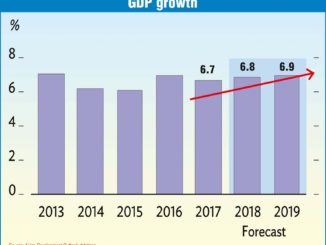

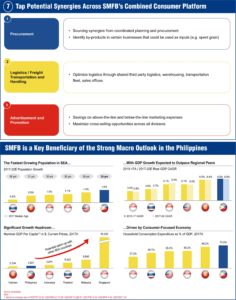

The Philippines food industry reached a market value of $9,259 million in 2017, accounting for 25.5% of the Southeast Asian food industry.

According to GlobalData, the industry is expected to grow to $13,127 million by 2022, at a CAGR of 7.2%.

Several factors, including robust economic growth, a thriving tourism sector, a large youthful population, and the expansion of large retail chains are contributing to the growth of the industry.

This has led food manufacturers to expand their operations and product portfolio in the Philippines. For example, SMFB, which operates in the fastest growing segments of the food industry (particularly, branded processed meat, dairy, and protein), expanded its portfolio with new products such as Magnolia Chicken 3-Way and Purefoods Pulled Pork BBQ.

This has led food manufacturers to expand their operations and product portfolio in the Philippines. For example, SMFB, which operates in the fastest growing segments of the food industry (particularly, branded processed meat, dairy, and protein), expanded its portfolio with new products such as Magnolia Chicken 3-Way and Purefoods Pulled Pork BBQ.

SMFB’s overall food market share, which includes branded processed meat, dairy, protein, and animal feeds, was at 21.7% in 2017.

Distribution

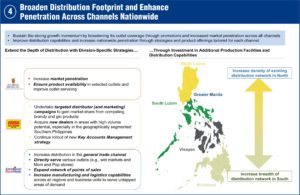

The majority of food industry players in the Philippines distribute their products predominantly through traditional distribution channels such as in wet markets, mom and pop stores, small grocery stores, wholesalers, dealers, and neighborhood butchers and bakeries.

However, modern trade has been rising in regions such as Luzon including Greater Manila, and more modern distribution outlets have been growing significantly in recent years, such as hypermarts or supermarkets, convenience stores or grocery stores. The continued development of the modern trade network, along with cold chain infrastructure will be important in driving consumption in other regions.

Another key distribution channel for food players is foodservice, which includes restaurants, hotels, and other food manufacturers or catering companies.

Another key distribution channel for food players is foodservice, which includes restaurants, hotels, and other food manufacturers or catering companies.

Some of the major food players in the Philippines also operate exclusive branded food retail outlets. For example, SMFB operates around 1,200 retail stores across the Philippines that offer its Magnolia branded products.

Branded processed meat industry

The branded processed meat industry was valued at $385 million in 2017, of which refrigerated products accounted for 83%, while canned products accounted for 17% of the total market.

According to GlobalData, the refrigerated and canned segments of the industry are expected to grow consistently with each other, mainly driven by emerging demographic and consumption trends such as demand for convenience and increased availability.

Regionally, Luzon including Greater Manila, was the biggest consumer of branded processed meat, which accounted for 74.9% of the total market by value.

According to GlobalData, this region is projected to grow at a CAGR of 8.8% from 2017 to 2022F.

The region has a significantly higher per capita consumption, and is expected to grow faster given urbanization and greater disposable income, both of which drive demand for premium and specialized offerings.

Visayas and Mindanao accounted for the remaining 25.1% of the market. A boom in tourism along with rapid economic growth will continue to support branded processed meat’s growth in the region.

Visayas and Mindanao accounted for the remaining 25.1% of the market. A boom in tourism along with rapid economic growth will continue to support branded processed meat’s growth in the region.

Competitive landscape

According to GlobalData, SMFB is the largest company in the Philippines for the branded processed meat industry, leading with a 35% market share in 2017.

According to GlobalData, SMFB is the largest company in the Philippines for the branded processed meat industry, leading with a 35% market share in 2017.

CDO Foodsphere, Inc. and Century Pacific Group emerged as the second and third largest players, respectively.

SMFB has captured market share over the last few years from its key competitors as well as from other smaller players.

In terms of brand share, SMFB’s Purefoods brand led the market with a 35% market share, almost double of the second largest player CDO Foodsphere, Inc.’s CDO brand.

