A sovereign wealth fund is nothing more than taxpayers’ money, your money, our money, being pooled by the government (thru an independent state investment body), converted into US dollars and invested in presumably worthy projects, here and abroad, to multiply the value of the fund. Something like buying Apple shares for $1 and then those shares rising phenomenally in value to $1,000. That is the hope.

The head of President Marcos Jr.’s economic team has painted a rosy picture of the economy and the outlook for next year.

“Despite the threats of geopolitical risks and a slowing world economy, our latest economic indicators have been encouraging. For the first three quarters of 2022, the Philippine economy grew by a solid 7.7% despite inflationary pressures and other risks. This suggests that we are well on our way to securing our full-year target of 6.5% to 7.5%. We might even achieve the upper bound of this target,” Finance Secretary Benjamin Diokno told a forum Nov. 22 on public-private partnership organized by Stratbase.

In a separate forum on Nov. 30, he disclosed that the Philippine government has created a sovereign wealth fund to be called The Maharlika Wealth Fund patterned after the Temasek Holdings sovereign wealth fund of Singapore.

A sovereign wealth fund is nothing more than taxpayers’ money, your money, our money, being pooled by the government (thru an independent state investment body), converted into US dollars and invested in presumably worthy projects, here and abroad, to multiply the value of the fund. Something like buying Apple shares for $1 and then those shares rising phenomenally in value to $1,000. That is the hope.

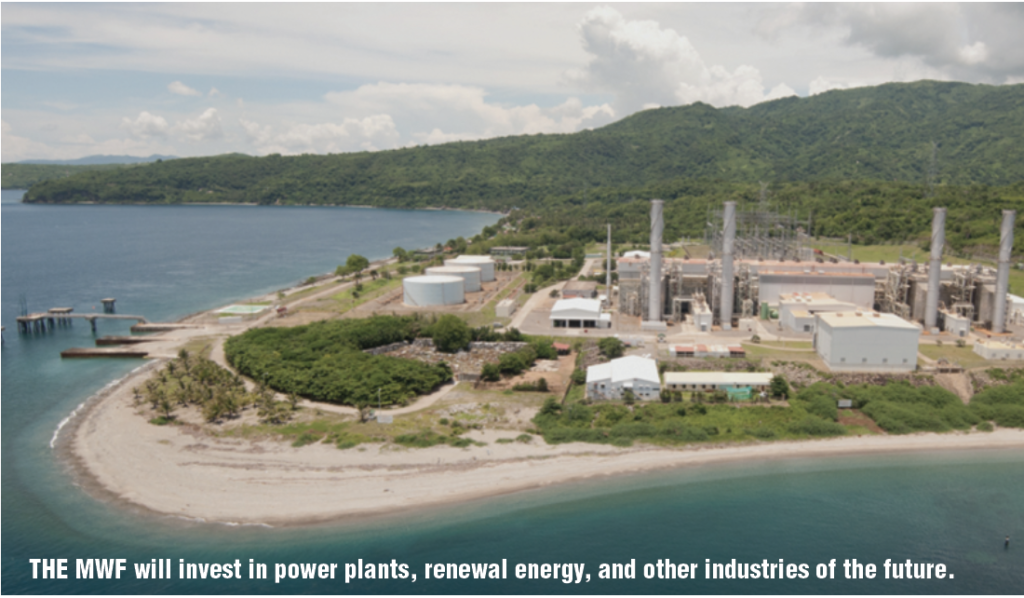

Offhand, I think the Fund should invest in power plants, telcos, mass transit, renewables, robotics, and storage battery factories—the industries of the future.

Albay Second District Rep. Joey Salceda has filed House Bill 6398 to make the Fund legal.

Explains Salceda in his bill: “The MWF is to generate consistent and stable investment returns with appropriate risk limits to preserve and enhance the long-term value of the Fund, obtain the best absolute return and achievable financial gains on its investments, and to satisfy the requirements of liquidity, safety/security, and yield in order to ensure profitability.”

