Stimulus package costs P1.74 trillion, 9.1% of GDP

Finance Secretary Carlos Dominguez III said on May 19 that building on the economy’s solid fundamentals and making it more resilient against future challenges ensure the country’s recovery by next year (2021) from the global economic slump triggered by the coronavirus disease 2019 (COVID-19) outbreak.

In a Senate hearing, Dominguez disclosed one of the largest stimulus measures in the country’s history—an across-the-board cut in the corporate income tax (CIT) rate from 30% to 25% starting July this year.

“The large and immediate rate cut in the second half of 2020 also sends a strong signal to the world that the Philippines is positioning itself as a premier investment destination for companies that are looking to diversify their supply chains,” the Finance chief said.

The faster and bigger CIT cut will free up almost P42 billion in business capital this year alone—and P625 billion over the succeeding five years, Dominguez estimated.

The recalibrated corporate tax reform or Package 2 of the comprehensive tax reform program (CTRP), he said, is “clearly not an effort to raise taxes as (this) will be decisively revenue-negative.”

Economy better positioned

The Finance secretary told senators solid fundamentals resulting from President Duterte’s prudent fiscal management strategy have made the economy better positioned to overcome the pandemic by way of a four-pillar strategy.

The strategy involves P1.74 trillion ($34.31 billion) or 9.1% of the country’s gross domestic product (GDP)—to help the country bounce back from the global health crisis.

While 2020 will be a challenging year for the economy, Dominguez told the Senate hearing he is optimistic that “the timely implementation of our economic recovery program, together with the efforts of the private sector, will enable our country to get back on its positive growth trajectory.”

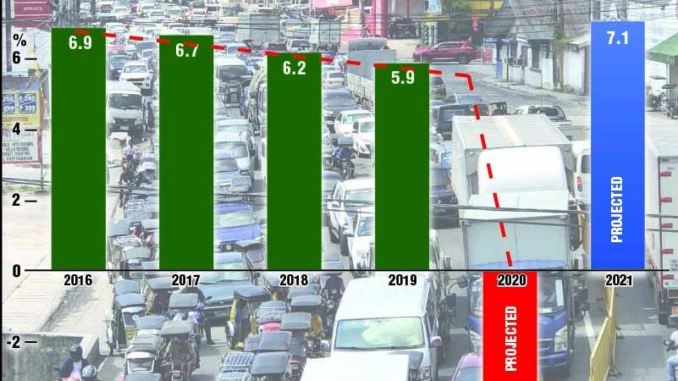

Dominguez heads the government’s economic team. He said projects the country will bounce back in 2021 with a GDP growth rate ranging from 7.1% to 8.1%.

Resilience

“Countries around the world are moving toward jump-starting their economic engines. Whether the Philippines underperforms or outperforms its peers and neighbors will depend largely on our comparative resilience, and of whether we build on or demolish our solid fundamentals,” said Dominguez in his report to the Senate on the government’s socioeconomic efforts thus far to defeat the COVID-19 contagion.

The Senate met May 19 as a Committee of the Whole Tuesday afternoon to discuss the status of the government’s measures to suppress COVID-19 and restart the economy.

“In partnership with the Congress, the Duterte administration will protect our economic gains, support our recovery, strengthen our resilience, and solidify our return to the path of inclusive and shared prosperity,” Dominguez said.

Pass tax reform and resiliency measures

The Finance chief stressed the Senate’s role in preparing the economy for the COVID-19 crisis. Such role is the passage of tax reform and other economic resiliency measures, and cited the part it will play in coming up with one of

Rather, he said, it is meant to fuel economic dynamism, especially among the country’s growth engines—the micro, small and medium enterprises (MSMEs)—that employ a majority of Filipino workers, Dominguez said.

In his report, Dominguez also thanked the Congress for acting swiftly against the coronavirus crisis by passing the Bayanihan to Heal as One Act, which grants expanded budgetary powers to the President to effectively carry out the government’s COVID-19 response measures.

Four-pillar strategy

“This has enabled the government to pursue a four-pillar strategy to shield the Filipino people against the adverse impact of the pandemic and craft a recovery program to gradually jumpstart the economic activities. The strategy has a combined value of P1.74 trillion or 9.1% of GDP,” Dominguez said.

This four-pillar anti-COVID strategy covers the following: (1) providing poor and low-income households, small-business employees and other vulnerable groups emergency and wage subsidies; (2) marshalling the country’s medical resources and ensuring the safety of healthcare front-liners; (3) fiscal and monetary actions to finance emergency initiatives and keep the economy afloat, and (4) an economic recovery plan to create jobs and sustain growth under a post-quarantine scenario, which will be funded largely by pillar No. 3.

Five priority actions

In the meantime, Dominguez said he has recommended to the President five priority actions to revive the economy while, at the same time, protecting the health and well-being of our citizens:

(1) Reviving and accelerating the “Build, Build, Build” infrastructure modernization program, subject to compliance with minimum health standards;

(2) Hiring contact tracers to boost our efforts to treat infected persons and slow down viral transmission;

(3) Attracting foreign investors in search of resilient, high-growth economies like ours by passing a redesigned Corporate Income Tax and Incentives Rationalization Act (CITIRA) to include flexible tax and non-tax incentives to better target the kind of investors our economy needs.

(4) Promoting the manufacturing of products that have strong, inelastic demand, such as food production and logistics, to stimulate demand; and

(5) Supporting their whole value chains, from inputs to packaging and logistics.

In underscoring the President’s prudent fiscal management approach, Dominguez cited the following: revenues that accounted for 16.1% of GDP in 2019, the highest rate in the country’s history in 22 years; last year’s shrinking of the debt-to-GDP ratio to 39.6%, which was the lowest since 1986; and a credit rating upgrade to “BBB+,” the highest the Philippines has ever received and only one notch below the coveted “A” rating.

Rice tariffication

Dominguez also pointed to the rice tariffication law that has continued to keep inflation low at 2.6%, year-to-date; the country’s strong gross international reserves (GIR) of US$89 billion as of March; and last year’s lowest recorded rates of 5.3% unemployment and 14.8% underemployment: and the poverty level down to 16.6%, as among the results of the President’s prudent fiscal management policies.

Even amid the negative impact of COVID-19, he said The Economist magazine, in its April 30 issue, ranked the Philippines as No. 6 out of 66 selected emerging economies in terms of fiscal strength.

Dominguez said “this ‘saving-for-a-rainy-day’ approach to economic management has gained for us the trust and confidence of the world’s most respected credit rating agencies and development partners,” such as the Asian Development Bank (ADB), World Bank and Asian Infrastructure Investment Bank (AIIB)—“allowing us to borrow money at lower interest rates and longer repayment periods.”

He said the strong demand for the government’s latest global bond issue also “demonstrates the resiliency of global investor interest in the Philippine economy despite an environment gripped with pandemic fear.”

GDP growth rate to decline to 3.4%

Dominguez made it clear that the pandemic would weigh down heavily on the economy this year as shown by its contraction by 0.2% in the first quarter alone, and the Development Budget Coordination Committee (DBCC)’s projection of a full-year -2.0 to -3.4% GDP growth.

Revenues would also fall to P2.61 trillion or 13.6% of GDP, while disbursements will rise to P4.18 trillion or 21.7% of GDP. This is 10% higher than the actual disbursements in 2019 and slightly above the program the DBCC approved in March by P12 billion, Dominguez said.

This disbursement program takes into account the releases for the COVID-19 initiatives charged to savings coming from austerity measures, among others, he said.

Budget deficit P1.56 trillion, 8.1% of GDP

With the revised revenue and disbursement program, Dominguez said the budget deficit is projected to reach P1.56 trillion or 8.1% of GDP this year.

“For as long as our deficit-to-GDP ratio will not exceed 9%, our ratio will remain in the median of comparable countries in ASEAN (Association of Southeast Asian Nations) and in East Asia; among peers with similar credit ratings; and among other emerging market economies. Below this threshold, the debt-to-GDP ratio will be around 50%, which is far lower compared to our historical performance,” Dominguez said.

“While the Philippines is better positioned to overcome the pandemic than at any other time in recent history, we still have to realize that our funds are not endless so we need to spend our resources responsibly and cost-effectively,” he added.