Overwhelmed by the people’s 91% unprecedented job approval and trust ratings for their president, Rodrigo Roa Duterte is returning their gesture of solid support.

The world’s—and history’s—most popular strongman will now relax the globe’s severest and longest lockdown to reopen the Philippine economy and bring things to a level a bit short of pre-COVID-19 normalcy.

People aged 21 to 60 can now go out without permits. Public transport operates at 50% of capacity. Nearly all industries can restart their factories. Restaurants now have fewer capacity restrictions. All hotels can operate at 100% Churches can take in up to a third of capacity. But expect to celebrate the nine-day midnight masses before Christmas, although at half of the crowd attendance last year.

Begun on March 15, 2020, the series of lockdowns shut down 75% of the economy, shut down 70% of businesses, laid off easily 20 million workers, made three of every 10 Filipinos hungry, and impoverished half of the country’s 23 million families.

Of the 20 million workers rendered jobless, seven million will never get back their old jobs. Official unemployment figure tripled from 5% in 2019 to almost 18% by the first half of 2020. In July, unemployment improved somehow to 10%.

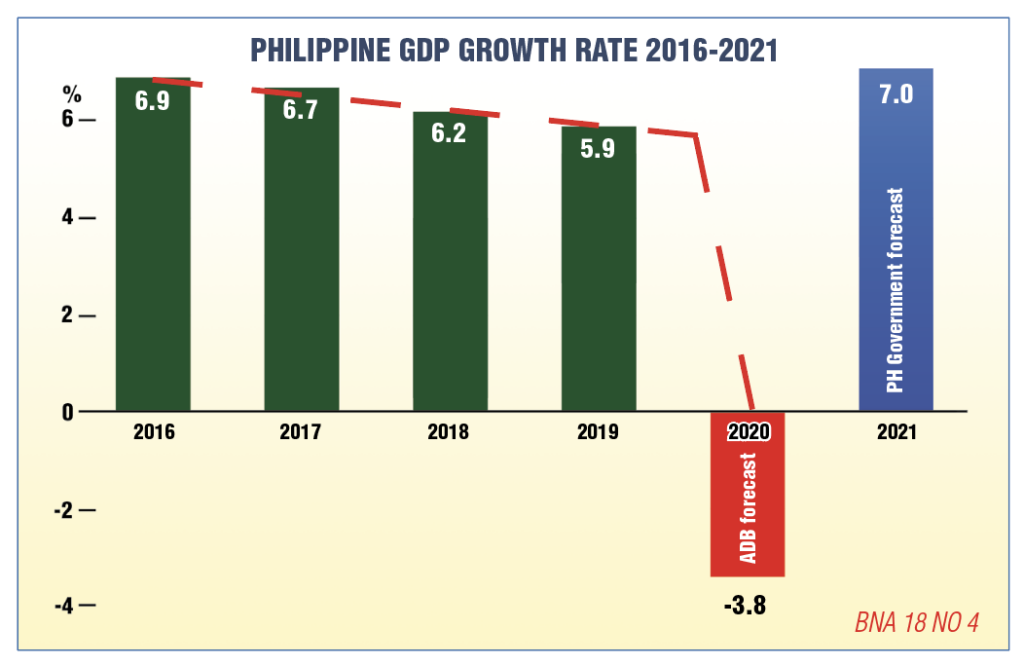

In the first three months of this year, the economy contracted by 0.7%; in the second quarter, it collapsed totally by 16.5%—the deepest contraction ever in the country’s history. For the first half, the economic output was reduced by 9%.

PH GDP to drop 8.3%

For the whole of 2020, economic production will decline by 8.3%, according to the International Monetary Fund. That is the deepest economic contraction year-on-year ever, ever. The 8.3% nosedive also discounts recent reopening moves by the government. Some five million Filipinos who previously had escaped poverty will become poor again.

Government economists think the economy will recover fully in 2021, regaining its average growth of 6% in the past 20 years. That is being too optimistic. With global slowdown, “all our recovery efforts will face strong headwinds,” concedes Finance Secretary Carlos “Sonny” Dominguez.

Cynics think it will take at least three years for the Philippines to get back to its old GDP growth clip of 6%.

Duterte’s lockdowns hidden under various acronyms that only few people, excluding even some of his own cabinet members, understood, proved ineffective.

More harm than good

Admits Finance chief Dominguez, “it (the lockdown) was doing more harm than good.” In place of lockdowns, the head of Duterte’s economic team insists on “health protocols so we don’t get a spike in cases.” Duterte himself sums up the health protocols in three words – “masks, hugas, iwas” – for wear masks, washing your hands frequently, and keeping a distance from the others.

“We cannot completely lock ourselves up to avoid COVID-19 at the expense of other vital dimensions of our lives. We should take less costly but effective measures,” Dominguez says.

PH became Asia’s pandemic epicenter

Instead of COVID being contained dramatically as it was in China, Vietnam, South Korea, and Japan, the severe restrictions of lockdown on movement of people and production of goods made the Philippines the epicenter of the pandemic in Asia and for a while the 18th hardest hit among 220 countries in the world.

Worse, they also made the Philippines, from being among the world’s fastest growing economies to among the world’s top economic laggards. Globally, the country will also register the biggest loss in GDP value between 2020 and 2025.

Per Worldometers, at this writing, 41.04 million have been struck by COVID-19; 1.129 million have died.

The Philippines is No. 20, worldwide, in number of cases, with 360,775, having been overtaken by Indonesia, with 368,842 cases. Indonesia has 12,734 deaths, almost double the Philippines’ 6,690. Indonesia and the Philippines are the hardest hit countries of ASEAN; because of that, their economic outlook is uncertain, says IMF.

Based on other metrics, the Philippines is worse off than Indonesia. The Philippines has 3,379 cases per million people; Indonesia less than half that, at 1,344. The Philippines has 61 deaths per million; Indonesia just 46.

Cases in the Philippines peaked at 6,871 per day on Aug. 10, 2020. Since then, they have steadily declined to 1,811 cases per day on Oct. 14, have stabilized at 2,604 as of Oct. 19.

As to the much touted vaccine, well, don’t bank on it too much. To reach what they call herd immunity, up to 70% of the population have to be vaccinated, according the chief scientist of the World Health Organization. Herd immunity means a sick person will infect only one other person (1×1 equals 1), stopping the virus from jumping from one person to many others.

Even with a vaccine, studies indicate immunity is good for only seven months. Which means every six months, one has to get vaccinated. That’s very expensive.

The vaccine, if you consider the greed of drug companies, could cost as much as P20,000 per inoculation. Governments should give away it for free.

Economy starts to recover

There are signs the economy is indeed stirring up. Reports Dominguez:

“The continuous slower contraction in manufacturing production also signals rising economic activities. The value of production index for the month of August continued to drop at a slower annual decline of 13.8% from a high of 40.1% in April. The volume of production index also continues to shrink at a slower annual rate of 9.9% in August, compared to a high of 37.6% in April.”

“The combined collections of the Bureau of Customs and the Bureau of Internal Revenue exceeded our revised target for the first nine months of the year by 8%. These are strong indicators that the economy is starting to recover.”

The good news

“It is fortunate that when the COVID-19 crisis hit, the Philippines was financially ready,” says Finance Chief Sonny Dominguez.

Addressing a Manila Times forum, Dominguez recalled that since 2016, “we had started building up our finances to support our aggressive infrastructure program designed to lift Filipinos out of poverty. Little did we know that this financial build-up would also serve to buttress our defenses against economic shocks.”

He says “the game-changing reforms we passed over the last four years have strengthened our fiscal stamina. Without our series of tax reforms, the rice tariffication law, and other far-reaching measures, the COVID-19 crisis would have inflicted much more pain on our people and on the economy.” The measures, he points out, “have provided us the necessary tools needed to fight the pandemic.”

Reforms pushed by Dominguez raised tax to GDP revenue effort to 16.1% — “the highest in more than two decades”.

Also, last year, total debt as a percentage of GDP went down to a historic low of 39.6%. Other countries perennially borrow at more than the value of their GDP.

Exults Dominguez: “The Philippines has the lowest external debt position among the ASEAN-5 countries. In 2019, we posted a 20.2% external debt-to-Gross National Income ratio.”

Other achievements

Other achievements on the economic front:

— Gross international reserves hit an all-time high of $100.5 billion by end of September 2020, 10 months’ worth of imports.

— The $100 billion record reserves exceed foreign debts of $87.5 billion, meaning if it wants to, the Philippines can wipe out all its foreign debts.

— In the past crises devalued the peso. Not this time. The peso has instead appreciated, by 4.3% per dollar.

“Our credit ratings have endured a global tide of downgrades and remain at historic highs,” gushes Dominguez.

Its strong position gives the Duterte administration “enough room to reallocate budget items to fight the pandemic. We were able to quickly access emergency loans from our development partners and the commercial markets at very low rates, tight spreads, and longer repayment periods,” reports Dominguez.

However, the government expects lower taxes “as we increase spending in healthcare and relief measures to prop up the country for recovery. The borrowings we have secured will help cover our revenue shortfall.”

“There were enough excuses to grow the deficit and borrow more money,” the finance chief points out, “we have chosen to take the path of fiscal prudence.”

The goal

Dominguez wants a deficit-to-GDP ratio in the middle of our ASEAN neighbors and credit rating peers. “This conservative approach will allow us to continue accessing the financing we need at favorable terms for the Filipino people,” he explains.

For its part, Congress has passed two stimulus laws – Bayanihan One and Bayanihan Two.

Both have been criticized for allocating too little too late.

Both Bayanihan One and Two, explains Dominguez “recognize that the fight against the pandemic has an indeterminable timeline. This is going to be a marathon, not a sprint. We have to be prudent in the use of our finite fiscal resources. After all, it is the virus that ultimately dictates the timeline in this battle.”

Dominguez thinks Bayanihan Two opens the way for the government to begin rebuilding our domestic economy by ensuring help to key industries, without intervening excessively in the workings of the private sector financing.

The credit programs will support, rather than diminish, the financial sector’s continued strength and stability.

For instance, notes Dominguez, Bayanihan Two “infuses additional capital into our government financial institutions, enabling them to expand lending support for enterprises in distress. This will have a large multiplier effect in economic activity. Every peso infused into our government financial institutions will generate around 10 times its value in credit. The additional capital will be used to protect the productive parts of our economy.”

With higher lending capacity, the government banks can serve as wholesale banks and rediscounting agents for smaller and medium sized banks and microfinance institutions.

Infrastructure

The Duterte administration remains focused on infrastructure – its Build, Build, Build program. “It will play a pivotal role in our economic recovery,” asserts Dominguez.

Additional reforms are in the pipeline. Reports Dominguez:

“We seek to lower the corporate income tax rate by 5 percentage points immediately and incentivize countryside investments. We aim to mitigate the threat of non-performing assets to our banking system. We want to support strategically important companies facing solvency issues. We also seek to provide greater support to the agriculture sector by increasing credit access to the entire agricultural value chain.”

Other reforms

Duterte’s economic team eyes more ways to help revive the domestic economy. Reports Dominguez:

“We are turning this crisis into an opportunity to boost the competitiveness of our manufacturing and agriculture sectors. We support the rehabilitation of our tourism infrastructure and facilities.

“We are accelerating digital transformation of our government processes to drastically cut red tape, hasten the delivery of services to the people, and curb corruption.

Digital economy

“The Department of Finance is also studying how to tax the digital economy better. The regulatory mechanisms should make certain that the shift to the digital economy will expand opportunities for legitimate enterprises. Our regulations should also protect the welfare of consumers. We will continue to maintain a pro-business environment for our enterprises to prosper.

As the entire global economy is expected to contract by about 4.4%, all our recovery efforts will face strong headwinds.

By exercising prudence in managing our fiscal affairs, we are confident that we will outlast this emergency.

“Next year, we expect the Philippine economy to post a strong rebound. The challenges are large, but we are determined to build back a better economy that the Filipino people deserve.”

Meanwhile, among emerging market and developing economies, the IMF forecasts growth at –3.3% in 2020, 0.2 percentage-point weaker than in the June 2020 WEO Update. Growth, however, strengths to 6% in 2021.

Prospects for China are much stronger than for most other countries in this group, with the economy projected to grow by about 10% over 2020–2021 (1.9% this year and 8.2% next year).

Activity normalized faster than expected after most of the country reopened in early April, and second quarter GDP registered a positive surprise on the back of strong policy support and resilient exports.

For many emerging market and developing economies excluding China, prospects continue to remain precarious, IMF says.

This reflects a combination of factors: the continuing spread of the pandemic and overwhelmed health care systems; the greater importance of severely affected sectors, such as tourism; and the greater dependence on external finance, including remittances.

All emerging market and developing economy regions are expected to contract this year, including notably emerging Asia, where large economies, such as India and Indonesia, continue to try to bring the pandemic under control.

The IMF growth projections imply wide negative output gaps this year and in 2021 as well as elevated unemployment rates across both advanced and emerging market economies.

India’s economy is projected to contract by 10.3% in 2020, before rebounding by 8.8% in 2021.

Growth for emerging market and developing economies excluding China is projected at –5.7% for 2020 and 5% for 2021.

The projected rebound in 2021 is not sufficient to regain the 2019 level of activity by next year.

Growth among low-income developing countries is projected at –1.2% in 2020, strengthening to 4.9% in 2021.

Higher population growth and low starting levels of income imply that even this more modest contraction compared with most emerging market economies will take a very heavy toll on living standards, especially for the poor.

For the long term, among emerging market and developing economies, growth is projected to decline to 4.7% by 2025, well below the 5.6% average of 2000–2019.