By the PricewaterhouseCoopers (PwC)

A year and a half after the first enhanced community quarantine (ECQ) was declared in Luzon, the Philippines faces greater challenges because of the Delta variant. Since the first ECQ on March 17, 2020, the Philippines had 2.2 million COVID-19 cases and over 35,000 deaths.

The number of daily new COVID-19 cases also reached an all time high of 26,303 on September 11. With just 12.4% of the total population fully vaccinated as of August 25, the Filipinos’ lives are still far from normal.

During the first months of the pandemic in 2020, businesses had to temporarily close or reduce their operations while some were affected by supply chain disruptions. To adjust to the current environment, most businesses had to adopt a remote working environment, change their products and/or services, and invest in digital solutions.

Having adjusted to the current reality, majority of the CEOs feel confident about their growth prospects in the next 12 months, and an even greater number of CEOs believe that their company will experience growth in the next three years.

While the economic crisis is far from over, having a positive leadership outlook is critical to steering the business to recovery while boosting employee morale.

As a result of the closing of the economy, business disruptions, travel restrictions and healthcare crisis, the Philippines had the worst economic performance since the World War II ended in 1947.

Unemployment rate also peaked at 17.6% in the second quarter of 2020 while the country’s external debt grew to $98.5 billion in the fourth quarter of the same year.

Despite having the Bayanihan 1 and 2 laws, most CEOs believe that the Philippine economy will just grow by up to 5% in 2022, and it will take more than two years for the country to recover from the impact of the pandemic.

While the Bayanihan 2 law was signed into law on Sept. 11, 2020, its budget expired on June 30, 2021, leaving P6.49 billion of unused funding. Having declared the MECQ for Luzon and other cities in August 2021, further economic and job losses are expected until the end of the year.

With the country’s worst crisis, good governance both at the national and local levels are critical for the country to survive and recover.

To help the economy recover, the CEOs identified healthcare, infrastructure and education as the sectors that the government should prioritize.

In spite of the approved budget through the Bayanihan 2 law, healthcare workers raised concerns such as unpaid risk allowances and hazard pay.

Even before the pandemic, the Philippines already had a shortage of hospital beds. Currently, there are only approximately 9.9 beds for every 10,000 people, which are not enough to support the ongoing health crisis.

Such number is also below the World Health Organization’s recommended standard of 2.3 beds for every 1,000 population or 23 beds for every 10,000 people.

Five laws were signed by President Rodrigo Duterte to increase the bed capacity of hospitals in the cities of Iloilo, Las Piñas, Tuguegarao, Quezon, and Surigao del Norte in November 2020.

The government, through the Public-Private Partnership Center (PPP Center), is also bidding out the development of the new 700-bed UP Philippine General Hospital (PGH) Diliman, which has an estimated project cost of P21.3 billion.

According to the PPP Center, It is envisioned to be a world-class hospital, serving the poor, with related educational and research facilities.

As of Sept. 11, 2021, 76% of the 4,200 ICU beds and 68% of the 20,500 isolation beds have been utilized across the country.

Infrastructure spending, which used to average around 6% of the country’s GDP from 2017 to 2019 and provided over six million jobs, should also be among the focus areas according to majority of the CEOs.

Under the government’s flagship infrastructure program, around 119 projects were planned to be completed. Because of the pandemic however, some projects were either put on hold or cancelled and as of July 2021, only 11 have been completed.

Just recently, the government appropriated P1.8 trillion in the 2022 National Expenditure Program (NEP) for infrastructure projects that will be started in the Duterte administration’s final year.

Programs to be covered by the budget include road network development, flood management, bridge programs, rail transport projects, land public transportation projects and aviation infrastructure.

The planned infrastructure spending is expected to contribute over 5% of the country’s GDP in 2022.

The education sector, which faced several challenges during the pandemic, should also be prioritized, according to the CEOs.

In the 2018 Program for International Student Assessment (PISA) that was completed by the Organization for Economic Co-operation and Development (OECD), 15-year-old students who participated in the study scored lower in reading, mathematics and science than most of the countries that were covered by the PISA.

According to the assessment, expenditure per student in the Philippines was the lowest among the participating countries, and 90% lower than the OECD average.

While the government had initiatives to help improve the educational system, the pandemic further disrupted the sector. Challenges faced by majority of the nine million K-12 students in both private and public schools include financial and technological concerns.

Families from the lower income segment were also not prepared for the requirements of online learning such as laptops and better internet connectivity.

In the same manner, teachers were not given the proper training and resources to adjust to online education. In certain cases, teachers had to fund their own materials and technological tools despite the hard-earned wages.

