By Antonio S. Lopez

2024 has been the best year for Philippine banking, the region’s oldest banking system.

And 2025 might prove even better, if only slightly, despite unprecedented geopolitical challenges of the worst trade war in 100 years, the highest tariffs in 100 years, the resurgence of imperialist America after 80 years, and the sudden end of the 80-year-old trans-Atlantic security, economic and cultural alliance.

The Philippines economy is not as heavily dependent on foreign trade as its Asian neighbors.

“The Philippine banking system maintains its solid performance, recording continued growth in assets, loans, deposits, and earnings,” reported the Bangko Sentral ng Pilipinas in a status report for the third quarter 2024. (See related article on pages 10-12, 14)

Growth momentum

“This growth momentum was accompanied with robust capital and liquidity positions that exceed domestic and global standards, enabling banks to support their expanding operations and risk-taking activities,” BSP governor said.

“It has been a remarkable year,” gushed BSP Governor Eli Remolona Jr., today rated as among the world’s best central bankers.

In December 2024, bank lending rose a hefty 12.2% year-on-year, faster than the 11.1% yearly growth in November 2024. Month-on-month, lending growth was 1.4%, meaning if annualized (multiplied by 12), the increase could be 16.8%, making loans growth a historic high. In 2024, loans for all types or purposes grew robustly, over 2023.

In past years, loans growth was sluggish at 5%, or less, a year. Normally, to support economic growth, banking lending should double the GDP or economic growth rate. If GDP growth is 6%, then the rise in bank loans should be 12%.

Bank lending up 14%

As of end-September 2024, bank loans grew double digits, by 14.1% to P15 trillion, and assets by 11.4% to P26.7 trillion.

The 14.1% loan growth in 2024 was higher than the 7.9% in 2023, and the pre-pandemic growth of 13.8%.

The 11.4% asset growth was higher than the 9% in 2023, and the 11% pre-pandemic growth rates.

Growth in deposits up to September 2024 was in single digit, 7.1%, to P19.6 trillion. Growth in profits up to September 2024 was 6.4% to P290.1 billion.

Record profits

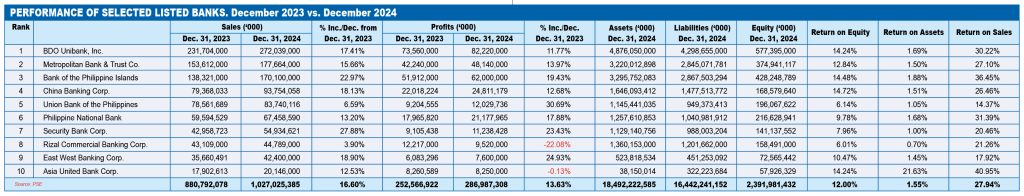

A number of banks, especially the big banks, reported record high profits. They include the listed banks like BDO, Metrobank, BPI, Chinabank, PNB, and Security Bank.

In 2024, BDO reported record profits of P82 billion (P6.83 billion per month), up 12% over 2023; BPI, P62 billion (P5.16 billion per month), up 19%; Metrobank P48.1 billion ((P4 billion per month), up 15%; Chinabank, P24.8 billion (P2 billion per month), up 13%; Union Bank, P12 billion (P1 billion per month), up 31%; and Security Bank, P11.23 billion (P936.5 million per month), up 23%.

Lower inflation, lower interest rates

With inflation moderating, the BSP is expected to cut interest rates further, bringing them to an average of 2%, before the massive interest rate increases in the past two years that brought the BSP policy rate to a high of 6.25%.

Lower interest rates should result in more loan demand and improved non-performing loan ratios for banks.

The system has plenty of money. Bank deposits as of September 2024 totaled P19.6 trillion but loans reached only P15 trillion, despite double digit growth in lending. This means the system has P4.69 trillion of unlent deposits. The BSP aims to bring down the reserve requirement (the ratio of deposits parked with the BSP) to exactly zero.

BSP reported domestic liquidity (M3) grew by 7.7% year-on-year to P18.8 trillion in December, the same pace as in the previous month. On a month-on-month seasonally adjusted basis, M3 increased marginally by 0.2%.

Credit rating upgrade

In early 2025, the Philippines received from S&P (Global) an upgrade in our credit rating outlook. In March 2025, the country exited the grey list or watchlist of countries due to its money laundering track record.

In 2025, the BSP launched the peso IRS (interest rate swap) market, said Remolona, and “we took significant steps to expand the government repo (repurchase) market. We also rolled out the Financial Services Cyber Resilience Plan and helped pass the Anti Financial Account Scamming Act.”

Says Remolona: “The BSP will continue to ensure that domestic liquidity conditions remain consistent with the prevailing stance of monetary policy, in line with its price and financial stability objectives.”

Bank loans up 12%

Per preliminary BSP data, outstanding loans of universal and commercial banks (U/KBs), net of reverse repurchase (RRP) placements with the BSP, grew by 12.2% year-on-year in December from 11.1% in November.

On a month-on-month seasonally-adjusted basis, outstanding U/KB loans, net of RRPs, rose by 1.4%.

Outstanding loans to residents, net of RRPs, increased by 12.4% in December from an 11.4% growth in the previous month. Outstanding loans to non-residents expanded at a faster rate of 5.7% in December from 3.9% in November.

Loans for production activities rose by 10.8% in December from 9.8% in November, due largely to the sustained increase in lending to key industries such as wholesale and retail trade, repair of motor vehicles and motorcycles (10.1%); electricity, gas, steam and air-conditioning supply (14.2%); manufacturing (7.4%); financial and insurance activities (7.4%); and construction (12.6%).

Likewise, consumer loans to residents went up further by 25.0% in December from 23.3% in November, due to the increase in credit card loans; salary-based general-purpose consumption loans and motor vehicle loans.

February 2025 inflation

Headline inflation dropped to 2.1% year-on-year in February from 2.9% in January. This was below both the market’s expectations and the BSP’s forecast range. The year-to-date average inflation rate is 2.5%, within the Government’s inflation target range of 2-4%.

On a month-on-month seasonally adjusted basis, headline inflation was at 0% in February compared with negative 0.1% in January. Core inflation similarly declined further to 2.4% in February from 2.6% in the previous month.

Lower food inflation, particularly for vegetables due to improved supply, drove the decline in headline inflation. Local retail rice prices also declined further, reflecting in part lower imported rice prices.

Easing inflation for housing, water, electricity, gas, and other fuels. as well as downward adjustments in gasoline and diesel prices, also contributed to the moderation in non-food inflation.

The February inflation outturn supports the BSP’s prevailing assessment that inflation will remain within the target range over the policy horizon. Nonetheless, uncertainty over global economic policies and their potential impact on the domestic economy continues to warrant close monitoring.