“WE WILL PULL THROUGH”

By Antonio S. Lopez

In 2023, the man of the hour –and possibly, the hero of the year— is our central banker, Bangko Sentral ng Pilipinas Governor Felipe Manguiat Medalla, 73, a veteran economist and a committed public servant all his professional life.

Medalla was dean of the UP School of Economics which produced most of the Philippines’ economic planners.

He took his economics and accounting from La Salle Manila, and his MA in economics from UP. He has a Ph.D. in economics from Northwestern University, Illinois.

He served as economic planning secretary of President Joseph Estrada who inherited a recession and licked it in his first three months. Medalla became BSP governor on June 30, 2022.

BSP’s Job No. 1: Price stability

BSP says its main responsibility is to formulate and implement policy in the areas of money, banking and credit with the primary objective of preserving price stability. Price stability refers to a condition of low and stable inflation. By keeping price stable, the BSP helps ensure strong and sustainable economic growth and better living standards.

As the chief monetary authority, Medalla’s main job thus is fighting inflation, the bane of every Filipino and of every businessman worth his salt.

To fight inflation, Medalla has resorted to something drastic—raising interest rates.

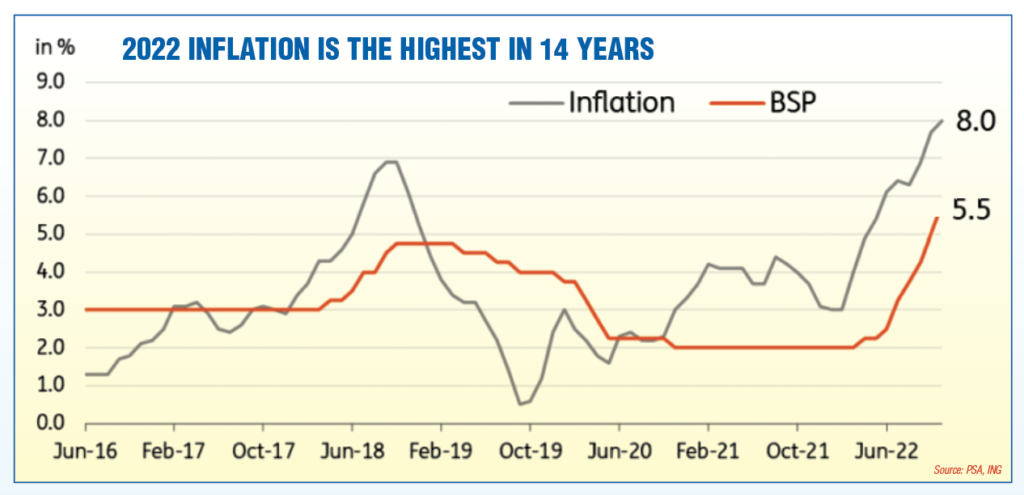

Accordingly, in less than a year, the BSP CEO more than doubled the interest rate banks pay for borrowing money from the central bank overnight, from 2% in February 2022 to 5.5% by December. The job is not done yet. More rate increases are due.

According to ING, BSP expects inflation to settle at 5.8 % this 2022 while 2023 inflation is now forecast to average 4.5% (from 4.3%).

ING’s chief economist Nicholas Mapa “expects inflation to stay elevated well into 2023 given the prevalence of second-order effects, or price increases driven by the initial energy price shock. With inflation expected to stay high, we believe BSP will retain its hawkish stance going into 2023, taking its cue mainly from the Fed while also monitoring the path of inflation.”

Mapa expects “the BSP to bring its policy rate to as high as 6.0-6.25 % this year, although recent comments from Medalla suggest that he is open to a potential ‘BSP pivot’ sometime in the second half of 2023.”

The price of money

Interest rate is the price you pay for money. If the price is high, you lessen the demand for money. With less money, a consumer buys less, because his demand is dampened. With less demand for goods, the rise in prices of such goods slows down. That is the theory.

The rate of an increase or decrease in prices is called inflation. Inflation is the biggest enemy of poverty. It cuts or reduces the purchasing power of one’s income. If a year ago, you had P100 and the price of goods you buy with the 100 rises by 8%, this year, then your purchasing power is reduced to just 92. The P100 you had a year ago is now worth only 92, thanks to 8% inflation.

