By Regina Capital

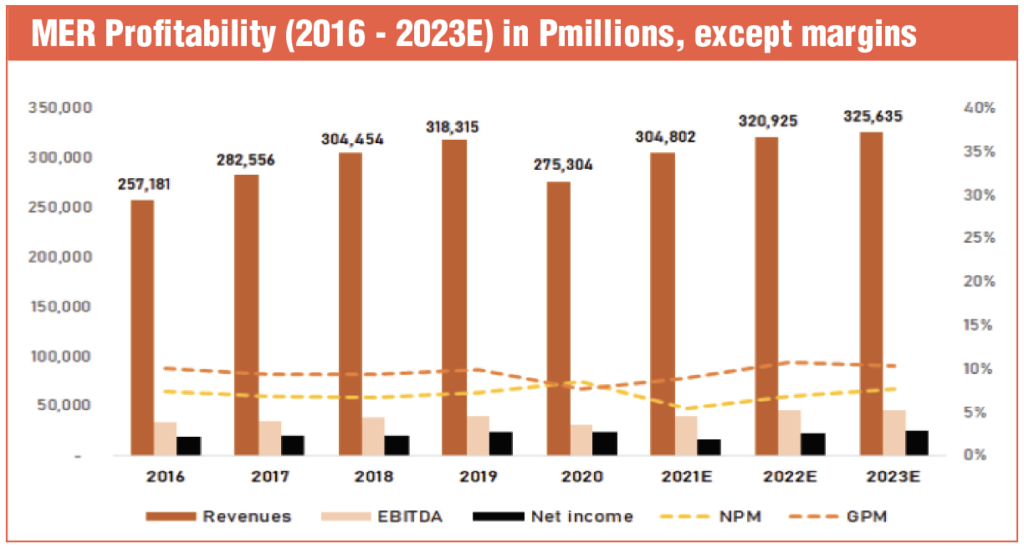

Manila Electric Company (MER) reported P16.52 billion in earnings in 9M21, accounting for roughly 75% of our 2021E projected net income. In line with this, we are maintaining our forecast model and introducing 2023E figures.

The outlook for the power industry as a whole this coming year is generally supportive of MER’s potential bottomline growth, in our view. The upcoming 2022 elections will likely lead to higher power demand from all segments, therefore allowing MER to benefit from sustained sales growth.

On top of that, the gradual reopening of the economy could lead to the Commercial segment recouping its sales and going back to pre-pandemic levels, assuming the much-talked-about Omicron variant doesn’t pose that big a threat to the country’s recovery from the pandemic.

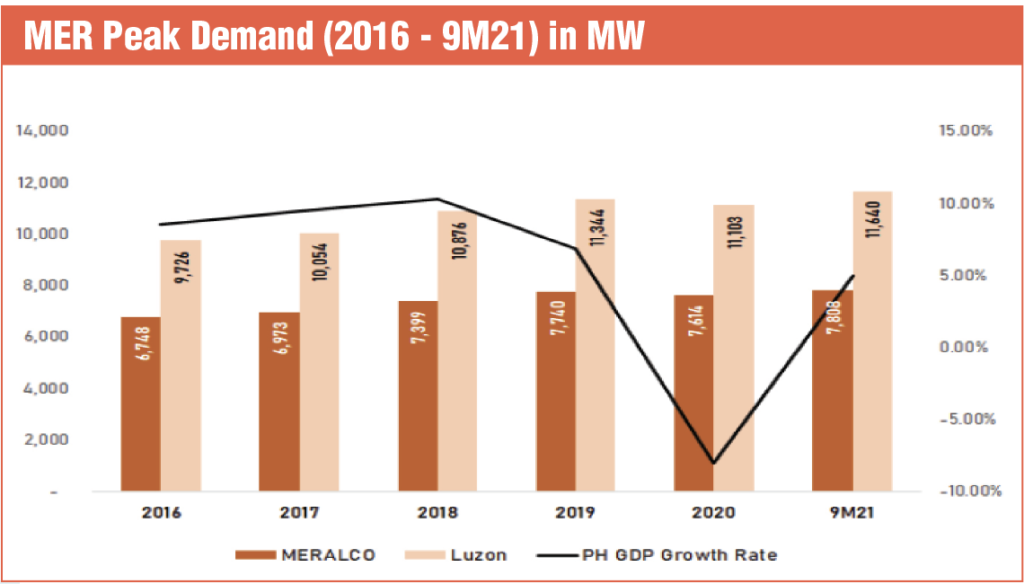

Meanwhile, power supply for next year is expected to remain tight, especially during the dry season. Peak demand was at 15,282 MW in 2020. Based on the DOE’s assumptions, this could climb to 17,350 MW by 2021E.

