By Antonio S. Lopez

.

.

Bankers by nature are a pessimistic lot. When they extend a loan, they suspect the borrower won’t be able to pay for it. So they establish the borrower’s character, demand a lot of collateral, and monitor his activities. Bankers often fret about their operating environment—the micro and macro fundamentals of the economy.

Thankfully for the banks, for the economy, and for the people, Bangko Sentral ng Pilipinas Governor Benjamin E. Diokno is cut from a different cloth. A blue chip economist, he combines exuberant optimism and sensible pragmatism.

Diokno’s down-to-earth application of academic dogma to practical reality has been honed by years he spent as the budget chief of three presidents. He knows the value of money and the harm it does when it is misspent or is absent from the till.

Pro-growth and pro-people

Diokno’s reputation as a pro-growth and pro-people policymaker convinced President Duterte to name his then budget secretary on March 7, 2019 as the fifth governor of the Bangko Sentral ng Pilipinas (BSP).

As budget chief, Diokno billed Duterte’s main economic program, Build, Build, Build as “The Golden Age of Infrastructure”, a game changer to power robust growth. BBB does two things: It modernizes the economy and it creates 150,000 jobs for every P100 billion spent on infra. Cumulative infra spending of over P4 trillion has created six million jobs.

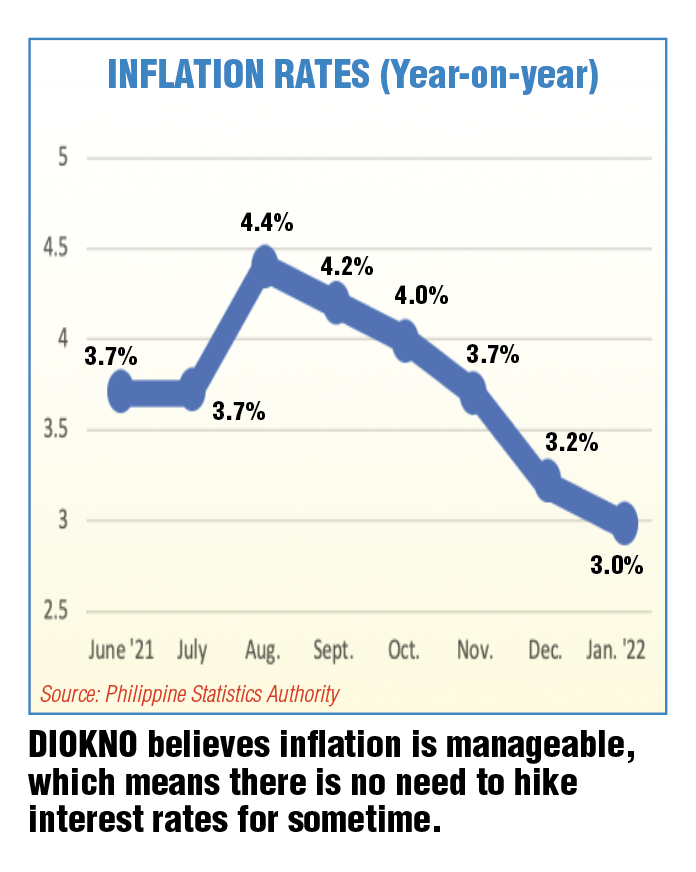

At BSP, Governor Diokno went immediately, to work. He tamed inflation, cutting it from nine-year high 6.7% in September and October 2018 to 2.5% for the whole of 2019. He initiated an aggressive digitalization to reach to the more than 50 million adult Filipinos who are unbanked or have no banking accounts.

Diokno’s response to the pandemic

Then the pandemic struck in early 2020. Diokno knew exactly what to do. He accelerated the reduction in the reserve requirement ratio (RRR) for bank deposits to reach a 21-year low of 12% by April 2020, from 18% in 2018. He halved the BSP’s policy interest rate from 4% to 2%—the lowest ever, drastically reducing the cost of borrowing.

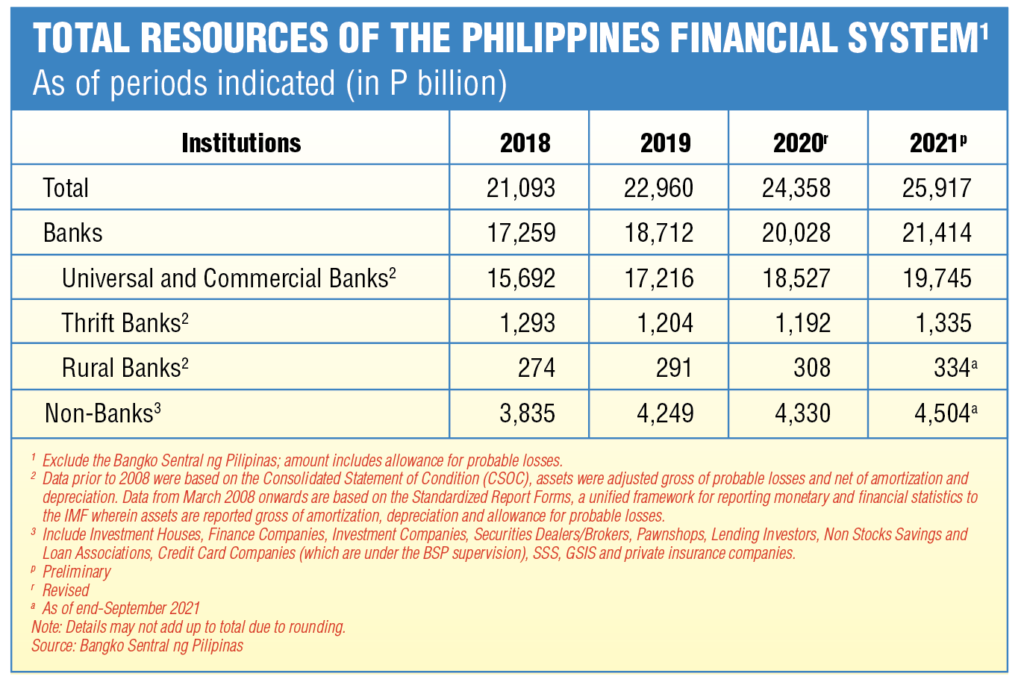

Diokno pumped an unheard of P2.3 trillion into the financial system—about 12% of GDP. He gave cash to the national government. In 2020, the BSP lent P540 billion to the national government for its ayuda and vaccine purchases. That was repaid. January this year, the BSP lent another P300 billion.

The governor did all these even while keeping a tight watch on inflation. “Monetary authorities should be both decisive and nimble when dealing with economic crises,” he declared.

Economic recovery is the priority

With inflation at 3% per year, the loans to the government and the P2.3 trillion pumped into the system are in effect free money. Diokno calls the monetary policy stance “sufficiently accommodative to support the ongoing economic recovery.” “Economic recovery is the BSP’s priority,” declares the governor.

While not required to do so, Diokno released dividends to the national government to beef up its cash—P23 billion in 2020, P15 billion in June 2021, and P896 million in August 2021.

A series of regulatory relief measures was also intended to enable banks to provide financial relief to their borrowers. The BSP allowed banks to postpone by

(Turn to page 25)