Effective end of this year, Januario Jesus “JJ” Atencio retires as president and CEO of 8990 Holdings, Inc., the publicly listed leading mass housing developer.

It is not that JJ has been ousted from 8990 for so-so performance. “8990 remains a growth company,” he points out.

The more likely reasons for his self-imposed retirement are: one, burnout brought about by cumbersome red tape; two, he wants to do other things, for himself and for the country, in which he has complete control and probably, complete ownership; and three, remaining as a director, he could still help in visioning for 8990’s directions.

As CEO, JJ was a hands-on manager. He encouraged his homebuyers to text him anytime of the day. “It is part of our consumer focus,” he says. But then 8990 is on track to build 40,000 homes.

Also, building houses is not as easy and predictable as it used to be. From concept to actual delivery, mass housing now requires at least 100 signatures and at least 200 supporting documents. If you are really good, he smiles, “you can produce all that in one year, double from just six months 25 years ago.”

A large 8990 project in east of Metro Manila has been gestating for past two years and a half, because the mayor does not want to give the go-signal “even if we are willing to share”. Of late, the Department of Agrarian Reform has stopped land conversions, restricting land available for both housing and factories.

Another trend. Everytime there is a new president, the company suffers a hiccup, not necessarily a plateau. Thankfully, 8990, each time, stages a rebound and what a rebound it is. “We are a patient and a very resilient company,” he asserts with pride in calming fears of headwinds. “With a housing backlog, it is imperative for a business like ours to continue innovating and reading the signs to be flexible.” Why that missionary zeal?

“Homelessness remains a major problem in the Philippines,” JJ notes. At least four million families do not have a dwelling place they can call a home. Demand grows by half a million a year but annual production is 250,000 units at best. “8990 is blessed that God has given us an opportunity to run a good business,” says JJ, “but also to solve a great social problem – housing.” Food, clothing and shelter are man’s basic needs. Among the 12 million Filipino expats—their needs focus on three: education, insurance, and housing.

More than profits

“A company,” the Jesuit-educated JJ argues, “is more than about profits. It must have a sense of mission to change this country for the better. Otherwise, the business is not sustainable.”

JJ owns only 10.37% of 8990 Holdings. He has two main partners – Luis Yu, the chairman, who owns or controls 44.24%, and Mariano Martinez, who has 19.91%. The partnership has been exceedingly profitable for the three. Named after an old model of a Nokia phone, 8990 started in 2003, with 30 employees and four project.

A $1 billion company

From barely $4 million, 8990 grew in market value (and assets) to as high as $1 billion, making JJ, Luis and Marin awesomely wealthy. It has completed 50 mass housing projects and is completing a dozen more to bring total completed houses to 41,000. The company can build a house in just eight days but lately, it has taken eight months to sell them, because of government red tape.

Share price rose to as high as P10.50 after its listing. It has fallen to as low P5.37 (valuing the company at P29.6 billion), down 33% from its 12-month high of P8.05 (or P44.4 billion market cap) but still above its book value per share of P3.50 (P19.3 billion in total book value).

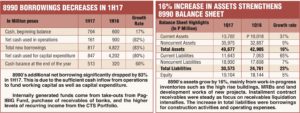

As of end-2016, 8990 had assets of P47.77 billion, equity of P19.26 billion (P9.34 billion retained earnings), and annual revenues of more than P10.87 million. In 2015 and 2016, 8990 had revenues of P9.27 billion and P9.33 billion, respectively, with net income of P3.722 billion and P3.575 billion, respectively.