In addition, the looming depletion of Malampaya could also pose an upside risk to MER’s average retail price. As of 9M21, about 70% of MER’s total billed amount consisted of passthrough costs—still a net positive for local DUs like MER.

Considering the foregoing, we are maintaining our 12-month TP for MER at P370.00/sh. The last traded price of P295.00/sh as of Dec. 3, 2021 still provides a significant upside to our fair value. Therefore, we are reaffirming our BUY recommendation on the stock.

Updates, Disclosures and News

+ MER is seeking approval from the DOE to purchase 170 MW of power in preparation for an anticipated increase in demand during the dry months and election period, coupled with the declining gas supply from Malampaya. MER earlier sought approval from the DOE to secure the same level of capacity during the dry months this year, but it was not granted.

+ ONE Meralco is allocating an estimated P76 billion for renewable energy projects to transition to cleaner energy in 10 years. The group is developing RE projects with a total capacity of 1,500 MW in 7 years.

+ MER has been extending cost-saving solutions primarily to its + business customers to trim their electric bills as they strive to bounce back from the pandemic.

+ House of Representatives Deputy Speaker and 1Sagip Party Rep. Rodante Marcoleta has called for a review of the legislative franchise of MER in the wake of accusations that its profits nearly doubled than what had been authorized.

Fair Value Buy

Power demand expected to grow in 2022E;

+ Tight power supply could raise average retail rates; Increasing customer count; Disconnection activities back up again;

– Elevated leverage vs industry average; Large reliance on high system-loss Residential segment; Slightly lower div yield vs historical;

Q21 earnings read above our estimates. MER’s 3Q21 net income grew by 49.12% y/y to P6.57 billion in 3Q21 on the back of stable revenue growth (+14.82% y/y to P82.62 billion) and further boosted by increasing contribution from SBPL, GBPC, and PacificLight. Its 9M21 earnings stood at P16.52 billion, corresponding to 75.2% of our 2021E projected income. In line with this, we are maintaining our forecast model and introducing 2023E figures.

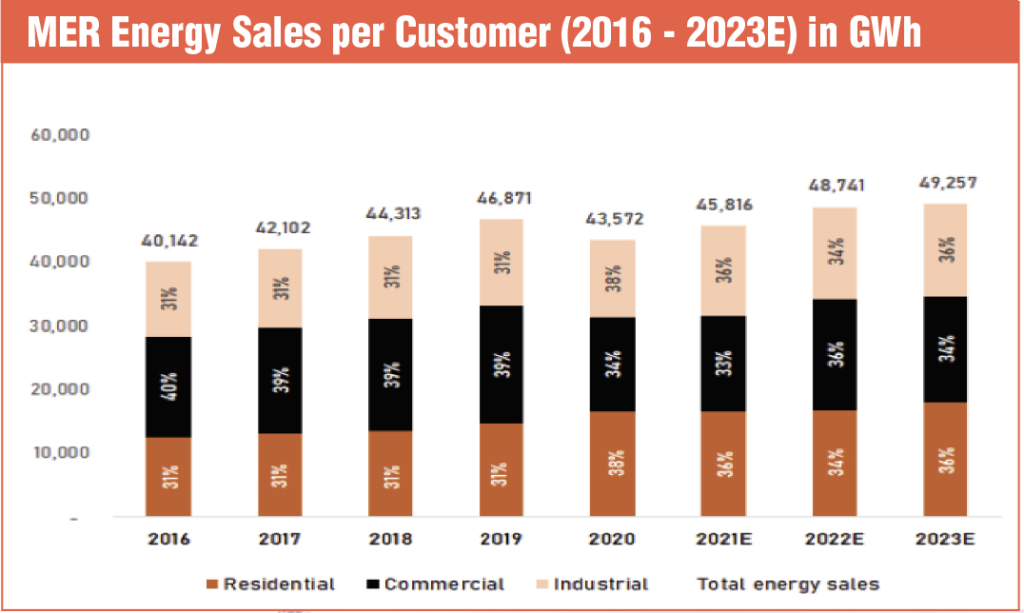

Consolidated energy sales volumes rose by +5.71% y/y to 34,398 GWh in 9M21, reflecting recovery across all segments. Notably, energy sales to MER’s Industrial customers are now back to pre-pandemic levels and contributed to 29.84% or 10,263 GWh of the total sales.

