By ANTONIO S. LOPEZ

Oxfam is calling on governments to introduce one-off solidarity wealth taxes and windfall

taxes to end crisis profiteering, and permanently increase taxes on the richest 1%, for example

to at least 60% of their income from labor and capital, with higher rates for multi-millionaires

and billionaires.

Life is unfair, you might say. Or unequal. In the last two years of the COVID-19 pandemic, a total of $42 trillion in new wealth was created in the entire planet.

Of that $42 trillion, $26 trillion or 62% was taken by just the richest 1% of the world’s 7.888 billion people.

The world’s richest –those with $1 million in cash or assets—number just 62 million.

So 7.888 billion people minus 62 million leaves you with 7.866 billion sharing the remaining $16 trillion ($42 trillion minus $26 trillion) in new wealth not grabbed by the 62 million ultra rich in the past two years.

The super rich 62 million took in 1.62 times as much as the $16 trillion shared by 7.866 billion ordinary mortals.

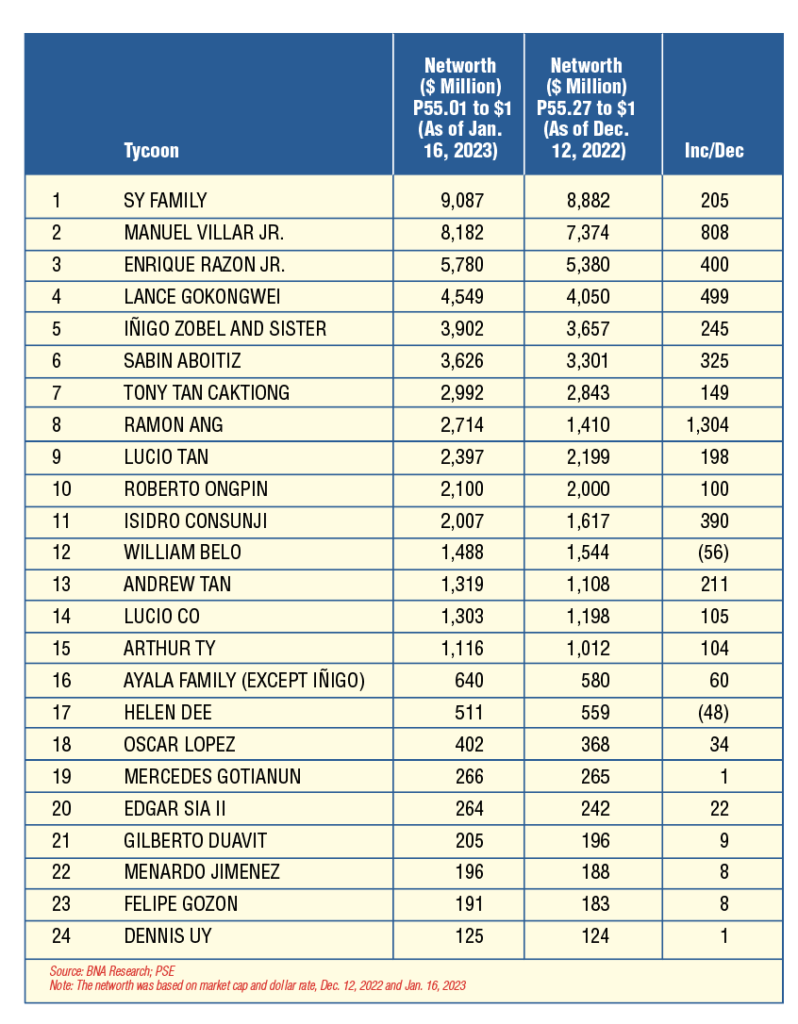

In the Philippines, the country’s ten richest billionaires had combined wealth of $45.329 billion (P249.35 billion) as of Jan. 16, 2023, an increase of $4.233 billion over their combined wealth of $41.096 billion as of Dec. 12, 2022.

The January 2023 wealth of the Richest Ten Filipinos is equal to 11% of the estimated GDP of $423 billion as of end-2022, meaning each of the ten makes, on average, the equivalent of 1.1% of total economic production of the country.

All the top ten Filipino billionaires chalked up wealth increases. The Top Ten and their wealth (increase in one year, in

parenthesis):

- Henry Sy family, $9.087 billion ($205 million);

- Manuel Villar Jr, $8.182 billion ($808 million);

- Enrique Razon Jr., $5.78 billion ($400 million);

- Lance Gokongwei Jr., $4.549 billion ($499 million);

- Iñigo Zobel and sister, $3.902 billion ($245 million);

- Aboitiz family, $3.626 billion ($325 million);

- Tony Tan Caktiong, $2.992 billion ($149 million);

- Ramon S. Ang, $2.714 billion ($1.304 billion);

- Lucio Tan, $2.397 billion ($198 million); and

- Roberto V. Ongpin, $2.1B ($100 million).

These ten have these businesses: Food, property, banking, power, utilities, and casinos.

Damning report

The damning report is published as the world’s elites gather in the Swiss ski resort of Davos for four days (Jan. 16-20) of the World Economic Forum, the annual winter debating club of big business, media, government, and professionals trying to solve the world’s

problems—in the last half century.

Instead of improving, life for 99% of the world’s peoples has become harsher and less safe. For the first time in 76 years, the world is faces the grim prospect of a Third World War, one which will be a fight to the finish, with no ground rules of human behavior, from conventional armies facing each other on barren and bloodied battlefields, to tactical and strategic nuclear war, and even perhaps, a battle of satellites up in outer space.

“The global progress in reducing extreme poverty has come to a halt amid what is expected to be the largest increase in global inequality since World War II,” warns Oxfam.

Oxfam’s report shows that the super-rich have also seen extraordinary gains in the last two years – for every $1 of new global wealth earned by a person in the bottom 90%, each billionaire gained roughly $1.7 million.

The combined fortune of billionaires has increased by a staggering $2.7 billion (£2 billion) a day.

This comes on top of a decade of historic gains – both the number and wealth of billionaires having doubled over the last ten years.

Inflation hits at least1.7 billion workers

At the same time, at least 1.7 billion workers now live in countries where inflation is outpacing wages, and over 820 million people – roughly one in ten people on Earth – are hungry.

Oxfam is calling for a systemic and dramatic increase in taxation of the super-rich to claw back pandemic gains fueled by public money and private greed.

Danny Sriskandarajah, Oxfam GB chief executive said, “The current economic reality is an affront to basic human values. Extreme poverty is increasing for the first time in 25 years and close to a billion people are going hungry but for billionaires, every day is a bonanza.”

Oxfam is calling on governments to:

- Introduce one-off solidarity wealth taxes and windfall taxes to end crisis profiteering.

- Permanently increase taxes on the richest 1%, for example to at least 60% of their income from labor and capital, with higher rates for multi-millionaires and billionaires. Governments must especially raise taxes on capital gains, which are subject to lower tax rates than other forms of income.

- Tax the wealth of the richest 1% at rates high enough to significantly reduce the numbers and wealth of the richest people, and redistribute these resources. This includes implementing inheritance, property and land taxes, as well as net wealth taxes.

- Empower public and tax administrations to track the wealth of the richest people and corporations. Taxing the wealthiest is impossible unless public and tax administrations are supported to identify and track the true wealth of the richest people and governments take action to dismantle tax secrecy and tax offshore wealth and assets.