First half performance

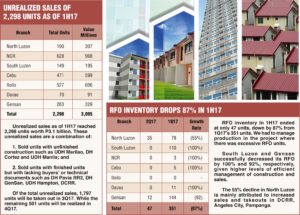

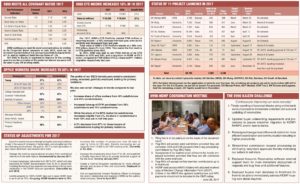

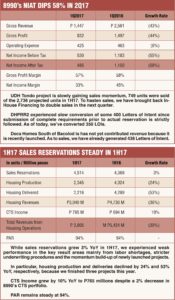

In the first half of 2017, 8990 Holdings hit 95% of its target registering P3 billion in revenues versus its goal of P3.2 billion. After tax net income of P1.2 billion was also on target, with 94% of internal quota of P1.3 billion.

Still, year-on-year gross and net income figures fell 41% and 44%, respectively because of the continued delays in the delivery of its new projects’ licenses, labor shortages in the construction finishing and the momentum build-up of recently launched projects, but which are being addressed by the company.

Since the second half is usually stronger, 8990 still expects whole year revenues of P10 billion and profits of P5.4 billion, up 42%, boosted by the launch of 11 new projects.

Aside from the additional revenues arising from the new projects, he pointed out 8990 expects to realize revenues arising from the delay in the processing of the permits of various projects last year.

JJ says a total of 2,706 units in eight projects worth P2.4 billion in Iloilo, Cebu, Bacolod, and Davao were not realized last year due to various delays in the processing of permits.

“We wish to emphasize that these revenues are not lost, but merely delayed,” Atencio says.

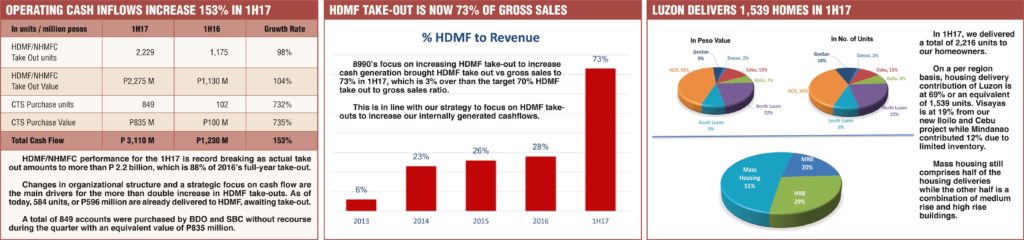

He added that, “given an environment of stricter licensing and permits, coupled with the possibility of interest rates increasing in the short-term, the thrust of 2017 is generation of cash from increased take-out levels with HDMF, CTS Purchase of banks, securitization and issuance of preferred shares which will be used to pare down debts.”

8990 will bounce back

By JJ Atencio – CEO, 8990 Holdings Inc.

(Speech during the fourth annual shareholder’s meeting, July 31, 2017)

With the permission of our Chairman Emeritus, our Chairman, esteemed members of the Board of Directors, the hard-working Executives and teams of 8990, our dearest shareholders of HOUSE, our friends from the PSE and the media, Ladies and Gentlemen, good afternoon. Thank you very much for coming to our fourth annual stockholder’s meeting.

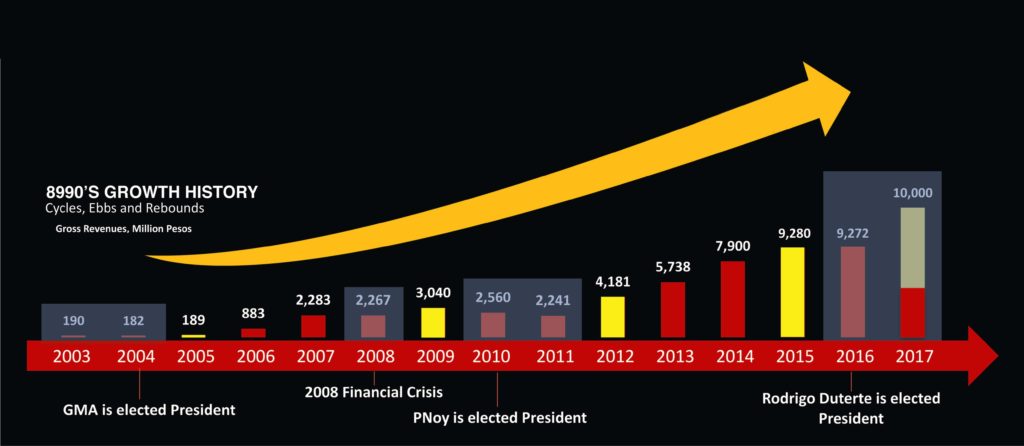

I’d like to begin my President’s Report by saying that our performance in 2016, where we posted flat growth in gross sales and negative 4% in earnings, can be better understood in terms of our growth history when we started with this business 13 years ago.

2016 has happened before.

As I traced our historical income performance from 2013 to today, I discover that this is not the first time 8990 has experienced a bad year. The first was in 2004, and then in 2008, then the years 2010 and 11 and this year 2016.

The common denominator it seems, is the change of government ushering in a new President, a new bureaucracy, and with it, a new housing policy. There is an emerging trend in our growth pattern of having a business cycle that starts and ends when a new administration is elected into power.

What we have experienced in our history is a temporary disruption in our growth as a result of these political changes. And the change of government in 2016 is no exception.

This is what I mean: we bounced back with P189 million in 2005 from declining revenues in 2003 and 2004 when Gloria Macapagal-Arroyo became President. We rebounded to reach P3 billion in 2009 from P2.3 billion after the 2008 financial crisis.

We posted a 60% growth to P4.2 billion in 2012 from P2.6 billion in 2010 after the election of President Aquino, growing this by 3.6 times to P9.3 billion in 2015 as President Duterte takes over the government in 2016.

But what is important to realize is that your company is and, has always been able to adapt to change rather quickly, instituting the reforms and innovations needed to confront these issues courageously, allowing us to bounce back strongly, pushing the company to new and greater highs in the years to come.

When we started 2016, we were excited to announce the launching of 14 new projects that would add 75,608 units to our inventory. Out of these new projects, 7,000 units will comprise 57% of 2016 performance, bringing in P7.3 billion in 2016 revenues.

Out of these 14 projects however, we were successful in launching only 6. Eight projects did not get their permits on time, due to new policies, regulations and officials, both at the national and at the local government level, that should have brought us 2,706 more units and increased our performance by P2.4 billion. We had no choice but to slide them over to 2017.

As early as mid-2016, we started improving our internal processes, making changes in our organizational structure, building stronger relationships with financial institutions and increasing our capability to handle more output.

We changed our organizational structure from centralized national to three main regions to make control, decision making and execution more efficient and focused.

We increased manpower from 287 to 370, hired experienced executives, to cope with the increasing volume of take-outs with Pag-IBIG Fund where we decided to raise our take-outs to 70%, thus increasing our cashflows to fund our NCR condominium projects.

On the production side, we started to increase our casting forms from 58 sets to 65, with the goal of reaching 103 sets by third quarter of 2017.

To maintain quality with increase production, we increased our engineering force from 27 to 39 and established a quality assurance group as well.

To safeguard an efficiently store, maintain and retrieve documents, we created a central document warehouse staffed with four librarians and a state-of-the-art archival software where files can be viewed and downloaded for use of the branches through a secure mobile-app.

We hired an experienced investor relations officer to increase the level of relationships with funds and investors as well as the analysis and coverage of HOUSE.

We have also started the documentation of all our processes that will lead to the publication of manuals of operations for engineering and construction, purchasing, sales and documentation, permits processing of new projects, and homeowner’s manuals for each type of housing product to generate efficiencies in our processes across all functional areas of the organization as well as to educate our buyers regarding the technical and financial aspects of their new house.

We are untiring in our efforts to improve our company’s strategy-making and execution efforts, using our landbank of 655 hectares, with at least 145,000 units and an estimated value of at least P175 billion in the next five to seven years. It is a great inventory, meant to take advantage of the 5.8 billion backlog in affordable housing.

What is notable in 2016 is the 13% contribution of our Metro Manila condominium projects that have given us a 16% contribution to topline revenues, making the performance per region more balanced today.

As our condominium projects gain traction in Tondo, Ortigas Avenue Extension, Cubao, Commonwealth, Las Piñas that comprise our emerging presence in the national capital region, coupled with our strong commitment to continue with our townhouses, single-attached units and medium-rise buildings in the provinces, we can evolve 8990 into a multi-product company that can solve the housing problems of all working class Filipinos, whether they choose to live in the city or the suburbs, while selling at price points well within the low-cost affordable housing space.

It is also in 2016 that our cash flow from operations turned positive from negative P2.2 billion in 2015 to positive P430 million by the end of the year.

In adopting a “cashflow-focused strategy”, the principal drivers were the increased take-outs with Pag-IBIG Fund, the more active level of CTS purchases by the banks and the growth in recurring income from the CTS portfolio. Moving forward, we expect to see a dramatic rise in cash generation as we continue with prioritizing cash generation in the years to come.

That, my friends, is the future of 8990. This is what we are all invested in, and what we are working for. We just need to go beyond the temporary slow-down we are experiencing today, and remain focused instead on the ways we are solving issues, strengthening our internal capabilities, as well as the potential of the huge market and the position of this company as the leader in the mass housing industry.

Of course there will be problems along the way, and certainly success will not be given on a silver platter. The environment today is far from sunny and bright. We are now in the midst of several issues that threaten to devastate the industry on a magnitude I have never seen before:

- Erasing VAT exemptions and BOI Incentives, making socialized and low-cost housing more expensive and inaccessible to the lower-middle class;

- Additional permits both at the national and local level that stretches processing time of new projects to one and half years;

- The removal of Home Guaranty Corporation – a critical shelter agency.

And most significantly, from 1988 to 2015, the rate of conversion of agricultural land is only 1.22%. 1.22%. Negligible. We’re barking at the wrong tree, ladies and gentlemen, since 90% of our buyers are first time real property owners, mass housing has an effect of genuine land distribution; we are able to convert large tracts of landholdings owned by a few and sell them to thousands of ordinary Filipinos, not just farmers, in a way so similar to agrarian reform.

Any move to restrict land conversion for mass housing will not only be ineffective for agriculture and agrarian reform, but will create new problems for the affordable housing sector.

But the good news is: we are prepared for this, and have begun steps to anticipate all these headwinds and storms that threaten to rain on our parade.

Before I end, I’d like to make this personal announcement. As early as two years ago, I started telling everyone, my partners, relatives, family of my intention to retire at 55. Next year, I would be celebrating 25 years in the housing industry as I turn 56 in January. Realizing that I am at the homestretch of life and wanting to do something else, my partners and the Board have agreed with my wish to retire on December 31 this year. And so I am happy, excited even to say goodbye to this industry that has given me a meaning life, and has prepared me for the next chapter of my book, whatever that may be.

As I told my executives about this decision, I also said to them not to celebrate and party yet because they still have to bear with me for five months more. We welcome our COO, Mr. Willy Uy who shall take a more active and decisive role for the rest of the year.

I’d like to thank everyone, my partners, the Board, all our investors for continuing to believe in 8990. When my partners and I established 8990 13 years ago, we were driven by the idea that housing is not about houses, it’s about people and how we can use this housing business as a vehicle to make people lives better.

We, together with our executive and teams continue to live this vision everyday. Please do not lose hope, and be encouraged by the fact that 8990 is resilient, it is patient and working hard everyday to overcome the obstacles we face today. We are deeply thankful that God has given us the opportunity not only to run a good business, but also to solve a great problem.

Thank you very much and have a great day.

So I hope that as we go through the rest of the report, and indeed, for at least the rest of this year, we will find not only comfort but also the strength in knowing that your company has always remained resilient, and we are always finding creative solutions to issues, problems and the growing complexities of this business.