the Duterte administration, which is faster than the expansion rates in all other previous administrations. GDP growth for the first nine months was 4.69% under Corazon Aquino, 2.10% Fidel Ramos, 0.17% Joseph Estrada; 3% Gloria Macapagal Arroyo; and 5.98% under Benigno Aquino III.

The average inflation rate was 2.64% in the first 11 months of the Duterte presidency while the debt-to-GDP ratio declined from 43% as of the end-June 2016 to 41.9% by the end-March 2017.

Says Dominguez: “The government is on track to meet its economic targets.”