TRAIN – Tax Reform for Acceleration and InclusioN – is the most significant and far-reaching tax reform and legislation under the administration of President Duterte.

This early though, some cynics dismiss it as just another TREN – Tax Reform Empowering None or No One.

The reason for such cynicism is high prices which have soared to unprecedented highs in the last six and a half years.

In Duterte’s first full month in office, in July 2016, inflation was a sluggish 1.3%, from a heartwarming 0.7% in 2015.

His administration ended 2016 with 1.8% inflation rate. Then in the whole of 2017, the inflation rate almost doubled, to 3.2%.

In the first four months of 2018, inflation averaged 4.1% — 28% higher than the 3.2% inflation in the whole of 2017, and 2.3 times the whole year 2016 inflation of 1.8%.

The inflation spiral began at the same time that the TRAIN Law took effect, on Jan. 1, 2018. The inflation rate was 3.4% in January (compared with 2.5% in January 2017), 3.8% in February (3.1% in February 2017), 4.3% in March (3.1% in March 2017), and 4.5% in April this year (3.2% in March 2017).

The inflation spiral began at the same time that the TRAIN Law took effect, on Jan. 1, 2018. The inflation rate was 3.4% in January (compared with 2.5% in January 2017), 3.8% in February (3.1% in February 2017), 4.3% in March (3.1% in March 2017), and 4.5% in April this year (3.2% in March 2017).

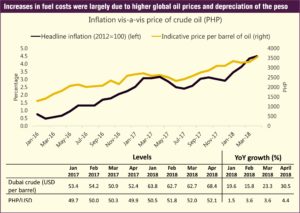

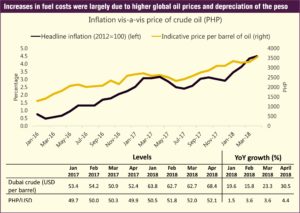

In a twist of fate, the TRAIN law took effect in January 2018 just as oil prices began climbing and the peso against the dollar began its dive.

The 4.5% April 2018 inflation rate is the highest in the last six and a half years. It is the steepest price increase, since the rate jumped from 10.6% in 1989 to 19.4% in 1991.

Now, inflation is bad for you and your pocket. It is like stealing money from you. The 4.5% inflation rate of April 2018 means the P100 you had last year is worth only P95.50 today, without you having bought anything with the P4.50 you just lost.

The other way of looking at high inflation is that it would have been better to have bought something with your P100 last year, say, a yard of cotton fabric, because that fabric is now worth P104.50. Which means that inflation encourages consumption and speculation and discourages savings (because inflation diminishes the value of your money over time when stored with a bank).

The other way of looking at high inflation is that it would have been better to have bought something with your P100 last year, say, a yard of cotton fabric, because that fabric is now worth P104.50. Which means that inflation encourages consumption and speculation and discourages savings (because inflation diminishes the value of your money over time when stored with a bank).

Another impact of high inflation is higher cost of money. Banks have raised the interest rates for lending. Interest rates are the price for money given out as loans by the banks.

Interest rates should be higher than inflation rate. Otherwise, the banks lose money. If inflation is 4.5% and the interest rate is 5%, the half percent difference will not be enough to cover the bank’s operating cost (usually two percentage points) and the cost of that money (which is the interest yield of the deposit that was converted into loan, usually another two percentage points).

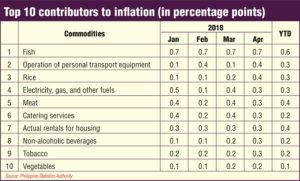

Naturally, consumers and wage earners are aghast. Aghast because the commodities that have shown the steepest rise in prices are those that they need most and have the greatest impact on them. Food items like fish, rice, meat, vegetables, and non-alcoholic drinks like juices and soft drinks. These five items contributed 1.6 or 35.5% of the 4.5 inflation rate in April.

