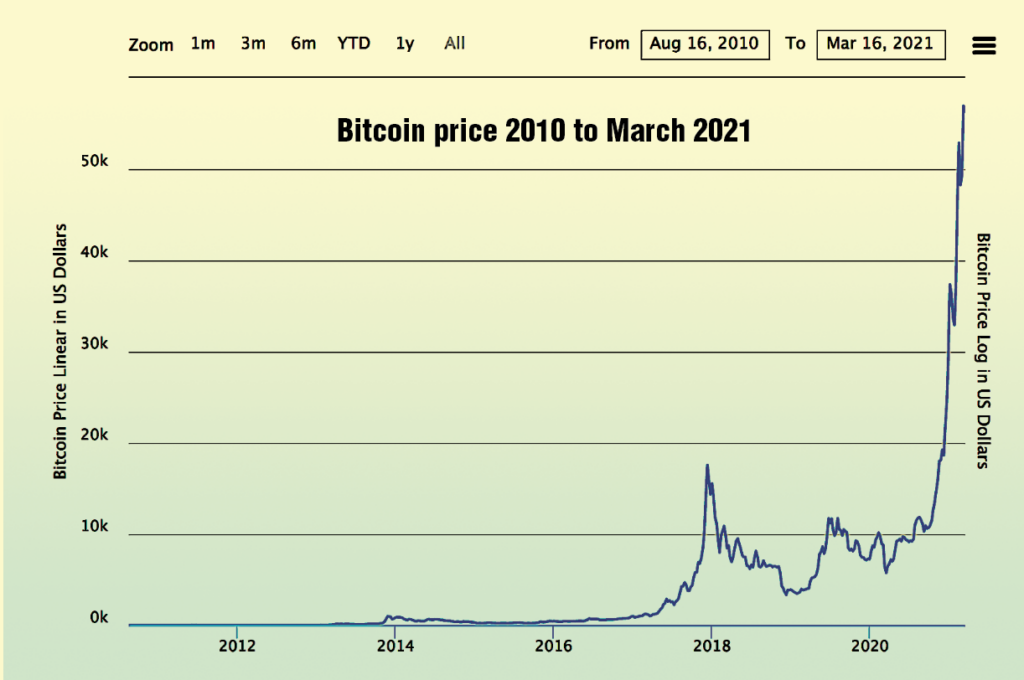

On March 11, 2020, WHO declared COVID-19 a pandemic and the bitcoin (BTC) was worth $7,950. The next day BTC plunged to $4,810. It slowly rose to around $10k in May. By November it held around $18,000.

Last December 2020, Elon Musk, CEO of US automaker Tesla, surprised the market when he tweeted about bitcoin, the most well-known cryptocurrency. BTC was valued at $23,500, the first time it surpassed its previous high of $20k in 2017.

In the next 19 days, BTC’s value rose quickly to $40,700, but then dropped three days later to $35,500.

On February 8, Musk revealed to the SEC that Tesla bought $1.5 billion worth of bitcoins and that it will now accept bitcoins as payment for its products.

The cryptocurrency market went crazy and BTC’s value rose from $46,300 on February 8 to a record-high $57,500 on February 21. A week later, BTC plunged to $45,100.

This week, BTC climbed beyond expectations and shot past $60,000 on March 14. Two days later it went down to $56,924.

Bitcoin’s bumpy ride

Bitcoin is not an actual coin but an invented cash payment sent directly and anonymously from one computer to another. Transactions are protected by codes that need to be decrypted, so it’s called cryptocurrency.

Bitcoin is the first cryptocurrency invented in 2008 by a self-identified but anonymous Satoshi Nakamoto. He made the first transaction in 2009. In 2010 BTC was worth $0.06.

In 2011, one bitcoin equalled $1, then $6 by 2012. In 2013, BTC climbed slowly to a high of $979.

In 2014, BTC began at $881 but continued to drop to about $302 due to various bitcoin-related crimes and stock exchange glitches like the shutdown of the major exchange Mt. Gox in Japan.

By February 2015, BTC was worth $262 and its popularity grew with investors, banks, and businesses worldwide. Buyers half jokingly asked “Can I pay in bitcoins?” to merchants’ confusion. Speculators fueled public hysteria with their instant millions that many exchanges sprouted to charge fees for bitcoin purchases and a bitcoin currency symbol was created—a capital B with two vertical bars.

By 2016, bitcoins languished at around $500. The next year, it climbed to about $2k and hit its peak in December 11, 2017 at $19,400. Investors predicted it would shoot past $20k—but it never did for the next three years. Instead, it continued to drop down through 2018 and ended the year with $3,442.

BTC began 2019 at $3,804, peaked in June and August to about $11,900, and ended in December at $7,232.

Why is bitcoin so volatile?

Bitcoin was invented as an alternative online payment so users wouldn’t need banks, cash, or credit cards. The parties agree on its value. A buyer can pay for an item in the amount of bitcoins that the seller is willing to accept. So Anne can buy Ben’s book with one bitcoin.

With this month’s BTC below $60k, the baseball team Oakland A’s will accept one bitcoin for a season suite for six. The offer is only good until April, as we don’t know what bitcoins will be worth later.

Unlike legal tender which has an imposed value, bitcoins have a perceived value based on demand, supply, and its predicted future price. This makes bitcoin more of a speculation rather than a currency. But its volatility constrains advisers to caution investors: “Buy only what you can afford to lose.”

To become a widely used currency, BTC has to stabilize. Otherwise it will deter businesses from accepting it as payment as its value can quickly go down in exchange for the price of goods which remain relatively constant.

Like with any new quick moneymaker, public perception of bitcoins is greatly colored by current events, rumors, and hysteria. Since its inception, bitcoins are highly reactive to various market forces—or even just to one person, as Musk has shown with his tweets and huge purchase. Tesla’s BTC purchase gave it a sheen of legitimacy that shot up the price to $60k. He’s accused of manipulating the market.

To add to the confusion, bitcoin is flooded with competition from over 4,928 other cryptocurrencies. Many, like the second-largest cryptocurrency Ethereum, claim to be better, faster, and more secure than BTC. This can dislodge bitcoin’s dominance as more improved altcoins are created.

The bitcoin network depends on miners to verify transactions to add to the blockchain. Ideally no one controls the network. But if a miner has 51% of the computing power, he has the power to reject transactions and create its own blockchain, even if it’s incompatible from the network consensus.

China mines a monthly average of 67% of the world’s bitcoins. Next is the US at 7%, then Russia at 5.9%, Kazakhstan at 5.61%, and Iran at 3.52%. Cheap electricity is a major factor in the location of mining pools. (University of Cambridge)

Finally, an inherent vulnerability of bitcoin is its reliance on technology. It is a software network that runs on computers which requires electricity and a reliable internet. What happens if electric power or internet connection is lost? How will users access their digital wallets? It’s critical to safeguard the bitcoin infrastructure so it can weather the inevitable hurricanes, floods, fires, or calamities. You don’t need such technology to buy with cash.

Please follow me on FB & Instagram @IvyDigest