Initially, the pool of money will be provided by the GFIs—Government Service Insurance System (GSIS), the pension fund of state workers; the Social Security System (SSS), the pension fund of private workers: the Land Bank (today, the second largest bank); and the Development Bank of the Philippines.

Of course, the Bangko Sentral, the state gaming monopoly PAGCOR, and the national government will also pitch in. BSP alone has $90 billion in foreign reserves, more wealth than any Filipino.

Meanwhile at the Stratbase forum, Diokno said: “Over the medium term, the goal is to create high-quality and green jobs. To achieve this, we will invest heavily in physical infrastructure, digitalization, and human capital development.”

Here are excerpts from Diokno’s PPP speech:

From 2023 to 2028, we expect the economy to expand even faster at 6.5% to 8%

Foreign direct investment inflows are on the rise. In 2021, just a year since the onset of the pandemic, we reached all-time high inflows of $12.4 billion.

Our latest revenue collections reflect higher economic activity. From January to September 2022, total revenue collections reached P2.7 trillion.

That’s 19% higher compared to the same period in 2021, and we expect revenue collection to even exceed its pre-pandemic level this year.

Our labor market has bounced back. In September of this year, we recorded an employment rate of 95% – the highest recorded since the pandemic hit in January 2020.

Unemployment has also continued its downtrend to 5%, from 8.9% a year ago. This figure is the lowest unemployment rate since the last quarter of 2019.

While the effects of the pandemic still linger and new threats have emerged, we move forward with renewed confidence, equipped with the fiscal tools and strategies required to navigate an environment beset with uncertainties.

To guide our vision, the government has crafted an eight-point socioeconomic agenda containing strategic interventions to decisively address challenges to recovery.

In the near term, we will reduce socioeconomic scarring from the pandemic, arrest the acceleration of food prices, and ensure macroeconomic fundamentals.

Over the medium term, the goal is to create high-quality and green jobs. To achieve this, we will invest heavily in physical infrastructure, digitalization, and human capital development.

Such massive investments will require fiscal prudence and a cohesive strategic plan. For this, the economic team has prepared a Medium-Term Fiscal Framework – the first in Philippine history.

This fiscal plan aligns our financing program for the next six years, with a sharp focus on improving tax administration, enhancing the fairness and efficiency of our tax system, and promoting sustainability to address climate change.

But we cannot achieve any of these alone. We recognize that effective public-private cooperation holds the key to a host of desirable goals such as workforce up-skilling, climate change mitigation, and infrastructure development.

We will harness the public-private partnership mechanism to execute impactful projects consistent with our development goals.

This requires a sound framework to facilitate the execution of public-private partnership projects.

And to demonstrate our commitment, we have revised the implementing rules and regulations of the Build-Operate-Transfer Law.

Transparency and accountability underpin the revised IRR, particularly in processing infrastructure or development projects, to arrive at the real cost of the project to the government, consumers, and taxpayers.

Hopefully, the revised IRR will allow us to sustain our current momentum of infrastructure spending despite budgetary constraints.

We also anticipate significant benefits from the implementation of key structural reforms such as the Corporate Recovery and Tax Incentives for Enterprises Act or CREATE and the economic liberalization laws.

CREATE has transformed the country’s corporate tax structure and has modernized our tax incentive system.

This landmark reform cuts corporate tax rates by 10 percentage points for domestic micro, small, and medium enterprises, and by 5 percentage points for all other corporations, including foreign enterprises. This significantly reduced the cost of doing business in the Philippines.

CREATE also offers a single menu of superior incentives for businesses and activities that are aligned with our strategic priorities.

Meanwhile, amendments to our investment laws widen the space for international firms to invest in previously protected sectors, such as, among others, telecommunications, toll roads, and shipping; form part of joint ventures with the private sector; and even fully own enterprises employing advanced technologies.