In November 2008, Satoshi Nakamoto shared his paper on a cryptography blog where everyone is identified only by their online names. He invented an electronic payment system called Bitcoin where users can pay each other directly with virtual money called bitcoin (BTC) without using banks or wire transfers. It was anonymous and almost untraceable.

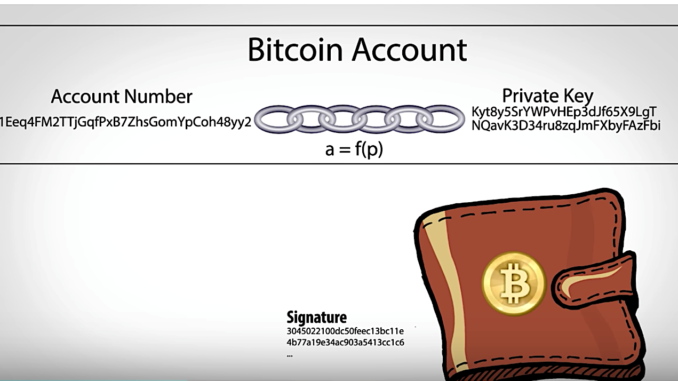

Users download the Bitcoin software onto their computer and they get a digital wallet with an account number or public key and a private key (like a password that only the user knows). All numbers are a random string of 26-35 characters, so they are hard to remember. The software is also your ledger to keep track of every Bitcoin account and anyone in the network who wants to decode a transaction can update it, so it’s public.

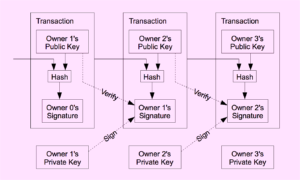

To send BTCs, you use your account number, your private key, and a digital signature that is used only once for each particular transfer, and broadcast your payment online to other computers with a BTC software (the network). After ten minutes (it now takes longer) all the keys are decrypted. The transaction is verified and broadcast back to the network. If everyone agrees, it is entered as a block into everybody’s ledger, which reflects the new amounts of BTC in each account. You can now buy more BTCs with cash or credit card.

If you want to earn BTCs, your computer can be a miner or one that maintains the network and decodes BTC transactions using the public key and digital signatures to verify that the transfers are valid, meaning you only spend what you have and it is sent from an existing account to another existing account. Miners need massive computing power and electricity to outrun all other miners trying to decode the same block. The first one to solve the code wins some BTC. Miners can also add a transaction fee to a block solved.

Once verified, your transfer is linked to a previous block in the ledger that shows all previous validated transactions of BTCs in general, and your own BTC transactions in particular. This is known as the blockchain because every transaction refers to a previous transaction involving that particular BTC. This is how they safeguard against double payment since it is difficult to fake a BTC’s origin. Also, you would have to create your own succeeding blocks to make your fake BTC transfer seem valid. But it would be almost impossible to overpower the network of miners who are racing to decode your block after you broadcast your transaction.

Bitcoin accounts are identified by a combination of letters and numbers but it is still possible to trace a particular transaction. Also, the public ledger allows everyone to see how much BTCs every account holds.

Easy come, easy go

At first, Bitcoin struggled like a start up. Nakamoto gave away 50 BTCs to anyone who signed up in 2009. He was the only one who verified the transactions and created the first blocks. Some treated BTC as a joke when it was offered as payment.

In 2010, an online black market called Silk Road was the first to accept BTC as currency. Buyers used BTC to buy mostly drugs. The anonymity allowed buyers to pay for illegal activities. That’s when Bitcoin’s popularity spread and inexplicably, when Nakamoto disappeared. No one knows his identity.

In 2013, the FBI shut down Silk Road and seized nearly 30,000 BTCs. The owner is now serving life imprisonment for drug trafficking.

Early 2014, Japan-based Mt Gox, the only big Bitcoin exchange at that time, lost 740,000 BTCs, now likely worth over $5 billion. Some 2,000 BTCs were withdrawn from customer accounts stored in the exchange. Most of the money was never recovered and the owner was charged with embezzlement and data manipulation in 2017. Mt Gox filed for bankruptcy and sold over $400 million BTCs early this year.

Bitcoin: From $0 to $19,000

At first, Bitcoins were worthless. Its price slowly climbed to $10 and stayed flat until 2013 when it rose to about $137. From then, it averaged about $200 until its explosive growth in late 2017 when it hit $19,000. Now it fluctuates around $8,000 depending on news and public hysteria.

