The BSP remains committed to its mandate of maintaining price and financial stability, and a safe, efficient, and inclusive payments and settlements system.

Gov. Diokno

By Governor Benjamin E. Diokno

Bangko Sentral ng Pilipinas

(Presented during the Philippine Economic Briefing (PEB) held at the Philippine International Convention Center (PICC) in Pasay City, April 5, 2022.)

Good morning to everyone joining us today here and online. It is my privilege to speak before you in today’s Philippine Economic Briefing, with the theme “Six Years of Institutionalizing Game-Changing Reforms and Shaping the New Economy.“

Over the past six years, we have achieved many accomplishments and faced a few serious challenges. In 2020, economies across the globe suffered severe downturns due to the coronavirus pandemic.

And this year, just as we were adjusting to the new normal, Russia’s invasion of Ukraine and the global response present new challenges and uncertainty. But we are optimistic as we see clear signs of recovery.

But for this morning, let me first discuss key developments in the BSP’s focus areas over the last six years, then conclude with our outlook.

The BSP remains committed to its mandate of maintaining price and financial stability, and a safe, efficient, and inclusive payments and settlements system.

At the same time, the BSP maintained a reform-oriented mindset.

The COVID-19 pandemic did not deter us from pursuing game-changing reforms. In fact, the pandemic had proved to be a catalyst that accelerated many of our reforms, such as digitalization and sustainability in the financial system.

On the monetary front, the BSP adopted the Interest Rate Corridor framework in 2016 to strengthen the transmission of changes in the monetary policy stance to the rest of the economy.

In addition, the inclusion of BSP securities in standard monetary operations provided an additional instrument for managing liquidity in the financial system.

In 2019, President Rodrigo Roa Duterte signed Republic Act No. 11211, amending the BSP Charter. This granted the BSP the authority to issue its own debt securities.

This law embodies measures to align the BSP’s operations with international standards and global best practices, thus improving the BSP’s corporate viability and enhancing its capacity for crafting proactive policies, among others.

Another key reform passed to address the impact of the pandemic is the “Financial Institutions Strategic Transfer Act”.

FIST Act

The FIST Act is a pre-emptive measure to ensure banking sector stability in case of significant spikes in loan defaults.

The passage of R.A. No. 11439 or the Act of Providing for the Regulation and Organization of Islamic Banks, marked an important milestone in the history of Islamic banking in the Philippines.

Islamic finance will help attract funds from Islamic investors looking for opportunities to support infrastructure requirements particularly in the Bangsamoro Autonomous Region in Muslim Mindanao.

In line with our efforts to promote greater financial inclusion, the BSP introduced the basic deposit accounts framework. This enables the account holder to access a wide range of financial services, including savings, credit, insurance, investments, and remittances, with limited requirements.

As of the second quarter of 2021, the number of basic deposit account holders reached 7.4 million. This brings deposit account ownership to a total of 90.5 million Filipinos.

The BSP launched the National Retail Payment System or the NRPS, which promotes interoperability among payment service providers, allowing for efficient and seamless transactions.

The NRPS is a safe, efficient, reliable, and interoperable retail payment system and is a critical enabler of our financial inclusion initiatives.

Digital Payments Roadmap

The BSP launched the Digital Payments Transformation Roadmap 2020-2023, charting strategies for an efficient, inclusive, safe, and secure digital payments ecosystem.

The roadmap aims to convert half of the total volume of retail payments into digital form and onboard 70% of Filipino adults into the formal financial system using payment or transaction accounts by 2023.

We are now seeing the fruits of our efforts to digitalize the country’s payments system.

As of end-2020, the share of monthly digital payments volume reached 20.1%, slightly exceeding the BSP’s target of “20% in 2020” set in 2015.

This indicates that the adoption of digital payments remains on track to reach at least the 50% mark by 2023.

The issuance of the Digital Banking Framework also aims to advance financial inclusion and the adoption and growth of digital financial services in the country.

As of end-2021, the BSP granted digital bank licenses to six financial institutions. This is expected to further accelerate the creation of e-money accounts.

We also launched the Sustainable Central Banking Program, which aims to foster environmentally responsible and sustainable policies and work practices in our key functions and operations.

The BSP also issued the Sustainable Finance Framework and the Environmental and Social Risk Management System Framework.

Sustainability is central to achieving the BSP’s core mandates of maintaining price and financial stability, given the potential impact of climate disasters on supply of goods and services, as well as on incomes.

As such, the BSP invested $550 million, to date, in the green bond fund of the Bank of International Settlements.

Against the backdrop of all these milestones and reforms, the Philippine economy remained strong. From 2016 to 2019, the Philippine economy expanded annually by 6% to 7%.

However, as a result of the COVID-19 pandemic, the economy contracted by 9.6% in 2020, following 21 years of uninterrupted growth.

Economy rebounds strongly

The economy rebounded strongly, growing at 12% in the second quarter of 2021, and has managed to sustain growth since then.

Mobility is back

With mobility restrictions easing, the economy is returning to pre-pandemic growth levels.

In any case, the BSP pursued initiatives that supported the economy throughout the pandemic.

First were measures to boost market confidence, such as cuts in the policy rate to promote credit-taking activities and the reserve requirement to increase loanable funds.

Second were extraordinary liquidity measures, such as provisional advances and remittance of dividends to the national government, and purchases of government securities in the secondary market.

So far, the BSP has infused over P2.2 trillion to the financial system, equivalent to about 11.1% of GDP.

Third were regulatory and operational relief measures to maintain stability of the financial system and ensure public access to financial services.

The Philippines’ long history of implementing critical structural reforms strengthened the economy’s resilience to face the challenges of the pandemic.

Despite the impact of the pandemic on the economy, credit rating agencies have maintained the Philippines’ investment grade ratings—amid a wave of negative rating actions globally.

This shows confidence in the whole-of- government efforts, including the BSP’s response measures toward recovery from the COVID-19 crisis and a better post-COVID Philippine economy.

Watching inflation

Moving on to key developments in the monetary, external and banking sectors, during the periods 2016-2021, the BSP has been able to keep inflation low and stable. Manageable inflation provided an enabling environment for growth.

From January to March this year, headline inflation stood at 3.4%, well within the target range of 2% to 4%.

While upside risks exist including shortages in domestic pork and fish supply, as well as from the potential impact of higher oil prices on transport fares, average inflation is projected to settle within the target band in 2023.

Meanwhile, the country’s strong external position continued to be a key credit strength, inspiring investor confidence.

Remittances from overseas Filipinos registered a 5.1% growth in 2021; at the height of the pandemic (2020), they only contracted by less than 1%.

The BPO industry remains a steady source of foreign exchange. BPO receipts in 2021 grew by 9.5%.

FDI hits $10.5 billion

In 2021, net FDI inflows increased by 54.2% to $10.5 billion. As of February 2022, Gross International Reserves stood at $107.8 billion, which continue to provide a liquidity buffer equivalent to 9.5 months’ worth of imports of goods and payments of services and primary income. As bank regulator, the BSP ensures that the Philippine banking system is sound and stable.

Indicators show the continued growth of assets, deposits, and capital, as well as net profit, capital and liquidity buffers.

Banks have ample loan-loss reserves and a manageable loan quality.

These allow the banking system to support the economy.

Bank credit grew seven consecutive months since August 2021, reaching 8.8% last February reflecting the expansion in business activity. This supports the view of an even stronger economic rebound this year.

Now, let me briefly touch on our economic outlook and the BSP’s policy normalization strategy.

The government expects economic growth to accelerate to a range of 7% to 9% this year and 6% to 7% next year.

There are strong bases for this optimistic outlook.

Growth will be supported by the implementation of the 2022 national budget, Build, Build, Build Program, the Corporate Recovery and Tax Incentives for Enterprises law, and Executive Order No. 166, adopting the Ten-Point Policy Agenda to Accelerate and Sustain Economic Recovery from the Pandemic.