Most schools also relaxed their admission and continuing educational requirements to ensure that they have enough enrollees to support their operations.

Given these challenges, the CEOs are concerned that the country’s quality of education will further deteriorate. To address this, the government allocated P773.6 billion to the Department of Education, Commission on Higher Education (CHED), state universities and colleges (SUCs), and the Technical Education and Skills Development Authority (TESDA).

Such appropriation will cover the development, reproduction and delivery of learning resources for basic education-learning continuity plan as well as the computerization program.

The budget will also support the implementation of the Universal Access to Quality Tertiary Education (UAQTE) and other education assistance and subsidies, such as Student Financial Assistance Programs (StuFAPs) and Private Education Student Financial Assistance (PESFA).

COVID-19 impact and insights

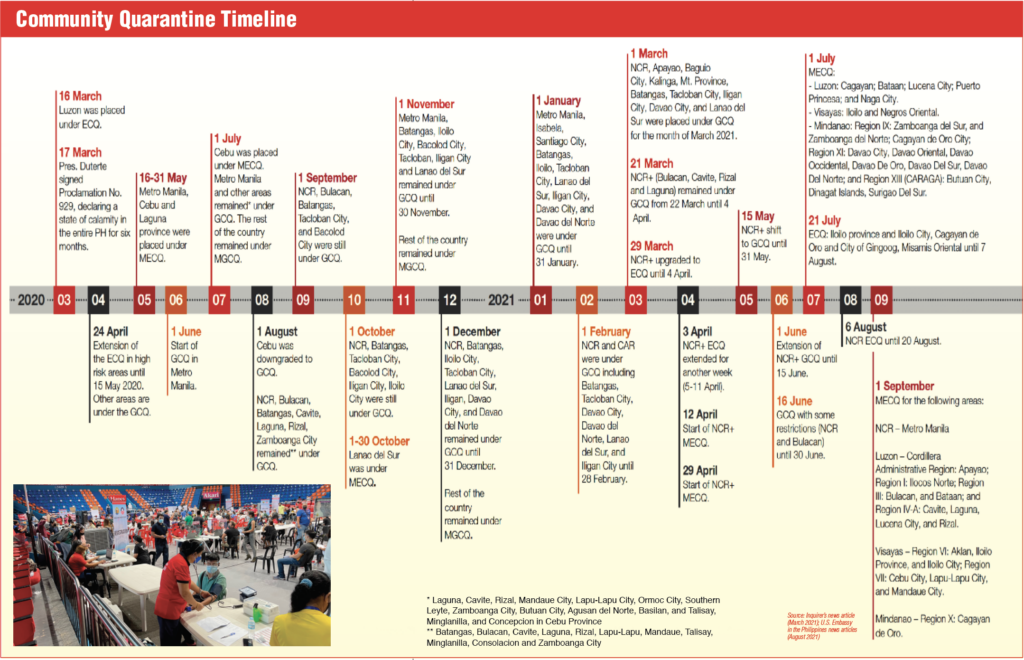

Luzon and other areas in the country have been under ECQ for four times since the pandemic started. Under the ECQ, the strictest lockdown, only essential industries are allowed to operate and most of the people are not allowed to go out.

For a consumption- driven economy, the closure of establishments such as malls, restaurants and other businesses have an immediate direct negative impact on the economy.

Since the first ECQ, household final expenditure has been declining until the first quarter of 2021.

Throughout the year, spending on restaurants and hotels, transport, recreation and culture, education, alcoholic beverages, tobacco, clothing and footwear, furnishings, household equipment, routine household maintenance and health has declined.

While household final expenditure grew by 7.2% in the second quarter of 2021, total spending is expected to decline in the succeeding periods because of the extended MECQ that will be revisited on or before September 15.

According to most CEOs surveyed, their revenues, profits, productivity, employee and customer count, and utilization decline each time the government imposes a lockdown.

To support their businesses, majority of the CEOs tapped external debt, and infused capital from both their personal funds and existing investors in the past year. Going forward, majority of the CEOs still plan to tap external debt and/or equity to help their businesses.

Despite the successful listings of Monde Nissin, AREIT, DDMP Reit, etc., only a few of the CEOs say that they’ll raise capital through the capital markets.

Accessing the capital markets may be challenging for certain companies unless they have shown resilience and growth during the pandemic.

COVID-19 and the rest of the world

The global economy contracted by 3.2% in 2020 largely because of the pandemic. In the early part of 2021, people from different parts of the world expressed optimism because of the vaccine rollout. Nevertheless, the emergence of COVID-19 variants forced countries to impose lockdowns again to manage the number of new infections.

Countries such as Singapore, Australia, New Zealand, Canada, the Philippines, and more had to close their economies again because of the surge in the number of COVID-19 cases.

Despite having several stimulus programs and fiscal incentives, one thing became clear – a faster and equitable vaccination rollout worldwide is critical for the global economy to recover and to prevent the further mutations of the COVID-19 virus.

Despite the worsening healthcare crisis, 62% of the CEOs say that the global economy will improve in the next 12 months. According to the International Monetary Fund, the global GDP will grow by 6% in 2021, with the emerging and developing economies growing at a slightly faster rate than the advanced economies.

Policies that may help economies recover include those that will stimulate trade, invest in human capital, accelerate digitalization and support sustainable initiatives and infrastructure.

In the Philippines, the government is targeting a 4% to 5% GDP growth in 2021 and a growth rate of over 5% in 2022. Most CEOs, however, say that the slow vaccine rollout, reliance on lockdowns as well as the ongoing political uncertainty will delay the country’s recovery.

With just 12.9% of the Philippine population fully vaccinated as of Sept. 3, 2021, 66% of the CEOs are dissatisfied with the vaccine rollout in the country.The impact of the pandemic on other countries also affects local businesses. According to the CEOs, the United States, China, Singapore and Japan are important for their company’s overall growth.

Among these countries, China had the fastest growth rate with its GDP growing by 18.3% in the first quarter of 2021. While the virus has not been fully contained in China, its government was able to fully vaccinate 27.7% of the population as of end-August, and is aiming to vaccinate 70% to 80% of its 1.4 billion population by the end of the year or early 2022.

Aside from having a more stable local economy, China was able to generate 2.97 million jobs in the first quarter of 2021, which is 27% of its annual goal of 11 million jobs. Other economic drivers include the 25.6% growth in real estate investment, 33.9% growth in consumer goods sales, 24.5% growth in industrial values and more.

The Philippines, on the other hand, was lagging behind the major Asian countries in terms of growth. In the first quarter of 2021, Vietnam, Singapore and Thailand reported positive growth rates.

While such countries have not yet achieved herd immunity, their policy responses were swift and helped manage the impact of the virus on the economy and healthcare situation.

In Vietnam, mobile applications that provide alerts on positive cases and exposures were installed by around 60% of its population.

Vietnam’s fiscal measures in 2020 include a fiscal support package with expected value of VND291.7 trillion (3.6% of GDP) to support the economy in 2020, deferring payment of value added tax and corporate income tax obligations, and more. Vietnam also continued to implement fiscal and monetary policies in 2021 to further mitigate the economic and social impact of the pandemic.

While Vietnam has been among the successful countries who managed COVID-19, the country is currently facing challenges as the Delta variant infected more people beginning June 2021. Currently, Vietnam has over 570,000 reported COVID-19 cases, with almost all contracting the virus from July to September of this year.

Similarly, Singapore introduced several fiscal measures amounting to around $69 billion in 2020. Government support includes cash payouts to all Singaporeans (higher for families with children under 20) and additional payments for unemployed individuals and those from the lower-income segment.

Support given to companies and employees include wage subsidies, rental support, financing scheme, job creation initiatives and more.

Digital and long-term strategy

To adjust to the new world and meet the challenges caused by the pandemic, businesses had to move fast and react in agile ways.

Digital solutions and tools that became more relevant during the pandemic include cloud-based solutions, platforms, marketplaces and payment solutions. As of the first quarter of 2021, the Bangko Sentral ng Pilipinas said that the volume of PESOnet transfers already reached 39 million, which was four times the volume in the same period last year.

Similarly, the value of fund transfers through the InstaPay system was P552 billion in the first quarter of this year, and was thrice the value of the transfers made in the first quarter of 2020.

With the ongoing COVID-19 crisis, there is a continuing need for companies to do business digitally. Based on the results of the survey, 84% of the CEOs plan to increase their investments in technology or digital.

Seventy-four percent (74%) of the CEOs also say that they’re planning to invest more in cybersecurity and data privacy solutions.

As organizations accelerate their digital transformation, they become more vulnerable to cyber attacks. Using new technologies and connecting with more external stakeholders digitally also mean new risks for businesses.

Given the embedded and developing cybersecurity risks, organizations should have a cyber strategy in place to ensure having a resilient digital ecosystem.

While there is a clear need to accelerate the digital transformation of businesses, 84% of the CEOs also say that they plan to increase their long-term investments in leadership and talent development. With COVID-19 disrupting the world, people saw the need for sophisticated leadership – one that can steer an organization through uncertainties and a rapidly changing environment.

During the pandemic, leaders had to make quick decisions that often had trade-offs and may have had negative consequences. According to Blair Sheppard, the global leader of strategy and leadership for the PwC network, and Susannah Anfield, a member of the global strategy and leadership team at PwC, leaders must have the confidence to project a clear strategy, and the humility to correct course and recognize the need for change.

The leaders of today and tomorrow must have a deep understanding of the business and environment they operate in, work through complex systems, and communicate with its various stakeholders effectively.

Sustainability

The pandemic showed us that new business models and practices work, and can be more sustainable. As a result of COVID-19, businesses shifted to remote working and online socializing, and became more open to near-shoring, localizing the supply chain, using 3D printing, etc.

Other practices that emerged during the pandemic such as automated manufacturing and the “make where you sell” approach can improve the way we produce and consume, and may help with the global sustainability goals.

Currently, there is a need to have more sustainable business practices because if the pre-pandemic business trends and practices continue, the global losses from climate change could reach $600 trillion by the end of the century.

The Philippines is part of the 193 member states of the United Nations that adopted the Sustainable Development Goals (SDGs) in 2015. There are 17 SDGs that are part of the 2030 Agenda, which has three major pillars – People, Prosperity and Planet, and Peace.

As of November 2020, 48% or 12 indicators were ahead of the path to target while 52% or 13 indicators were behind the path to target. To ensure that we are on track to achieving the SDGs, the government has integrated such goals in the national long-term vision.

Based on our past CEO surveys, some Philippine CEOs have included sustainability in their long- term goals. This year, however, we are seeing that the pandemic has accelerated the implementation of sustainability plans. According to our survey, 43% of the CEOs have included climate change and environmental damage in their strategic risk management activities.

Nevertheless, only a number of CEOs are implementing more sophisticated and impactful initiatives such as carbon emission reduction, use of renewable energy, and carbon capture and storage. Based on PwC’s analysis, global carbon emissions must be cut in half by 2030.

New analysis from PwC’s Net Zero Economy Index, which tracks progress among the G20, shows that a decarbonization rate of 11.7% is required to keep global warming within 1.5°C.

To get there, countries with the highest rate of decarbonization in 2019 will need to double their efforts moving forward, and those with the lowest rate may need improvement by up to tenfold.

Despite the impact of the pandemic on businesses across various sectors, majority of the CEOs still prioritized their employees’ welfare by providing COVID-19 assistance, and health and wellness benefits.

During the pandemic, there were more instances of mental health concerns that resulted from worrying about COVID-19. Other employees also experienced challenges while transitioning to remote working. To help their employees, 47% of the CEOs also provided work- from-home allowances because of the new work setup. Unlike before, the employees now have to invest in faster internet and furnishings to make remote working comfortable and possible.

Continuing the relationship with suppliers also became critical during the pandemic. As a result of business disruptions, some companies had to cancel their orders and supply arrangements.

The logistical concerns due to lockdowns and travel restrictions also affected the availability of raw materials and prices. To help their suppliers, a number of CEOs maintained their regular orders, accepted price increases and even advanced their payments.

In times of crisis, we normally expect business leaders to prioritize survival and liquidity. In our survey, however, over 50% of the CEOs say that they’ve implemented initiatives to improve their governance such as ensuring ethical business practices along the value chain, revisiting the corporate governance policies, and ensuring proper tax compliance. With the growing awareness about sustainability, more companies are pushing harder for businesses to address the social and environmental concerns across the value chain.

As seen in the results, more leaders are now focusing on developing products and/or services that treat its employees and environment ethically.

Incorporating sustainability in business practices and operations has never been more important as it is today. According to PwC’s June 2021 Global Consumer Insights Pulse Survey, more consumers became more environmentally sensitive.

Most of the respondents also said that they buy from companies that are conscious and are supportive of protecting the environment. Consumers now are also more educated with the majority saying that they’re more aware of the need to shop sustainably.

Corporate governance policies are mostly shareholder-centric. What the pandemic showed us is that corporate governance policies such as dividend policies and risk management should take into consideration its broader stakeholders such as employees, suppliers, customers and communities.

Such decisions may include delaying the distribution of dividends and reallocating those to employees in times of crisis, extending financial assistance to suppliers to avoid disrupting the value chain and more.

While businesses have incurred financial losses due to the pandemic, business leaders looked for ways to protect jobs.

A number of businesses quickly pivoted and moved online, adopted flexible working arrangements, streamlined operations, introduced new products and adjusted their business models. Businesses looked beyond shareholder value, placing purpose and sustainability at the heart of the new normal.

One thing remained clear throughout the pandemic, the human connection is stronger – the Filipino bayanihan spirit shines through.