Because of the meteoric rise in price last year, many individuals and private ventures bought and sold bitcoins and established cryptocurrency exchanges. Stories abound of fantastic crashes and overnight riches. Others made their own cryptocurrency to make their own initial coin offering (ICO) in the hopes of making money when their own coin price goes up.

You can easily create your own cryptocurrency in minutes. There are over 1,300 copycat currencies online, even joke ones that people still ignorantly buy. But in this case, being first matters. Bitcoin is still the highest priced and most recognized cryptocurrency.

Quick money-making schemes

Unfortunately, when there is an opportunity, the unscrupulous take advantage. Majority of cryptocurrency ICOs, exchanges, and wallets are just quick money-making schemes. They use the words bitcoin or blockchain and the unknowing public buys it up. There is no regulation to set up a website or wallet; nor to make an ICO or an exchange to buy or sell Bitcoins; or offer Bitcoin investment advice. So victims just assume that what they find online is legitimate. Often, the website later just goes offline and disappears with the “investor’s” money. There is no trace and no recourse.

Another scheme is to make an online Bitcoin digital wallet to keep it separate from an exchange which can be hacked, like Mt Gox. One bitcoin wallet, StrongCoin, claims only the user knows his private key as it is encrypted when he downloads their app. The user then buys or sends bitcoins to his digital wallet stored with StrongCoin. Then when the same user tries to use his private key, he is banned and there is no way for him to access his funds. There is no number to call and emails are ignored. But one customer used his 3G phone, which showed a different IP address from his current device, and he retrieved his Bitcoin. Others were not so clever.

Is Bitcoin a currency or an asset?

Nakamoto defines Bitcoin as a peer-to-peer e-cash system. It’s not an actual coin because it is a virtual form of payment. It uses codes that need to be decoded that’s why it’s called a cryptocurrency.

“We define an electronic coin as a chain of digital signatures.” (Nakamoto) So each e-coin contains its own record of transactions.

Unlike other currency like the dollar or peso which is backed by the government’s guaranty, Bitcoin is based on people’s belief in what it is worth. So its valuation is based on demand, supply, and its perceived future price. The price goes up if many people want to buy it, supply is limited, and many think it will be worth more in the future. In this sense, it becomes more of a speculative commodity instead of a currency because people are buying Bitcoins not to use it for payments but to hold on to it until its price goes up and they can sell it for a profit.

Skeptics think Bitcoins are a pump and dump scheme, a form of securities fraud where a stock’s price is artificially inflated so they can sell it at higher price.

Bitcoins are limited to 21 million, with about 16 million bought up. Nakamoto owns 1 million BTCs, or about 5% of the whole ecosystem. Like any major BTC holder, he can manipulate the market price by dumping his BTCs.

BTC has also been likened to a pyramid scheme, which supports itself by recruiting more people to join, or in this case buy more BTCs, and the earliest buyers make the most money from the recent joiners. In any case, the more people buy Bitcoin, the higher its price rises.

It is predicted that by 2140 no more new Bitcoins will be created. From then, the ecosystem will maintain itself by rewarding miners with higher transaction fees. So if your transaction does not pay a fee, miners will ignore it and it may not be verified to be included in the blockchain. That will certainly dampen its wide use.

Miners need immense computing power and electricity. They solve math problems more quickly if they have more computers and faster processors, that’s why miners are buying up pricey GPUs (graphics processing units), the digital equivalent of shovels. GPU cards are used in the mining process to break down intense calculations to decode a BTC transaction. AMD and Nvidia, leading GPU designers, now limit sales of GPUs to crypto-miners to accommodate their main market of gamers.

Some investors believe in the blockchain technology but not in Bitcoin. Blockchain’s immutability has many security applications that can ensure the integrity of land titles, contracts, produce, and goods. It is already used by IBM in its supply chain of precious metals and minerals.

The Bitcoin virtual payment system runs on blockchain so most people confuse Bitcoin with blockchain and likely buy BTC thinking they are investing in blockchain. Blockchain is touted as a revolutionary way to ensure that the direct transfer of goods is valid without relying on a third party to verify it. We’re supposed to trust a computer more than humans.

Right now, the technology is too new to know for certain how computers are supposed to validate human transactions. Even Nakamoto himself laid out the limitations and dangers of the blockchain.

More on cryptocurrency in BizNews Asia Vol 15 No 39.

IVY DIGEST

Ivy Lopez is a lawyer turned journalist who studied in the Jesuit-run Ateneo de Manila University and the University of Pennsylvania’s Wharton School.

Ivy’s column Ivy Digest serves the busy reader by reviewing worthwhile publications and covering relevant issues in business, law, education, leadership, psychology, parenting, technology, and career advancement.