Before the MAP, Dominguez tackled four issues: one, people are sick and want a vaccine against COVID-19; two, the economy is sick and needs to reopen soonest; three, incentives for business amid the severest recession in 100 years; and four, government finances.

The Finance chief is clearly worried about the contingent liabilities in government PPP contracts. These are losses the state must pay private companies as penalties in case something goes wrong. Even more worrisome is the contingent liabilities of state-run agencies like the SSS, GSIS and PhilHealth. They are running deficits way above their capacity to make profits.

Department of Finance Secretary Carlos Dominguez spoke Tuesday Jan. 12, 2021 before the Management Association of the Philippines which has a new president, Aurelio “Gigi” Montinola III, the former president of the Bank of PI and of the Bankers Association of the Philippines and today, the chair of the family-owned Far Eastern University (FEU), the second largest private university and with its vast real estate holdings, one of the richest.

Dominguez tackled four issues: one, people are sick and want vaccine against COVID-19; two, the economy is sick and needs to reopen soonest; three, incentives for business amid the severest recession in 100 years; and four, government finances.

A former banker and entrepreneur, Sonny Dominguez is worried about what is called contingent liabilities of government corporations, meaning possible losses or government liabilities that the national government is not aware of now, mainly because of bad accounting and bad management.

The DOF chief singled out three major corporations: the state-run private pension fund Social Security System, the state-run government pension fund Government Service Insurance System, and the state-run but badly managed and corrupt private health insurance plan, PhilHealth. Dominguez winces that SSS and GSIS treat their premium collections as revenues (they are not; they are trust funds) and do not seem to provide for future cash outlays for members like benefits and pension.

Hence, a strict audit would show these GOCCs are technically bankrupt. To cover up their deficits, these GFIs keep on increasing members’ contributions without a corresponding improvement in service. SSS, for instance, is one of the most complained about government agencies. The deficits, by the way, will have to be financed by taxpayers, thru more taxes and impositions, and by government, thru more borrowings.

Now for those sick with COVID. Dominguez does not seem that much alarmed. Only 9 out of the 100,000 Filipinos who get sick die. In Sweden, he pointed out, it is 90 out of 100,000.

Per Worldometers, the Philippines, with a population of 110 million, is No. 30th in the world in number of COVID cases, at 489,736 and 9,416 deaths. Sweden, which has a population of just 10.13 million, is 31st, with 489,471 cases and 9,433 deaths. For every one million Filipinos, only 85 die from COVID. For every one million Swedes, 931 die from COVID. That’s almost 11x the death ratio of PH.

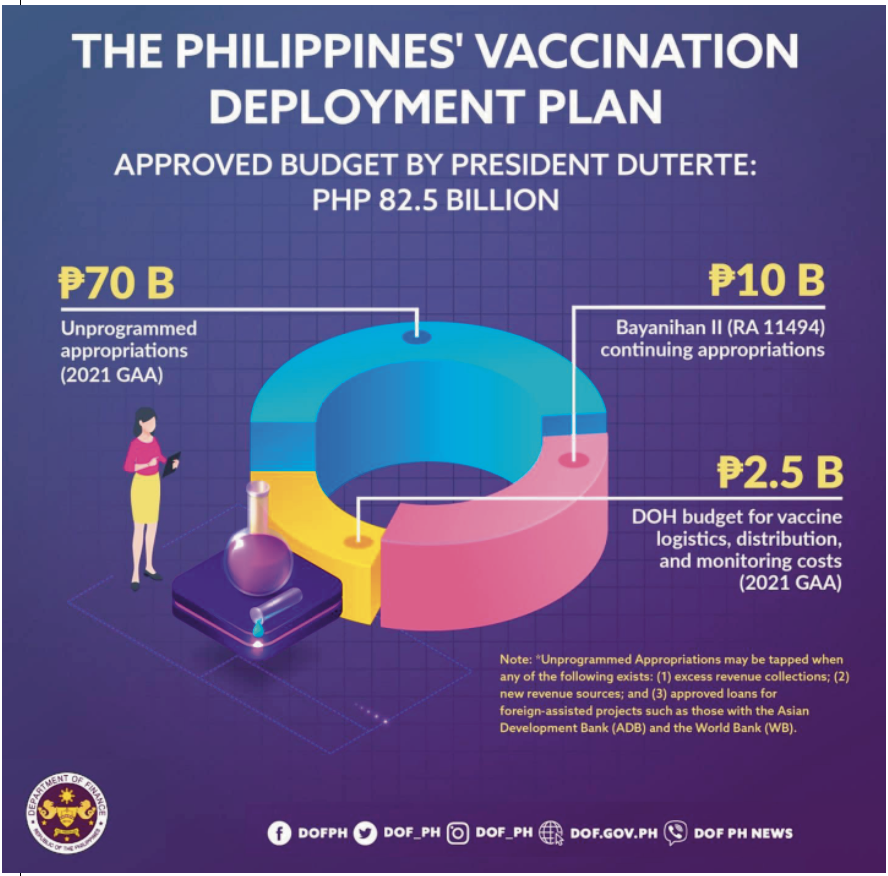

Starting February, COVID vaccines will arrive in the Philippines. The government has the money to buy the vaccine—from the budget and from borrowings. Figures on how much vaccine has been purchased vary but they are up to 140 million doses—good for 70 million Filipinos.

Whether by design or by incompetence, government seems in no hurry to deploy the vaccines. Anyway, notes Dominguez, per survey 47% of Filipinos don’t want to be inoculated. That’s more than 51 million Filipinos or more than half of the 70-million target for vaccination.

Anyway, exulted Dominguez: “We have managed to keep our COVID-19 infections moderate. We do not expect the sort of surges we now see in many countries.”

Meanwhile, reviving the health of the economy, requires some brinkmanship or boldness.

“When the pandemic struck, the Philippine government prioritized the health and safety of its people above everything else,” Dominguez told the MAP.

That meant closing down up to 75% of the economy. Growth rate collapsed, by 11% in 2020 from a hefty 6% gain in 2019.

Unemployment tripled to 17.7% before steadying at 8.7% by October 2020. Government borrowings rose from 39.6% of GDP in 2019 to 53.5% in 2020. The government can no longer afford those setbacks.

“The depth of the pandemic’s economic impact must be matched by bold initiatives of our enterprises and the government,” Dominguez said.

As it turns out, it will be mostly boldness by government which went on to spend up to P2.66 trillion or 14.7% of GDP to cope with COVID, under four pillars:1) P506.08 billion in emergency support to vulnerable groups; 2) P57.73 billion in resources to fight COVID; 3) P1.3 trillion in monetary action to keep the economy afloat; and 4) P7891.61 billion in economic recovery program to create jobs and sustain growth.

To finance that, the government raised P2.63 trillion in gross financing, 2.57x the P1.02 trillion it raised in 2019. Despite being overborrowed, the Philippines kept its awesome debt ratings—like BBB by Fitch.

Fitch downgraded the credit ratings of 33 sovereigns (government debts), including Mexico, Colombia, and Italy, countries that used to have the same good ratings as the Philippines.

The Philippines’ growth prospect is strong, according to Fitch, 6.9% growth in 2021 and 8% in 2022. Good credit ratings mean the Philippines can borrow pa more. It also means government can spend more. The 2021 budget is a record P4.5 trillion of which P1.7 trillion will go to social services (education and health), and P5 trillion in 2022.

Notable: The Philippines has record $104 billion in reserves, which can buy 11 months of imports; the peso strengthened by 5% in 2020. With little production and with plenty of money, inflation of course has risen to 3.5% for 2020 from 2.5% in 2019.

Private business is hurting. So Congress is considering lowering corporate income taxes – currently the highest in ASEAN, to as low as 20%, from 30%, and to 1%, from 10%, for non-profits like schools, retroactive to July 2020. This is the Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill.

CREATE seeks to reform in the government’s fiscal incentives regime to maximize perks extended to investors while minimizing foregone revenues amid the harder times wrought by the pandemic. All incentives-giving agencies will report to a new body to harmonize and rationalize the incentives programs.

Congress also has passed a company that will absorb the bad loan assets of the banks and another bill that enables government to rescue ailing companies thru equity infusions or joint ventures. (Attention: PAL). This is the GUIDE bill.

As for cha-cha, Dominguez said the government wants to open up most areas of the economy, except land ownership by foreigners. As to some politicians inserting political charter amendments to keep themselves in power, the finance chief seems to imply that is up to the people to reject.

Dominguez wondered why private is always asking for incentives before investing or taking action.

“If it’s a good thing, you do it yourself … I don’t know why everything now depends on whether or not we give you tax breaks. Just do it yourself—if you’re going to make money, do it. Nobody’s stopping you—why do you need an extra boost from us?” Dominguez said.

He recalled that he did not seek incentives when he forayed into his banana production, banking and mining businesses in the past.

“We didn’t go to the government and say, ‘we’re going to invest so much but give us a little tax boost.’ No, we calculated it and said, ‘we’re going to make money and, by the way, if you give us an incentive, thank you!’ But we are not going to make our decision [based on] whether or not we get that incentive,” Dominguez said.

— Tony Lopez