The secret: How to be big, profitable, and fast growing

By Antonio S. Lopez

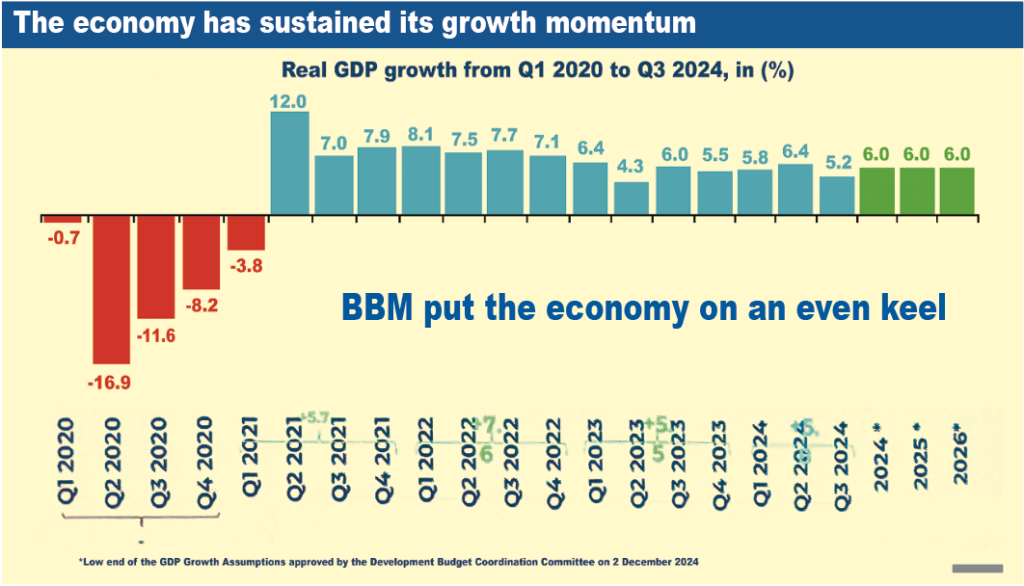

2024 has been a good year for the Philippines’ largest corporations, especially for conglomerates which are highly diversified. Growth in revenues and profits were in double digits or high single digits, reflecting economic resilience and recovery from nearly three years of the COVID pandemic.

The country’s largest corporations meet the two criteria for any enterprise to survive and thrive in the long term—profitability and growth. Profits make companies attractive to investors, especially in the short term. Growth is essential to a company’s long term vision and survival.

No wonder, the biggest Philippine enterprises have been around for at least half a century. And they have been consistently among the most profitable.

Venerable companies all

The largest, San Miguel Corp., has been the star player of Philippines business for 134 years. Henry Sy Sr.’s retailing behemoth, SM Investments Corp. (SMIC) started business in 1958, 66 years ago.

The Manila Electric Co., founded 1903, has been retailing electricity for over 121 years. JG Summit Holdings of the late Gokongwei Jr. , who died in 2019 at age 93, was founded in 1990, began his business in 1943, when he was just 17.

The present Aboitiz Equity Ventures is what used to be Aboitiz & Co. established by Paulino Aboitiz in the 1800s.

The Ayala story

Ayala Corp., formally, is the Philippines’ oldest company. It was founded in 1834, making it 190 years old. “It’s an extraordinary milestone,” gushes Ayala Corp. Chair Jaime Augusto Zobel de Ayala, the family’s seventh generation steward. He credits his people’s skill and talent for Ayala having lasted this long “staying true to their vision and purpose”.

Ayala reports 19% growth in core earnings in 9M24

Ayala Corp. (Ayala) posted a core net income of P36.7 billion, a growth of 19% in the first nine months of 2024.

The performance was anchored by the company’s core units, BPI, Ayala Land, Globe, and AC Energy & Infrastructure (ACEIC). Including one-off items, Ayala’s reported net income increased 5% to P34 billion.

BPI posted a record-high P48 billion in reported net income, up 24% due to sustained growth in loans, fee income, and net interest margin (NIM) expansion.

Ayala Land net income grew 15% to P21.2 billion on resilient residential demand and consumer activity.

Globe’s core net income improved 19% to P17.6 billion as the company posted record service revenues complemented by lower expenses that led to EBITDA margin expansion. This was boosted by stronger contributions from Mynt, the operator of GCash. Net income including non-recurring gains, was up 6% to P20.6 billion.

ACEN’s reported net income accelerated 24% to P8.1 billion, driven by higher attributable renewable energy generation, a strong net selling merchant position in the Philippine Wholesale Electricity Spot Market (WESM), and net value realization gains of ~P2.5 billion.

ACEIC, the parent company of ACEN, registered a core net income of P8.7 billion, up 21% as the strong performance of ACEN, growth in net financing income, and forex gains offset lower contributions from its thermal assets. Including one-off items, ACEIC’s net income was flat at P10.2 billion.

“Ayala’s growth is being sustained by the strong performances of our core businesses. We continue to manage our younger businesses to get them to sustainable trajectories in the near term. We strive to build a simpler, more collaborative and more connected Ayala,” Ayala President and CEO Cezar P. Consing said.