Imagine if with your P100 a year ago you could buy two kilos (2,000 grams) of rice, at P50 per kilo. But the price of rice goes up by 8%, to P54. That means with the same P100, you can buy only less than two kilos, or just 1.84 kilos or 1,840 grams—160 grams less.

8% inflation means one less meal a day

On average, a Filipino eats 320 grams of rice a day. So a reduction of 160 grams, because of an 8% inflation, means missing half of your meal in one day.

If the 8% inflation persists for one year, you will be eating only half of your daily meal requirement each day for 365 days. That’s bad. You will feel bad. You will hate your government. Or at least blame somebody for that somebody having messed up your daily meal because there is not enough rice while demand is constant or rising so that the cereal’s price has to increase to dampen demand.

Inflation concern nationwide

That is exactly what is happening in most places in the Philippines today. Food is 50% of a poor man’s daily expenditures; 50 of every P100, daily. Of that 50, P15 is allotted for rice, which unhappily is in short supply.

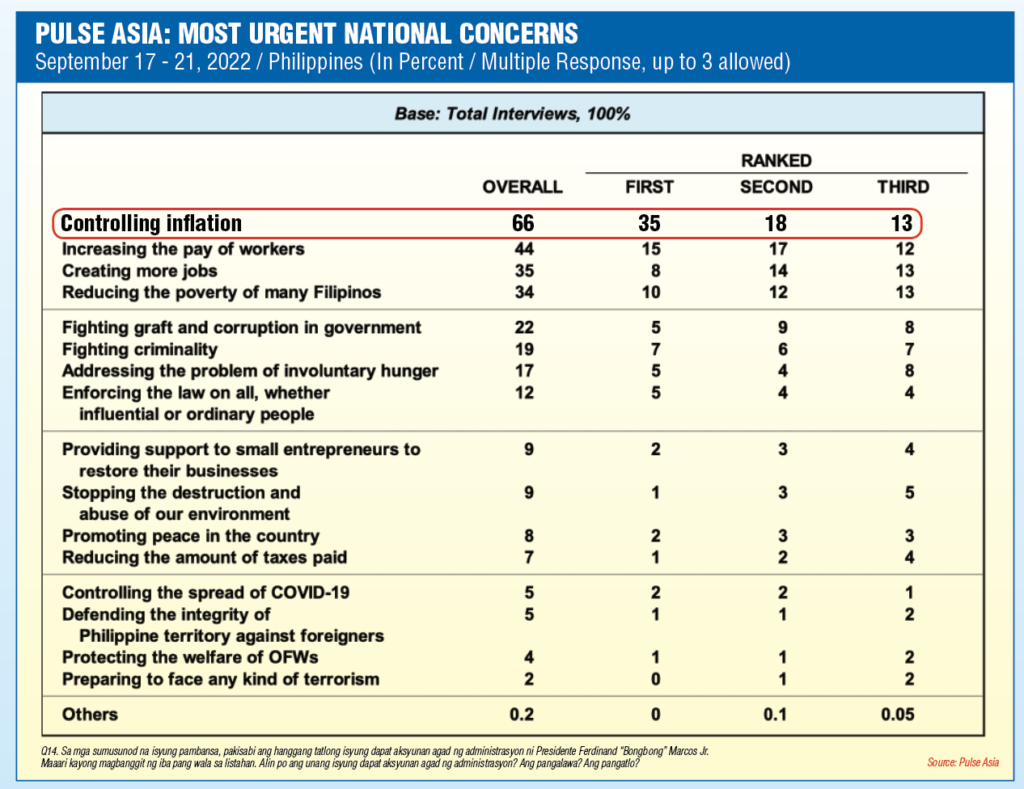

Not surprisingly, in September 2022, respected pollster Pulse Asia found out that most Filipino adults (66%) are concerned about the soaring prices of basic commodities; public concern regarding this matter became more pronounced between June 2022 and September 2022 (+9 percentage points).

Amidst the continuing increase in the prices of basic goods, 66 of every 100 Filipinos say controlling inflation is issue No. 1 for the administration of President Marcos Jr.. This view is widespread, in all geographic areas (56% to 81% of people surveyed), and all income classes (51% to 71%).

Accordingly, almost half of Filipino adults cite increasing workers’ pay as an urgent national concern (44%) while around a third of them are concerned about job creation and poverty reduction (35% and 34%, respectively).