The rise in rice prices was particularly appaling, from 0.1 share of inflation in January 2018 to 0.3 in April 2018, a three-fold increase.

People naturally blame the TRAIN law.

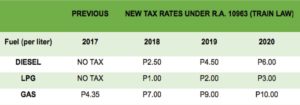

Beginning January 2018, TRAIN slapped a P2.50 per liter excise tax on diesel, from zero before, a P1 tax on LPG, from zero; and a P7 tax on gas, from P4.35 per liter last year. The tax law also imposed taxes on soft drinks and any liquid that has sugar, except when the sugar comes from coconut or corn. More higher taxes per volume of such products will be imposed in 2019 and 2020. The effect is that diesel tax would have risen from zero based on the price in December 2017, to 20% by 2020.

Beginning January 2018, TRAIN slapped a P2.50 per liter excise tax on diesel, from zero before, a P1 tax on LPG, from zero; and a P7 tax on gas, from P4.35 per liter last year. The tax law also imposed taxes on soft drinks and any liquid that has sugar, except when the sugar comes from coconut or corn. More higher taxes per volume of such products will be imposed in 2019 and 2020. The effect is that diesel tax would have risen from zero based on the price in December 2017, to 20% by 2020.

Fishermen use diesel fuel to go fishing. Farmers use diesel-fed irrigation pumps in their farms. Your jeepney driver uses diesel for you to commute. So do truckers when they bring meat and vegetables to markets.

True, the rich also use diesel in their luxury SUVs but in terms of number of users, more poor people use diesel than the number of rich who consume it. (Government figures indicate 60% of diesel is consumed by the rich).

Also, the government has been slow in providing social protection to the poor from high prices. They include outright cash doleouts monthly to poor households and discount coupons to drivers. The reason is simple: There are just too many of them, up to 10 million households.

Besides, Duterte is already giving free college education to the poor. And the average urban wage earner is now exempt from paying tax on income up of to P250,000 a year. Those are stupendous concessions, from a government that is running into deficits.

A number of legislators are now seeking either the suspension of the TRAIN taxes on fuels and other goods or an outright repeal of the law itself. They include Senators Bam Aquino and Grace Poe.

President Duterte is lukewarm. He concedes TRAIN has caused some inflation, which he says is an old problem. But “I need the money to run the government.”

Indeed, the President has doubled the salaries of soldiers and teachers, to an average P40,000 a month. He wants to modernize the economy by spending up to P8 trillion on infra under his “Build, Build, Build”.

Government technocrats insist people should not single out TRAIN for the unprecedented and stratospheric rise in prices in the last two years, when inflation rate more than tripled, by 3.5 times actually from 1.3% in 2016 to 4.5% by April this year.

Government technocrats insist people should not single out TRAIN for the unprecedented and stratospheric rise in prices in the last two years, when inflation rate more than tripled, by 3.5 times actually from 1.3% in 2016 to 4.5% by April this year.

Finance Secretary Carlos Dominguez III cautions against calls to suspend and amend TRAIN.

“Such a move would derail the implementation of the government’s ‘Build, Build, Build’ program meant to sustain the economy’s high growth momentum, and possibly even imperil the free tuition program in State Universities and Colleges (SUCs) and the salary hike for police and military personnel,” Dominguez, himself a former banker, argues.

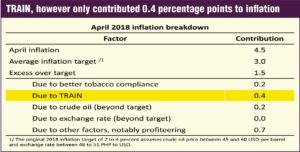

In any case, adds Finance Undersecretary Gil Beltran, an economist, “TRAIN pushed up inflation by only 0.4 percentage point, lower than DOF estimates of 0.7 percentage point. Other factors, such as the rise in global oil prices and the better collection of cigarette excise taxes drove inflation to 4.5% in April this year.”

“Suspending the implementation of the TRAIN law would also set back programs on health, education, and social protection for the country’s poorest families,” Beltran asserts.

