By the ASIAN DEVELOPMENT BANK

Global and regional developments since September have been roughly in line with pessimistic expectations laid out that month in the Asian Development Outlook 2022 Update.

The world economy chugged along in the third quarter (Q3) of this year but is now set to slow markedly, weighed down by weakening in the United States, euro area, and People’s Republic of China (PRC).

Persistently elevated inflation in the US led the Federal Reserve to raise its policy rate in November by 75 basis points, the fourth consecutive hike of that magnitude.

Despite a resilient labor market, investment prospects and consumer confidence worsened, suggesting that the Q3 rebound to seasonally adjusted annualized growth of 2.6% will be short-lived.

Similarly in the euro area, GDP growth outperformed expectations in Q3, but annual inflation spiked further to 10.6% in October.

Leading indicators are consistent with continued deceleration deepened by an energy crisis and aggressive policy rate hikes by the European Central Bank.

Economic activity in the PRC remains hampered by sporadic coronavirus disease (COVID-19) outbreaks, zero- COVID restrictions, and continued weakness in the property market.

Growth picked up to 3.9% year on year in Q3, as the Omicron wave faded, but is now losing steam. The official PRC purchasing managers’ index (PMI) fell to 49.4 in November, below the threshold of 50 separating expected improvement from deterioration, as conditions worsened across all sectors except construction.

Adding to a consumption shift post pandemic from goods to services, slowdowns in the world’s largest economies are further depressing demand for manufactured goods from developing Asia.

Exports of goods from the PRC declined by 10.4% between July to October. In the rest of the region, exports dropped in July by more than 7% from their peak in June and stabilized around that level in August. Lower export orders point to continued weakness going forward.

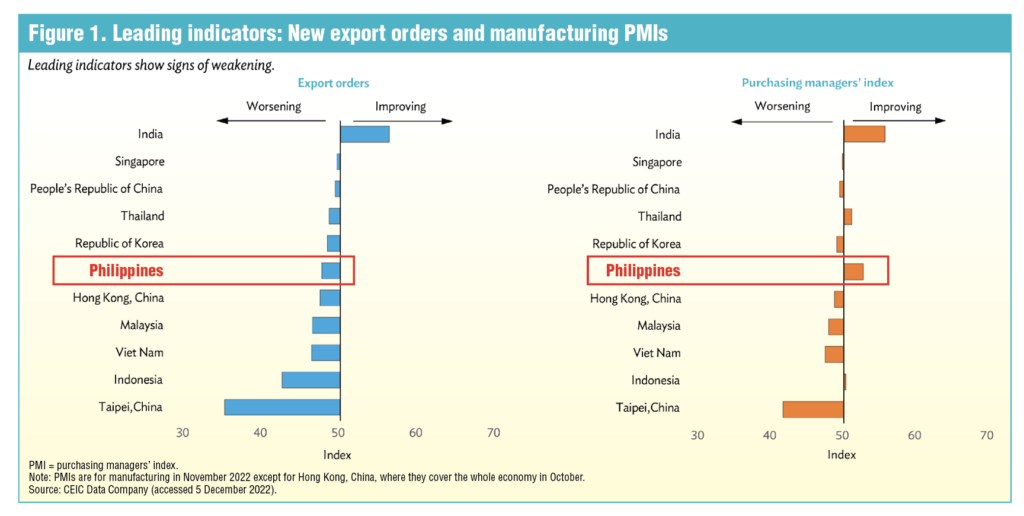

Among the 11 economies for which data on new export orders are available, 10 recorded readings below 50 in November, indicating declines from the previous month (Figure 1, page 4). India was the only exception.

Readings of 48.3 for the Republic of Korea (ROK) and 35.1 for Taipei, China are particularly indicative of the worsening external environment, as these economies are typically bellwethers for international trade conditions. PMI readings are also consistent with softening economic activity in most economies.

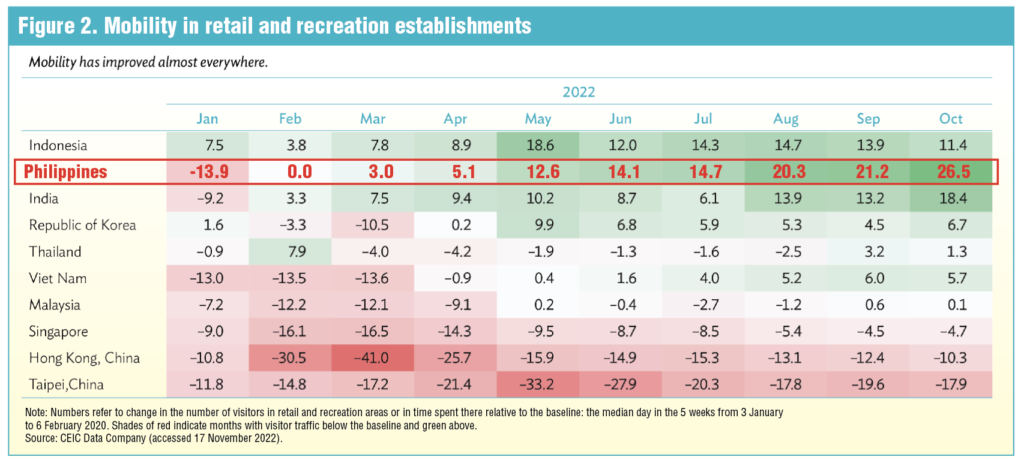

Easing pandemic conditions and containment measures have underpinned healthy domestic demand in most of developing Asia this year. Mobility improved almost everywhere from earlier in the year (Figure 2, page 4).

Reflecting this, retail sales growth year on year was strongly positive from May to September in Indonesia, Malaysia, the ROK, Singapore, Thailand, and Viet Nam. In the same period, retail sales increased only slightly in the PRC, weighed down by lockdowns in April and May, and declined in Hong Kong, China, where strict pandemic curbs started to relax gradually only in September.

Regional inflation having risen further in the second half of 2022, may have already peaked in many economies. Global oil, gas, and food prices have come down from their highs earlier this year, though they remain more elevated than before the Russian invasion of Ukraine.

Headline inflation in developing Asia reached 5.6% in September, up from 3% at the start of the year, then declined to 5.2% in October (Figure 4, page 5).

For 22 of the 28 economies in developing Asia with monthly inflation data, inflation has now come down from peaks reached earlier in the year, including in the largest economies: the PRC, India, Indonesia, the Republic of Korea, and Taipei, China (Figure 5, page 6).

Central banks continue to raise policy rates, striving to curb inflation and safeguard financial stability. Monetary authorities in developing Asia have hiked rates 68 times by an average of 63 basis points per hike so far in 2022, up from 23 rate hikes averaging 38 points per hike in 2021 (Figure 6).

This has tightened financial conditions in the region, which have also

been greatly influenced by aggressive rate hikes in the US and Europe.

Financial markets have flip-flopped between optimism and pessimism in recent months, reacting to the latest US inflation numbers and whatever policy signals they can glean from Federal Reserve officials’ speeches.

But, in the year as a whole, the broad trend has seen financial conditions deteriorate. Regional bond yields have risen, credit default swap spreads have widened, equity markets have declined, and currencies have depreciated.

Regional outlook and risks

Global economic prospects have worsened since the September Update. The major advanced economies will expand slightly more than previously anticipated this year but are expected to endure sharp deceleration in 2023.

Tightening monetary and financial conditions will drag on economic activity in the US and the euro area next year, with the latter likely to fall into a technical recession.

Despite this, inflation is forecast to continue to exceed central bank

targets in both the US and euro area in 2023, necessitating continued tightening, and oil prices are projected to remain elevated. The baseline forecast assumes that the PRC will ease its zero-COVID policies only gradually to the forecast horizon.

Against this backdrop, this Supplement revises only slightly the regional outlook in the Update (table). Recovery in developing Asia is expected to continue but lose some steam. The region’s 2022 GDP growth forecast is revised down marginally to 4.2%, reflecting downward revisions for East Asia and, particularly, the PRC, where pandemic-induced disruption and unresolved problems in the property market are expected to weaken growth.

By contrast, growth projections are revised up for the Caucasus and Central Asia on continued benign economic spillover from the Russian invasion of Ukraine, for Southeast Asia on recovering domestic demand and tourism, and for the Pacific on rebounding tourist arrivals in Fiji.

The regional growth projection for 2023 is trimmed by 0.3 percentage points to 4.6% as a darkening global outlook is expected to slow expansion in every subregion but the Caucasus and Central Asia.

The Update forecast for regional inflation this year is revised down marginally to 4.4% as downward revisions for East Asia, Southeast Asia, and the Pacific outweigh upward revisions in the two remaining subregions.

With upward revisions for South Asia, Southeast Asia, and the Pacific in 2023, regional inflation is now forecast to ease less next year than projected earlier, to 4.2%.

Even with the further deterioration in forecasts, developing Asia will still grow more than other regions and suffer lower inflation than most. Risks to the outlook abound. Stubbornly high inflation in the US and other advanced economies could prolong the current monetary tightening cycle, and the

synchronized nature of the squeeze may bring overly restrictive monetary stances and unnecessary output and employment losses.

Further growth deceleration in the PRC caused by pandemic or property market issues also threatens to jeopardize regional economic prospects. Similarly, a dangerous situation in the Russian Federation and Ukraine could renew surges in commodity prices, stoking global inflation and inducing further monetary tightening. Additional challenges are geopolitical tensions, notably worsening PRC–US relations, and climate-related risks.

(read more from pages 4 through 11 here)