By ANTONIO S. LOPEZ

Land Bank has failed miserably in its original mission to finance and develop Philippine agriculture. Because of that failure, we have a severe food shortage, an unstable society, and the longest running communist insurgency in the world.

The Philippine Daily Inquirer and a number of senators have joined the growing chorus of objectors to the impending merger of the Land Bank of the Philippines and the Development Bank of the Philippines, the two biggest banks of the government.

I am one of the earliest to voice my opposition to the merger. My main reason is that Land Bank has failed miserably in its original mission to finance and develop Philippine agriculture.

Because of that failure, we don’t have enough food today. At least 25% of our food requirements have to be imported every year.

We have today the world’s most expensive plain rice (our cost of production is double the world average), the most expensive onions, potatoes, tomatoes, pepper, aside from having among the most expensive fish and pork.

The yearly cost of importing rice alone is $2 billion (P110 billion) —money that could have gone to job-creating economic activities. Or for educating our young people who by repeated global tests among nations have been shown to be the most stupid young people on earth.

They cannot read and write (see page 6, PISA result). If they can read and write, they don’t understand what they are reading. They cannot count beyond 100. They don’t know any science.

The result of that collective stupidity is bad governance because stupid people naturally make the wrong choices during elections.

Crucially, the food shortage has meant a very unstable society. Food after all is 50% of the average budget of Filipino households; 55% if you are very poor.

This explains why the Philippines’ — and the world’s—longest running communist insurgency is agrarian-based or food-based.

So you can say Land Bank indirectly has contributed to the communist insurgency which at one point (in 1987) reached an armed strength of 35,000 regulars, and to the state of mis-governance in this country.

The biggest producers of food—our farmers and fishermen—are the poorest of Filipinos. The have been let down and abandoned by the Land Bank which has gone heavily into commercial and business loans in an operation that will put Shylock into shame. It explains why Land Bank keeps saying it is very profitable but not as profitable as the better run private banks.

All commercial banks are required by law to allocate 25% of their loanable funds to agriculture and agrarian reform. Land Bank should lead in that purposeful action. But no. Its ratio of agri-agra lending, 26%, is the same, if not lower than all the other banks’. And LBP hits that ratio by simply buying securities or IOUs peddled by the government as compliance with agri-agra lending.

We have about seven million farmers and fishermen. Ask Land Bank how many it has reached out to. Just 10,000 in the case of agrarian reform beneficiaries. We pay with precious dollars with our food importations, money that comes mainly from the hard-earned dollars of our overseas Filipino workers—workers who went abroad precisely because they don’t have adequate income and don’t have adequate food to eat at home.

When Land Bank was founded 60 years ago, agriculture was the strongest and largest sector of the economy. We were a rice exporter. The economy has been taken over by call center agents, truck drivers and logistics operators, and of course, by bankers. These are the people who man Services or the biggest sector of the economy.

Agriculture contributed as much as 30% of total annual economic production or GDP and up to 70% of total employment. Today, aggie’s GDP share is down to 8.9%—the lowest in the last 100 years.

The main argument for the merger of LBP and DBP is bigness. Bigness is supposed to be good. That’s a lie. Credit Suisse (CS) was Switzerland’s second biggest bank. Last month, CS died, a victim of habitual mismanagement, mission failure, loss of confidence by its depositors, and by incompetent regulators.

The bank was built as the bank of the world’s richest and hoarders of illicit money, of kings, tyrants, and the corrupt. These people know a bad deal when they see one and they vote with their feet.

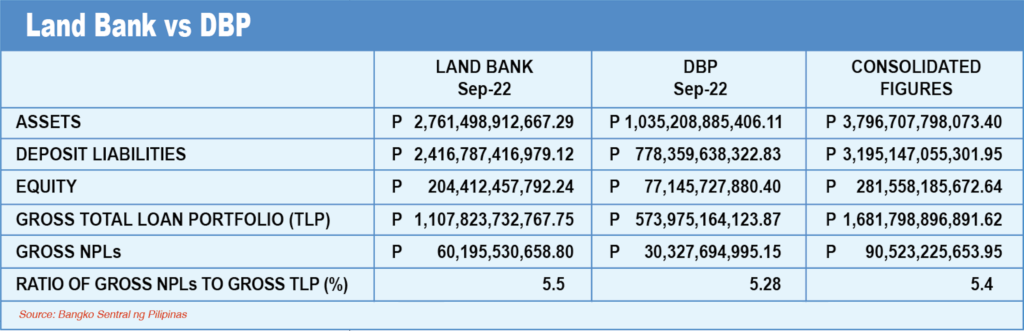

The consolidation of LBP and DBP would create a super bank, the biggest in the Philippines, with assets of P3.796 trillion, deposits of P3.195 trillion, and a loan portfolio of P1.681 trillion.

In contrast, BDO Unibank, the current No. 1 bank, has total resources of P3.727 trillion (just P69 billion smaller), deposits of P2.947 trillion (P248 billion smaller), loans of P2.523 trillion (P842 billion bigger), and capital of P442.95 billion (P161.392 billion

bigger).

Land Bank itself has total loans of P1.107 trillion, or just 45.8% of its total deposits of P2.416 trillion deposits. BDO’s loans-to-deposit ratio is a remarkable 85.6% (P2.253 trillion of loans out of P2.947 trillion of deposits).

BDO’s loans-to-deposits ratio is an awesome 85.6%—1.86 times bigger than Land Bank’s 48.5%.