Key trends

Demand for convenience

The Philippines is home to several large cities such as Metro Manila, Cebu, and Davao. Therefore, a considerable number of consumers in the country seek products that help to save time.

This is substantiated by a GlobalData survey, in which 77% of respondents state that they rely heavily on time-saving products and services.

With consumers spending most of their time away from home, meat manufacturers are addressing the demand for efficient and time-saving products and services by launching Ready-to-Eat processed meat products that are pre- marinated and pre-cooked.

SMFB has specifically addressed this trend by launching new handy, time-saving products such as Purefoods Crispy Pata, Purefoods Lechon Kawali, and Purefoods Pulled Pork BBQ.

Rising prosperity driving demand for indulgent products

According to GlobalData, with the rising prosperity in the Philippines, consumers are prompted to seek premium and high quality meat products. Meat companies are catering to this demand by offering processed meat sourced from imported cattle known for their tastier meat.

According to GlobalData, with the rising prosperity in the Philippines, consumers are prompted to seek premium and high quality meat products. Meat companies are catering to this demand by offering processed meat sourced from imported cattle known for their tastier meat.

As economic growth continues, consumers are willing to spend more on meat products flavored with unique flavors and spices.

Therefore, meat products in flavors and tastes ‘borrowed’ from foreign cuisines are becoming popular among customers in this highly competitive market. Meat manufacturers such as SMFB have launched products such as the Purefoods Deli Hungarian Cheese Sausage and the Angus Beef Franks which cater to the market seeking gourmet indulgent products.

Dairy industry

According to GlobalData, the market value of dairy industry in the Philippines reached $2,485 million in 2017.

According to the same source, the market value of the dairy industry is projected to grow at a CAGR of 4.6% for 2017 to 2022F, mainly driven by the rising income levels of Filipinos as a result of rapid economic growth as well as an increasing attention to health and nutrition.

According to the same source, the market value of the dairy industry is projected to grow at a CAGR of 4.6% for 2017 to 2022F, mainly driven by the rising income levels of Filipinos as a result of rapid economic growth as well as an increasing attention to health and nutrition.

On a per capita consumption basis, the Philippines is significantly lower than mature markets such as the United States and is also lower than most of its regional peers, implying further room for growth.

However, the low domestic production of dairy products along with lack of infrastructure has been limiting on both the production and distribution level.

Improvement in animal nutrition and farming practices will likely enhance production capabilities going forward, while the expansion of modern retail chains encouraged by investments in infrastructure will be advantageous for the industry, especially for perishable goods that require refrigeration.

Milk is a staple in diets of Filipinos and is the largest segment, accounting for 57.8% of the market in 2017.

Other dairy categories include cheese (13.9 % of total market value in 2017), butter and spreadable fats (8.9 % of the market in 2017), and ice cream (19.4% of the market in 2017).

On a regional basis, Luzon including Greater Manila, accounts for 57% of the market by value in 2017. On a per capita basis, Luzon including Greater Manila, expenditure is slightly higher than Visayas and Mindanao, but is largely expected to grow in line over the next few years.

Competitive landscape

The Philippine dairy market is fairly concentrated with the top five companies holding a large majority of the market. International players capture the majority of the market, with the exception of SMFB, which has gradually gained shares over the last few years and is the third biggest player in the market.

The Philippine dairy market is fairly concentrated with the top five companies holding a large majority of the market. International players capture the majority of the market, with the exception of SMFB, which has gradually gained shares over the last few years and is the third biggest player in the market.

On a sub-segment brand level, there are differences between the competitive landscapes across sub-segments, despite key players adopting a multi-brand and product strategy.

Key market trends

Increasing awareness of nutrition and well-being

Fueled by the desire to lead active lifestyles, Filipino consumers have been changing dietary habits and seek ‘better for you’ products focused on improved nutrition. The use of natural ingredients in dairy products has also been a major factor in influencing consumers’ choices.

According to GlobalData, 92% of respondents in a survey stated that they have a more favorable perception of groceries if the products have natural ingredients.

Dairy manufacturers are therefore highlighting specialized attributes of their products with claims on labelling, such as “free from”, “low fat”, “zero preservatives”. For instance, SMFB has launched Magnolia Purefresh Milk, Magnolia Low Fat Milk, and Magnolia Non-Fat Milk.

