By BSP Governor Benjamin E. Diokno, Ph.D.

(Presented at Standard Chartered Bank’s Sovereign Investor Forum, Oct. 12, 2021)

Finance Secretary Carlos Dominguez III, officers and staff of Standard Chartered Bank, and all the participants of this virtual investor forum, warm greetings to all of you.

I’m here today to present updates on the Philippine economy under the purview of the Bangko Sentral ng Pilipinas (BSP), to help guide you in your assessment of the country’s economic outlook.

I’ll begin by saying that while the road to full recovery remains bumpy for the Philip- pines and many other economies at present, the medium- and long-term prospects for the Philippines are promising.

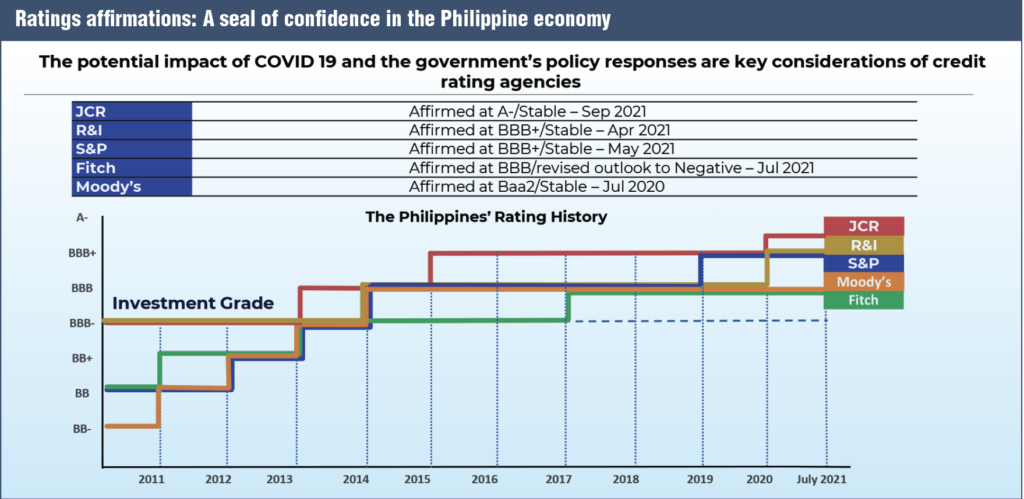

This opinion is shared by relevant third-party observers, including credit rating agencies.

PH remains investment grade

As Secretary Dominguez had also shown earlier, throughout the pandemic— amid a wave of rating downgrades worldwide—the Philippines has maintained its investment-grade credit ratings.

Beyond the short-term challenges of the pandemic, debt watchers say that sound fundamentals and policies will help the Philippines return to a sustainable growth path once the dust settles.

Let me share some of the latest economic indicators and macroeconomic projections for the short term…

Robust GDP growth

Gross domestic product (GDP) grew by a robust 11.8% in the second quarter, thus ending the pandemic-driven recession.

Growth was broad-based, fueled by manufacturing, construction, and wholesale and retail trade on the supply side, as well as household consumption, public construction, and private-sector investments on the demand side.

Unemployment lower

The unemployment rate had improved to 6.9% in July. However, with the re-imposition of stricter quarantine classification on affected areas due to the threats from the more transmissible Delta variant, the unemployment rate rose to 8.1% in August.

But with a calibrated approach to the lockdowns, more economic activities were allowed which helped bring down unemployment from the pandemic’s historic high of 17.6% in April 2020.

Meanwhile, net foreign direct investments rebounded by 43.1% to $5.6 billion in the first seven months of 2021 signaling a return of investor confidence.

Investments

Meanwhile approved investment applications from foreign investors rose by over 45% in the second quarter, with the bulk of the investments going into industries with high potential for job creation such as information and communication, construction, and manufacturing.

Manufacturing up

Manufacturing activity is improving, as shown by the recovery of Purchasing Man- ager’s Index in September after a temporary setback in August due to stricter quarantine measures to curb the delta variant.

Factory output sustains an upward trend with triple-digit growth in volume and value of production indices, as well as, sustained average capacity utilization rate.

Merchandise trade has recovered. For the first seven months, exports and imports sustained double-digit growth.