“The current spike in inflation is only temporary. All these programs we are implementing, which are made possible because of the additional revenues from TRAIN, are meant precisely to prevent prices from rising further in the future,” says Beltran. “TRAIN is a long-term measure that would push the economy to a much higher development path, create more jobs and improve the living conditions for our people.”

At a public hearing at the Senate, Beltran pointed out that while inflation reached 4.5% in April, month-to-month inflation, however, declined from 1.0% in January to only 0.5% in April. Year-to-date inflation was recorded art 4.1% by the DOF, Beltran estimated.

“This suggests a potential easing of inflation moving forward. The Bangko Sentral ng Pilipinas (BSP) expects inflation to temper and settle to 3.9% in 2018 and decelerate further to the midpoint of the target range (of 2% to 4%) in 2019,” Beltran said at the hearing.

The April 2018 inflation, he pointed out, was driven mainly by the higher prices of corn, fish, tobacco and personal transport. These price increases were a result of a variety of factors, and cannot be solely attributed to the impact of TRAIN.

For instance, tobacco prices, increased by 46% year-on-year in the first quarter mainly because of better tax collection.

“Of the 46% price rise, TRAIN only accounts for 2 percentage points of the increase; sin tax for the 4 percentage points; and the rest (40 percentage points) is due to the industry’s response to more efficient sin tax collection,” the DOF economist explained.

“Of the 46% price rise, TRAIN only accounts for 2 percentage points of the increase; sin tax for the 4 percentage points; and the rest (40 percentage points) is due to the industry’s response to more efficient sin tax collection,” the DOF economist explained.

Petroleum prices, meanwhile, increased by 34% year-on-year in the first quarter of 2018.

Of the 34%, TRAIN only accounts for 7 percentage points of the increase. The rest (27 percentage points) is a result of the higher world prices of crude oil and the peso depreciation, Beltran said.

Higher international oil prices along with the peso depreciation were also the primary factors for the increase in the cost of operating personal transport.

“Higher crude oil price and currency depreciation account for P9.10 or 22% of retail price, while additional excise tax on fuel arising from the TRAIN contributed less at P 2.80, including additional VAT, or 7% of retail price, Beltran estimated.

He explained that the inflation rates of clothing and footwear; housing, water, electricity, gas, and other fuels; health; overall transport; communication; and education slowed down consistent with the administration’s policy objectives.

Beltran higher salaries as a result of TRAIN, and the government’s increased spending to pump prime the economy induced demand, which, in turn, drove up prices.

He told the senators: “Moderate inflation is typical for a rapidly growing economy, and inflation has been manageable. The BSP has sufficient tools to reign in unwarranted price shocks and remains ready to implement necessary monetary measures to actively keep inflation under control.”

DOF Chief Dominguez has another explanation for the rapid rise in prices. People have plenty of money. It is called domestic demand. “They have more money to spend,” he smiles. He estimates households have P32 billion extra cash monthly because of tax cuts on income of wage earners, under TRAIN, plus the additional income from wage increases and new government projects.

DOF Chief Dominguez has another explanation for the rapid rise in prices. People have plenty of money. It is called domestic demand. “They have more money to spend,” he smiles. He estimates households have P32 billion extra cash monthly because of tax cuts on income of wage earners, under TRAIN, plus the additional income from wage increases and new government projects.

The tax cut on personal income freed P12 billion. Duterte also has free tuition in government colleges and universities. That’s another P3.5 billion monthly of savings. Plus the poor are given monthly P2.5 billion in doleouts. Of course, government workers like teachers and soldiers have had their salaries doubled. Other workers earn more because of government projects. The total effect of those pay increases: P15 billion. The grand total in a month: P32 billion.

But this explanation does not answer another problem: Inflation happens when there is so much cash going around and too few goods to chase or buy. So those too few goods have to rise prices. Hence, inflation.

This has been the situation in rice. There was not enough of rice. And so many people were looking for rice. So the rice merchants raised their prices.