The chief of the Philippines’ economic team Finance Secretary Carlos Dominguez III has told business journalists that while the Philippines may be behind other regional economies at this time in bouncing back from the malaise of the global pandemic, “the country’s recovery will be stronger on the back of its sound economic fundamentals.”

This optimistic forecast is anchored on the structural and tax reforms implemented and are being put in place on the watch of President Duterte, along with “what did not happen” to the economy, which is as important as what did, Dominguez told media on Tuesday, June 15, 2021.

“We might appear to be behind our neighbors for now, but our recovery will be stronger because of our sound fundamentals,” the Finance chief said.

He said the COVID-19 vaccination program, which “has been rolling out quite well …. gives us hope that we can now fully reopen our economy.”

No fiscal downturn

Dominguez pointed out the country did not suffer the kind of fiscal downturn that typically accompanies an economic crisis even with the massive expenditures that the government has incurred as a result of the Covid-19 global economic and health crises.

Dominguez pointed out that when the pandemic-induced crisis hit the country last year, the government “did not have to go back to the drawing board in order to plan for the country’s economic recovery” because “much of the spadework was done” over the last five years of the Duterte administration.

“Clearly, we avoided a lot of trouble. All the strengths that became evident when the challenges were greatest are not due to a stroke of good fortune. This was not luck. This was readiness,” said Dominguez in his pre-recorded speech at the virtual forum organized by the Economic Journalists Association of the Philippines (EJAP).

“They are the results of many years of fiscal discipline, forward-looking policy reforms, and continuing improvement in our administrative systems—especially through the adoption of new digital technologies,” Dominguez added.

Pandemic was a heavy blow

Although it is clear that the pandemic dealt the Philippines a “heavy blow,” he said that is not the full context of the country’s story.

To underscore his point on the importance for the media to communicate to the public about “what did not happen” as being equally important as what did, Dominguez cited other examples, among them:

As a result of the Duterte administration’s aggressive push for the full digitalization of the revenue agencies before the pandemic, the government did not fail to collect revenues even when people could not go out of their homes to file their income tax returns and pay their tax dues.

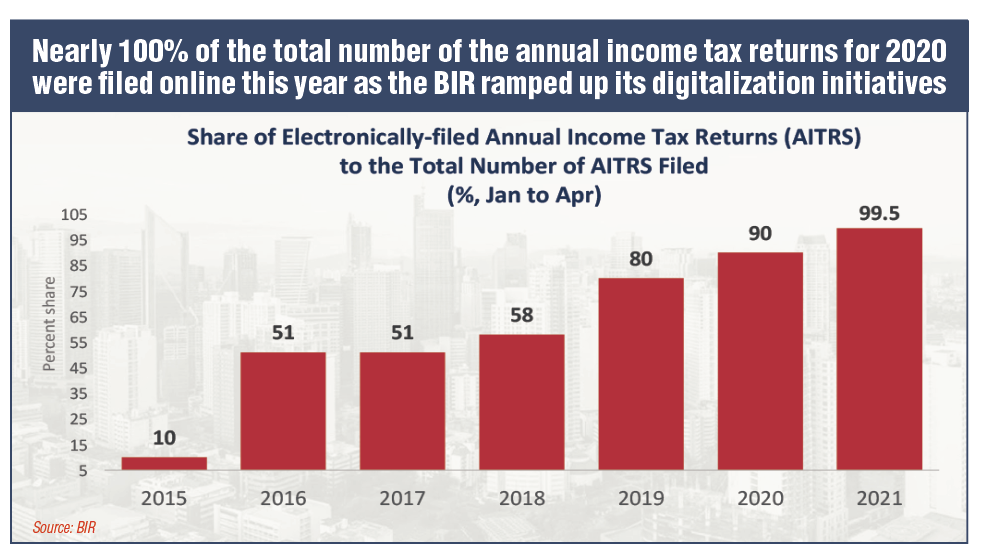

Electronic tax returns almost doubled

A proof of this effort is that the total number of annual income tax returns (ITRs) filed electronically soared to 90% in 2020 and to almost 100% last April, from just 10% in 2015, Dominguez pointed out.

The government achieved a two-decade high revenue effort at 16.1% of gross domestic product (GDP) in 2019 compared to only 15.1% in 2015. Dominguez said this 2019 feat helped bring down the debt-to-GDP ratio for that year to a historic low of 39.6% from 42.7% in 2015;

The Philippines did not lose its high credit rating of ‘BBB+’ earned from S&P Global in 2019 up to this day because of the country’s solid fundamentals even amid the pandemic;

The government never ran out of cash resources and has managed to meet the huge spending on its COVID-19 response despite the expected weakened revenue collection resulting from the on-and-off strict lockdowns.

P709 billion revenue losses

Dominguez said that as a result of the pandemic, the government’s total loss in terms of revenues amounted to P1.4 trillion in 2020, of which about P709 billion was sourced through the financing that it was able to access expeditiously and on very good terms through domestic bond offerings, official development assistance (ODA) and the international capital markets;

The government did not suffer constrained fiscal space despite the recent increase in borrowings as the affordability of the national debt remains manageable.

Debt interest ratio

Dominguez noted that debt interest payments as a share of revenues increased slightly from 11.5% in 2019 to 13.3% in 2020, which is still better compared with 14.7% in 2015.

Moreover, interest payments as a share of expenditures even improved to 9% last year from 13.9% in 2015, which indicates that the government’s additional debt is being beneficial to the country’s recovery and development agenda rather than being a burden to growth, he said;

The interest payment burden did not rise in proportion to the increase in the country’s debt stock, given that the average interest rate of the debt portfolio was reduced from 5.2% in 2015 to 4.2% in 2020; and

Healthy foreign reserves

The Philippine peso did not plunge in value as it did in 1997 during the Asian financial crisis.

Dominguez said the sound and prudent reserve management of the Bangko Sentral ng Pilipinas (BSP), allowed the country to sustain a healthy level of foreign reserves that could actually cover its total external debt.

“In the face of the many challenges that we confront today, compounded by the proliferation of fake news, our economic journalists have to deal with an even bigger responsibility,” Dominguez said.

“We rely on you to provide perspective on the daily grind of reporting events. By underscoring facts and giving accurate pictures, you will help reassure our people. You will arm your audience with the means to deal with the test and trials that we face,” he said.

Dominguez said that even while battling the pandemic, the government did not let up on the completion of its reform agenda.

To further strengthen the banking system, the economic team quickly pushed the passage in the Congress of the Financial Institutions Strategic Transfer Act (FIST) Law, which now allows banks to efficiently offload their bad loans and non-performing assets (NPAs).

FIST

While it is similar to the Special Purpose Vehicles (SPV) law of 2003, he said the FIST Act is also different as it was implemented within the first year of the pandemic, unlike the former which was passed belatedly and took five years after the 1997 Asian Financial Crisis to be enacted.

Dominguez said the Duterte administration also lobbied the congressional approval of its tax reform proposals even amid a pandemic, as evidenced by the historic passage of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, which, with its hefty reduction in the corporate income tax (CIT) rates, has become the largest ever fiscal stimulus program for businesses in the country.

CREATE rationalizes tax incentives

CREATE also opens the way for the government to rationalize the tax incentives system to ensure that fiscal and non-fiscal incentives are tightly targeted, performance-based, transparent, and time-bound, he said.

Alongside these reforms, Dominguez said infrastructure investments under President Duterte’s signature program “Build, Build, Build” will proceed at full speed to drive up economic activity and create jobs.

Build, Build, Build

Dominguez said infrastructure spending, which dramatically rose to an average of 5% of GDP from just around 2% during the previous four administrations, would not have been accelerated without “Build, Build, Build.”

He said the Duterte administration is determined to maintain financial prudence and fiscal strength so the country can face the future with a deep war chest, knowing fully well that “living and dealing with COVID-19 is a multi-mile marathon, not a 100-yard sprint.” “The Duterte administration will not let up on its zero-to-ten point socioeconomic agenda. The completion of the reforms under this program will ensure that our economic recovery will be sustainable, inclusive and resilient,” Dominguez said.

READ FULL ARTICLE HERE: