PH is ASEAN’s brightest star;

GDP to reach $1 trillion by 2033

By Ralph G. Recto

Secretary of Finance

(Keynote speech during the Philippine Economic Briefing in Manila, Philippine International Convention Center, May 27, 2024)

Fellow workers in government; members of the diplomatic corps; development partners; friends in the private sector and the media: good afternoon.

Thank you for the opportunity to brief you about our promising future.

The Philippine economic outlook is the brightest it has ever been.

The Marcos promise

And when we successfully reduce the poverty rate to a single digit by 2028, history will mark the Marcos, Jr. presidency as the turning point when the Philippines achieved genuine inclusive growth for Filipinos.

Let me highlight all the signs that point toward this goal.

Since President Marcos, Jr. took office in 2022, the Philippines has consistently become the brightest star in ASEAN, expanding among the fastest by 6.2%.

Global research firms and analysts affirm our economic vigor.

Despite external challenges, we are expected to outperform ASEAN economies with a projected growth between 5.8 to 6.3% in 2024.

The forecast for 2025 is even higher at 5.9 to 6.5%.

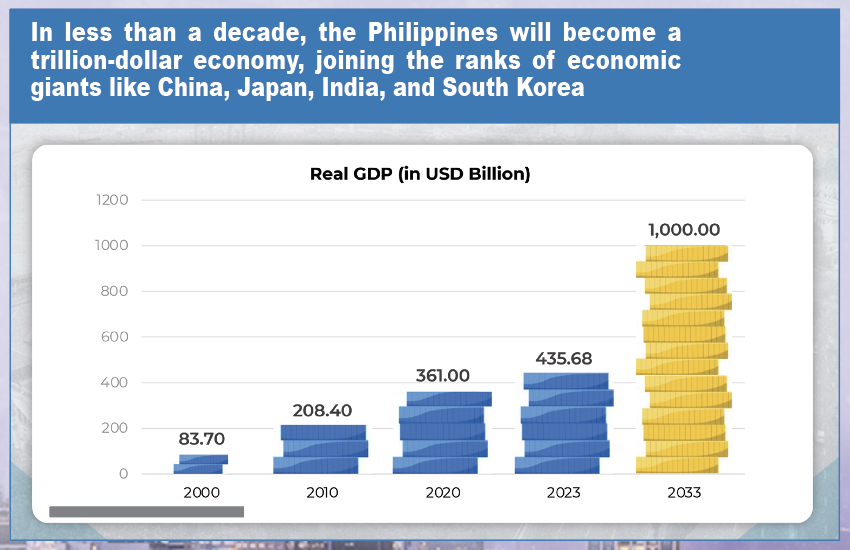

A $1 trillion economy

This trajectory puts us firmly on course to become a trillion-dollar economy in less than a decade. This means that by 2033, our economy will nearly triple in size, placing us in the league of economic giants like China, Japan, India, and South Korea.

