The Philippine economy has performed well despite a challenging economic and financial environment in 2023 beset by ongoing geopolitical tensions, imposition of trade restrictions, and extreme weather events resulting in high domestic commodity prices, especially for rice and fuel.

At the same time, we are forging for an even better outlook for 2024.

This is enabled by the reconstitution of the Economic Development Group (EDG) and the creation of the Inter-Agency Committee on Inflation and Market Outlook (IAC-IMO), along with the implementation of coherent macroeconomic policies, particularly with the establishment of the Medium-Term Fiscal Framework (MTFF), and the ongoing implementation of game-changing structural reforms.

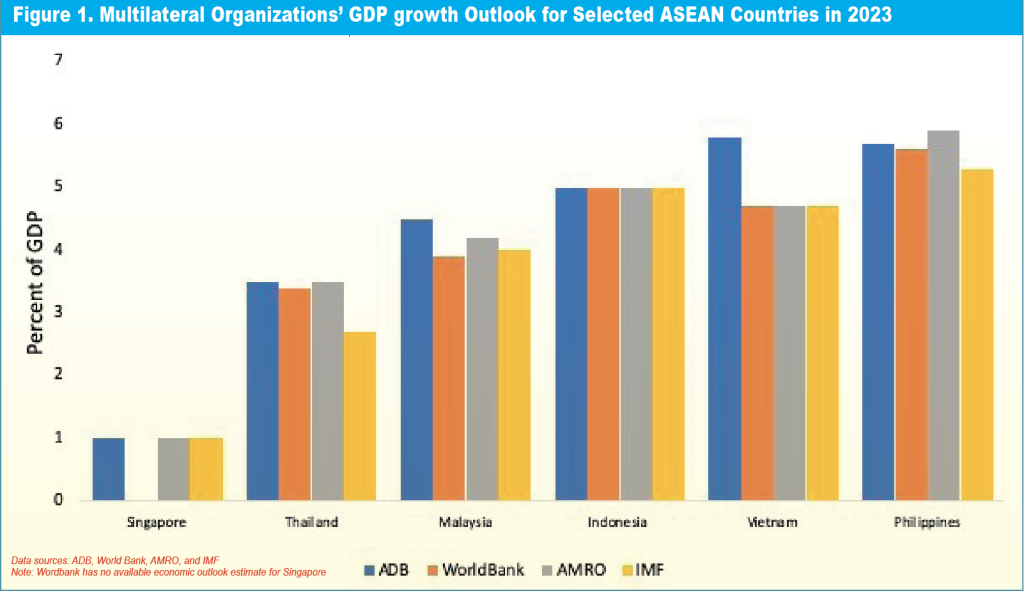

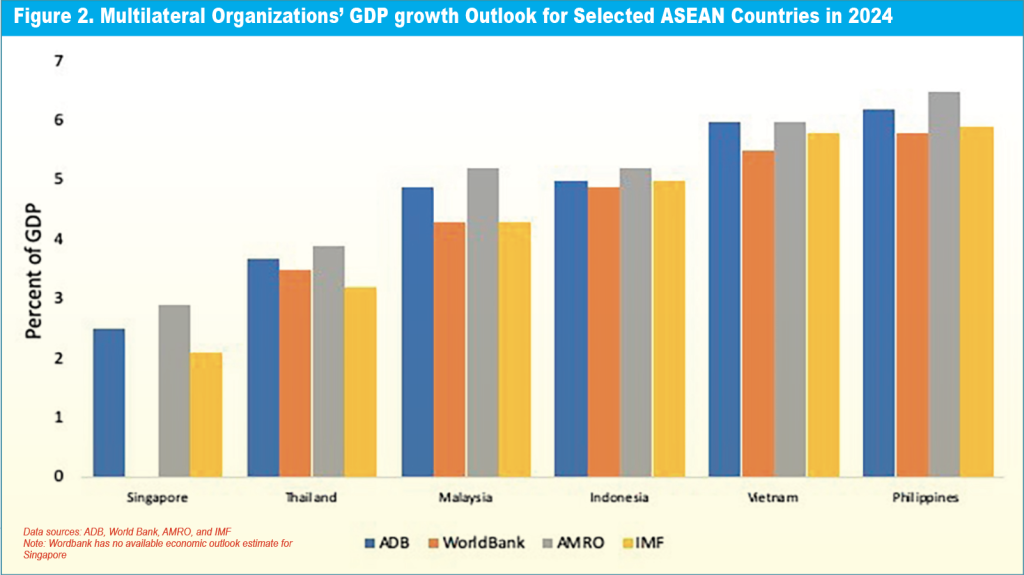

Most multilateral organizations share this optimism as they expect the Philippines to be one of the fastest growing economies among the major economies in Asia in 2023 and 2024 even with recent revisions in economic projections (Figures 1 and 2).

IMF Forecast

The International Monetary Fund (IMF) sees that the Philippine economy will have the strongest growth relative to ASEAN-4 and Vietnam, supported by an acceleration in public investment and improved external demand for the Philippines’ exports, after the country has withstood a confluence of shocks through its appropriate policy response and recent implementation of key structural reforms to stimulate exports, spur foreign investment, and raise growth potential.

The World Bank agrees that the country’s economy will accelerate in 2024 driven by private consumption. It projects the Philippines to be the fastest-growing economy among Asian countries in the East Asia and Pacific region in 2023, and the second-fastest in 2024.

Investor-grade

Credit rating agencies and market analysts also express confidence in the country’s macroeconomic fundamentals, as shown by the country’s maintained investor-grade credit ratings amid a sea of downgrades in other economies, including the US.

In particular, the S&P’s stable outlook for the country reflects its “expectation that the Philippine economy will maintain healthy growth rates and the fiscal performance will materially improve over the next 24 months.”

The Fitch Ratings forecasts that the country’s “growth over the medium term will be considerably stronger than the median of similarly-rated peers supported by large investments in infrastructure and reforms to foster trade and investment, including through public private partnerships (PPP).”

Moody’s also deems that the country will have a “rapid economic growth relative to peers, complemented by the stabilization and eventual reversal of the deterioration in fiscal and debt metrics.”

The Philippine economy will remain robust

The Philippine economy will likely grow close to the low end of the 6 to 7% growth target for 2023, despite a difficult global environment and existing domestic challenges. Economic growth will continue to be broad-based, led by the services and industry sectors.

It will be continually buoyed by robust domestic demand, supported by the further easing of inflation, lowest unemployment rate, and strong inflows of remittances from overseas Filipinos (OF).

The acceleration in government spending will also push growth as we expedite the implementation of catch-up plans, programs, and projects, particularly on infrastructure, as prioritized in the EDG discussions.

Inflation is on the mend

The inflation has been decelerating despite price pressure being a global issue in 2023.

This proves the effectiveness of aligned monetary and fiscal policies as well as the efficacy of direct measures to augment domestic supply, address logistical bottlenecks, and arrest uncompetitive practices in key commodity markets.

Inflation continued to slow down, reaching 4.1% in November 2023, down from 4.9% in October 2023 and from the 8% inflation recorded in November 2022 (Figure 3).

This brings the year-to-date (YTD) inflation rate to 6.2%. The decrease in overall inflation can be primarily attributed to lower year-on-year inflation rates in key sectors, specifically food and non-alcoholic beverages, transport, as well as restaurant and accommodation services.

On the average, inflation will be at 6% in 2023, aligned with the revised 6% inflation assumption of the Development Budget Coordination Committee (DBCC) for 2023.

The government’s direct measures to mitigate the impact of lingering supply-side factors on inflation as well as its commitment to a fiscal consolidation path through the MTFF allows fiscal policy to be consistent with the monetary policy tightening of the Bangko Sentral ng Pilipinas (BSP) to mitigate inflationary pressures.

These help in reducing inflation to within the BSP target range of 2-4% in the first quarter of 2024, averaging at 3.7% for full year 2024 and at 3.2% in 2025.

This progress is expected to yield positive influence on consumer spending and investments in the coming year and beyond.

The jobs market looks bright

The steady and low unemployment and underemployment rates underscore the continued economic momentum in our country.

In October 2023, the country recorded the lowest unemployment rate since April 2005 at 4.2%, same as the one recorded in November 2002 (Figure 4).

The quality of employment also continually improved as the underemployment rate was at 11.7%, lower than 14.2% a year ago, albeit higher than 10.7% in the previous month.

Moreover, improvement in the quality of jobs is evidenced by longer average hours of work, greater number of wage and salary workers that have a more remunerative class of work, and less unpaid family workers.

These developments show the successful initiatives of the government aimed at enhancing employment opportunities and labor conditions that resulted in a robust labor force participation.

The sustained improvement of the labor market environment, coupled with the declining inflation rate, remains as a strong driving force towards the country’s economic growth.

The manufacturing sector continues to support growth

Various data on the Purchasing Managers’ Index (PMI) for the Philippines generally recorded above the 50 threshold in the first 10 months of 2023, indicating a continued expansion in the sector.

The S&P Global (Figure 5) and the Philippine Institute for Supply Management posted PMIs of 52.4 and 54.8, respectively, for the Philippines in October 2023, suggesting continued manufacturing growth in the last quarter of the year.

Aside from PMI, the expansion of the manufacturing sector is also reflected in the growth in car sales at 25.9% year-on-year growth over the 10-month period.

Fiscal policy is sound

The 2023 fiscal numbers – the National Government (NG) debt-to-GDP and deficit-to-GDP ratios – are within the parameters of the Medium-Term Fiscal Framework (MTFF).

In the first three quarters of 2023, the NG deficit-to-GDP ratio has been trimmed down to 5.7% (Figure 6), below the 6.1% full-year deficit target, while the NG debt-to-GDP ratio anchors itself at 60.2%, also below the full-year target of 61.2% (Figure 7, see page 20).

This implies that the medium-term fiscal consolidation program is holding, gaining the recognition of multilateral organizations.

The IMF and the ASEAN+3 Macroeconomic Research Office (AMRO) acknowledged the MTFF as a firm commitment of the Marcos, Jr. administration to a gradual fiscal consolidation path aimed at igniting sustained growth while bolstering fiscal stability and restoring fiscal space, and stands poised for a dynamic economic future.

Moreover, the national budget was approved on time for the second consecutive year, showing the very strong relationship between the Executive Department and Congress.

Monetary policy and financial sector are performing well

The appropriate monetary policy succeeded in easing the entrenched inflationary pressures. The BSP’s key policy rate was increased by a cumulative 100 basis points this year to 6.5% to help anchor inflation expectations.

The banking sector also remains a source of strength with capital adequacy ratios (CARs) above regulatory requirements of the BSP and BSP-supervised institutions (BSIs), and non-performing loan (NPL) levels manageable. This suggests that banks are well-positioned to support the economy in the coming months.

Digitalization is on the march

The use of digital payments in financial transactions continues to deepen which could account for more than half of all financial transactions as close to 70% of adult Filipinos now have financial accounts.

The pervasive use of QR Ph, launched by the BSP, in public markets and local transport systems increase economic activities at the local level and support financial inclusion.

The external sector is improving

The Balance of Payments (BOP) position is forecasted by the BSP to be at a surplus this year at 0.2% from a deficit of 1.8% in 2022, as the latest current account forecast remain broadly unchanged while the financial account has been revised upward, a testament to the nation’s economic resilience.

The Philippine peso continues to appreciate, settling at 55.38 per US dollar on Dec. 27, 2023. The year-to-date average is now at P55.63/$, within the government’s exchange rate assumption at P55.50 to 60.00/$.

OF remittances, export revenues from Business Process Outsourcing (BPO) firms, tourism receipts, and foreign direct investments (FDI) will remain as stable sources of foreign exchange.

In the latest BSP external outlook for 2023, BPO revenues are expected to grow by 8% while travel receipts will expand by 110%. OF remittances will have a stable growth of 3% this year.

The current gross international reserve (GIR) level remains well above the IMF’s Assessing Reserve Adequacy metric at 1.9 index points in 2023, remarkably higher than China’s 0.7 as well as Malaysia and Indonesia both at 1.1. This will also be supported by the rising price of gold.

Moreover, the Philippines’ low external debt-to-GDP ratio also reflects the country’s robust external fundamentals.

Among the ASEAN-5 countries, the Philippines prides itself on having the lowest external debt-to-GDP ratio.

As of end-Q3 2023, the Philippines’ external debt-to-GDP ratio was only 28.1%, lower compared to Indonesia’s 28.9% and Malaysia’s 69.0% for the same period as well as Thailand’s 38.4% as of Q2 2023 (Figure 8, see page 22).

