In RSA’s strategic visioning, San Miguel’s business is not beer, not beverages, not food, not flour, not feeds, not packaging, not gasoline and diesel, not energy, not tollways—but growth and development.

With three airports—Bulacan, NAIA, and Caticlan—SMC is the largest airport operator in the Philippines.

Sept. 15, 2024 will be a watershed date for millions of Filipino travelers, for Philippine tourism, and indeed for the country’s economy in general.

On that day, a Sunday, the Philippines’ largest conglomerate in revenues—San Miguel Corporation— takes over total management of the Ninoy Aquino International Airport (NAIA) over the next 15 years, and possibly over the next quarter century, until 2048. NAIA has four terminals—1,2,3, and 4, with Terminal 4 serving purely domestic, short haul flights.

On Feb. 16, 2024, the Department of Transportation awarded to SMC the franchise to manage NAIA for 15 years, renewable to 25 years, with renewal to be decided by the 8th year of the contract.

SMC outbid two big bidders

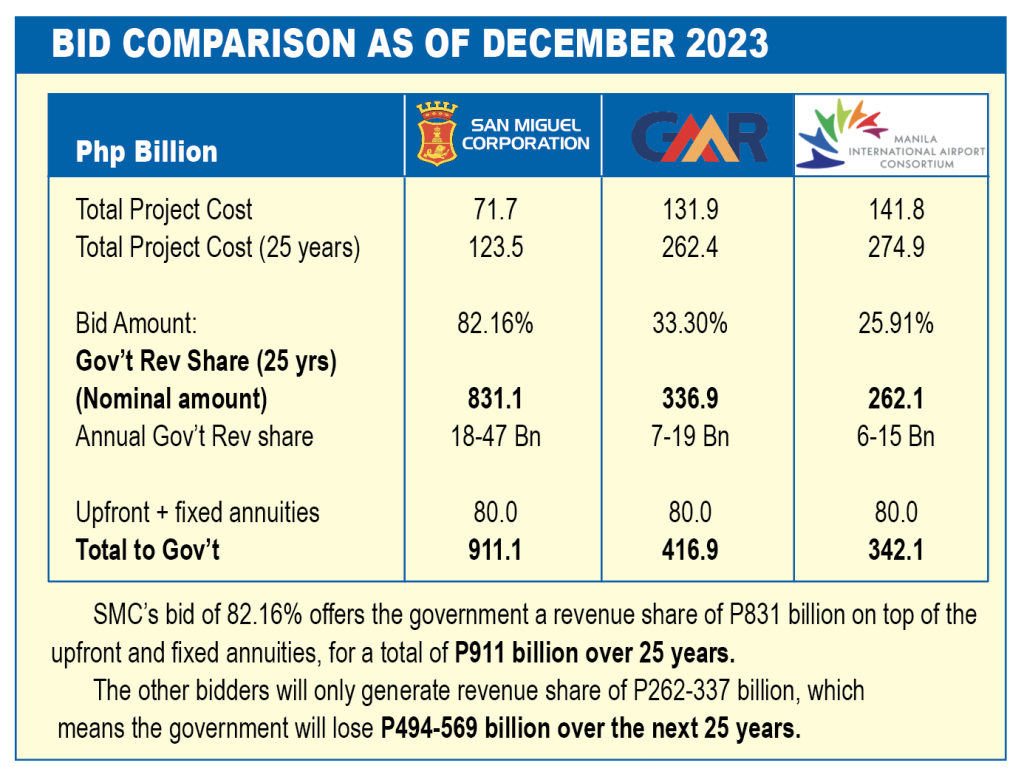

SMC outbid two other prominent bidders by offering the government a whopping 82.16% of all airport revenues, except passenger terminal fees (where sharing will be 70% for government and 30% for SMC).

The second placer, GMR, offered 33.30%, while third placer, the Manila International Airport Consortium (MIAC), offered much less, 25.91%.

In peso terms over the next 25 years, the 82.16% SMC government share bid translates into a whopping P831.1 billion; GMR’s 33.30% into P336.9 billion, and MIAC’s 25.91% into P262.1 billion. SMC’s revenue offer to the government of P831.11 billion is P494.2 billion more than GMR’s P336.9, and a colossal P569 billion more than MIAC’s P262.1 billion.

Korean partner

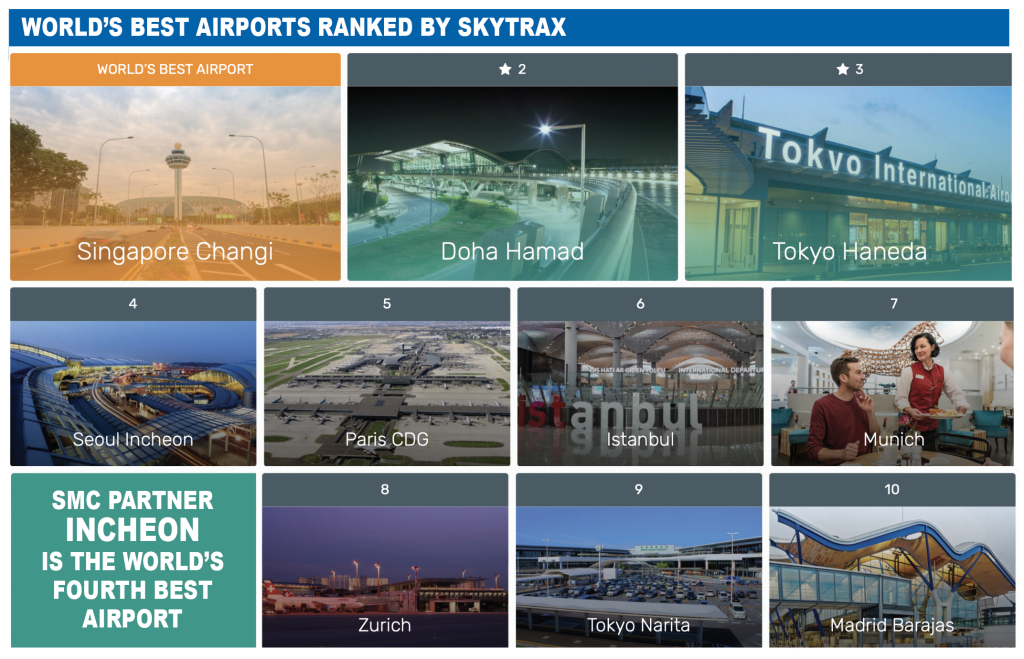

SMC has partnered with Incheon International Airport Corp. of South Korea to manage NAIA, beginning this September. Incheon is the world’s fourth best airport, after Singapore’s Changi, Qatar’s Doha Hamad, and Japan’s Tokyo Haneda.

The GMR Group is led by Helen Yuchengco Dee of RCBC-House of Investments. GMR built the Mactan Cebu International Airport.

The MIA Consortium is composed of taipans and tycoons in six conglomerates: Aboitiz InfraCapital Inc., AC Infrastructure Holdings Corp. (Ayala), Asia’s Emerging Dragon Corp. (Lucio Tan), Alliance Global-Infracorp Development Inc. (Andrew Tan), Filinvest Development Corp. (Mercedes Gotianun), and JG Summit Infrastructure Holdings Corp. (Gokongwei), and infrastructure investor US-based Global Infrastructure Partners (GIP). Airports currently and previously owned or operated by consortium members include Mactan-Cebu, Clark, London Gatwick, Edinburgh, London City and Sydney.

P80 billion in upfront fees

In addition to the revenue shares, each of the bidders was required to pay the government upfront and annuities a total P80 billion.

Hence, SMC’s offer totals P911.1 billion, GMR’s P416.9 billion, and MIAC’s P342.1 billion.

In 25 years, if government had accepted the MIAC offer of P342.1 billion as its share of revenues, it would have lost P569 billion, compared to SMC’s P911.1 billion (P911.1 billion less P342.1 billion).

If the government allowed the GMR offer, it would have lost P494.2 billion (P911.1 billion less P416.9 billion). Put another way, the two losing bidders each would have amassed easily P500 billion in additional revenues had the SMC bid been denied.

Why the generous SMC bid?

SMC President and CEO Ramon S. Ang made the government an offer it could not refuse. Why such a stupendously generous gift?

In RSA’s strategic visioning, San Miguel’s business is not beer, not beverages, not food, not flour, not feeds, not packaging, not gasoline and diesel, not energy, not tollways– but growth and development.

SMC must prudently diversify into businesses that underpin the growth and development of the Philippine economy.

In so doing, SMC makes life better for most Filipinos. In the process, the company commands the loyalty of its clients and consumers, today and in the long pull. San Miguel after all, is the largest consumer products company in Southeast Asia, aside from being the Philippines’ largest industrial company.

P1.5 trillion in annual revenues

SMC makes annual revenues of P1.5 trillion, 5.9% of Philippine GDP of P25.27 trillion. No other company contributes as much to annual economic production and services.

Meanwhile, aviation (mainly NAIA) according to the International Air Transport Association, contributes 3.4% of Philippine GDP.

Per IATA, Philippine aviation currently employs 1.2 million people— in 45,000 jobs directly, 127,000 in supply chain, 37,000 in employee spending, and 954,000 in tourism. In revenues, aviation contributes $10.4 billion in gross value added– $1.4 billion directly, $900 in the supply chain, $300 million in employee spending, and $7.7 billion in spending by foreign tourists.

7.7 million arrivals in 2024

This 2024, the Department of Tourism projects international visitor arrivals of 7.7 million, from a paltry 5.45 million in 2023.

With a more efficient airport and less airport congestion, the Philippines should easily attract ten million arrivals this year, on top of 40 million in domestic tourists; 90% of them go thru NAIA.

SMC is given four to five years to bring up NAIA passenger volume to 62 million per year from the present 50 million.

With NAIA under its management, SMC’s total contribution to annual economic production should hit 9.3% of GDP (5.9% plus 3.4%), an awesome share by any measure. Beginning 2025, P9 of every P100 of national economic output will be contributed by just one company, SMC.

Diversification strategy

RSA uncorked his strategy when he announced the largest and most massive diversification ever by any Philippine conglomerate in 2007.

Today, more than 60% of SMC revenues come from its diversification.

Per the experience of airport economies like Singapore, Qatar and Dubai, world-class airports are the best way to pump-prime an economy.

Philippines a rich country

Coincidentally, by 2049, if not earlier, per forecasts of major global think tanks, the Philippines will be one of the world’s 12 richest countries in terms of the dollar value of its economic production or GDP.

Today, the Philippine GDP, in purchasing power parity (PPP) terms, or what the dollar can buy in local goods, is worth $1.2 trillion.

The Philippines currently is the 34th largest economy on earth.

In 2022, Goldman Sachs ranked the Philippines the 14th largest economy by 2075, with real GDP of $6.6 trillion, bigger than France’s $6.5 trillion, based on 2021 dollars.

The only ASEAN country larger than the Philippines will be Indonesia, with GDP of $13.7 trillion, fourth largest, by 2075.

The Philippines overtakes all its ASEAN neighbors, except Indonesia, in economic growth.

Goldman Sachs made these projections in 2021, before the government awarded the NAIA rehab and management to SMC this year.

RSA a unique tycoon

No one in the current crop of CEOs, taipans and tycoons can probably match RSA for his visioning, skills at execution, and the speed as a first mover into many businesses that SMC is into today or is moving into. And his love for people and the environment.

From 2002, RSA was SMC president and COO. Since 2021, he has been the president and CEO. The mechanical engineer re-engineered San Miguel in a profound manner no one had ever imagined.

Until a quarter century ago, the venerable San Miguel was a cut-and-dry business producing great beer, ancient spirits, fancy carton and plastic boxes, as well as tasty chicken and flour on the side.

In its first 100 years, San Miguel’s business was good. Revenues were okay and so were the profits, considering the happy times.

SMC dominant in ten businesses

Today, the new San Miguel, at 134 years old and under RSA, is dominant in ten major businesses:

1) Fuel and oil: Petron Corp. is the largest and only integrated oil refinery and a leading oil marketing company in the country. It is also a strong player in the Malaysian market. With a total refining capacity of 268,000 barrels daily, Petron produces a wide range of refined petroleum products, including petrochemicals. It has 40 terminals in the region and more than 2,000 retail stations.

2) Beer and beverages: Over 90% of the market for beer; foods; which holds market-leading positions and most recognizable brands in many key food product categories in the country;

3) Power generation: SMC Global Power has 19% of power generation nationwide, 26% of the Luzon grid, and 7% of the Mindanao grid, with the island of Luzon representing 73% of the nationwide demand;

4) Infra and tollways: Representing almost 55% of the tollways length in the country;

5) Packaging: Offering a total packaging solution;

6) Airports. It manages the Boracay airport and is building the New Manila International Airport in Bulakan town, Bulacan province. Add NAIA.

Costing P740 billion with six runways, NMIA is the single largest investment by any entity in the Philippines. Add NAIA to the portfolio.

7) Water. SMC promises to deliver to households the cheapest, cleanest potable water there is. For a start, the company will provide cheap water 24/7 to 24 water districts of Bulacan. It wants to produce water up to 3,800 million liters a day (MLD) at a cost of around P8 billion. It is now providing potable water to 12 districts.

Bugsuk tourism resort

8) A 7-star integrated tourism resort. SMC’s 12,500-hectare Bugsuk property at the southern tip of the Palawan archipelago will be the biggest and most modern, with an initially straight 8 kms of 100-meter-wide white beach that rivals Boracay in the purity and fineness of its white sand.

9) Automobile distributorship. SMC sells the best-selling premium car, BMW, in the local market.

10) Cement. SMC is estimated to have 30% of the cement production.

SMC has fortified its claim as the biggest company in diversity, size of businesses and revenues with annual sales of P1.5 trillion, about 5% of GDP.

RSA himself spends billions on philanthropy and hardly anybody hears about it.

“We have the best minds, the most capable business leaders in the Philippines. Just imagine the collective experience and resources… Together, we can all do so much,” RSA says of what Filipino businessmen can do for the country.