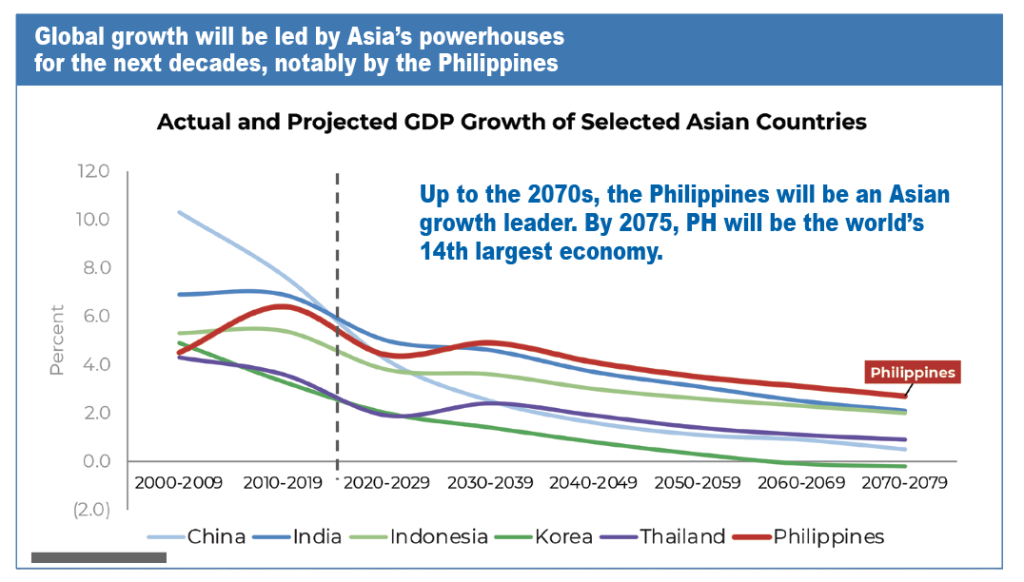

And we are expected to continue outpacing the growth of Asia’s economic powerhouses in the years to come.

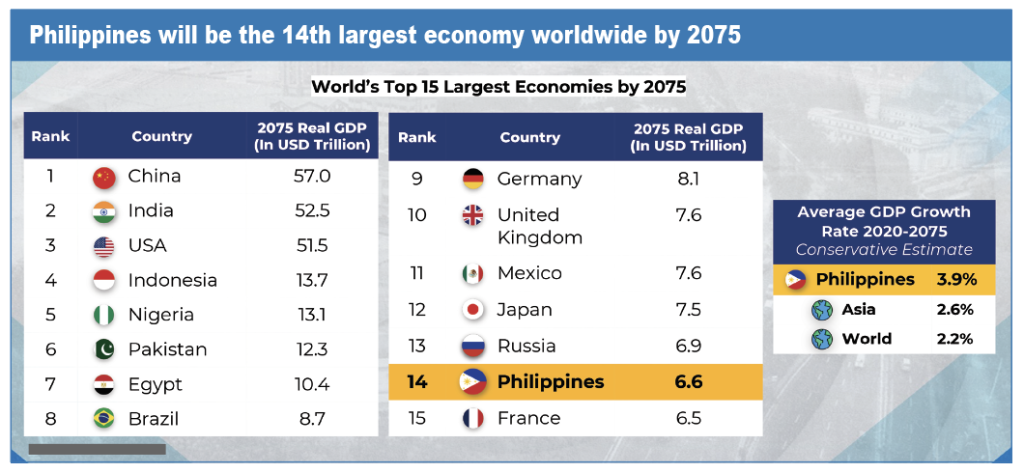

Fast forward to 2075, the Philippines will overtake France to become the 14th largest economy in the world.

With our arsenal of growth-enhancing strategies, this administration has the right policy tools and determination to take us there.

We will continue bolstering growth by arresting inflation through a whole-of-government approach. Ensuring food security is our top priority.

We share the view of the IMF that forecasts Philippine inflation to remain manageable despite external challenges, settling at 3.6% this year.

Inflation targets

This is well within the government’s target of 2 to 4%, and notably lower than the global average of 5.9% and that of developing economies at 8.3%.

As inflation eases, we anticipate a further acceleration in our already robust domestic consumption. This will help us reach our 6 to 7% growth target for this year and serves as a sturdy shield against global headwinds.

Our strong consumer spending, constituting over 70% of the economy, is bolstered by an increasingly vibrant labor market.

Employment

All our labor force indicators–unemployment and underemployment rates–continue to decline to historically low levels and are even better than pre-pandemic. In addition, more and more Filipinos are engaged in formal and stable jobs, constituting the largest portion of our workforce.

This is an indication of an expanding middle class and reinforces the Philippines’ path towards becoming an upper-middle-income country next year.

$6,500 by 2030

This expansion is seen to rapidly raise the country’s average income per person, nearly doubling from $3,541 last year to $6,500 by 2030.

As a result, the Philippines is expected to become the world’s 13th-largest consumer market by 2030, offering vast opportunities for local and foreign businesses. Another key driver boosting domestic consumer demand is the reliable stream of remittances from overseas Filipino workers.