A companion problem is corruption. Filipinos are irritated that a government that cannot control inflation also cannot control corruption. “Nearly a quarter of Filipino adults (22%) say the present dispensation should immediately take steps to combat corruption in government,” says the Pulse Asia September 2022 survey.

So there, when inflation is high and corruption is rampant, you have what you call misery. Misery, of course, is a precursor to outrage.

Inflation rages, 8% in November

Philippine headline inflation rose annually to its highest since 2008 to 8% in November 2022, from 7.7% in October 2022.

The surge in prices was triggered the 10% rise in food and beverage costs. Reports ING: “Supply disruptions caused by two deadly storms pushed up vegetable prices. Meanwhile, both utilities and transport costs posted slightly slower price increases, tracking the moderation in global energy prices.”

Also driving inflation was strong demand side pressures with items related to so-called revenge spending reporting faster inflation. “Restaurants and hotels (6.5% YoY from 5.7%) and personal care (4.2% YoY from 3.7%) the fifth straight month of accelerating inflation and with domestic demand resurgent, we could see this trend continuing into 2023,” says ING in an analysis.

BSP rate now 5.5%

At its meeting on monetary policy Dec. 15, 2022, the Monetary Board raised the interest rate on the BSP’s overnight reverse repurchase facility by 50 basis points to 5.5%, effective Dec.16, 2022. Accordingly, the interest rates on the overnight deposit and lending facilities will be set to 5.0% and 6.0%, respectively.

The BSP’s latest baseline forecasts show that average inflation is still projected to breach the upper end of the 2-4% target range for 2022 at 5.8% and 2023 at 4.5%.

Inflation to ease up in 2024 yet

However, BSP said the forecast for 2024 fell to 2.8% owing mainly to the further easing in oil prices, peso appreciation, and the slightly lower domestic growth outlook resulting in part from the BSP’s cumulative policy rate adjustments.

The Monetary Board arrived at its Dec. 15, 2022 decision after noting the further uptick in headline and the sharp rise in core inflation in November amid pent-up demand.

Moreover, upside risks continue to dominate the inflation outlook up to 2023 while remaining broadly balanced in 2024.

BSP said “the expected upside risks to inflation over the policy horizon stem mainly from elevated international food prices due to high fertilizer prices and supply chain constraints.”

Domestic front

On the domestic front, the BSP noted that trade restrictions, increased prices of fruits and vegetables due to weather disturbances, higher sugar prices, pending petitions for transport fare hikes, as well as potential wage adjustments in 2023 could push inflation upwards. Meanwhile, the impact of a weaker-than-expected global economic recovery continues to be the primary downside risk to the outlook.

Amid broad-based inflation pressures, persistent upside risks to inflation, and elevated inflation expectations, the Monetary Board deems it necessary to take aggressive monetary action to bring headline inflation back to within target as soon as possible. At the same time, an adjustment in the policy interest rate will continue to provide a cushion against external spillovers amid tighter global financial conditions.

The BSP remains steadfast in its commitment to its primary mandate of sustaining price and financial stability and stands ready to take all necessary action to bring inflation to within the 2-4% government target band over the medium term.

BSP likely staying hawkish

ING’s Mapa believes the BSP will likely retain its hawkish tilt.

“Demand side pressures remain evident after items related to ‘revenge spending’ experienced quicker inflation. Thus we expect BSP to carry out a 50bp increase at their meeting next week,” predicts Mapa, ING’s senior economist. “We believe BSP’s rate decisions will be dictated by Fed decisions,” says ING.

Governor Medalla has indicated his preference to maintain a 100 basis-point (one percentage point) differential with the Fed rate.

Analysts see the BSP chief matching one on one any Fed rate increases.

Still, Medalla hopes inflation will moderate middle of 2023 and on to 2024. Then, he can start reversing rate increases, but gradually.

Hot seat

Medalla knows fully well he is in the hot seat.

“This may be the most difficult time since I joined the Monetary Board more than a decade ago,” he told economic journalists in November.

He frets: “We are facing very difficult challenges. There is the very aggressive response of the US Fed [US Federal Reserve]. Then, we also have the Ukraine-Russia conflict, which along with domestic supply issues, pushed up the prices of oil and non-oil commodities. This has pushed inflation to the center of mainstream consciousness.”

In November 2022, instead of easing, inflation sizzled some more to a 14-year-high 8%.

read more on page 4-11 here