By TONY LOPEZ

On March 21, 2025, the family of the late Henry Sy Sr. and executives of his holding company, SM Investments Corp. (SMIC) marked the 20th year of its public ownership, at the Philippine Stock Exchange.

At the IPO listing anniversary were: Tatang’s eldest, Tessie Sy, vice chair of SM Investments, Amando Tetangco, chair, SM Investments; Frederic DyBuncio, president-CEO, and Jose Sio, Tatang’s most trusted adviser and former SM Investments vice chair.

The SM Investments share price closed at P800 on March 21; it dropped slightly, to P786 April 2, valuing SM Investments at P968 billion, down 21% from its October 2024 peak of P1.237 trillion.

The Sy family owns at least 63% of SM Investments, giving them P608.5 billion or $10.64 billion wealth. SM Investments is on a $1-billion share buy-back spree.

Growth story

SM Investments is the Philippines’ greatest growth story. It is the most valuable company.

With its March 21, 2025 P800 share price, SMIC shares grew 549 % (more than six-fold) in 20 years, a dizzying 27.45% yearly price appreciation. In 20 years, SM’s assets grew by 900% (ten-fold), a 12% annual growth.

CEO Frederic C. DyBuncio credits the group’s growth to SM’s unwavering commitment to the Filipino people and the vision of its founder, Henry Sy, Sr. “Over the past two decades, we’ve consistently created value, delivering steady returns to investors while expanding opportunities for people and communities. This legacy of growth and value creation continues to drive us forward.”

“The next 20 years will see SM continue to lead in retail, property, and banking, while expanding into new regions where growth is accelerating, especially in provincial areas.” the former banker said.

87 malls, 4,470 stores

In 2024, SM added 619 more retail stores, two malls and 73 bank branches, over 85% in the provinces, bringing SM’s footprint to 87 malls, 4,470 retail stores and 2,441 bank branches.

Hardship, hard work, ambition, timing, and luck. These are five ingredients of success I learned from Tatang Henry Sy, a good friend. He always granted me interviews and often offered me merienda in his Forbes Park home to listen to the latest Marites.

He first came to Manila by boat as a boy of 12 in 1936, with only ten centavos — in search of his father, an education, a better life, and a fortune. He spoke no English and no Tagalog. His mother, Tan O Sia, told Henry on the dayhe left, “Don’t look back.”

Henry grew the ten centavos, a pittance, into a fortune worth at least $20 billion if valued properly.

The boy-child cried when he first saw his father in Manila. “There has to be a better life than this,” Henry told me in an interview. His father’s store in Calle Echague was no bigger than two square meters.

The shop was multi-functional—store by day, bed by night, with the same table where goods were displayed serving as bed by nightfall. Every morning his father bought goods in Divisoria and carried them barefoot to Echague, a backbreaking, unrelenting routine. From his father, Henry learned one thing – discipline, hard work, and good credit.

Henry attended grade 1 at Anglo-Chinese School in Manila but he was in such a hurry he asked his teacher how he could speed up schooling. The reply: Have a grade of 90. He did, finishing grade school in five years, at the top of his class—remarkable, given that he had no textbooks and could only afford second-hand handouts.

By 1941, when the Japanese bombed Pearl Harbor, the Sys already had two stores, which happily were not devoured by war-induced looting. Under Japanese rule, Henry, by then a man at 17, got a bike and busied himself doing the buying and selling for the two stores. “In good times, I do my usual work. In bad times, I work harder.”

After the Battle of Manila, one of his two stores was razed, the other looted. The city was in ruins. His father left Manila back to China.

Postwar in Manila, Henry had saved a few hundred pesos. He found a new business hub – Plaza Miranda. He began buying cigarettes by the cartons from American GIs and selling them by the pack, making a peso per pack. He also sold scrap metal and other odds and ends.

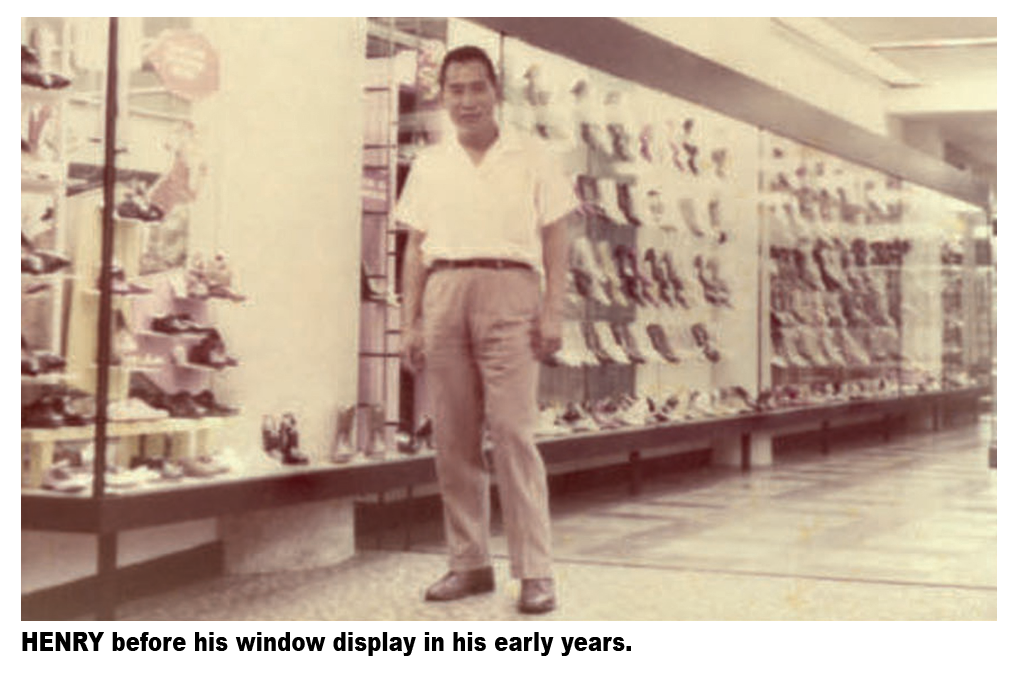

Later, with rented space from Don Vicente Rufino on Calle Carriedo, Henry built his first store, selling anything he could. It was also his house by night. US shoe importers offered to sell him shoes by the job lot. With a partner, Lao Kang, he opened Plaza Shoe Store and a second, bigger store, Park Avenue Store.

Fixed pricing

One day, a GI walked into one of his stores and bought a pair of shoes without haggling. Henry felt guilty for overcharging his customer. From then on, he adopted fixed pricing.

With two stores, he quit night school, finishing only a two-year course in Commercial Science at FEU. Wearied from grueling work the whole day, he was sleepy in class.

In 1949, China Bank gave him his first bank loan, P1 million. Today, he owns that bank, in addition to BDO.

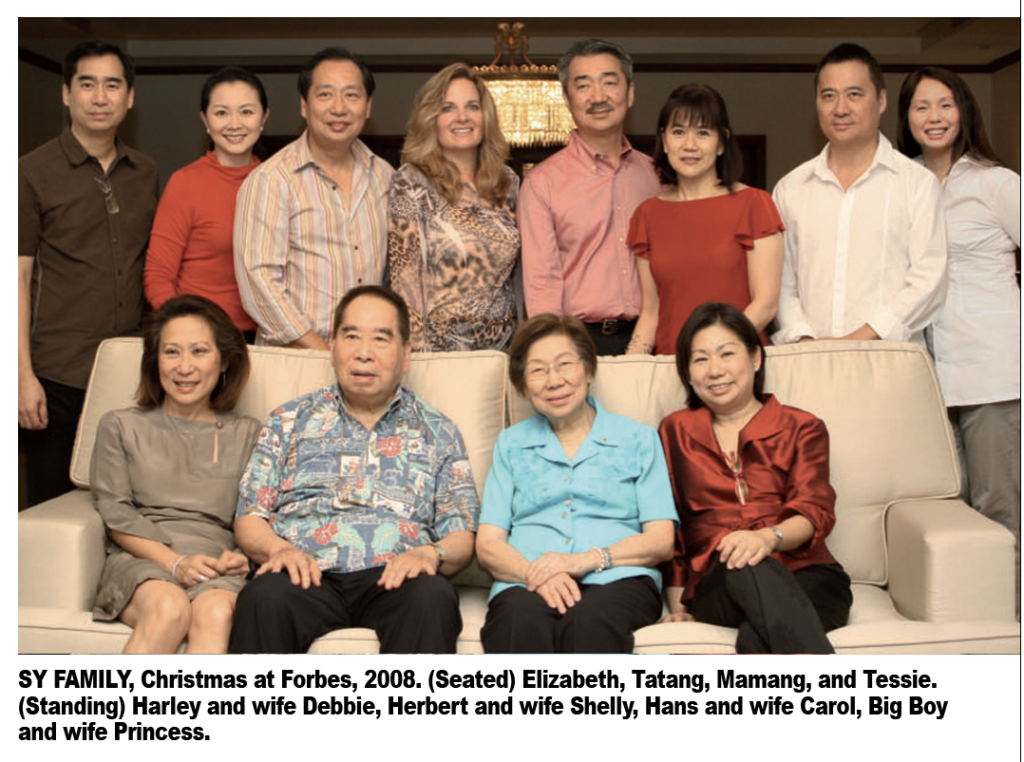

By 1959, Henry, after nine years of marriage to Felicidad, a teenage crush, had six children – Teresita (born 1950), Elizabeth (1952), Henry Jr. (1953), Hans (1955), Herbert (1956), and Harley (1959). They are the new management team today, plus a corps of professionals led mostly by topnotch bankers. Banking, after all, is SMIC’s biggest business.

Henry travelled to learn about retailing. The US had become the mecca of shopping centers, with the rise of Macy’s (1858), Sears (1893), and JC Penney (1903) following the post-war economic boom. In Europe, he observed the latest trends in fashion and retailing.

Like himself, Henry all his children were educated in Manila. The third generation is foreign educated. Theirs is the next growth story.