Banks remained profitable, recording an annualized net profit growth of 8.5% last year. Capitalization remained ample, with the capital adequacy ratio staying well above the BSP’s 10% minimum requirement and the 8% prescribed by the Bank for International Settlements.

Things are looking up for the economy and the country. The economy is expected grow by 7 to 9% this year, up from 5.6% in 2021.

At the same time, the rate of increase in recent daily COVID cases is slowing.

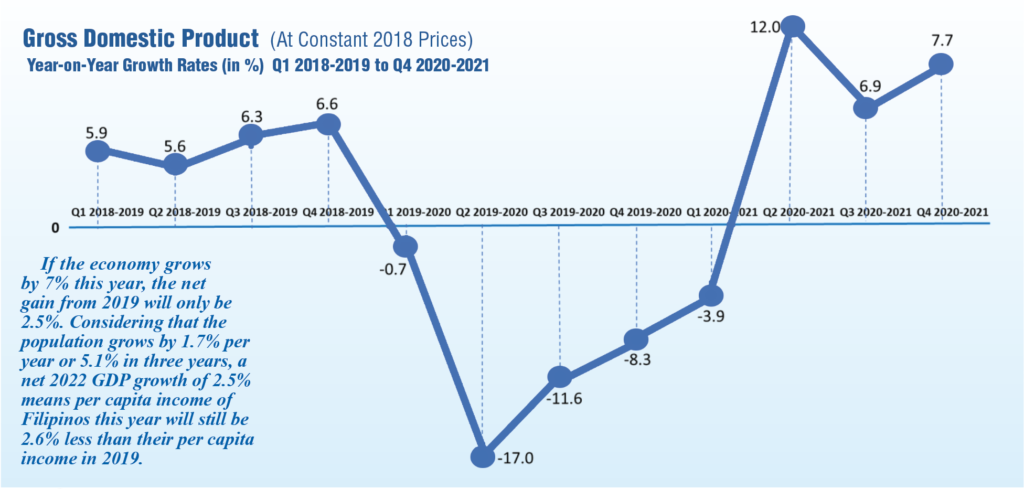

Since the economy contracted by 9.6% in 2020 and grew by just 5.6% in 2021, that’s a growth deficit of 4.0% this year, meaning the value of economic production last year was still below the 2019 value.

So if the economy grows by 7% this year, the net gain from 2019 will only be 2.5%. Considering that the population grows by 1.7% per year or 5.1% in three years, a net 2022 GDP growth of 2.5% means per capita income of Filipinos this year will still be 2.6% less than their per capita income in 2019.

Why is the income of Filipinos shrinking? Well, two things: The economy has shrunk to record lows; and two, between 16 million to 30 million Filipinos are jobless.

On its own, even if the president sleeps 24/7 for 365 days, the economy creates one million jobs a year. If growth is 7% or higher, the economy creates an additional one million to make it two million jobs per year.

Now, if only the banks could redeploy the P2.3 trillion pumped in by the Bangko Sentral into the system, then maybe the economy could create three million jobs a year.

The economy grew by a robust 6.6% per year in the first four years of the Duterte administration. Then growth collapsed to its lowest ever, by 9.6% in 2020. It will take five years or more to recover that collapse. It’s like a two-story house that went three stories down the ravine.

To bring it up to earth and still have two stories, you need to raise it by five stories just to be at the same level as before the fall. Remember, you had plans to build a third floor. Now, you cannot do that.

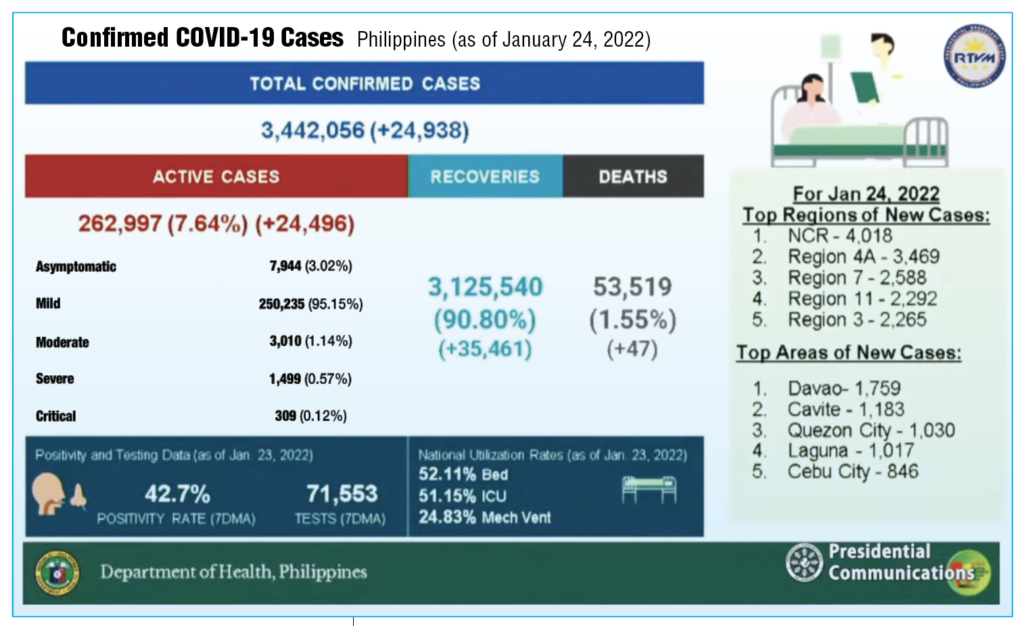

On the pandemic front, the Philippines recorded only 24,851 cases on Jan. 24, 2022, bringing total cases to 3.4 million. Active cases, 262,997, are 7.64% of the total.

Critical are 309 cases, just 0.12%. “It appears that the vaccines are really working,” says Health Secretary Francisco Duque last Jan. 24, 2022. Vaccination rate is only 51.15% of the population (with 123.36 million doses administered), the lowest ratio in ASEAN.

Case fatality rate is 1.5%. Some 53,519 have died since the pandemic erupted in February 2020. The percentage of increase in cases is coming down, said Duque.

The Jan. 24 tally of 24,851 cases is down from 29,730 on Jan. 23; 30,416 on Jan. 22; 32,633 on Jan. 21; and the two-year COVID peak of 38,867 on Jan. 15, 2022.

COVID cases are going down in Metro Manila. In the provinces, the number of cases is hitting a plateau. So current Level 3 lockdown in Metro Manila could become Level 2, an easing.

Meanwhile, Bangko Sentral Governor Benjamin Diokno addressed the Management Association of the Philippines on Jan. 13, 2022. He said:

“After five consecutive quarters of negative growth, the economy bounced back with growth of 12% in the second quarter of 2021 followed by 7.1% in the third quarter.

“Labor conditions have improved, with the unemployment rate declining to an 11-month low of 6.5% last November, from the peak of 17.6% in April 2020.

“Inflation decelerated to 3.6% last December. This brought the average inflation for 2021 to 4.5%, above the official target range of 2% to 4%. For this year and next, we see inflation easing back to within the target range.

“The country’s gross international reserves remain hefty at $107.7 billion as of end-November 2021, equivalent to 10.2 months’ worth of imports of goods and payments of services and primary income.

“Cash remittances from overseas Filipinos continue to be a reliable source of foreign exchange, growing by 5.3% to $25.9 billion in January to October last year, from a slight contraction in 2020.

“For the first 16 months, Foreign Direct Investments net inflows rose by 48.1% to $8.1 billion, up from $5.5 billion in the previous year.

“Meanwhile, the peso appreciated to an average of P49.3/$1 in 2021 from 49.6/$1 the previous year.

“The Philippine banking system has remained sound amid the COVID-19 pandemic.

“The banking system’s total resources grew year-on-year by 6.6% to P20.1 trillion as of end-October 2021.

“Asset expanded by 8.6% to P15.6 trillion, funded mainly by deposits, reflecting continued trust and confidence of the public in the banking system.

“Bank lending has improved. As of end- October 2021, banks’ total loan portfolio expanded year-on-year by 3.3% to P11 trillion.

“Non-performing loans ratio remained manageable at 4.4% over the same period.

“Banks remained profitable, recording an annualized net profit growth of 8.5% last year.

“Capitalization remained ample, with the capital adequacy ratio staying well above the BSP’s 10% minimum requirement and the 8% prescribed by the Bank for International Settlements.

“While the COVID-19 crisis has brought challenges, it helped accelerate financial digitalization and inclusion. More people started to embrace digital payment platforms and created electronic financial accounts,” said Diokno.

— Tony Lopez