By Antonio S. Lopez

In recent weeks, four issues have gripped the business community: the real property outlook; the impact of the expected ban on programmed online gaming operations or POGO or online gaming; the bill to lower corporate income taxes and withdraw current liberal incentives given locators at the Philippine economic zones; and the June 2019 Administrative Order 18 which has imposed a ban on additional economic zones in Metro Manila so industrial estates will fan out to the provinces.

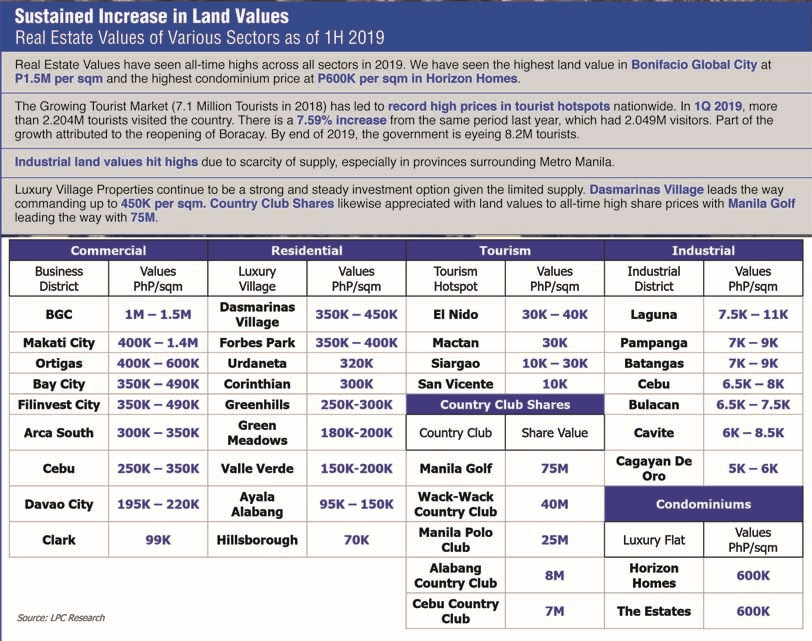

The property outlook

Real estate remains buoyant, but is no longer bullish.

Buoyant because the Philippine market is huge. It is 106 million Filipinos, the 12th largest market on earth. It is middle income, with $3,725 per capita gross national income or GNI. (GNI includes income of Filipinos abroad).

Real estate has been growing from 5% to 8% per year over the last 10 years. This growth should continue, but not at the hectic pace of the past decade. The economy is just too large as to be stymied by domestic and external factors in its path to growth.

On nominal basis, the Philippine economy is worth $330 billion. In terms of what it can buy in local goods, what economists call purchasing power parity, the economy is worth $875 billion—2.65 times more. So the nominal per capita income of $3,725 is actually worth $9,871. Filipinos are not only middle class. They are high income. Rich.

Filipinos are young. The average age is 24. Filipinos are what you call yuppies – young, upwardly mobile professionals. Being young, Filipinos are expected to multiply at a feverish pace, 1.7% per year or easily 1.8 million babies yearly. That’s a lot of manufacturing activity.

No longer bullish

In the short term, the outlook is no longer bullish.

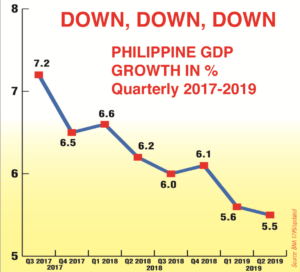

Industry is down. Manufacturing is down. Agriculture is down. Consumption, both by government and consumers, is down. Economic growth is down.

Before Duterte came to power, economic growth was 7.2% per year. This year, economic growth will be lucky to hit 6%. The betting is that growth this 2019 will only be 5.5% – the lowest and slowest in four years.

What does a one percentage-point reduction in growth mean? It means half a million jobs not being created. It means about P850 billion worth of goods and services not being produced. The Philippine GDP in current peso terms is worth P17 trillion. To get real growth of 6-7%, the GDP value must expand by about 10% per year.

Why slower growth

The noted economist Cielito Habito has a theory for the slower growth. It is not because passage of the 2019 budget was delayed for four months, although that is a factor.

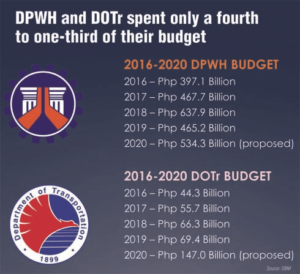

The main reason, it seems, is the apparent incompetence of government departments in charge of infrastructure.

The Department of Public Works and Highways (DPWH) and the Department of Transportation (DOTr) lacked what is called absorptive capacity.

In 2017, the DPWH spent only a third (34.1%) of its budget of P467.7 billion, which means P308 billion was left unspent. The DOTr did even worse. It spent only a fourth (25.6%) of its budget of P55.7 billion, leaving P41.4 billion idle.

In 2018, it was worse. DOTr spent only one-fifth (20.6%) of its P66.3 2018 budget, down further from 34.1%. The DPWH did better though, 39.2%, up from 34.1%. It spent P250 billion out of its 2018 budget of P637.9 billion, leaving about P388 billion unspent.

Now, P1 billion can create about 333 jobs –assuming it takes P3 million to create one job. So in 2017, DPWH’s unspent money of P308 billion would have created 106,666 jobs. DOTr’s unspent money of P41.4 billion in 2017 would have created 13,786 jobs that year. So 106,666 plus 13,786 that’s 120,452 jobs that should have gone to 120,452 jobseekers.

If each worker is also head of the family, that’s 120,452 families denied a breadwinner. You could imagine how those families managed to survive in 2017.

Not worried

DPWH Secretary Mark Villar is not at all worried about the massive underspending. “Those are only for the initial two years or a multi-year programmed budget,” he explains. Indeed, to build a bridge or a highway does not take a year. It takes at least couple of years, or even many years. “By today,” he assures, “our spending pace is 80% of the budget, that’s the highest ratio ever at DPWH.”

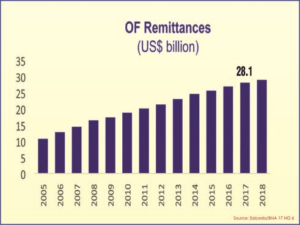

Another factor cited by Habito for slower growth is “is the significant slowdown in wage remittances from overseas Filipino workers (OFWs), known to be a dominant driver of consumer spending.”

“Annual OFW remittance growth was just 3.2% in the first half of this year, less than half the 2011 growth rate of 7.2%, after having averaged double-digit growth in the previous decade, topping 20% at its peak. Anecdotal evidence has been cited on falling deployment of Filipino seafarers, linked to recent observations that Philippine maritime schools are found to have fallen below world quality standards, while other nationalities gain higher shares of the market,” says Habito.

OF impact

OFW remittances amount to $28 billion a year. Times 52, that’s P1.45 trillion a year—8.5% of the economy. There are ten million Filipino expats deployed abroad—10% of our population and one-fourth of our labor force.

A third factor is the slowdown in industry and agriculture. “In the last several quarters, manufacturing has averaged only above 4%,” notes Habito. Before that, since 2010, manufacturing had grown faster than the overall economy, an average of 7-8%.”

But note — 60% of the manufacturing sector is still growing faster than 7%. “The 40% that slowed down, especially electronics which has turned negative for the first time in recent memory, has been casualty to the US-China trade war, which has depressed world trade as a whole. And it’s a war that’s not about to wind down any time soon,” says Habito in his Inquirer column.

In the medium term, the economic outlook remains bright. Outside of India, Vietnam and China, the Philippines, with 6% growth, will be the fastest growing in Asia, better than Indonesia (5.2%), Malaysia (4.8), Thailand (3.5) and Singapore (2.4), in that order, according to data from the National Economic and Development Authority (NEDA).

Trabaho Bill, Citira Bill, Train2

According Finance Secretary Sonny Dominguez, the second package of the Comprehensive Tax Reform Program (CTRP) now known as the proposed Corporate Income Tax and Incentives Reform Act (CITIRA) is good for business, good for the economy, and good for you.

• It will help bring the Philippines closer to its goal of attaining the coveted “A” investment grade credit rating in two years’ time.

• It will make the Philippines more attractive to investors by gradually lowering the corporate income tax (CIT) rate from 30 to 20% over a five-year period, and rationalizing the system of granting fiscal incentives to companies, Dominguez said.

• It will create up to 1.5 million jobs that are better-paying and of high-value, Dominguez said.

“A reduced corporate income tax and a simplified, fair and accountable tax incentives system will benefit tens of thousands of small and medium enterprises (SMEs and attract investments that will create quality jobs, enhance the skills of our workforce and bring in new technologies,” Dominguez said.

P1.12 trillion given away

The Philippines gave away an estimated P1.12 trillion in tax incentives and exemptions to a select group of 3,150 companies from 2015 to 2017, according to the DOF.

Such foregone revenues include income tax incentives, tax incentives on customs duties and tax incentives on import value added tax (VAT).

According to Finance Undersecretary Karl Kendrick Chua, at present, companies with no incentives, which means almost all of the country’s 900,000 SMEs that employ a majority of Filipino workers, pay the regular CIT rate of 30% of their net taxable income–the highest in the region.

In contrast, a select group of some 3,000 companies, including the elite Top 1,000 corporations, enjoy incentives that allow them to pay discounted tax rates of between 6% to 13% of net income only.

My own estimate is that on average, a big Philippine company pays only 1.8% as income tax. Ours is a society of the privileged elite. Did you know that only 100 families have ruled this country for the last 100 years? 100 out of 24 million families. In the past 60 years, our presidents have come from only four families.

Only 3,150 companies

About P441 billion, representing 2.8% of GDP, was given away to only 3,150 corporations in 2017 alone, Chua said.

Plus, another P63 billion was lost to revenue leakages like possible abuse of transfer pricing schemes, he added.

The Philippines’ 30% CIT rate is the highest among countries in the ASEAN region, thereby blunting the country’s competitiveness in attracting foreign direct investments or FDIs, Chua said.

Under the CITIRA bill, the CIT rate will be gradually reduced by 2% yearly starting in 2021 until it goes down to just 20% in 2029.

Fiscal incentives will also be performance-based, time-bound, targeted and made more transparent under CITIRA.

“This means that incentives will be granted based on the number and quality of jobs that will be created, the investments made on research and development (R&D) and skills training, the capital invested for countrywide infrastructure development, among other criteria,” Chua said.

Incentives for approved activities will also be given for a specific period, which are renewable if and when investors meet the approved criteria, he said.

Sunset provision

Chua said a sunset provision will likewise be given to firms currently enjoying incentives. “At the end of the incentives period, they will be allowed to reapply again for new incentives under the new regime if they qualify,” he added.

The bill also calls for an enhanced monitoring system of incentives, including the collection of detailed information on the cost and benefits of incentives so that the public would know if such perks are used properly.

The proposed Fiscal Incentives Review Board (FIRB), to be chaired by the Secretary of Finance, oversee all the investment promotions agencies (IPAs) under CITIRA, approve incentives to special projects, and regularly conduct cost-benefit analyses to determine the impact of corporate tax incentives on the economy.

DOF is proposing a provision stating that if lowering the CIT is determined to contribute to a larger than programmed deficit in the following year, then the President has the power to temporarily suspend the next scheduled reduction of corporate income taxes.

Excise taxes on sin products

The House has approved HB 1026 raising excise taxes on alcohol and imposing a new round of tax hikes on electronic cigarettes such as heated tobacco and vapor (vaping) products. HB 1026 increases the excise tax on alcohol products.

On incentives

DOF officials say that qualified firms will receive superior incentives, including additional tax deductions, when Package 2 of the Comprehensive Tax Reform Program (CTRP) is passed into law.

“The fear-mongering about the removal of incentives should stop. Package 2 will actually give superior incentives for the right reasons, such as the creation of good jobs, investment in research and development, and expansion in the countryside among others,” said Finance Undersecretary Karl Kendrick Chua. “These types of activities will be able to claim additional deductions, which will reduce companies’ tax liabilities.”

“For example, Package 2 allows an additional deduction of up to 50% on direct labor expense. This means that for every job created, companies can deduct up to 150% of direct labor expense, compared to just 100% in the present regime,” Chua said.

This particular incentive would benefit workforce-heavy industries like manufacturing and the IT-BPO sector, and encourage new investors to create jobs.

Superior incentive

Another superior incentive under Package 2 is that companies that invest in upgrading the skills of their Filipino employees may receive an additional deduction of up to 200% of the cost of their workers’ trainings, or double the 100% deduction given now.

Under Package 2 of the CTRP, the government will modernize the fiscal incentive system to establish a single menu of superior incentives that are performance-based, time-bound, targeted, and fully transparent.

The result is superior incentives available to all investors.

Chua said “Incentives are meant to encourage positive behavior, and we want to make sure our incentive system benefits firms whose activities are beneficial to the Philippines like job creation and training.”

Additional deductions that firms can avail of under the DOF-proposed incentive system, include: up to an additional 50% on top of the 100% deduction now allowed on the purchase and use of inputs from domestic suppliers, which will benefit local industries and producers; and up to an additional 100% or double the current 100% deduction on research and development (R&D) costs by R&D firms, which encourages innovation in such firms as semiconductor and tech companies.

Chua said that Package 2 allows companies to depreciate buildings and machinery directly used in qualified projects at an accelerated rate of 10% and 20%, respectively, allowing them to recover the cost of these investments more quickly.

Moreover, under this bill, business losses incurred during a company’s first three years of commercial operation can be deducted from gross income within the next five consecutive taxable years from the year when such losses were incurred, he said.

This enhanced net operating loss carry-over (NOLCO) gives firms more time to recover their initial losses, he added.

“We are also introducing an allowance which encourages firms to reinvest their profits into registered projects, or the reinvestment allowance. This will allow firms to claim up to 50% of profits reinvested into registered projects as a deduction for income tax purposes within five years from the time of reinvestment,” Chua said.

Infrastructure development is also encouraged through a deduction of up to 100% on expenses for public infrastructure, utilities, irrigation, and drainage.

“We see this as being useful to companies located in less-developed or far-flung areas, where their operations will benefit from the infra they build, while they can deduct part or all of this as a tax expense,” Chua said.

Chua said “We are giving superior incentives through a system where both the Filipino people and firms with registered activities benefit.”

DTI Lopez’s reaction

Under House Bill 313 or CITIRA, firms which already enjoy incentives prior to the effectivity of Package 2 would be allowed to continue to avail of such for the remaining period of the income tax holidays (ITH) or for a period of five years only.

For the 5% tax on gross income earned (GIE) paid in lieu of all national and local taxes by firms registered with the Philippine Economic Zone Authority (PEZA), the CITIRA bill provides that the said incentive be allowed to continue for two to five years, depending on how long they have been enjoying it.

DTI Secretary Ramon Lopez says the DTI supports Package 2, but would want a longer transition period of up to 10 years for firms already availing of the incentives. “For me, five to 10 years, that is still the position. We will discuss it with the Senate,” he said.

DTI wants a longer transition period to address concerns on the planned changes in the incentives regime raised by PEZA-registered firms that are already preparing exit plans in case Package 2 takes effect in its current form.

Part of the DTI’s push for a longer transition period is to raise the tax on GIE rate paid by PEZA-registered firms to 8% as the increase is expected to allow the government to generate additional revenues of P30 billion to P40 billion.

FIRB will also be composed of the National Economic and Development Authority director general, DTI and Department of Budget and Management secretaries, as well as the executive secretary as members.

On PEZA’s push to strengthen its role and functions through House Bill (HB) 3747, Lopez said the proposal would face hurdles.

Among the amendments being pushed under HB 3747 is to put PEZA under the Office of the President, give PEZA director general the rank of department secretary, and grant PEZA-registered firms a special preferred tax rate of 7% on GIE, provided the companies would have option to immediately enjoy the 7% on GIE instead of having ITH.

On AO 18

AO 18 seeks to “hasten human capital and infrastructure, as well as to provide needed interventions to strengthen ecozones in the countryside, and ensure the development of backward and forward linkages of industries in and around such ecozones.”

Peza shall “no longer accept, process or evaluate the establishment of ecozones in Metro Manila immediately.” “There is a need to promote rural development, ensure inclusive growth in the countryside, and create robust economic activity and wealth generation in areas outside Metro Manila,” the administrative order read.