The Residential segment, whose sales went up by +1.62% y/y, continued to account for the bulk (12,746 GWh or 37.05%) as a large percentage of the population were still working with WFH and/or distance learning arrangements.

Meanwhile, sales to the Commercial segment were up by +1.97% y/y to 11,281 GWh, but still soft compared to pre-pandemic levels—meaning there’s still room for organic growth as the economy gradually reopens.

Expanding powergen capacity. MGen’s attributable generation capacity (including its subsidiaries) stood at 1,532 MW as of end-Sep 2021. About 59% of this ran on coal, 33% on natural gas, 6% on diesel, and 2% on solar.

Since our last update, MGen had completed its acquisition of the 86% combined equity of GBPC from BPHI and JGS. Therefore, GBPC became a wholly-owned subsidiary of MGen. MER also acquired an additional 30% stake in Pacific Light last Jul, bringing its ownership to 58%.

Last Jun 2021, GBPC broke ground for its first renewable project, a 115 MW solar plant in Rizal—expected to start commercial operations in 2022. Other solar projects in the pipeline for this year include 45 MW in Isabela, 19 MW in Nueva Ecija, and 50 MW in Ilocos Norte.

Outlook: Boosted demand plus tight supply = higher rates.

The upcoming elections in 2022 will likely lead to higher power demand from all segments, therefore allowing MER to benefit from sustained volume growth.

This bullishness could further be buoyed by the continued reopening of the economy as quarantine restrictions start to become less strict—assuming the much-talked-about Omicron variant doesn’t pose that big a threat to the country’s recovery.

Meanwhile, power supply for next year is expected to remain tight, especially during the dry season. Peak demand was at 15,282 MW in 2020. Based on the DOE’s assumptions, this could climb to 17,350 MW by 2021E. In line with the expected supply crunch, MER is once again seeking DOE approval to purchase 170 MW of power in preparation for the anticipated increase in demand.

On top of this, the looming depletion of Malampaya also pose an upside risk to MER’s average retail price. As of 9M21, about 70% of MER’s total billed amount consisted of passthrough costs.

Leverage vs. Profitability

• MER has always had elevated leverage relative to the industry average. The pandemic didn’t change this. On top of that, the additional loan facilities obtained by MGen led to higher A/E in 2021E.

• The firm has relatively higher ROE than both the bourse and industry average.

• Compared to industry peer AP, MER has higher ROE and is more leveraged. This places the firm in the fourth quadrant of our isoquant—operating with higher returns and higher financial risk.

Legend:

I – Higher Returns, Lower Financial Risk

II – Lower Returns, Lower Financial Risk

IV – Higher Returns, Higher Financial Risk

III – Lower Returns, Higher Financial Risk

Perception vs. Profitability

• MER’s P/E is lower than both the index and industry average, meaning it is considered undervalued based on our perception isoquant. The same is the case for industry peer AO.

• There was a notable spike in P/E in 2020 on the back of the pandemic-induced drop in market prices across the board. Share price recovery was quick to come after this, so P/E started to normalize soon after.

• We expect MER to continue trading between 4.0x to 4.3x its book value in the next few years.

• The gray isoquants represent 2.0x, 3.0x, and 4.0x P/B.

Legend:

I – Undervalued (Bargain)

II – Fairly valued (Underperforming)

IV – Fairly valued

III – Overpriced

Efficiency vs. Profitability

• Compared to industry peer AP, MER has higher asset turnover, but lower margins

• Compared to the industry average, MER lags behind in terms of efficiency metrics but has slightly higher profit margins.

• The gray isoquants represent 4%, 8%, and 12% ROA.