Robust economic growth will continue in 2024

While multilateral organizations project a slower global outlook for 2024 at 2.9%, the Philippine economy is expected to improve, reinforcing its status as one of the fastest-growing economies in the region.

The DBCC assumes a growth rate of 6.5 to 7.5% for the country in 2024.

Amid the ongoing strong El Niño and geopolitical and trade tensions, the country’s growth is expected to be driven by strong private consumption, supported by the expected return of inflation within the target range, falling oil prices, robust public spending, greater investments lured by the country’s sound macroeconomic fundamentals, investment-grade credit rating, and the implementation of structural reforms, and increased demand for Philippine exports as supply chain bottlenecks ease.

Even better prospects

Economic prospects will be even better with the alignment of policies between fiscal and monetary authorities, proactive monitoring and speedy action on sources of inflation, and closer coordination of all public sector entities – national government, local government units (LGUs), the corporate sector, and government financial institutions – in moving programs and projects consistent with the Philippine Development Plan 2023-2028 and in easing the cost of doing business in the country.

With these, the Philippines can confidently march towards a robust economic future, with a path that constitutes a confluence of favorable factors.

First, the recognition of multilateral organizations of the Marcos, Jr. administration’s swift policy actions through the MTFF in response to the challenges arising from the global shocks shows a vote of confidence in the country’s policy environment.

Navigating a post-pandemic world, the Philippines charts a steady course toward fiscal stability as we remain on track to achieving our fiscal targets.

MTFF targets

The government aims to achieve its MTFF targets for 2024, which further reduces the NG fiscal deficit-to-GDP ratio to 5.1% and the NG debt-to-GDP ratio to 60% while maintaining the share of infrastructure spending at 5-6% of GDP.

With the consolidated efforts of the DBCC, the Philippines readies itself to fine-tune its fiscal compass next year.

Second, for two consecutive years, the national budget was approved on time – a difficult feat under global uncertainties. This indicates the very strong relationship between the Executive Department and Congress.

The timely approval of the 2024 national budget will ensure quick and efficient government spending for the coming year.

As early as August this year, following the release of the National Expenditure Program, the EDG has encouraged both government line agencies and government-owned and controlled corporations (GOCCs) to conduct early procurement activities to ensure that underspending will not be a drag again to economic growth next year.

Moreover, the government will be spending more in the early part of 2024 to help boost economic activity for the rest of the year and break the cycle of rushing its spending towards year-end.

BSP efforts

Third, BSP’s efforts on monetary policy actions and the direct strategies being implemented by the administration through the IAC-IMO to ease inflationary pressures appear to be bearing fruit, with the inflation rate returning to the target range of 2 to 4% in 2024 until 2028.

Along with the appropriate monetary policy actions from the BSP, efforts are being intensified toward addressing high inflationary pressures in order to sustain deceleration in inflation heading into 2024.

Keeping the inflation rate within manageable levels to protect the Filipino people’s purchasing power and maintaining macroeconomic stability shall remain the government’s top priority.

Fourth, the country’s investor-grade credit ratings are a vote of confidence in the economy. In November, both S&P Global and Fitch Ratings affirmed the Philippines’ BBB+ and triple-B ratings with Stable outlook, respectively.

In August 2023, Rating and Investment Information, Inc. (R&I), a Japanese credit rating agency, affirmed the country’s triple-B plus rating and revised its outlook from stable to positive.

Credit rating agencies and market analysts remain confident in the country’s macroeconomic fundamentals due to the sustained economic recovery, strong external position, improving fiscal position with declining debt, sound banking system, and stable political environment.

Fifth, our policy environment remains primed for heightened investment activities in the country with the enactment of the Public-Private Partnership (PPP) Code and the Maharlika Investment Fund (MIF).

The PPP Code optimizes public-private collaborations and helps ensure the realization of high-quality infrastructure and services in the country to reach the government’s target infrastructure spending of 5 to 6%.

The MIF is the Philippines’ first-ever sovereign wealth fund that will optimize national funds by generating returns to support the infrastructure development agenda of the government, create jobs, promote investments, strengthen connectivity, achieve energy, water and food security and support the government’s poverty reduction efforts by sustaining the economy’s high growth trajectory and ensuring sustainable development, with the end in view of promoting efficient intergenerational management of wealth.