Economic performance in the region is being shaped by both external and domestic developments.

By the World Bank

Growth

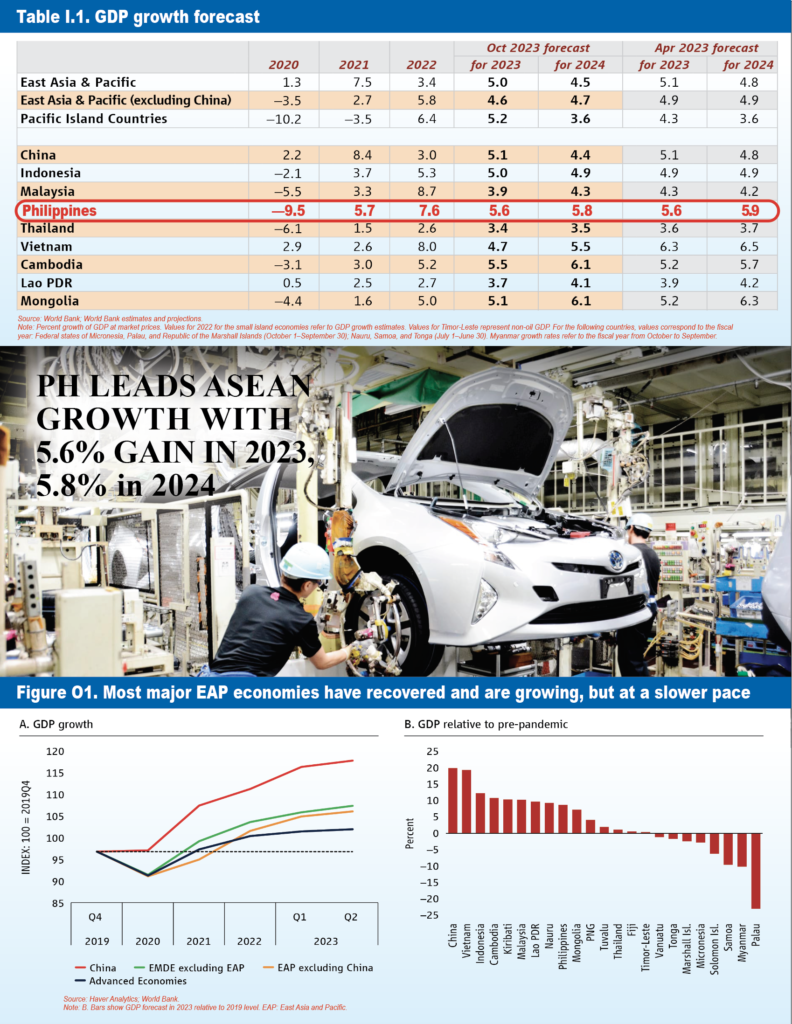

Most economies in developing East Asia and Pacific (EAP), other than several Pacific Island countries, have recovered from the succession of shocks since 2020 and are continuing to grow, albeit at a slower pace (figure 01).

China’s economy slowed to 0.8% (q/q) in the second quarter of 2023, after growing by 2.2% (q/q) in the first quarter.

The rest of the region grew at an estimated 1.0% (q/q) in both the first and the second quarter of 2023.

Determinants

Economic performance in the region is being shaped by both external and domestic developments. The key external factors are slowing global growth, still tight financial conditions and trade and industrial policies.

Among the domestic factors, the most important are the legacy of amplified public and private debt and the macroeconomic policy stance.

External factors

The external environment remains challenging for EAP countries. Global growth is projected to fall to 2.1% in 2023, from 3.1% last year.

Even though inflation is declining in major economies, core inflation in the US and EU remains elevated and labor markets remain tight, leading to continued high interest rates. Furthermore, almost 3,000 new restrictions were imposed on global trade in 2022, three times as large as those in 2019.

Domestic factors

Debt

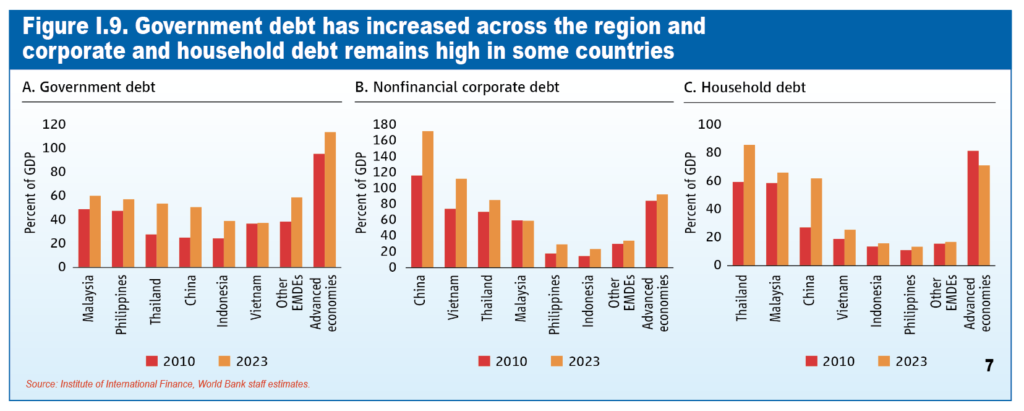

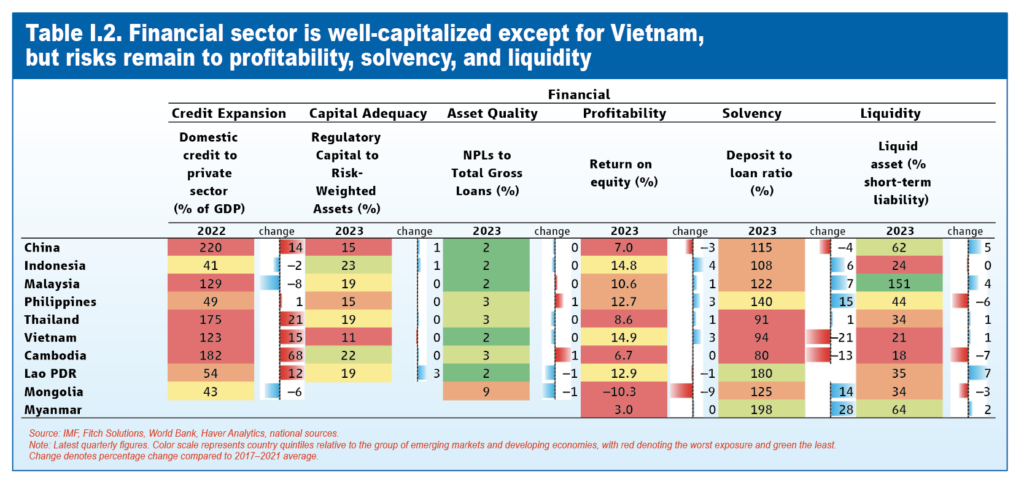

Debt as a share of GDP increased significantly over the last decade in most EAP countries. General government debt as a share of GDP has increased significantly in most of the region’s economies.

Corporate debt too has increased significantly in China and Vietnam by more than 40 percentage points of GDP since 2010, and now exceeds the level in advanced economies. And household debt is now significantly higher in China, Malaysia and Thailand compared to levels in other emerging markets.

High government debt limits fiscal space, constraining public investment, and, by leading to higher interest rates, hurts private investment. High corporate debt also hurts private investment by leaving firms with less resources for new projects. The cost of servicing high household debt erodes disposable income and hurts consumption

Macroeconomic policy

The macroeconomic policy stance in 2023 is less expansionary than in the 2020–2022 period in most economies. The major economies in the region are projected to have a lower structural balance in 2023 than in 2022, except Indonesia which already saw significant fiscal consolidation in 2022.

At the same time, policy rates in the EAP region have been raised starting in late 2022 but remain lower than in other emerging market and developing economies (EMDEs).

