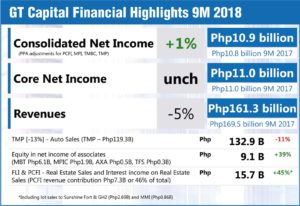

GT Capital Holdings, Inc. is on a roll despite declining stock market value. Profits during January-September 2018 hit P11billion on revenues of P161.3 billion. Consolidated net income rose 1%despite a 5% drop in revenues. Core net income of the group was unchanged.

Bank profits rose 27% to P16.8billion. Metrobank’s asset quality is better than the industry average. Banking offers a huge potential for growth. Only 577 of every 1,000 Filipinos have a deposit account, the lowest in ASEAN after Timor and Myanmar. In Singapore and Malaysia, people have three deposit accounts on average. After its colossal success in banking and automotive, the GT group has lately banked on power and infra to boost its long-term outlook.

Higher equity in net income of associates Metropolitan Bank & Trust Company (Metrobank), Metro Pacific Investments Corp. (Metro Pacific), AXA Philippines, Toyota Financial Services Philippines (TFS), and Sumisho Motor Finance Corp. (Sumisho) contributed to GT Capital’s financial performance.

“The country’s macro economic indicators as of the third quarter have shown some positive trends, suggesting that inflation may have already peaked. Oil prices have declined, foreign exchange rates have shown some strength, and food prices have stabilized. We believe that these factors, combined with the increased spending levels in the last quarter, provide a good backdrop for improved conditions in 2019,” GT Capital Chairman Arthur V. Ty explained.

“Our year-to-date results show the counterbalance between the soft auto sector volume sales mitigated by strong growth in financial services, property, and insurance segments. The consensus is that the decline in auto sales may have bottomed out as monthly volumes have stabilized. We are more optimistic for the coming year, anticipating a rebound in consumer confidence arising from a less volatile macroeconomic environment,” GT Capital President Carmelo Maria Luza Bautista said.

Metrobank posted a net income of P5.7 billion in the third quarter of 2018, representing a robust 55% increase from the P3.7 billion in the same period last year,bringing net income for the first nine months of the year to P16.8 billion or an increase of 27% year- on-year.

The strong growth was driven by the solid performance of the core business, as loans and deposits expanded by15% and 5% year-on-year, respectively, while the increase in operating expenses was kept at a manageable level.

Asset quality metrics remained healthy and better than industry average.

Consolidated revenues from Toyota Motor Philippines (TMP) reached P119.3 billion in the first nine months of2018. From January to September this year, the country’s dominant automotive company realized P6.6 billion in consolidated net income.

TMP attained retail vehicle sales of 109,402 units from January to September of 2018, while monthly sales grew 3%for September 2018 to 12,686 units from 12,315 units in the previous month. TMP continues to lead the Philippine auto sector with 37.4% overall market share.

Metro Pacific reported an 8% rise in consolidated core net income to P12.2 billion for the nine months ended Sept. 30, 2018 fromP11.3 billion for the first nine months of 2017, slowing slightly in the third quarter.

Nine-month core net income was lifted mainly by an expanded power portfolio following further investment in Beacon Electric Asset Holdings Inc. in 2017, continuing traffic growth on all domestic roads, and steady volume growth coupled with inflation-linked tariff increases at Maynilad Water Services Inc.

GT Capital’s property development subsidiaries, Federal Land, Inc. (FEDERAL LAND) and Property Company of Friends, Inc. (PRO-FRIENDS), attained a combined P18.4 billion in consolidated revenues from January to September 2018, rising a noteworthy 43% from the P12.9billion booked in the same period last year.

Combined real estate sales for the period grew by a significant 48% in the first nine months of 2018 to P16.1billion from P10.9 billion last year.

The two companies reported an aggregate net income of P2.3 billion in the first nine months of 2018, up 20%from P1.9 billion for the same period in 2017.

AXA Philippines’ net income from January to September 2018 rose by a noteworthy 21% to P2.14 billion from P1.77billion. Consolidated life and non-life total premium income for the period rose 24% to P28 billion from P22.7 billion. Sales in annualized premium equivalent rose 21% to P5.6 billion from P4.7 billion, driven by growth in regular and single premiums of 19% and 29%, respectively.