Moreover, game-changing legislation, such as the amended Public Services Act will drive economic growth, moving forward.

This economic outlook is supported in part by the BSP’s efforts toward financial digitalization and inclusion, and promotion of a stable inflation and financial environment conducive to economic growth.

However, the favorable economic outlook comes with risks.

Ukraine risks

One of the key risks to domestic and global economic growth is the ongoing conflict between Russia and Ukraine.

Its direct impact is inconsequential, yet its indirect impact through higher world oil prices and slower global growth could be significant.

The BSP supports the national government’s fiscal interventions to address risks to inflation and maintain the economic-recovery momentum.

As the Philippine economy recovers, the BSP’s pandemic exit strategy involves recalibration of monetary operations, unwinding of our liquidity provision, reducing monetary accommodation, and building our buffers in preparation for future crises.

We will continue to assess demand and supply conditions to ensure that we are able to implement our exit strategy in a timely and orderly manner.

We will strive to strike the right balance between providing support to the economy and fulfilling our mandates of price and financial stability.

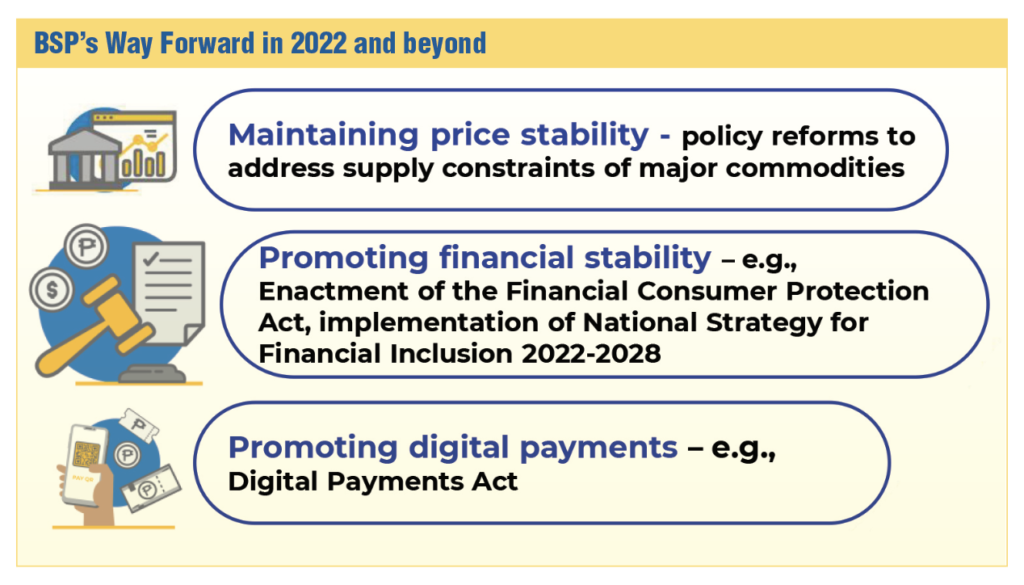

Further, the BSP supports policies and measures that will foster both the attainment of its mandates and post-pandemic economic recovery, including the:

- Institutionalization of policy reforms to address supply constraints of major commodities to help temper threats to domestic price stability;

- The enactment of the Financial Consumer Protection Act to improve the quality of financial services and contribute to greater financial inclusion;

- And promotion of digital payments under the Digital Payments Act, which will encourage the universal use of safe and efficient digital payments.

I would like to conclude with a Chinese proverb that says: “When the winds of change blow, some people build walls, others build windmills.”

The reforms that we have instituted are the results of our openness to embrace new things and our courage to deal with the challenges of our times.

The past six years tested our resilience as a nation. But we are emerging better and stronger because we opted to build windmills that have harnessed the winds of opportunity.

We searched for solutions and acted boldly in the face of difficult situations. Moving forward, we will continue to transform challenges into opportunities for improving the life of every Filipino.

READ MORE HERE: