GMA Network is the most trusted major tv network today, a tribute to the station’s evenhanded and balanced treatment of news, information, and entertainment—a valuable quality given the state of misinformation and disinformation in social media today.

At P16 per share, the 3.361 shares outstanding of GMA Network were valued in October 2021 at a whopping P53.977 billion, an increase of P33.811 billion or 167.66% in just nine months.

On Jan. 5, 2021, GMA Network, Inc. began the new year then with its share price closing at P5.95, down 5 centavos from its Dec. 29, 2020 closing price of P6.

Within the first six months of 2021, the stock price of the Philippines’ largest broadcast network rose to a new high of P14.40 per share. The surge corrected a bit before scaling an unprecedented high of P16.66 per share on Oct. 4, 2021, closing at P16.06 that day.

At P16 per share, the 3.361 shares outstanding of GMA Network were valued in October 2021 at a whopping P53.977 billion, an increase of P33.811 billion or 167.66% in just nine months.

With 29.03% ownership, the GMA Network family holdings of the late Gilberto Duavit now led by GMA Network President Gilberto Duavit Jr. were suddenly worth P15.669 billion, up P9.8 billion from end-2020.

GMA Network Chair and CEO Felipe L. Gozon has holdings of 27.07%. In late September, those became valued at P14.61 billion, an increase of P9 billion.

The third major owner, the family of Menardo Jimenez has 27.81%. By late September, the equity was worth P15 billion, an increase of P9.4 billion.

GMA Network’s stock closed at P13.78 per share on Dec. 14, 2021, valuing the company at P45.84 billion. Of that, Gozon has stocks worth P12.42 billion, the Duavit family P13.3 billion, and the Jimenez family, P12.7 billion.

GMA Network has big plans at expansion and diversification into non-tv businesses. Those plans, however, will require careful and savvy execution. ABS-CBN used to generate a third of its revenues from non-tv businesses.

Owners made P1 billion per month for 9 months

What did GMA Network do that enabled its three major owners to accumulate wealth at the rate of P1 billion per month for nine months straight, January to September 2021?

Four things:

One, GMA Network, Inc. has become a near-monopoly, following the closure of its arch rival ABS-CBN Broadcasting Corp. in July 2020.

Before ABS-CBN’s closure, its Channel 2 and GMA’s Channel 7 had a commanding 70% of the free tv market between them.

With ABS-CBN apparently gone for good, GMA Network ate into the other half of the 70% and readily increased its market share to an unheard of 54%.

Two, GMA Network was already a hugely profitable cash cow even before the ABS-CBN’s closure which it had beaten handily in the ratings and market share game.

Out of its 2020 profits, GMA Network declared a whopping P6.56 billion in cash dividends on March 26, 2021—its largest ever cash dividend, eclipsing the previous high cash payout of P3.54 billion declared in March 2017 out of the 2016 profits.

Biggest profit in history

In 2020, GMA Network reported its biggest profit in its 70-year history, a gargantuan P6.0 billion, more than double or 128% higher than 2019’s P2.639 billion, on the bank of a 17% rise in revenues to P19.33 billion, of which P17.72 billion were tv advertising.

Three, even before ABS-CBN closure, GMA Network had been the No. 1 television station in terms of public trust, and ratings.

Gushes Gozon:

“I have to say that even before the ABS-CBN shutdown GMA was already the No. 1 free TV station in the Philippines. And after ABS-CBN was shut down, we continued to improve our reach and content in all aspects like creative, production quality, technical. And so, we feel that we remain ready for the competition as before.”

Indeed, GMA Network is the most trusted major tv network today, a tribute to the station’s evenhanded and balanced treatment of news, information, and entertainment—a valuable quality given the state of misinformation and disinformation in social media today.

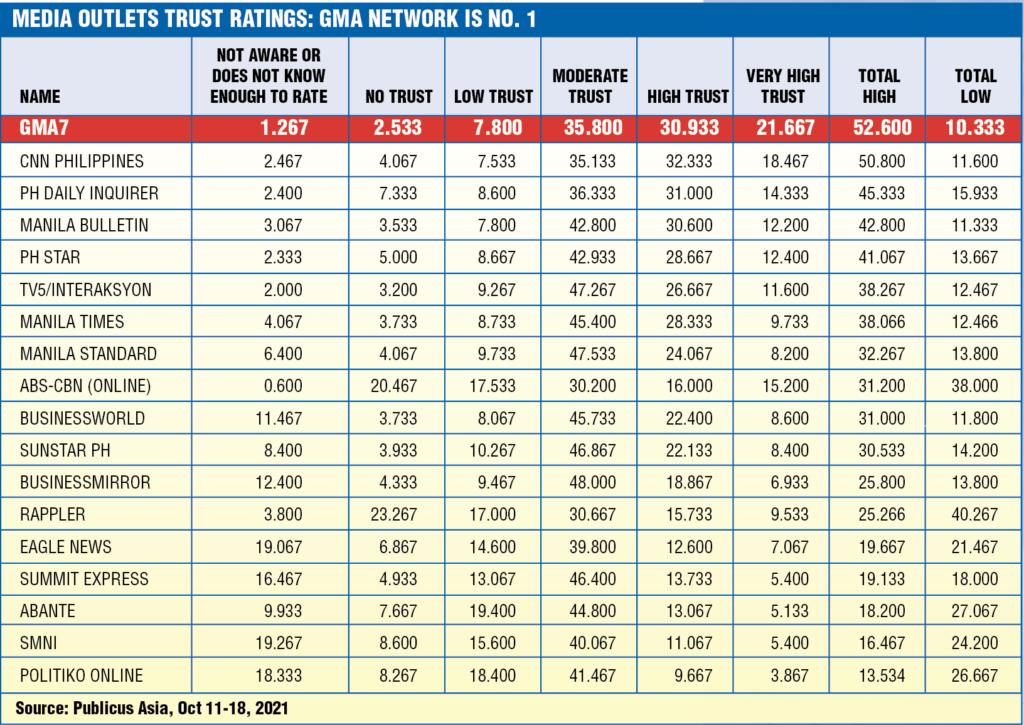

In the Publicus Asia survey of Oct. 11-18, 2021, among 18 media outlets rated by respondents, GMA7 topped the field, with total high trust rating of 52.6%, and a total low trust of just 11.6% (See Media Outlets Trust Ratings, page 6). A close second was CNN Philippines, with a total high trust rating of 50.8% and total low rating of 11.6%.

More Filipinos trust GMA7

More than half of Philippine tv viewers have a high trust in GMA7. Only one of every 10 tv viewers has a low trust in the network.

Among the 18 media outlets polled, GMA enjoyed the highest “very high trust” rating of 21.667%. GMA also had the lowest No Trust among the 18 media companies, just 2.533%.

Rappler had the highest No Trust rating among the media outlets, a disturbing 23.67%, followed closely by ABS-CBN Online, with 20.467. Rappler and ABS-CBN Online are the only two media outlets with double-digit No Trust ratings—One of every four Filipinos in the case of Rappler, and one of every five in the case of ABS-CBN Online.

What remains of the once mighty ABS-CBN, ABS-CBN Online was ranked only No. 9, with total high trust rating of 31.2% and total low trust rating of 38% which exceeded total trust rating by 6.8%. If there were 50 million Filipinos watching tv, a 6.8% difference would translate into 7.3 million more Filipinos not trusting ABS-CBN Online than trusting the online tv of the Lopezes.

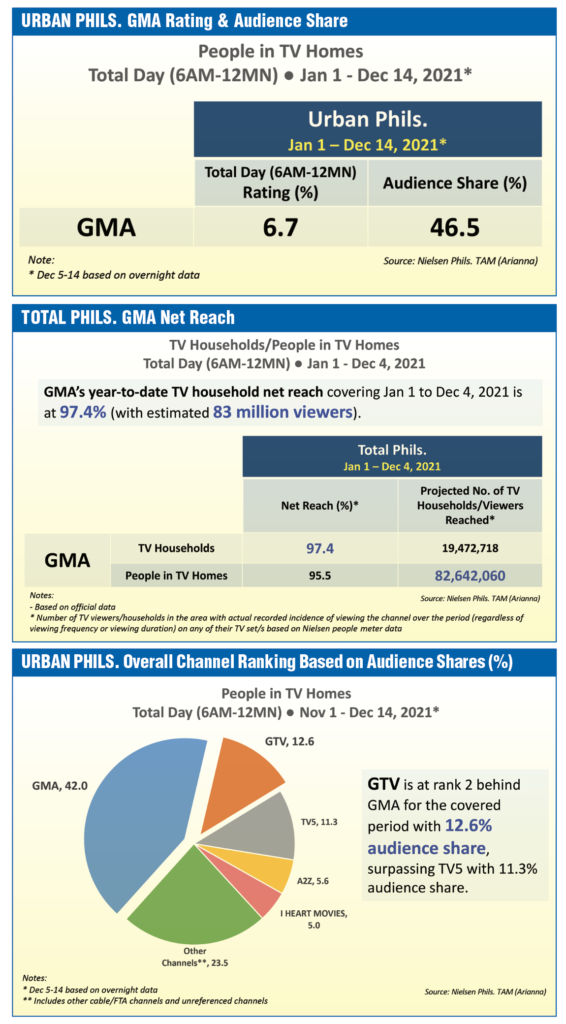

From January to May 2020, GMA had an audience share of 33.8%, higher than ABS-CBN’s 30.2%.

Why GMA is No. 1

Why has GMA Network remained No.1?

To answer that, Gozon says he has to set aside modesty:

“I have to say that even before the ABS-CBN shutdown, GMA was already the No. 1 free tv station in the Philippines. And after ABS-CBN was shut down, we continued to improve our reach and content in all aspects like creative, production quality, technical, etcetera, etcetera. And so, we feel that we remain ready for the competition as before.”

He adds:

“To remain No. 1, we have to continue to produce world-class quality content to our audiences here and abroad. We have also to invest heavily in talent management and development, and continue to put up more digital stations nationwide so more Filipino homes can enjoy digital TV viewing. We have to continue to pursue new platforms and partnerships to deliver content to more Filipinos abroad.”

84 million Filipinos watch GMA

GMA Network claims that with 48.8% people audience share (per NUTAM in 2020), it reaches over 84 million Filipinos across the country with 48.8% people audience share in NUTAM for the year 2020.

With 47 VHF, 32 UHF. And 7 DTT stations, as well as 23 radio stations nationwide, GMA is the country’s largest broadcasting network.

GMA is known as the Kapuso (One in Heart) network. It prides itself in bringing what it calls superior Entertainment and the responsible, unbiased, and timely delivery of accurate News and Information to Filipinos worldwide. Its flagship channel, GMA, broadcasts free-to-air via VHF Channel 7 and its permanent digital TV signal on UHF channel 15.

In addition, GMA also owns a wide array of media-related entities engaged in film production, music publishing and distribution, set design and implementation, audio-visual production, and new media.

“With seven decades of dedication and genuine public service, GMA Network has won an award that tops all else—the hearts of Filipino audiences here and abroad,” says the company.

GMA Network became No. 1 in nationwide TV ratings in early 2010, posting its biggest lead over competition in 2011. It has kept that lead in 2020, a lead that is insurmountable given the puny competition.

GMA’s commanding nationwide viewership gives it the much needed leverage to generate advertising revenues. Hence, the huge profits of recent years.

Extremely well-managed

Four, GMA Network has been extremely well-managed, if initially conservatively, under the tandem of Chair and CEO Felipe Gozon and President Gilberto Duavit Jr.. The two have turned a once sluggish behemoth into a veritable money machine.

Since 2011, when Gozon took over as CEO, and up to September 2021, the tandem has delivered P31 billion in cumulative profits on aggregate revenues of P162.26 billion—an unprecedented feat and far better than ABS-CBN’s profit performance when the Lopez network was at its peak.

Without flamboyance, Gozon and his team are vicious cost cutters and tough negotiators.

Looking at bigger and different things

Moving forward, Gozon is looking at bigger and different things.

GMA Network is pumping cash into GMA Ventures, Inc, which Gozon says will help the company deliver “more revenues and net income for our stockholders”. GMA Ventures will focus on non-core businesses outside of TV.

“If a good opportunity presents itself for the company to earn considerable revenues and net income, even if that will require the investment of a substantial amount, then [GMA Ventures Inc.] can invest in it. Provided not much risk is involved in the business to be invested on,” CEO Gozon told stockholders during a special meeting on Dec. 9, 2021.

At the same time, the tv business will undergo a P2-billion “expansion of our digital transmission network, upgrading of our post-production capabilities, and of our content layout facilities, and expansion of our regional TV network, etc., etc. We have not yet started the construction of our new building and studios. And it does not include our investments in content and other investments.”

GMA’s stockholders approved an initial P100 million into GMA Ventures and authorized GMA Network’s executive committee to pump another P1 billion if needed.

“We have organized GVI and if a good opportunity presents itself for the company to earn considerable revenues and net income even if that will require the investment of a substantial amount then GVI can invest in it provided not much risk is involved in the business to be invested on,” Gozon told stockholders. He added that there are prospective targets for acquisitions.

“We have already made small investments in one or two so-called startup companies. But at this point we prefer not to identify them,” the CEO revealed.

Gozon assured stockholders that future cash dividend payouts will not be affected given that GMA has no long-term debts and cash flow remains “very healthy.”

For 2021, Gozon GMA will fall short of its revenue target but will exceed its income target. He hopes the COVID restrictions will be relaxed so the economy can recover.

For 2022, two things are going. One, the recovery in late 2021 will continue into next year; and two, the presidential elections will probably add 5% to revenues.

ABS-CBN

Since People Power of 1986, ABS-CBN had been GMA Network’s longest and prime competitor, followed by TV5.

As the erstwhile largest broadcasting company in the Philippines in terms of product and service range and financial asset base, ABS-derived close to 51% of its total revenues from broadcasting.

Cable and satellite businesses had a 22% share of ABS-CBN sales.

Other businesses, which comprise movie production, new media ventures, publishing and other consumer products and services, made up about 27% of total sales.

In comparison, GMA was initially, the second largest although the oldest broadcasting company in the region.

GMA derives more than 88% of its business from broadcasting. International operations add 7% of revenues. Other businesses which include film production, new media services, and other services contribute less than 5% of total sales.

MVP invests P40 billion in TV5

A third major player is TV5 which was formerly known as ABC 5. The group of PLDT Chair Manuel V. Pangilinan has invested at least P40 billion to make TV5 a major player.

TV5 completes MVP’s concept of media pipelines – Cignal TV, the newspaper group Philippine Star, the radio network, and of course, the formidable telco property PLDT and Smart, the largest in the country.

It is estimated that the tv audience in social media is now about 20% of the market.

TV5 was re-launched in 2008 as TV5 after reaching a partnership with MPB Primedia, Inc. (MPB), a local company backed by Media Prima Berhad of Malaysia—with MPB producing and sourcing most of the entertainments programs of the channel.

On Oct. 20, 2009, Media Prima divested its share in TV5, selling it to Mediaquest Holdings Inc., the broadcasting division owned by the Beneficial Trust Fund of the Philippine Long Distance Telephone Company (PLDT).

READ FULL ARTICLE HERE: