Baby boomers create their own economy. As the world’s largest population after World War II until 2014, they are the most influential consumer that shaped business, modern lifestyle, and the world economy.

Born from 1946 to 1964, boomers aged 53 to 71 comprise 21% or 1.6 billion of the world. Yet they outspend all other generations by $400 billion yearly.

Medical advances and modern conveniences adds 30 years to their lifespan, so boomers will live well past their 90s. In affluent countries like Japan, Germany, and Sweden, over 20% are older than 50. In the US, it’s 50%.

First and best consumers

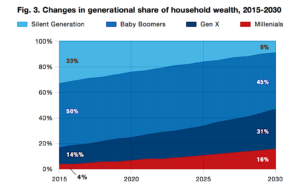

Boomers are the first consumers, the wealthiest generation, and the biggest spenders. They control some 80% of the US aggregate wealth and will bestow history’s largest inheritance, some $53 trillion, to their heirs (if they don’t spend it all first). In the US alone, boomers contribute about 50% to GDP and federal tax revenue. Standalone, the boomer economy will be the third largest in the world next to US and China.

After over 30 years of hard work and discipline, boomers are now at the top of their game as leaders of their industry or business, and earn thrice as much as millennials. They control their leisure time, have the most disposable income, and they want to enjoy their elevated lifestyle.

Oxford Economics says that boomers spend at least $7.6 trillion a year on consumer goods and services and direct spending. They outspend the average consumer in 119 of 123 consumer packaged goods segments and across all health care categories.

“The Longevity Economy is refuting the conventional wisdom that consumers over 50 spend less. In fact, they spend more than any other age group, and will increasingly challenge businesses to win their attention.” (Oxford Economics)

Since the 2008 US recession, boomers contributed 50% to consumer spending growth. They spend twice more than millennials; spend the most online worth over $7.6 billion; and are the top buyers of new and expensive cars worth over $90 billion a year.

“Restricting its estimate to those aged 60 and up, market research firm Euromonitor predicts that by 2020, worldwide older-adult spending will reach $15 trillion—and that’s well before global aging will fully hit its stride.” (Joseph Coughlin, The Longevity Economy, 2017)

Share the wealth

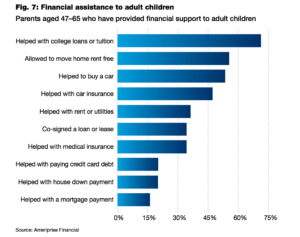

But boomers don’t just spend on themselves, they buy for their loved ones. Boomers spend for their aging parents’ care, medical, and utility bills.

But boomers don’t just spend on themselves, they buy for their loved ones. Boomers spend for their aging parents’ care, medical, and utility bills.

Over 90% financially assist their kids and pay for college, let them live home rent-free, and help buy a car. Grandparents spend the most on direct purchases and gifts for their grandkids; then on education (which grew by 90%); children’s clothes and apparel; travel and recreation; toys; and baby items.

“In 2032, consumer spending by Americans over 50 is forecast to increase by 58%, to $4.6 trillion, while spending by those aged 25–50 is forecast to grow by only 13%, from $2.9 trillion to $3.2 trillion.” (Oxford Economics)

Most boomers, especially the women, are still heads of their household who make all the financial and consumer decisions. They dictate purchases for goods, food, furnishing, kids’ clothes and possessions, electronics, appliances, cars, healthcare, dining, and vacation. They choose their utilities, doctors, and other service providers. In the US, UK, and Australia, boomers own at least one home and are the richest landlords.

“The average wealth of households headed by people over 50 is nearly $765,000, compared with $225,000 for those headed by 25–to-50-year-olds.” (Oxford Economics)

Technology adapters

“Technology, too, plays a large role in the Longevity Economy. Today’s over-50s were the first generation to grow up with consumer electronics, computers, and the Internet. As a result, they are more technically savvy than their predecessors.” (Oxford Economics)

“Technology, too, plays a large role in the Longevity Economy. Today’s over-50s were the first generation to grow up with consumer electronics, computers, and the Internet. As a result, they are more technically savvy than their predecessors.” (Oxford Economics)

Boomers are quick technology adopters and were the first to use credit cards. They lead other generations in internet use, broadband at home, smartphones, tablets, social media, Facebook, and Pinterest. (Pew Research)

Boomers are the largest constituency on the web and over 51% spend more time online than millennials. Over 82% are self-described heavy internet users and frequently search online for information, news, weather, videos, games, health, and reviews. They spend over 11 hours a day on Facebook and are 19% more likely to share content than any other generation.

Boomers spend the most online than other generations; buy more expensive items; and spend the most time researching products and visiting online stores. Boomers have the means, so they spend the most on the latest and most expensive electronics. They love their laptops and check their emails on it daily. Over 40% buy Apple products.

When boomers bought houses in the suburbs, malls and retailers grew alongside them to cater to their consumerism. Now they prefer to stay home and shop online. This could be one reason for the rise of e-commerce and the fall of malls.

Bust the boomer myths

Adults past 50 are often perceived as frail, unproductive, and dependent on family for support and healthcare. We think grandpa is sick, broke, and outdated. But none of this applies to majority of boomers today.

Adults past 50 are often perceived as frail, unproductive, and dependent on family for support and healthcare. We think grandpa is sick, broke, and outdated. But none of this applies to majority of boomers today.

Contrary to expectations, many boomers remain active and strong, live and work longer, and still contribute significantly to the world’s economy. They want to work past retirement and remain productive indefinitely.

Businesses have abandoned boomers and now target millennials who now outnumber boomers. Companies expect the same high level of consumerism they enjoyed from boomers. But there are flaws in this simplistic theory because boomers are so different from millennials.

Mainly, boomers have acquired decades’ worth of wealth that millennials have not even begun to replicate. Boomers are in top positions with excellent credit, no more dependents to support, and a fully paid home. They have the most disposable income to spend.

Meanwhile, millennials are still finding their way, building their career, or mostly self-employed, and may be burdened with school debt or the financial obligations of raising kids and buying a house. Many are still living with their boomer parents and still ask them for financial help.

But they’re not done yet, and the income gap will continue to widen as boomers live longer. Boomers plan to keep working after retirement, which gives them continued income apart from their retirement savings. Due to many years of experience, males aged 60-74 had premium pay about 20% more (10% for women) than average workers aged 25 to 59.

“While they often have trouble competing for jobs, older, better educated, more experienced workers are typically more productive and earn higher hourly wages than their younger, less educated, and less experienced counterparts.” (Oxford Economics)

Basically, millennials do not behave like boomers. Millennials are price conscious, likely due to their pressing financial obligations and median pay. Whereas boomers seek products that cater to their discerning needs, regardless of price. Boomers expect great customer service, knowledgeable and helpful staff, and high quality goods—and they are willing to pay for it.

Maybe in a few decades millennials will surpass boomer wealth, but for now and the coming decades, boomers are a formidable market that cannot be ignored.

Reigniting the boom

How do you reach the boomers? By dispelling the notion that aging is bad and adapting to their needs. Give the boomers what they want and they will reward you with their loyalty and patronage.

“Rather, the problem is our very idea of old age, which is socially constructed, historically contingent, and deeply flawed…” (Coughlin)

Businesses need to recognize that there is no one way to grow old, that aging is a unique process, and boomers as a determinative force will demand with their wallets. Products and design must be inclusive, intuitive, and exciting. To stay competitive, companies must understand how boomers want to lead their lives. They are a unique generation that merges tradition and technology and they have always modified the world to suit their needs.

“The baby boomers, in short, will act as a sorting mechanism in the longevity economy, ruthlessly separating the companies that solve their real demands from those acting on a tired, false idea of oldness.” (Coughlin)

IVY DIGEST

Ivy Digest serves the busy reader and extracts relevant data from chosen worthwhile publications to incite ideas and inform decisions. The author Ivy is a lawyer and journalist who studied in the Ateneo de Manila University and the University of Pennsylvania’s Wharton School.