By Tony Lopez

In July 1972, Manila Bay and Lingayen Gulf had a date in Central Luzon. It became what a British author described as northern Luzon’s “most serious floods recorded or remembered by man…775 persons were confirmed dead and damage to the economy amounted to some £60 million” (”£1 billion in today’s money).

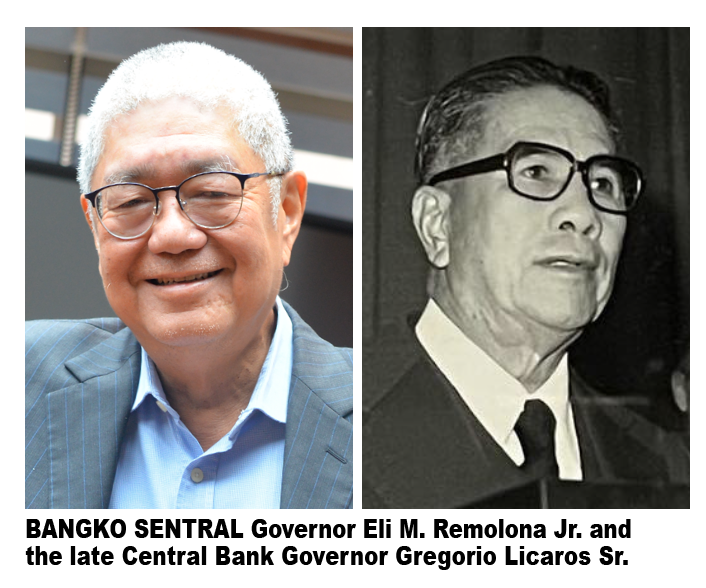

Responding to the crisis, then Central Bank Governor Gregorio Licaros Sr. immediately pumped P200 million (P13 billion in today’s money) into Luzon for the national economy to recover and prevent massive hunger.

Luzon then accounted for over 70% of total economic production or GDP. I was a senior business reporter of The Manila Times. Licaros called me up for me to headline the story: “CB pumps P200M into Central Luzon”. Brave effort. But it was not enough. The nascent New People’s Army marauded into the countryside. By August 1972, President Ferdinand Edralin Marcos Sr. had to declare martial law.

CB’s primary purpose

The primary purpose of the old Central Bank of 1949 was to promote a rising level of production, income and employment. PIE—production, income and employment. Create a big economic pie so nearly everyone could share in it.

Today, the CB’s successor, the Bangko Sentral ng Pilipinas (circa 1993) has been given a rather innocuous if nebulous mission. “The Bangko Sentralshall provide policy directions in the areas of money, banking, and credit.”

In simple terms, that means monitor the inflation and the interest rate, two functions basically abstruse to the common man. PIE –production, income and employment are easier understood, to monitor, and to pin down responsibility for failure. But MBC—money, banking, and credit? What do they mean to the man in the street? Especially banking. About 70 million Filipinos have no bank account. So a bank has no meaning to the majority.

A technician

Our BSP governor has become nothing more than a technician. He monitors the inflation rate and the interest rate, and with them, the peso-dollar rate (which is a metric of monetary stability). They affect the cost of money.

But if you have no money, cost means nothing. Just like electricity. If you have no electricity, its price means nothing. Everything becomes cheap as long as you have electricity. Per BSP, 67% of households (18 million of 27 million households) have no savings. They have no money to park in a bank.

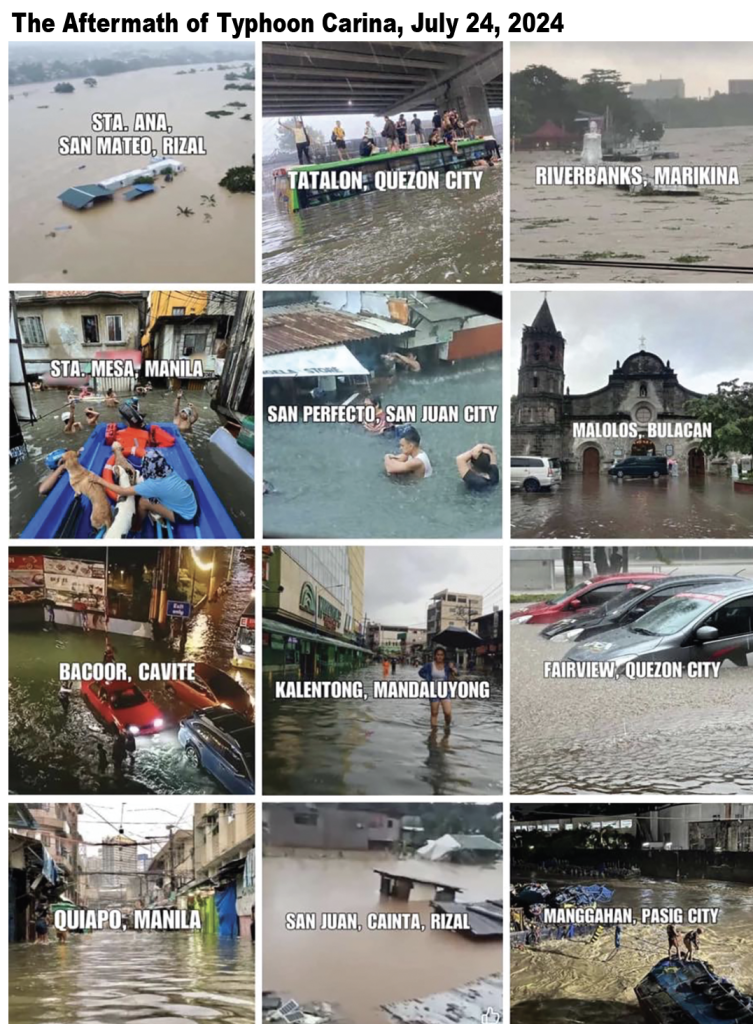

In July 1972, 388.6 millimeters of rain fell in two weeks, enough to inundate Metro Manila and half of Luzon.

With Carina (Gaemi to English-spokening people), on July 23 and 24, 2024, 461.4 millimeters of rain came in just 12 hours and the whole Metro Manila and most of Luzon were inundated– the Great Flood of 2024.

In 1972, the Central Bank took quick, decisive actions, to rescue the economy.

Decisive action

In 2024, we have yet to hear from the Bangko Sentral what, if any, quick and decisive actions it has taken to enable people to cope with the Great Flood. Brave nonchalance. After all, a rising production, income and employment is no longer the present central bank’s principal responsibility.

In a statement, President Ferdinand Romualdez Marcos Jr. pinned the blame for the massive July 2024 flooding on waste disposal, poor flood control construction, —and climate change. Ondoy of 2009, he recalled poured more rains. But Carina had a “greater” impact; more areas in Metro Manila were flooded and more people were affected.” Sporting a golfing cap and a white T-shirt emblazoned with the Bagong Pilipinas logo, Bongbong toured flooded areas of the national capital. “Things are very different (when actually seeing them ) than what you read from a piece of paper, he deadpanned.

“Valenzuela (north of Manila) always gets flooded. They already have many flood control [structures, 32 in Valenzuela], but they were overwhelmed by the volume of water. We have to reexamine some of the designs of our flood control,” Marcos told reporters after surveying the city a day after the floods. “We have more flood control [projects] now than before, but [look at] climate change. This is what the effects of climate change are,” he noted. “I hope people learn their lesson, Don’t throw garbage willy nilly,” the President pleaded.

Usual suspects

Yeb Saño, executive director of Greenpeace Southeast Asia, blamed the usual suspects—climate crisis and carbon pollution. “These devastating floods are yet another indication of the destruction facing millions as the climate crisis accelerates. But while countries like mine struggle against increasingly ferocious storms and rising sea levels, the fossil fuel giants that are driving the crisis are making billions and continue to drill for yet more oil and ever more profits,” fumed Saño.

He singled out Shell, which “produced 10 times the carbon pollution of the Philippines in the last 50 years – made almost $30 billion in profit last year. The Philippines has been chosen to host the Loss and Damage Fund which could provide a vital lifeline to help countries on the frontline of the climate crisis deal with the escalating damage costs. We urgently need bold global action to force the fossil fuel industry to stop drilling and start paying their climate debts.”

“The government needs to intervene much more boldly in the economy,” says the think tank IBON Foundation’s Sonny Africa, “which is not to be confused with its populist shows of aid-giving for political patronage purposes and to defuse social unrest as the midterm elections near.”

Perhaps, BSP should listen to that clarion call—intervene much more boldly in the economy, and pour money, more money into the production of basic goods –like rice, corn, fish, chicken, and meat, today, all in short supply.

And hey, why is the central bank now called BSP? Because the economy collapsed, and the central bank had to be reinvented.