“We focus on industries on which the country’s future depends…protecting our natural resources and creating strong, cohesive communities where every Filipino has equal access to a better future. This means forging ahead with projects that will transform the Philippine economy, and more importantly, our communities.”

— Ramon Ang

By Tony Lopez

In June 2024, San Miguel Corporation made two decisions that could well impact its operations over the next five to ten years.

First, SMC on June 11, 2024, elected John Paul L. Ang, 44, as vice chairman, president, and chief operating officer (COO), succeeding his father, Ramon S. Ang, 70, who became chairman and CEO of the Philippines’ largest and most diversified conglomerate.

RSA became SMC vice chairman in 1999, at 45, and COO in 2022 at age 48. RSA, a mechanical engineer, is perhaps the best of the current generation of entrepreneurs and the most visionary and most pro-people of our tycoons. His achievements as headman of SMC exceed those of his predecessors combined. Today, SMC is RSA, and RSA is SMC.

Second, SMC launched on June 18 its P20-billion bond offering to refinance existing debt. The latest bond series carries lower interest rates and longer repayment periods. This will save SMC some money. The bonds have the highest credit rating meaning they have the lowest risk and best yields (7.2584% for six-year, six-month bonds due in 2031, 7.7197 for Series 2034 10-year bonds.

Succession settled

The first decision means SMC addresses its succession problem. RSA will have a successor and a second in command, his eldest son, Paul. Deeply religious and steeped in interdisciplinary studies from the Jesuits, Paul built, from 2010, a P110-billion cement business from scratch, the Eagle Cement Corp..

When SMC bought 99% of Eagle in 2022, it made P98 billion for his dad, RSA, the principal stockholder. Ramon, in turn, used the money to consolidate his holdings in SMC and make forays into other businesses. RSA, on paper, owns 23.05% of SMC.

In 2023, SMC’s cement business reported a four-fold revenue growth to P37.2 billion. Operating income was significantly higher, at P6 billion. EBITDA rose to P9.5 billion. Eagle Cement itself reported P25.44 billlion in revenues, P5.39 billion in profit before tax, and P7.4 billion EBITDA, equivalent to an EBITDA margin of 29.1%.

SMC can raise cash it wants

The second decision, refinancing debts, means SMC remains capable of raising any amounts of cash it needs to refinance debts, fund existing projects, and finance future ventures. SMC has total loans payable of P1.17 trillion and equity of P666 billion.

SMC’s two biggest projects are:1) the P735-billion New Manila International Airport (NMIA) in Bulakan town, Bulacan province, just 15 mins. driving from Manila and 30 mins. from Makati; and 2) the rehab of the old Ninoy Aquino International Airport (NAIA) for which RSA has promised to pay the government P900 billion over a 30-year period. The P19.74 billion net proceeds from the June 2024 bond offering will go mainly to the Bulacan airport whose runway is ready for concreting.

Strengths

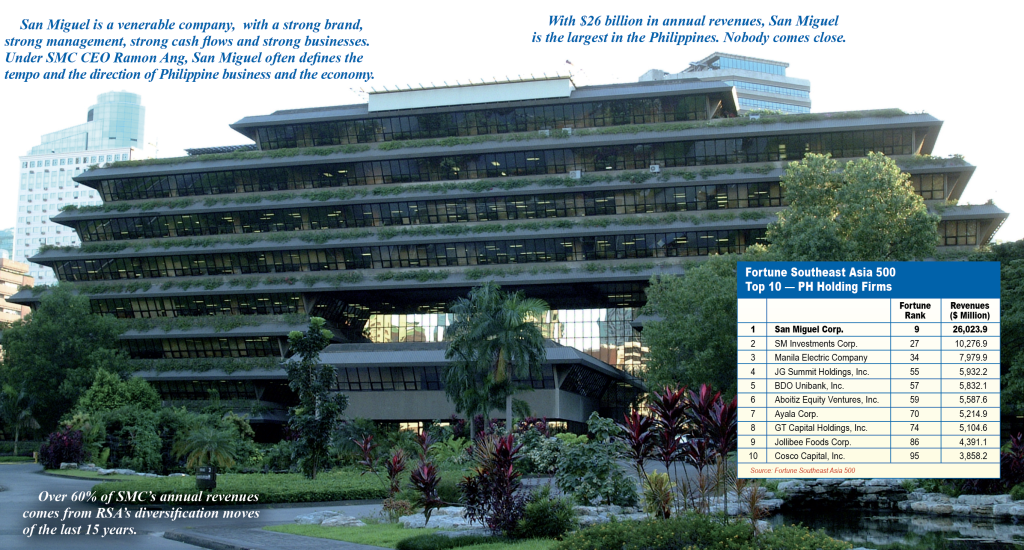

It is easy to see why SMC can raise any cash it wants effortlessly. San Miguel is a venerable company, with a strong brand, strong management, strong cash flows and strong businesses. Under SMC CEO Ramon Ang, San Miguel often defines the tempo and the direction of Philippine business and the economy.

Founded in 1980, SMC is almost synonymous with the name Philippines. It is the original Philippine multinational with more than 100 factories and facilities locally and in the rest of Asia.

It has “an extensive portfolio of products that include beer, spirits, non-alcoholic beverages, poultry, animal feeds, flour, fresh and processed meats, dairy products, coffee, various packaging products and a full range of refined petroleum products, most of which are market leaders in their respective markets.

“In addition, SMC contributes to the growth of downstream industries and sustains a network of hundreds of third-party suppliers.”

SanMig premium beer

San Miguel means quality premium beer sold at a very reasonable price. Combining quality, reasonable pricing, and savvy marketing has enabled SanMig to hold over 90% of the local beer market in the last quarter century. SMC has the largest retail network, with up to two million retail sari-sari stores. Its Petron alone has 1,800 retail stations, 40% of them company-owned and with a commanding 36.2% of the market. In Malaysia, Petron supplies 20% of KL Airport’s aviation fuel.

Spectacular diversification

In just 15 years, from 2007, RSA turned an aging (founded 1890) and stodgy beer, beverage, food and packaging company into a sprawling conglomerate dominant or with a substantial presence in ten major industries – beer and beverages, food, packaging, energy, fuel and oil, infrastructure (tollways), property and leasing, cement, luxury automotive, and airports, thanks to unprecedented and breathtaking diversification.

About 60% of SMC’s annual revenues come from RSA’s diversification moves.

The businesses grew marvelously despite massive taxation (for beer, beverages, alcoholic drinks and refined petroleum products; rigid regulations (for tollways, energy, and airports), crippling red tape (for all businesses), and stiff competition (SMC has been a constant victim of insidious bad-mouthing).

SMC has P2.5 trillion in assets

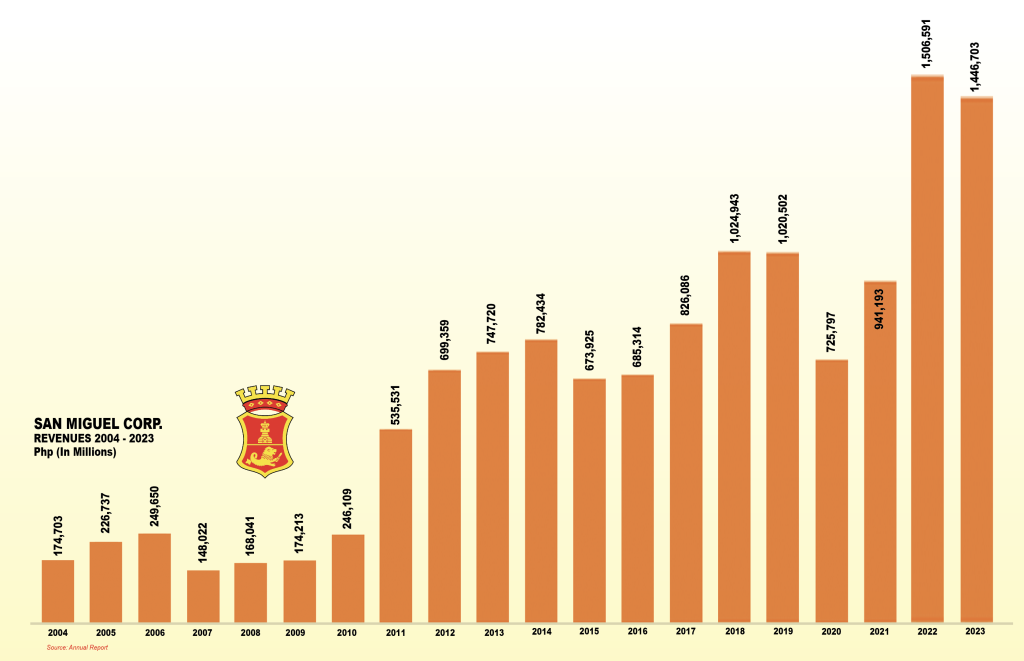

SMC has total assets of P2.5 trillion, annual sales of P1.446 trillion (equivalent to 6% of GDP in 2023), market cap of P240 billion (third largest, after SM Investments Corp., P1.02 trillion; and Ayala Corp., P355.56 billion), EBITDA of P205 billion, and 2023 profits of P45 billion.

With three airports – NAIA, Bulacan and Boracay, SMC revenues would soon reach 10% of GDP.

“The past year (2023), has been remarkable,” RSA told SMC’s stockholders at their June 11, 2024 annual meeting, “we delivered strong full-year results and achieved record profits, supported by a stable economy and initiatives that continue to bear fruit.”

Investing and getting things done

“The next few years will be about investing and getting things done. We will build on our success by creating value through nation-building projects, maximizing synergies, and integrating sustainability across our businesses,” said Ang.

“Every step we take will further strengthen our company and drive positive change across the broader Philippine society.”

Ang says SMC’s future is in sustainability which has “the potential to significantly impact the future of our country.”

“Throughout San Miguel today is a greater push towards sustainability. Our goal is to achieve net zero (emissions) by 2050.”

SMC wants progress, fast

SMC is not content with making profits. It wants progress for the country, and fast. That means helping solve major problems.

“We are addressing key social issues such as poverty, energy and food security, infrastructure gaps, among others, to uplift Filipinos and drive sustainable economic growth,” Ang explained.

In this regard, the SMC chief said, “Our mega-poultry farms nationwide embody our approach to sustainable food production. They ensure a stable and affordable supply of chicken, ultimately contributing to food security and regional stability.”

Also, “our energy projects, including the nationwide Battery Energy Storage System and the upgraded Ilijan LNG facility, support our country’s transition to cleaner energy. These initiatives align with our goal to reduce carbon emissions and provide reliable and affordable power for all,” Ang said.

Big projects on stream

“In terms of infrastructure development, our MRT-7 project, now 70% complete, is seen to significantly enhance urban mobility. Our New Manila International Airport project is progressing well. And as part of the New NAIA Infra Corp., we are also set to take over NAIA to start its modernization in mid-September,” Ang narrated.

Ramon Ang’s dream for every Filipino is a better life. “‘Malasakit’ is part of everything we do,” he stresses.

Ang wants “a more resilient and globally competitive Philippines, one with the necessary infrastructure to thrive in the global economy, enjoys energy security and food security, and can attract the kind of investment that will create support projects that will generate economic vitality.”

Ang concludes, “We focus on industries on which the country’s future depends…protecting our natural resources and creating strong, cohesive communities where every Filipino has equal access to a better future. This means forging ahead with projects that will transform the Philippine economy, and more importantly, our communities.”

Congrats RSA.

Good luck Paul.