SMC and SM fuel the Philippines’ robust economic growth

The Philippines’ two largest conglomerates are powering the country’s robust economic growth this year and in the coming years.

Both having demonstrated unprecedented expansion in the past 25 years, San Miguel Corp. and SM Investments Corp. (SMIC) are defining the private sector growth trajectory and strategies of the next quarter century.

SMC is banking on massive industrialization — heavy investments in infrastructure, energy, industrial plants, and consumer goods to generate the double-digit growth it needs to maintain its market dominance and exploit its first mover advantage in a number of growth areas. San Miguel’s slogan is — “Your World Made Better”.

For its part, SMIC is banking on consumption (which accounts for 84% of GDP on the spending side) — and calibrated diversification into new growth sectors to remain dominant in businesses it knows best – retailing, property, banking and savvy portfolio investments. SM Group’s slogan is — “We’ve Got It All for You”.

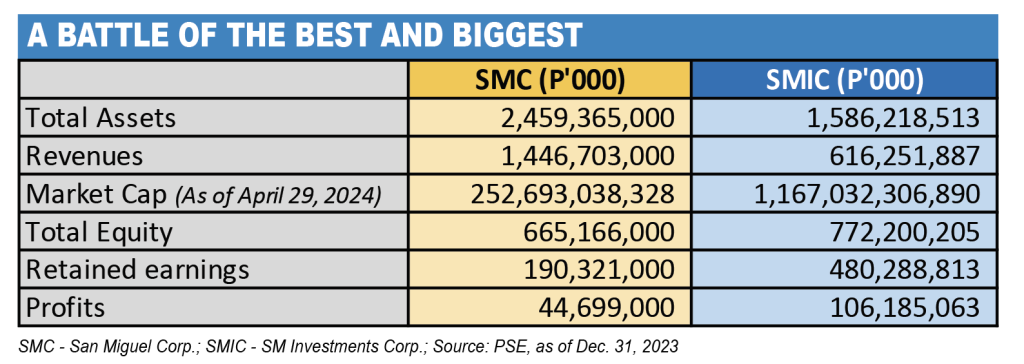

SMC biggest in assets and revenues

San Miguel is the biggest conglomerate in terms of assets (P2.459 trillion), revenues (P1.446 trillion), and diversity of businesses. About 6% of Philippine GDP is produced by SMC alone.

Under President and CEO Ramon S. Ang, SMC is No. 1 in at least ten businesses – food manufacturing (Purefoods), beer and beverages (SanMig), power generation, tollways, cement, airports, petroleum oil refining and marketing (Petron), and super luxury cars (BMW and Ferrari). SMC has more than 100 industrial plants in the Philippines and the rest of Asia.

“We had a strong finish in 2023,” gushes Ang, SMC’s vice chairman since 1999 and president since 2002. He is the visionary behind the conglomerate’s frenetic growth of the past 25 years. “We expect to sustain last year’s strong financial performance as SMC’s major investments continue to deliver and benefit from the country’s economic growth.”

SMC has banked largely on massive industrialization to push its growth and that of the economy. It is today the single largest investor in the Philippines.

Its P735-billion ($13 billion) San Miguel Aerocity in Bulacan is the single largest investment ever by any company, foreign or local, in the country.

Building the Bulacan airport and having won management of the premier gateway Ninoy Aquino International Airport (NAIA) and the Boracay Airport in Caticlan make SMC the Philippines’ biggest airport operator, accounting for more than 90% of total arrivals and departures.

SMIC most valuable Philippine company

SMIC is No. 1 in market capitalization (P1.167 trillion), profits (P106.185 billion), banking (BDO and Chinabank with combined 2,368 branches), bank profits (P95.4 billion, P73.4 billion BDO, P22 billion China), retail (3,853 stores, including 85 malls and 419 stores opened in 2023 alone), and property development—85 malls, 67 primary residences, 22 lifestyle cities, 18 office buildings, 10 hotels, six convention centers and one arena, as of end-2023.

“Our focus is on responsible growth,” says Teresita T. Sy, vice chair of SMIC and the matriarch in the conglomerate run by the six siblings of the late legendary taipan Henry Sy Sr. who died in 2019 at the age of 94.

The SM group’s growth has banked largely on consumption which today contributes up to 84% of total value of the GDP.

“SM Investments Corp. (SMIC), the parent company of the SM Group, continues to see potential for regional development and targeted high growth sectors,” says SMIC. This strategic direction is aligned with the SM Group’s commitment to foster sustainable economic advancement and lasting impact in areas and communities outside of the National Capital Region (NCR).

SM’s three largest companies, SM Investments Corp., SM Prime Holdings, and BDO, comprise 33% of the value of the Philippine Index.