Demand for quality and experimentation

Given the increasing disposable incomes, consumers are becoming increasingly sophisticated and seek products that offer indulgent experiences, driving demand for high quality products that are premium, or made from decadent ingredients.

The Filipino consumers’ willingness to experiment has likewise led dairy manufacturers to create new flavors that are unique and novel, while catering to the preference of local familiar flavors. SMFB has, for instance, extended its Magnolia Best of the Philippines ice cream range with new flavors, such as Tablea Yema, Macapuno Caramel, and Taro White Cheese in March 2018.

Protein industry worth $6.4B

The protein industry in the Philippines reached $6,388 million in 2017, of which pork accounts for 52.4% of total market value, followed by chicken, beef, and other animal protein.

Pork also accounts for the highest per capita expenditure, and is forecasted to grow at the fastest pace at a CAGR of 12.3% from 2017 to 2022F.

According to GlobalData, growing populations, robust economic growth and a tradition for meat-heavy diets drive growth in demand for fresh meat products.

The Philippines relies heavily on meat imports as local production cannot keep up with domestic demand. However, continued development of production facilities and government initiatives will likely increase domestic production in the coming years. On a regional basis, Luzon including Greater Manila, accounted for 61.6% of the market value in 2017, with a higher per capita expenditure, and is also expected to grow significantly faster in the next few years.

Competitive landscape

The protein market in the Philippines is relatively fragmented with three main players. SMFB is the leading player in the protein industry with 23.5% market share in terms of total value in 2017, through its Monterey and Magnolia brands. Magnolia is the No.1 brand in the market in 2017 with 20% market share. Wilson Farms and Fresh Options are the second and third players in the market with 15% and 12% market shares, respectively.

Key market trends

Concerns for food safety and transparency

With a number of meat concerns in the Philippines in the last few years, consumers have become more cautious when purchasing fresh meats. Butchers and meat companies are addressing such concerns with more information on the source and quality standards they follow. Some meat companies claim that they slaughter chickens that are bred on their own poultry farms and dressed only in AAA dressing plants accredited by the National Meat Inspection Service.

Demand for fresh and natural products

As consumers become more health-conscious, consumers have become cautious of artificial additives and ingredients such as preservatives, flavorings and colors. Meat producers have tried to address the demand for free range meats, which have gained popularity for their pure and natural attributes. SMFB, for instance, offers its Magnolia Whole Chickens range, which is free from antibiotics, promotants, hormones, and steroids, and is also grown in stress-free environments.

Feeds industry worth $2B

The Philippine animal nutrition and health (animal feeds) industry reached $2,027 million in 2017, and is expected to grow at a CAGR of 8.7% from 2017 to 2022F.

Growth will mainly be driven by the growing demand for meat and dairy products, which are expected to enjoy attractive growth and are supported by government initiatives.

Given the preference for pork in the Philippines, demand for hog feed will likely see the strongest growth.

According to GlobalData, the rising imports of wheat and corn will lead to opportunities for players in the market, which is evidenced by SMFB and Cargill’s announced plans to set up new feed mills across the country. The shift away from antibiotic use in livestock farming will continue to spur innovation in the sector.

Competitive landscape

According to GlobalData, SMFB is the leading player in the Philippine animal feeds market in 2017 and had 25% market share, significantly ahead of the closest competitor Purina Animal Nutrition.

Each of the companies has one main brand: SMFB’s B-Meg, United Animal Health’s JBS United and Aboitiz Equity Ventures’ Pilmico.

Key market trends

Demand for customization and product specificity

According to GlobaData, with the needs of livestock being unique, farm owners often prefer custom-made animal nutrition solutions.

This demand for specialized livestock solutions prompts animal nutrition manufacturers to innovate and design products catering to the specific requirements of animals in partnership with livestock farmers.

Likewise, varying nutrition requirements drive demand for animal feed with specific attributes that comply with changing requirements. This in turn is spurring the need for animal nutrition with added or fortified nutrition that helps with the different stages of animal life.

Manufacturers are therefore offering animal nutrition products with specific nutrients for particular occasions. For instance, SMFB has launched products like B-MEG Premium SUPER INAHIN 2, which contains ingredients that help improve milk production in lactating pigs to ensure healthy piglets.