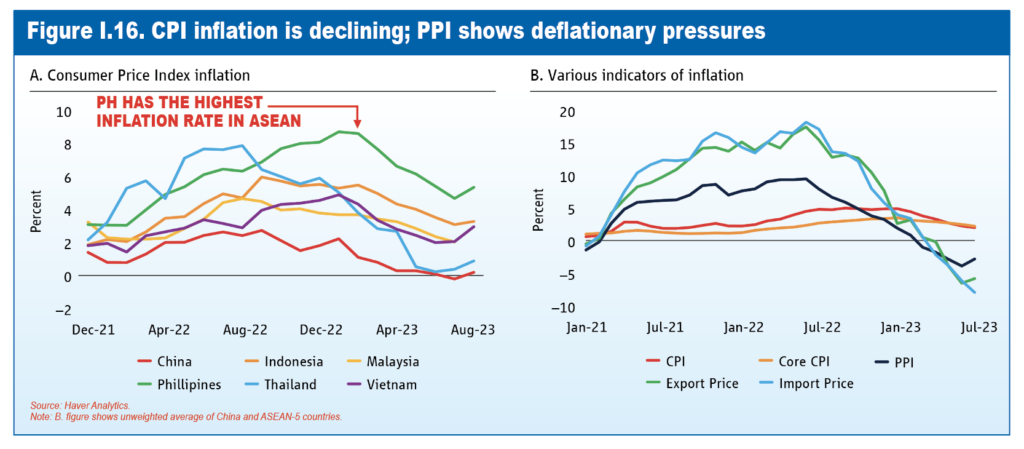

Authorities appear to be balancing the need for monetary policy support and risks of continuing inflation. Rates have recently been reduced in China and Vietnam in response to declining inflation and weaker growth.

Demand weakening

Exports

Foreign demand for manufactured goods and commodities is weakening as global growth slows down.

Goods exports have fallen by more than 20% in Indonesia and Malaysia, and by more than 10% in China and Vietnam from their levels in the second quarter of 2022.

An ongoing revival of tourism has helped services exports in the Philippines, Thailand and many Pacific Island countries.

Trade and industrial policy measures in the EAP countries’ major trading partners are affecting their exports. As demonstrated in earlier EAP Updates, the tariffs imposed by the US on China since 2018 shifted US imports towards other countries in the region.

More recently, the Inflation Reduction Act (IRA) and the CHIPS and Science Act of August 2022, introduced domestic content requirements linked to subsidies granted under the new laws.

These Acts were followed by a decline in the exports of the affected products to the US from China and the ASEAN countries, and a slight increase in the exports from Canada and Mexico which are exempted from these requirements.

Consumption

Private consumption, bouncing back from COVID and inflation-induced austerity, had sustained growth in the region but is running out of steam, unexpectedly early in China.

In China, the current trend of retail sales is flatter than the pre-pandemic trends due to both proximate factors (e.g. falling house prices and increased household debt) and structural factors (e.g. aging).

Consumption growth has flattened also in the other EAP economies after the post-Delta variant bounce, for reasons similar to those in China: increasing household debt (e.g. in Malaysia, Thailand) and aging populations (e.g. in Malaysia, Thailand, Vietnam).

Investment

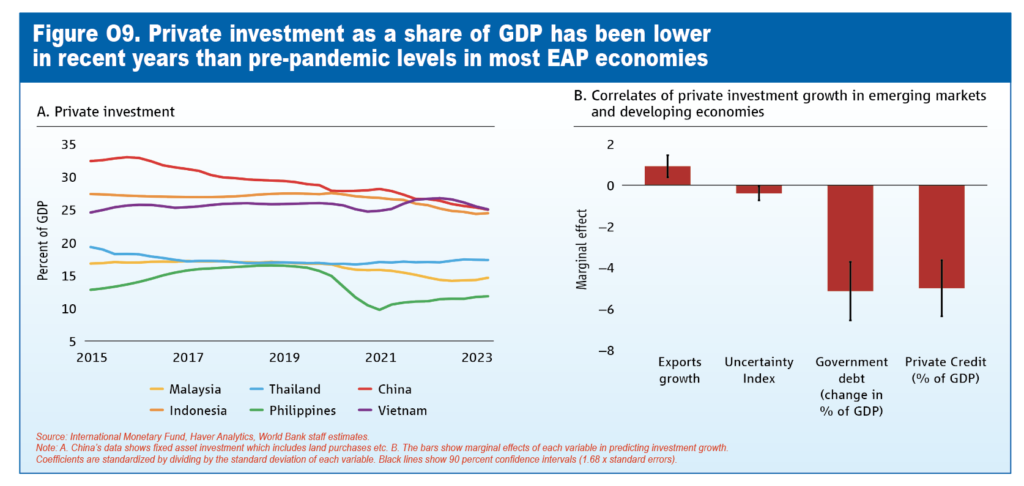

Investment as a share of GDP has been lower than pre-pandemic levels in developing EAP over the last few years (figure 09, above).

Investment growth is affected by export growth, corporate and government debt, and policy uncertainty. All countries in the EAP region are seeing a slowdown in export growth and most have seen a significant increase in all forms of debt. For example, the share of government debt in GDP has increased by 10 percentage points, on average, since 2019.

Several countries have also seen high policy uncertainty because of political transitions and instability, as well as international tensions.

China

China’s economic performance today is being shaped by how it has grown in the past and how it aims to grow in the future. And what happens in

China matters for the whole region; a 1% reduction in its growth is associated with a reduction in regional growth by 0.3 percentage points.

China’s past growth, largely driven by investment in infrastructure and property, has left firms and local governments burdened by debt – as saturated infrastructure yields diminishing returns and an oversupply of housing reduces property prices.

China’s aggregate domestic non-financial debt-to-GDP ratio has more than doubled from 132% in 2007 to 285% in 2023.

Property accounts for 65% of total household assets, and in July 2023, secondary market home prices in lower-tier cities were more than 20% below the 2021 peak.

The external environment has also become more challenging.

China is seeking new drivers of growth based on consumption and innovation that would avoid the problems inherent in the old model of growth, but the transition is proving difficult. Some policy choices and changes have exacerbated uncertainty for consumers and investors.

Loss of confidence, attributable in part to falling property prices, increased indebtedness, and the implications of aging, has led to a further increase in the already-high savings rate to 33%.

Private fixed asset investment growth has hovered around zero percent since 2021, weighed down by high debt, declining operating profits and persistent uncertainty.

The Producer Price Index has declined by an average of 0.4% per month in January-July 2023, with deflation threatening to increase the real burden of debt and erode corporate profits.

Stronger structural reforms – including further liberalization of the Hukou system, stronger social safety nets, greater regulatory predictability for investments in innovative and green products – could help revive consumption and investment, creating the basis for inclusive and sustainable growth.

Growth outlook

Growth in the region remains higher than the growth projected in other EMDEs but is slowing compared to earlier projections.

The EAP region is projected to grow by 5.0% in 2023, about 0.1 percentage points lower than was expected in April 2023.

Growth in China is projected to be 5.1% in 2023, faster than 3.0% in 2022.

However, growth in the rest of the region is projected to slow to 4.6% in 2023 from 5.8% in 2022, and down from the 4.9% projected in April 2023.

The Pacific economies are expected to continue expanding in 2023, with growth projected to be 5.2%, on average, in 2023.

The EAP region is projected to grow by 4.5% in 2024. While domestic factors are likely to be the dominant influence on growth in China, external factors will have a stronger influence on growth in much of the rest of the region.

Growth in China is projected to slow to 4.4% in 2024, as the bounce back from the re-opening of the economy fades and both proximate problems, such as elevated debt and weakness in the property sector, as well as longer-term structural factors weigh on growth.

Growth in the rest of the region, is expected to edge up to 4.7% in 2024, as easing global financial conditions and the recovery in the global economy offset the impact of slowing growth in China.