Remittances, which have been a steady source of foreign exchange throughout the pandemic, grew by 5.8% in the first seven months of the year. Gross international reserves are hefty and provide an adequate liquidity buffer.

Foreign debt exposure manageable

Meanwhile, the Philippines’ exposure to foreign debt remains manageable, at only 26.5% of GDP as of end-June 2021, and low compared to its ASEAN neighbors (Malaysia, Indonesia, and Thailand).

Inflation averaged 4.5% in the first nine months of the year, slightly above the target range of 2 to 4% on account of supply-side pressures. But it remains manageable.

The BSP expects inflation to settle at the upper end of the target range of 2-4% in 2021 at 4.4%.

However, we expect inflation to settle at 3.3% in 2022 and 3.2% in 2023.

We see the risks to the inflation outlook remaining broadly balanced over the policy horizon.

The banking system remains sound

Banks remain adequately capitalized as the average capitalization of banks exceeds the minimum regulatory requirement.

In the meantime, non-performing loans remain manageable.

Growth projections trimmed

As a result of the resurgence of COVID cases in the third quarter and the imposition of calibrated mobility curbs, the government had to trim its growth projection for 2021 from 6 to 7% to 4 to 5%.

For 2022, the government retained its 7-9% growth projection.

In any case, the Philippine Government has taken a whole of government approach in tackling the pandemic-induced challenges.

There have been massive responses from both the fiscal and monetary sides.

What the BSP has done

On the part of the BSP, we have done quite a lot to help safeguard livelihoods, maintain order in the financial markets and restore the economy to its robust growth path.

Besides slashing the reserve requirement and the key policy rate, which now stands at a historic low of 2%, we have extended liquidity support to the National Government, purchased government securities in the secondary market, among others, and implemented various regulatory forbearance.

These include counting of loans to micro, small, and medium enterprises as compliance to the reserve requirement, allowing staggered booking of loan losses, and increase in the single borrower’s limit, among others.

So far, the BSP has infused a total of P2.3 trillion (or $44 billion) in liquidity to the financial system, equivalent to 12.7% of GDP.

BSP to continue to support the economy

As the favorable inflation outlook allows, the BSP will continue to support the economy until there is clear evidence of robust and sustainable progress to economic recovery.

The decision on the timing and circumstances under which BSP will dial back its pandemic-induced support measures depend primarily on the evolution of various domestic factors, as well as global, developments and spillovers.

When domestic developments warrant a withdrawal of policy support as economic recovery gains traction, the BSP will ensure a smooth transition in winding down its time and state-bound measures.

At the same time, the BSP will continue to coordinate closely with fiscal authorities to ensure enough policy support remains for the economic recovery to be sustained.

Macroeconomic assumptions

Here are some of the latest near-term macroeconomic assumptions which reflect our confidence in the economic recovery:

The economy is expected to grow from 7 to 9% next year and from 6 to 7% in 2023.

Inflation will provide an enabling environment for higher consumption and investments, as this is seen within the 2 to 4% target range next year and in 2023.

Foreign direct investments are expected to reach $7 billion this year, and $7.5 billion by next year. This will be aided in part by government efforts toward easing doing business, supported by a liberalized FX environment put in place by the BSP.

Trade is expected to pick up further amid a recovery in global demand and improving business sentiment here and abroad.

Exports are expected to grow by 14% this year and 6% next year, and imports by 20% and 10% over the same period.

Robust external accounts

The country’s external accounts will remain robust, with the GIR staying well above $100 billion. The steady inflows of remittances and business process outsourcing (BPO) receipts will continue to boost the GIR.

Speaking of the country’s strong external payments position, this will continue providing support to the peso. I would like to point out that the peso’s recent depreciation is manageable and in line with the behavior of regional and emerging economies’ currencies.

While short-run fluctuations in the peso are affected by market sentiment, its medium- to long-term movements are largely supported by economic fundamentals as indicated by the relative stability in the movement of the real effective exchange rate of the peso.

Market exchange rate

As a matter of policy, the BSP pursues a market-determined exchange rate. It does not target any particular level of the exchange rate.

Nevertheless, the BSP retains some scope to intervene in foreign exchange (FX) markets in response to excessive FX volatility in order to ensure orderly market conditions, avoid excessive volatility in the exchange rate, and therefore minimize any undue impact on inflation and inflation expectations.

When warranted, the BSP can provide dollar liquidity to ensure that legitimate demands for foreign currency are satisfied.

The banking sector is expected to remain resilient to the pandemic.

Bad bank debts below 10%

We expect bad debts to stay below 10%—far from the levels seen following the Asian financial crisis.

The Financial Institutions Strategic Transfer (FIST) law enacted earlier this year—which allows banks to unload bad assets to FIST corporations—serves as a pre-emptive measure against any material rise in non-performing assets.

Let’s move on to my next point on the Philippines’ medium and long-term prospects…

The Philippines does not simply aim to recover from the crisis.

There is a whole-of-government effort toward a post-COVID Philippine economy that is better than ever. This means an economy that is stronger, more technologically advanced, more inclusive, and sustainable.

I will briefly tackle each of the four aspects and how the BSP is contributing to their attainment.

First, a stronger economy. The government has implemented various measures geared toward investment and job creation, including policies on ease of doing business, tax reforms, and critical infrastructure projects. It is also investing heavily in human capital development.

The government also continues to pursue critical legislative measures such as further liberalization of the economy as earlier mentioned by Finance Secretary Dominguez.

Liberalization initiatives

The BSP has a range of initiatives complementing these efforts.

For instance, to name just a few…

Several waves of foreign exchange liberalization help enhance the ease in do ing business.

Properly calibrated limits on bank loans support infrastructure development.

Opening of the banking sector to more foreign players helps boost economic activities and bring in innovative financial technology.

Prudent management of external ac- counts and structural current account inflows have led to the accumulation of FX reserves and boosted the economy’s resilience to external shocks.

On top of these, consistent with our financial stability mandate, we have a regulatory framework that allows innovation while emphasizing risk management. This has led to a banking system that can withstand headwinds and support the economy during good and bad times.

And, consistent with our price stability mandate, prudent monetary policy has put in place a manageable inflation environment that protects the purchasing power of households and supports productive activities.

Second, a more technologically advanced economy. Technology aids exponential growth in output. In the area of finance, it makes transactions easier and faster, which in turn, speeds up income generation.

Amid this backdrop, the BSP is at the forefront of efforts to achieve a more technologically advanced economy.

Last year, we launched the “Digital Payments Transformation Roadmap,” which aims to transform the Philippines into a cash-lite society by 2023 through the digitalization of financial services.

Digital banking

In addition, the BSP is also actively promoting digital banking.

We have recently approved 6 digital bank licenses.

We expect them to help fuel recovery and long-term growth for the Philippines, alongside conventional banks.

Third, a more inclusive economy. Another goal under our Digital Payments Transformation Roadmap is for at least 70% of Filipino adults to have bank accounts by 2023. We expect to achieve this mainly through financial technology (FinTech).

FinTech makes affordable financial products and services accessible to more people, including low-income earners and those residing in remote places, which in turn, enhances financial inclusion.

On top of this, the BSP has a long list of regulations and initiatives meant to ease access of low-income earners, as well as micro, small, and medium enterprises (MSMEs) to formal credit and other financial services.

Also, the BSP fully supports the rollout of the National ID system, which will allow many marginalized Filipinos to have proper identification that will give them access to a wide range of financial services.

A more sustainable economy

Lastly, a more sustainable economy. The threats posed by climate change require a massive and urgent response. And the BSP recognizes the financial sector’s potential to push the sustainability agenda forward.

As such, last year we issued the “Sustainable Finance Framework,” which sets out broad expectations for banks to integrate sustainability principles in their operations. Soon, we will be issuing more regulations that champion sustainability.

Allow me to highlight three takeaways.

First, the Philippine economy’s recovery process is underway, as evidenced by various indicators.

Second, we will not allow the pandemic to distract us from achieving our vision: A country that is stronger, more technologically advanced, more sustainable, and more inclusive than ever before.

And third, as long as a manageable inflation outlook allows, the BSP will continue to support the economy until sustained recovery is evident.

Thank you very much for listening.