Despite comprising only 4% of the labor force, OFWs send home an amount equivalent to 9% of GDP annually.

These remittances not only provide a stable income source for their families. They also catalyze the growth of small businesses in communities.

Tourism

Our tourism industry is another significant contributor to our economic resilience and represents a low-hanging fruit for growth.

The industry strongly rebounded from the pandemic, posting sustained increases in tourist arrivals and tourism receipts.

Ports

Ongoing improvements in our airports and seaports are expected to boost annual tourist arrivals from 5.5 million in 2023 to a projected 43 million by 2030, with tourism revenues rising from 9% to 22% of GDP.

Our export of services also provides us with additional buffers, as it is less vulnerable to the impacts of trade wars compared to the export of physical goods.

The country’s business process outsourcing continues to be a strong driver of employment with over 1.7 million people, generating hefty revenues.

These, along with our low external debt and healthy reserves that exceed standard benchmarks, should keep our currency stable and resilient to adverse external shocks.

Our banking system is also a key pillar of strength.

In 2023, the average capital adequacy ratio of banks was 16.9%, and the liquidity coverage ratio was 182.7%, both exceeding international benchmarks.

This means that our banks are strong and stable, and are capable of providing more lending support to businesses and individuals.

Fiscal position

Our economic build-up is further supported by a solid fiscal position, which ensures stability for businesses.

With our strong commitment to fiscal discipline, we recently recalibrated our fiscal targets to ensure that strategic and growth-enhancing fiscal consolidation remains at the forefront of our agenda.

These new targets are realistic, pragmatic, and proactive, accounting for various domestic and external factors. Our fiscal deficit, which has steadily decreased to 6.2% of GDP in 2023, will continue to diminish sustainably, reaching 3.7% of GDP by 2028.

This narrowing deficit path is underpinned by higher revenue collections and improved expenditure management. With total revenues already reaching P1.5 trillion as of end of April, we are on track to meet our collection target of P4.3 trillion this year.

BIR collects P1 trillion

The BIR has already collected close to one trillion––or P970.3 billion — representing a 15.4% increase from last year.

The BOC, on the other hand, recorded a 6.5% growth rate in its collection, reaching P299.3 billion.

And we are focusing on growing our tax revenues further by plugging tax leaks and improving tax administration, especially in the e-commerce market, through digitalization—a process that, admittedly, will take some time.

In the meantime, we have strategically tapped into non-tax revenue streams to generate additional funds without imposing new or increased taxes on our people.

This allowed us to collect P188.8 billion in non-tax revenues as of end-April, 48.8% higher from the same period last year. The surge is primarily driven by higher dividend remittances from GOCCs. As of May, these already reached P88.6 billion. Our privatization efforts are also expected to boost non-tax revenue.

Meanwhile, our fiscal consolidation plan ensures that the economy will continue to outgrow our debt in the medium term. Our debt-to-GDP ratio further dropped to 60.1% in 2023, and is on track to decline further to 55.9% by 2028.

We have been very prudent with our borrowings. The majority of financing is sourced domestically to take advantage of high liquidity in the economy. This provides a venue for ordinary Filipinos to invest and help in nation-building.

To ensure that we get the best value in funding our financing requirements, we secure only the cheapest deals to save on borrowing costs. For example, we recently obtained $2 billion in financing from the global bond market at exceptionally historic low rates.

The pricing of our issuance was so competitive compared to our higher-rated peers, showing that the Philippines is performing well beyond its current credit rating. This presents a strong case for a potential rating upgrade.

The DOF has also successfully secured financing agreements for infrastructure projects at very concessional rates and highly favorable terms.

Subway by 2029

This includes the continued funding for the country’s first-ever Metro Manila Subway Project, which will be up and running by 2029. Our growth-enhancing initiatives also include directing our accelerated spending program towards more infrastructure and human capital development programs.

These two investment areas will provide the highest multiplier effect in the short term and in the long term.

