(Review of the macroeconomic assumptions and Fiscal Program for the 2021 President’s Budget, Dec. 11, 2019)

By the DBCC

We, the members of the Development Budget Coordination Committee (DBCC), held a meeting to revisit the macroeconomic assumptions and medium-term fiscal and growth targets of the government. This is in light of recent developments, both domestic and external, as well as in preparation for the proposed 2021 National Expenditure Program (NEP).

Macroeconomic assumptions

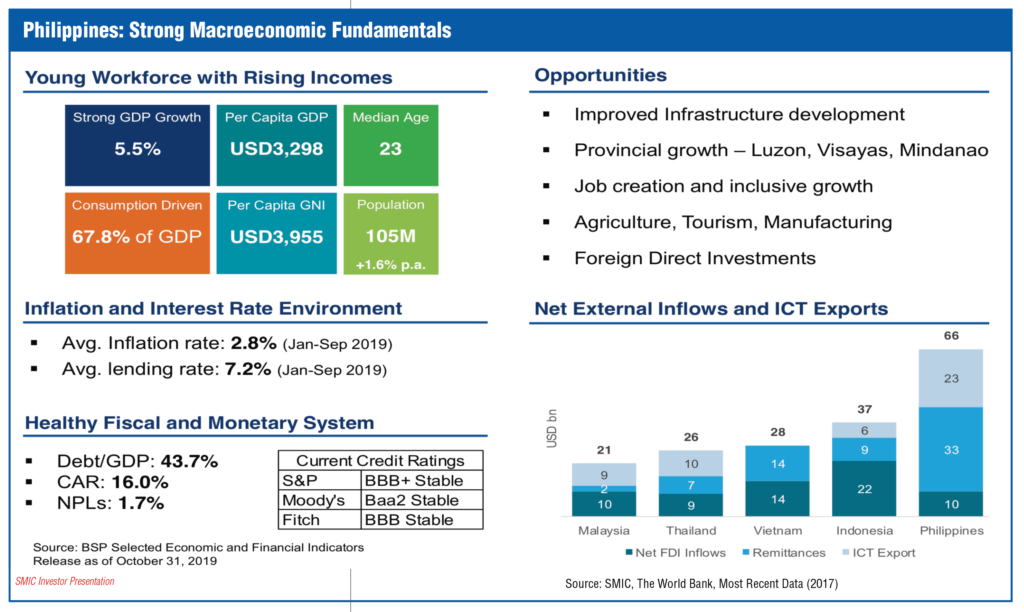

The average inflation rate for 2019 is projected to settle at 2.4%, indicating relatively stable prices for Filipino consumers, while the assumed average rates for 2020 to 2022 will remain between 2% to 4% throughout.

In addition, the assumption for the dollar price of Dubai crude oil per barrel has been adjusted downwards in the medium-term. For 2019, the projected range has been narrowed to the range of $63.00 to $64.00 per barrel. From 2020 to 2022, the price range is now projected to average between $55 to $70 per barrel.

Furthermore, the peso-dollar exchange rate assumption is revised downward to the range of P51 to P52 against the dollar in 2019 and from P51 to P54 against the dollar from 2020 to 2022.

Likewise, the assumptions for the 364-day Treasury bill rate and the 6-month London Interbank Offered Rate (LIBOR) have been adjusted downward. The average T-bill rate will range from 5.1% to 5.3% in 2019 and 3.5% to 4.5% in 2020 until 2022. On the other hand, the 6-month LIBOR will range from 2.3% to 2.4% in 2019, and from 1.5% to 2.5% from 2020 to 2022.

The assumption for goods export growth is revised downward in the short term to 1% for 2019 and 4% in 2020 due to continuing unresolved trade tensions. However, the assumptions for 2021 and 2022 are retained at 6% as global economic activity is expected to recover in the medium-term.

Assumptions in services exports growth were maintained at 9% from 2019 to 2022. The services imports growth projection for 2019 was adjusted downward to 2% in 2019, and fixed at 4% in 2020 and 5% in 2021 and 2022.

Medium-Term Fiscal Program

Revenue collections are projected to reach P3.15 trillion in 2019, equivalent to 16.8% of Gross Domestic Product (GDP). Meanwhile, disbursements are targeted to hit P3.76 trillion in 2019, which is equivalent to 20% of GDP.

For 2020, revenues are projected to increase to P3.49 trillion, equivalent to 16.6 of GDP, while disbursements are programmed at P4.16 trillion or 19.8 of GDP. Revenue and disbursement projections are estimated to rise to P4.31 trillion (17.0 of GDP) and P5.12 trillion (20.2 of GDP), respectively, by 2022.

The comprehensive tax reform program can help ensure a reliable revenue base and, more importantly, enhance the modernization of our economy.

Quickly completing the passage of the remaining tranches of the tax reform will ensure a steady revenue flow and equitable sharing for the government’s social and infrastructure programs while securing fiscal stability long into the future.

The speedy passage of the Corporate Income Tax and Incentives Rationalization Act (CITIRA) will help attract additional investment into the country and the alcohol and e-cigarette excise tax adjustments will substantially bridge the funding gap for the Universal Health Care program.

Given the revenue and disbursement program adopted by the DBCC, the deficit target will be maintained at 3.2% of GDP from 2019 to 2022 to sustain the government’s investments in infrastructure and human capital development.

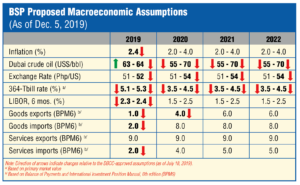

Accounting for the aforementioned factors, the GDP growth target is projected at 6% to 6.5% in 2019 and 6.5% to 7.5% in 2020 to 2022.

FY 2021 National Expenditure Program

Consistent with the macroeconomic assumptions and foregoing fiscal targets, the FY 2021 cash budget is pegged at P4.640 trillion. The proposed P4.640 trillion cash budget for FY 2021 is higher by P540 billion or 13.3 than the P4.100 trillion cash budget for FY 2020 and is equivalent to 20.2 of GDP.

The proposed 2021 National Budget will continue to support anti-poverty and peace-sustaining measures through funding of recently-approved legislative measures.

In line with this, there will be continued funding for the following priority social protection and economic programs:

• Universal Health Care Program

• Pantawid Pamilyang Pilipino

Program

• Rice Tariffication Law

• Provision for the Annual Block Grant, Special Development Fund, and Share in National Taxes of the Bangsamoro Autonomous Region in Muslim Mindanao (BARMM)

• Universal Access to Quality Tertiary Education

• Refocusing of National Government assistance to LGUs with high poverty incidence

• Climate change mitigation and adaptation measures

The DBCC also approved the creation of the Subcommittee on Sustainable Development Goals (SDG) to review and recommend to the DBCC SDG-related policies and programs.

We are committed to building a more effective and competitive economy, one that will provide good jobs to our workers, improve the living conditions of the poor, and create more opportunities for all Filipinos.

The DBCC is composed of the DBM’s acting Secretary Wendel Avisado, NEDA Secretary General Ernesto Pernia, Finance Secretary Carlos Dominguez, and BSP Governor Benjamin Diokno.