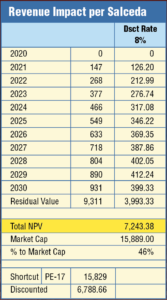

Seven trillion, two hundred billion pesos (P7.2 trillion).

That is the projected savings, in net present value or the value at present prices of the future stream of income (or savings) businesses are likely to generate because of the CREATE Act.

The bicameral conference of the Ways and Means Committees of the House of Representatives and the Senate on Wednesday, Feb. 3, ratified the bill establishing CREATE scheme. President Rodrigo Roa Duterte is expected to sign the bill into law, in time for the deadline for payment of taxes on income of both corporations and individual taxpayers.

Albay Second District Rep. Joey Sarte Salceda chairs the House Ways and Means Committee. He is the principal author of the CREATE bill. Taguig Senator Pia Cayetano chairs the Senate Ways and Means Committee. In that capacity, she sponsored the CREATE Bill in the upper chamber.

National Internal Revenue

Code amended

CREATE is short for Corporate Recovery and Tax Incentives for Enterprises Act. It amends 13 major sections of the National Internal Revenue Code of 1997 and creates a new title called XIII (Tax Incentives).

The P7.2 trillion is an estimate made by Congressman Salceda, an economist, prominent analyst, and management expert, aside from being a veteran public servant—15 years as congressman, nine years as Albay governor and one year as cabinet member. He has been an economic adviser to Philippine presidents.

To arrive at the figure, he assumed a cash flow and discounted it by an assumed cost of money or normal profit yield of 8%, a conservative assumption, he points out.

The P7.2 trillion, is 46% of the P15 trillion total market capitalization of the Philippine Stock Exchange and is equivalent to 40% of the country’s Gross Domestic Product (GDP), or the total output of goods and services in a given year. (See chart, “Revenue Impact”, page 4).

Salceda has singlehandedly shepherded the measure thru the congressional labyrinth and thru the Senate many of whose 24 members have their eyes moist on the presidency.

“CREATE Act is perhaps the largest stimulus program and biggest tax reform measure ever crafted by Congress,” exults Salceda. It is the greatest economic reform program ever undertaken by the government, outside of the 1987 Constitution.

P12 trillion in investments

Salceda uses an even bigger figure to project CREATE’s economic impact. “Removing the uncertainty will be like opening the floodgates to investment. I expect at least P12 trillion in combined domestic and foreign investment over the next decade due to CREATE alone. About $90 billion of that will be FDI (foreign direct investments),” he reckons.

“This will also result in around 1.8 million jobs over the next 10 years. Combined with economic amendments to the constitution to maximize impact, we can produce some 8.4 million jobs,” Salceda adds.

Investor uncertainty over

Salceda says CREATE ends investor uncertainty on the country’s fiscal regime and tax policies.

“We are also ending hesitation to invest in the Philippines. Because it took us time to come up with a consensus version, however, we lost $18 billion in foregone FDI from 2018 to 2020. The bleeding stops now,” Salceda notes.

“Fixing the incentives regime to make it more performance-based is also crucial. The current investment priorities plan covers some 70% of GDP. While I am willing to give incentives, they must be linked with economic outcomes. Better jobs for our people. Higher wages. More training. More research and development. Stronger business. More competitiveness,” Salceda told the House Ways and Means Committee last week.

Frontloading relief

Salceda points out that while CREATE will result in some P931 billion in tax savings for businesses, this is to frontload relief and cover the economic gap brought about by COVID-19. He says the final bicameral version was able to shave off P282 billion from the original revenue loss under the Senate version.

“We are frontloading relief now because relief is needed now,” Salceda says. He says that competitiveness is a key issue that CREATE hopes to resolve.

“With CREATE, we are also lowering corporate income tax to bring it closer to the ASEAN region’s average. ASEAN has been the fastest growing economic region in the world. Our neighbors are our friends, but they are also our competitors. We must strive to keep up with them,” Salceda urges.

Tax relief

“We also introduced several tax relief provisions in this bill for all sizes of businesses, especially small and medium ones. With quick vaccine rollout, the chance is stronger that businesses will devote tax savings to creating new jobs. That is why we have also introduced COVID-19 measures in this bill, including VAT and duty-free importation of vaccines,” Salceda declares.