A young population

With a median population age of only 25 years old, our greatest competitive advantage rests in our people. Thus, we are harnessing our demographic sweet spot by investing heavily in education and social services.

Specifically, we aim to fully equip Filipinos with new technological know-how so we can position ourselves as the hub for technology-driven industries.

We are also running full speed ahead with the Build Better More program to create more jobs that stimulate domestic consumption while boosting our competitiveness.

P9.5 trillion infra

This robust infrastructure build-up involves an annual public infra spending of up to 6% of GDP, driven by 185 flagship projects worth P9.5 trillion.

With the Public-Private Partnership Code in place, we expect to speed up the delivery of critical infrastructure projects across the archipelago.

Currently, 125 PPP projects are primed and shovel-ready. Five of these projects are already in the advanced stages and are slated for awarding this year.

These include the Tarlac-Pangasinan-La Union Expressway Extension Project, the Laguindingan Airport, the New Bohol International Airport, the UP-PGH Cancer Center, and the Dialysis Center for the Renal Center Facility of the Baguio General Hospital and Medical Center.

Our strategy for rapid expansion is further powered by reforms that will drive investment-led growth.

The current policy landscape for investments in the Philippines has never been more open and liberalized.

BBM primary marketer

In fact, President Marcos, Jr. himself has been our primary marketer, actively engaging with leaders and investors around the world to strengthen partnerships.

His proactive diplomacy has already yielded $2.3 billion in foreign direct investments for the first two months of the year. This is nearly 50% higher than the same period last year.

The figure is expected to surge as we begin to realize the $72.2 billion worth of investment pledges gathered from the President’s world engagements alone as of last year.

Bottlenecks

We are aggressively addressing bottlenecks and expediting processes to realize these investment pledges, particularly in high-priority sectors.

These include infrastructure, renewable energy and power, critical minerals, financial services, healthcare, consumer and retail, manufacturing, and IT-BPM, among others.

We are intensifying efforts to address investor concerns, such as high electricity costs, through the CREATE MORE bill.

This enhances both fiscal and non-fiscal incentives and provides corporations with a 200-percent deduction for power costs incurred during the income tax holiday period.

CREATE MORE will also incentivize investments in priority industries within the special economic and freeport zones.

This will be instrumental in turning the Luzon Economic Corridor into a prime location for export-manufacturing firms and positioning the Philippines as Asia’s top destination for cutting-edge production and innovation.

Red tape

Bureaucratic gridlock and red tape are also being addressed through decisive measures like Administrative Order 23.

This puts an end to the systemic issue of smuggling through a digitally integrated system for pre-border technical verification and cross-border electronic invoicing.

Furthermore, the President institutionalized green lanes for strategic investments. This is a whole-of-government approach to streamline approval and registration processes as well as address investor concerns.

Ease of paying taxes

Meanwhile, the Ease of Paying Taxes Law is a giant leap forward in creating an environment that is investor-friendly, simple, and innovative.

We have now significantly simplified tax compliance procedures, reduced red tape, and embraced technology to make it easier for taxpayers to fulfill their obligations.

Along with the implementation of our liberalization laws, we have removed roadblocks to clear the way for a more rapid economic expansion.

But to be clear, our growth-enhancing initiatives are meant not only to create an economy that is ready to compete with the rest of the world.

They’re designed to harness the talents of our young workforce and build a nation where every Filipino can thrive, secure decent jobs, and create better lives for themselves.

9% poverty incidence

All of these are aimed to provide pathways out of poverty for about 14 million Filipinos, or cutting poverty incidence to 9%, by the end of the President’s term or sooner. This is the single most important number that we aim to achieve.

Even with headwinds along the way, there are a lot of reasons to be confident and excited about our nation’s future.

So, I hope you will help us spread the word: We have all the makings of a prosperous economy — and we have a bold and decisive leader to fully realize that potential. Lahat po kayo ay makakaasa na sa Bagong Pilipinas, sama-sama po tayong uunlad at giginhawa. Maraming salamat at mabuhay po tayong lahat.