INCOME TAX

Compensation income earners:

- Reduced the income tax rates of almost all or 99% of the 7.5 million individual income taxpayers.

- Exempted the first P150,000 annual taxable income, and retained the P82,000 tax exemption for 13th month pay and other bonuses and the maximum P100,000 additional exemption for up to 4 dependents. This translates to an approximate tax-exempt monthly income of P25,000 for workers with 4 dependents.

- Based on BIR data, 81% or 6.1 million of the 7.5 million income taxpayers (both wage earners and self-employed and professionals) will be exempt from paying taxes—triple the current 2 million exempt minimum wage earners.

- Provided for indexation or automatic adjustment of the income tax schedule every 3 years so there won’t be any repeat of an outdated and unjust income tax system where lower income earners are pushed to higher tax brackets because of inflation.

Self-employed and professionals:

- Introduced the 8% flat tax on gross sales or receipts for easier compliance. This is to encourage self-employed and professionals to pay their taxes correctly, which according to BIR data, only contribute 15% of the total income tax collection.

- The 8% flat tax is made optional so that self-employed and professionals can choose which tax rate (either 8% flat tax or schedular personal income tax rate) is more favorable to them.

- With higher income tax exemption, marginal income earners—who are self-employed individuals deriving gross sales or receipts not exceeding P100,000—will be exempt from paying income taxes. These include farmers and fisherfolk, sari-sari store and carinderia owners, market vendors, tricycle drivers.

- By automatically exempting them, in effect, marginal income earners from income tax, we would finally afford them equal protection and benefits that the minimum wage earners have long been enjoying.

|

1997 Tax Code |

Senate Bill |

||

|

Annual Taxable Income |

Tax Rates |

Annual Taxable Income | Tax Rates |

|

Not over P10,000 |

5% |

Not over P150,000 |

0% |

|

Over P10,000 – P30,000 |

P500 + 10% of the excess over P10,000 | Over P150,000 but not over P250,000 | 15% of the excess over P150,000 |

| Over P30,000 – P70,000 | P2,500 + 15% of the excess over P30,000 | Over P250,000 but not over P400,000 |

P15,000 + 20% of the excess over P250,000 |

|

Over P70,000 – P140,000 |

P8,500 + 20% of the excess over P70,000 | Over P400,000 but not over P800,000 | P45,000 + 25% of the excess over P400,000 |

| Over P140,000 – P250,000 | P22,500 + 25% of the excess over P140,000 | Over P800,000 but not over P2,000,000 |

P145,000 + 30% of the excess over P800,000 |

|

Over P250,000 – P500,000 |

P50,000 + 30% of the excess over P250,000 | Over P2,000,000 | P505,000 + 32% of the excess over P2,000,000 |

| Over P500,000 |

P125,000 + 32% of the excess over P500,000 |

||

- For instance, a teacher, who has two dependents, with a monthly income of P17,254 is currently taxed at 20%. Under the proposed new tax scheme, he or she will be already exempt and will no longer have to pay taxes. The teacher will be able to take home bigger pay and save P13,176 in annual taxes or P1,098 monthly savings.

- Another example, a call center agent, with no dependent, earning about P16,136 a month is currently taxed at 20%. Under the proposal, his or her current P20,576 annual tax due will be reduced to P4,557 at a lower tax rate of 15%, resulting to approximately P16,019 annual savings—close to the call center agent’s monthly income.

EARMARKING

- Instead of generally allocating revenues for infrastructure, health, education and social protection expenditures, the earmarking provision is made more specific to directly benefit the poor.

For five years, revenues shall be allocated to fund the following:

Incremental revenues from petroleum excise tax will go to:

- Unconditional cash transfer of P300 per month for a period of 3 years for the bottom 50% poorest households

- Aid in the implementation of PUV modernization project

Incremental revenues from sweetened beverage tax will go to:

- Health programs for the bottom 50% poorest households to address obesity, diabetes, and other non-communicable diseases

- Provision of dialysis ward or unit in all national, regional, and provincial government hospitals

- School-based supplemental nutrition programs and provision of water fountains in public schools

- Supplemental feeding for children and adults in areas with high incidence of hunger

- Emergency employment and retraining programs for affected workers in the sweetened beverage industry

Remaining revenues will go to:

- Phased implementation of Free College law

- Infrastructure programs to address congestion and improve mass transport

- Expansion of provision of free medicines for poor families in government hospitals

- Expansion of Philhealth package to include outpatient care for indigents and senior citizens

- Provision of social pension for all senior citizens except those with contributory pension system

- Provision of scholarships for health professional education

- Provision of subsidy and housing projects for fisherfolk

- Expansion of technical assistance to support the sugarcane block farms of agrarian reform beneficiaries to increase their productivity

ESTATE TAX

- Reduced and simplified estate tax to a flat tax rate of 6% based on the net value of the estate.

Current Estate Tax Table:

|

Amount of Estate |

Tax Rate |

|

P1 to |

exempt |

|

P200,000 to |

P0 + 5% of the excess of P200,000 |

|

P500,000 to |

P15,000 + 8% of the excess of P500,000 |

|

P2,000,000 to |

P135,000 + 11% of the excess of P2,000,000 |

|

P5,000,000 to |

P456,000 + 15% of the excess of P5,000,000 |

| P10,000,000 and above |

P1,215,000 + 20% of the excess of P10,000,000 |

- Increased and simplified estate tax deduction to P5 million in lieu of other deductions which currently amounts to a total of P2.7 million [P1 million standard deduction, P1 million family home, P500,000 medical expenses, P200,000 funeral expenses].

- Included up to 3 hectares of family farm in allowable deduction.

- Increased allowable bank withdrawals from P20,000 to P500,000 to help the heirs settle the expenses relating to the passing of the decedent, which include paying for funeral expenses or for final medical bills of the deceased relative, or paying the estate taxes imposed on them.

DONOR’S TAX

- Reduced and simplified donor’s tax to a flat tax rate of 6% on net donations for gifts exceeding P100,000, regardless of relationship between donor and donee.

Current donor’s tax table:

|

Amount of Donation |

Tax Rate |

| P1 to not over P100,000 |

exempt |

|

P100,000 to not over P200,000 |

P0 + 2% of the excess of P100,000 |

|

P200,000 to not over P500,000 |

P2,000 + 4% of the excess of P200,000 |

|

P500,000 to not over P1,000,000 |

P14,000 + 6% of the excess of P500,000 |

|

P1,000,000 to not over P3,000,000 |

P44,000 + 8% of the excess of P1,000,000 |

|

P3,000,000 to not over P5,000,000 |

P204,000 + 10% of the excess of P3,000,000 |

|

P5,000,000 to not over P10,000,000 |

P404,000 + 12% of the excess of P5,000,000 |

|

P10,000,000 and above |

P1,004,000 + 15% of the excess of P10,000,000 |

Current tax rate for donations to strangers: 30%

SWEETENED BEVERAGE TAX

- Excluded milk (plain milk, infant formula milk, and growing up milk; and powdered, ready to drink, flavored and fermented milk with less than 5 grams of sugar per 100ml) given its nutritional value.

- Excluded coffee (ground and 3-in-1) as one of the most consumed food items of ordinary Filipinos. A Kantar survey showed that 90% of consumers of 3-in-1 coffee are low-income earners.

- Other excluded beverages are: 100% natural fruit and vegetable juices, unsweetened tea, meal replacement and medically indicated beverages. Sweetened beverages that used coco sugar and stevia are also excluded.

- Lowered the rate to P5 per liter, as proposed by the Sugar Alliance of the Philippines, in the first two years of implementation. This is to allow the FDA to build its capacity—to boost its manpower and put in place the equipment needed for a sugar content-based taxation (P0.05 per gram of sugar) for the succeeding years.

- House Bill 5636 imposes P10 per liter for local sugar and P20 per liter for others. This 2-tiered proposal would violate WTO rule that bars the taxing of imported products at higher rates to favor domestic products.

- Imposing excise tax based on sugar content, rather than per liter, would be more reasonable and more effective in encouraging Filipinos to consume healthier drinks and curbing the prevalence of diabetes and obesity. It is also what is being practiced by some other countries.

PETROLEUM EXCISE TAX

- Excluded kerosene because it is widely used as fuel for lighting and cooking by around 3 million households in far-flung areas.

- Reduced the rate for LPG (1-1-1) because it is commonly used by Filipino households for cooking.

- Adjusted the rates to 1.75-2.00-2.25 to minimize the shock to the economy to keep inflation within target so as to prevent undue increase in prices of commodities.

- The original proposal of DOF was straight out P6-increase, while House Bill 5636 provided for a phased implementation of 3-2-1.

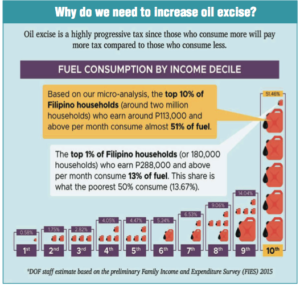

- According to DOF, the richest 2 million families (or richest 10% of Filipinos) consume 50% of oil products in the country.

- Provided for a safeguard provision that would suspend the increase if Dubai crude oil exceeds $80 per barrel or if consumer price index (CPI) breaches the inflation target set for the year.

- Granted power to DOF to require fuel marking to combat oil smuggling.

- Based on the estimates by the oil industry, the government loses P44 billion annually from oil smuggling.

VAT BASE EXPANSION

- Increased VAT threshold from P1.9 million to P3 million—exempting small businesses with total annual sales of P3 million and below from paying VAT. This would provide them due tax relief that would encourage them to grow and generate more and better jobs.

- Micro, small, and medium enterprises (MSMEs) represent 98 percent of all registered businesses in the country.

- Retained the VAT exemption of raw food/agricultural products, health and education, as well as of senior citizens, PWDs, BPOs, cooperatives, renewable energy, Red Cross, Boy Scouts and Girl Scouts.

- Retained the VAT exemption of socialized housing so as not to exacerbate the 6-million housing backlog of the country.

- VAT exemption of government-owned and controlled corporations (GOCCs), state universities and colleges (SUCs) and national government agencies will shift to a form of subsidy through the tax expenditure fund (TEF) under the national budget.

- House Bill 5636 provides for a general repeal of all special laws granting VAT exemption.

AUTOMOBILE EXCISE TAX

- Adopted a progressive version similar to House Bill 5636 where the most expensive cars will be taxed at much higher rates while taxes of lower-end models will only slightly increase.

- According to DOF, at least 80% of Filipino households do not own cars.

- Exempted hybrid and electric cars to encourage greener and cleaner transportation options.

|

Current |

Senate Bill |

||

|

Net manufacturer’s price |

Rate |

Net manufacturer’s price |

Rate |

|

Up to P600,000 |

2% |

Up to P600,000 |

4% |

|

Over P600,000 to P1.1 million |

P12,000 + 20% of excess over P600,000 |

Over P600,000 to P1.1 million |

P24,000 + 35% of excess over P600,000 |

|

Over P1.1 million to P2.1 million |

P112,000 + 40% of excess over P1.1 million |

Over P1.1 million to P2.1 million |

P199,000 + 55% of excess over P1.1 million |

|

Over P2.1 million |

P512,000 + 60% of excess over P2.1 million |

Over P2.1 million to P3.1 million |

P749,000 + 90% of excess over P2.1 million

|

|

Over P3.1 million |

P1,649,000 + 100% of excess over P3.1 million |

||

For example, a Toyota Vios will approximately increase by P20,000 (from P812,000 to P832,000) while a BMW X5 30d will increase by P3.2 million (from P6.6 million to P9.8 million).

PASSIVE INCOME AND OTHER TAXES

- Increased the final tax on foreign currency deposit units from 7.5% to 20%; capital gains tax for stocks not traded in stock exchange from 5% or 10% to 20%; tax on dividend income from 10% to 20%.

- Based on the Family Income and Expenditures Survey (FIES), 97% of dividend income and 74% of interest income belong only to the richest 20% of the population. This will improve the progressivity of the bill, as this will only affect those who have the ability to pay additional taxes.

- Reduced the interest rate from 20% to twice the legal interest rate. Prohibited the simultaneous running of deficiency and delinquency interest rate. Under current regulations, a taxpayer subject to an assessment may be charged with up to 40% interest.

- Increased the coal excise tax from P10 per metric ton to P20 per metric ton.

- Included cosmetic procedures and body enhancements undertaken for aesthetic reasons in the list of non-essential goods and services to be levied with 20% excise tax. Reconstruction of facial and body defects due to birth disorders, trauma, burns, disease, and those intended to correct dysfunctional areas of the body shall be exempt.

* The Department of Finance (DOF) is still computing the revenue impact of this version but more or less P130 billion, similar to House Bill 5636.

* A product of 19 Senate ways and means committee public hearings, two technical working group meetings, three consultative meetings, three workshops, and hundreds of resource persons.