Plainly speaking, CREATE Act is expected to spur feverish manufacturing, industrial and economic activity to enable the country to recover from the worst health and economic crisis in 100 years, regain its once robust growth, and march in proud cadence with the vigorous expansion of its Asian neighbors such as China, Vietnam, Malaysia, Thailand and the rest of the ASEAN.

CREATE is a major economic platform of the administration of President Rodrigo Duterte, the fourth plank of four key reform measures designed to enable the country to cope with the COVID-19 pandemic.

The three earlier laws are the Bayanihan 1 and Bayanihan 2 and TRAIN—Tax Reform for Acceleration and Inclusion Act (RA 10963). These three laws proved inadequate to stimulate a dormant economy, largely because of leakages in the cash transfers to beneficiaries, corruption in the bureaucracy, and slow disbursements for urgent projects.

Cash to users

CREATE is supposed to deliver or create cash for its users. Instead of tax money being paid to government, the tax money will be reduced or withheld or eliminated outright so the private sector can use it for employment and productive purposes.

If the Bureau of Internal Revenue collects that tax money, there ensues the issue of “friction cost” or corruption which can easily diminish government revenues by 30%.

CREATE “makes capital income taxes and financial intermediary taxes simpler, fairer, and more efficient,” says Salceda. It makes Philippine taxation at par with those of its ASEAN neighbors.

(See tabulation, by Congressman Salceda on pages 16-25).

Strong rebound

The reform measures, says Finance Secretary Carlos Dominguez, the leader of Duterte’s economic team, are expected to push the Philippines into a “strong rebound”, with an economic growth rate of 6 to 7% in 2021, from 2020’s dismal 9.5% decline – the worst in the country’s history.

The recession was triggered by the government’s exaggerated response to the pandemic. Duterte imposed the world’s longest and strictest lockdown. This marooned consumers in their homes and crippled business and industry. Since consumption is 83% of the economy, the economic slump has turned into a prolonged recession.

CREATE is supposed to put cash in consumers’ hands and capital in the vaults of corporations to trigger an economic dynamism and revival not seen in the last 50 years of the republic.

Senate action

Except for some controversial provisions –the grant of incentives to industries and businesses where some of the senators have a stake and simply favored—the Senate basically adopted the Salceda version of the original CREATE bill.

Sen. Pia Cayetano addressed the Senate “giddy with excitement” on the major features of the new law:

– Importation of COVID-19 vaccines are exempt from import duties. Note that the Senate version already included exemption of the vaccines from VAT.

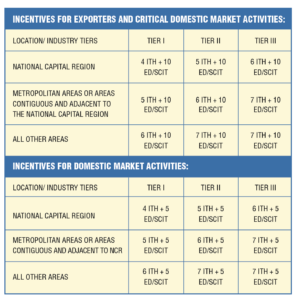

– Enterprises have the option to choose between the Special Corporate Income Tax of 5% or Enhanced Deductions after enjoying the Income Tax Holiday (ITH)

– Higher incentives for enterprises located outside of metropolitan areas

– Additional incentives for enterprises that fully relocate outside of NCR

– Additional incentives for those who will locate in areas that are recovering from disasters or armed conflict.

“Instead of just a 1% drop in corporate income tax, we are giving an immediate 5% drop, reduction of our corporate income tax rate, it will now stand at 25%. And for MSMEs, it will be 20% depending on certain conditions,” explained Cayetano.

Senate insertions

Senator Cayetano said the key provisions in the Senate version retained in the bicam on Feb. 3, 2021 are:

– Immediate reduction of the corporate income tax to 20% for domestic corporations with total assets not exceeding P100 million (excluding land) and total net taxable income not exceeding P5 million 25% for all other corporations;

– 1% minimum corporate income tax (MCIT) effective July 1, 2020 until June 30, 2023;

– 1% tax rate for proprietary educational institutions and hospitals which are non-profit effective July 1, 2020 until June 30, 2023;

– VAT exemption threshold for socialized and low-cost housing to P2.5 million (from P1.5 million at present) and P4.2 million for house and lot (from P2.5 million at present);

– VAT exemption for medicines for cancer, mental illness, tuberculosis, and kidney diseases beginning Jan. 1, 2021;

– VAT free importation and sale of COVID-19 medicines, PPEs beginning Jan. 1, 2021 to Dec. 31, 2023.

The senators insisted on creating three tiers of businesses or industries

Cayetano said CREATE “will serve as our roadmap to a more sustainable future, as well as our fulfillment of the overdue reforms in the country’s tax and fiscal incentives system.”

Cayetano said the CREATE bill “seeks to provide a lifeline for struggling businesses affected by the ongoing pandemic, through the immediate and substantial reduction in our corporate income tax rate. This will be a game changer for all businesses – both big and small – who need as much support as they can get during this time of global health and economic crisis. Businesses will have more cash at their disposal, which they can use for inventory, for capital equipment, for employee benefits, and more.”

Performance-based, time-bound incentives

She said CREATE seeks “to make our fiscal incentives system more performance-based and time-bound. Our new incentives package aims to attract businesses that will create more jobs for our people and bring in technologies and innovations. It likewise promotes inclusive growth by offering higher incentives for those that will choose to invest in the countryside, as well as in areas recovering from disasters or conflict.”

“CREATE would be a fulfillment of previous attempts by past administrations to rationalize and instill accountability into our tax and fiscal incentives system. This will ensure that the benefits of the incentives we grant to various businesses will ricochet back to the Filipino public,” Cayetano enthused.

Salceda’s record

Salceda has been in public office for nearly a quarter century. He was first elected Albay congressman in 1998 and served for nine years until 2007.

He was elected Albay governor in 2007, an independent, and served for nine years until 2016 when he again ran for congressman. He was reelected in 2019 to serve the current 18th Congress.

A green economist and a disaster resilience specialist, the brain behind the Philippines’ laws on disaster risk reduction and climate change adaptation.

In Congress, he was chairman of the Committees on Appropriation, Economic Affairs, Oversight and Trade and Industry.

He also served as an economic adviser to the Philippine presidents.

Salceda Asia’s best analyst

Before his public stints, Salceda became Asia’s best stock market and best paid analyst, earning a tidy fortune that helped bankroll his foray into politics.

He is cum laude management engineering graduate from Ateneo 1982, and has an MBA from the Asian Institute of Management, graduating with distinction.

As governor, he made Albay a first class province and the No. 1 or Best in Governance among the country’s 80 provinces.

He made Albay disaster-resilient, eliminated its tuberculosis, and fashioned Albay as a major tourism destination.

He improved the province’s human capital tremendously producing a college student in nearly every household—188,000 out of 230,000.

Tax incentives

Under the new title Tax Incentives of the Internal Revenue Code:

– No gain or loss shall be recognized on a corporation or on its stock or securities if such corporation is a party to a reorganization and exchanges property [if] in pursuance of a plan of [merger or consolidation] reorganization solely for stock or securities in another corporation that is a party to the reorganization.

– Sale or exchanges of property used for business for shares of stocks covered under this subsection (on reorganization) shall not be subject to value-added tax (VAT).

Tax policies

CREATE declares as state policy “to develop the national economy towards global competitiveness by implementing tax policies instrumental in attracting investments, which will result in productivity enhancement, employment generation, countrywide development, and a more inclusive economic growth, while at the same time maintaining fiscal prudence and stability.”

To achieve these objectives, the state shall:

(a) Improve the equity and efficiency of the corporate tax system by lowering the rate, widening the tax base, and reducing tax distortions and leakages;

(b) Develop, subject to the provisions of this (CREATE) act, a more responsive and globally-competitive tax incentives regime that is performance-based, targeted, time-bound, and transparent;

(c) Provide support to businesses in their recovery from unforeseen events such as an outbreak of communicable diseases or a global pandemic and strengthen the nation’s capability for similar circumstances in the future; and

(d) Create a more equitable tax incentive system that will allow for inclusive growth and generation of jobs and opportunities in all the regions of the country and ensure access and ease in the grant of these incentives especially for applicants in least developed areas.

READ FULL ARTICLE HERE: